Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide on Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form is a document that allows merchants to charge a customer's credit card for goods or services. This form not only captures essential details such as the cardholder’s information and payment amount but also serves as a consent mechanism, ensuring that the customer has authorized the transaction. The purpose of the form is to provide a legal and verifiable record of the customer's agreement to the charges, reducing potential disputes.

In transaction processing, the credit card authorization form plays a pivotal role in establishing trust between the buyer and seller. It's commonly used in various situations, notably in businesses that require payment in advance, for subscription services, or during events where customers pin down their commitment ahead of time. This document is essential for protecting both parties, ensuring transparent communication regarding payments.

Do credit card authorization forms help prevent chargeback abuse?

Chargebacks can occur when a customer disputes a charge on their credit card statement. This process allows cardholders to reverse transactions they deem unauthorized or incorrect. While chargebacks serve consumer protection, they may also be exploited by malicious customers, leading businesses to face significant losses. A well-designed credit card authorization form helps mitigate this risk by providing evidence that the cardholder has agreed to the transaction, making it more difficult for frivolous chargebacks to succeed.

For example, suppose a restaurant processes a customer's order using a credit card authorization form that clearly states the transaction details. If that customer later claims they never authorized the payment, the restaurant can present the signed authorization form to show legitimate consent. Businesses often succeed in defending against chargebacks by leveraging these forms effectively.

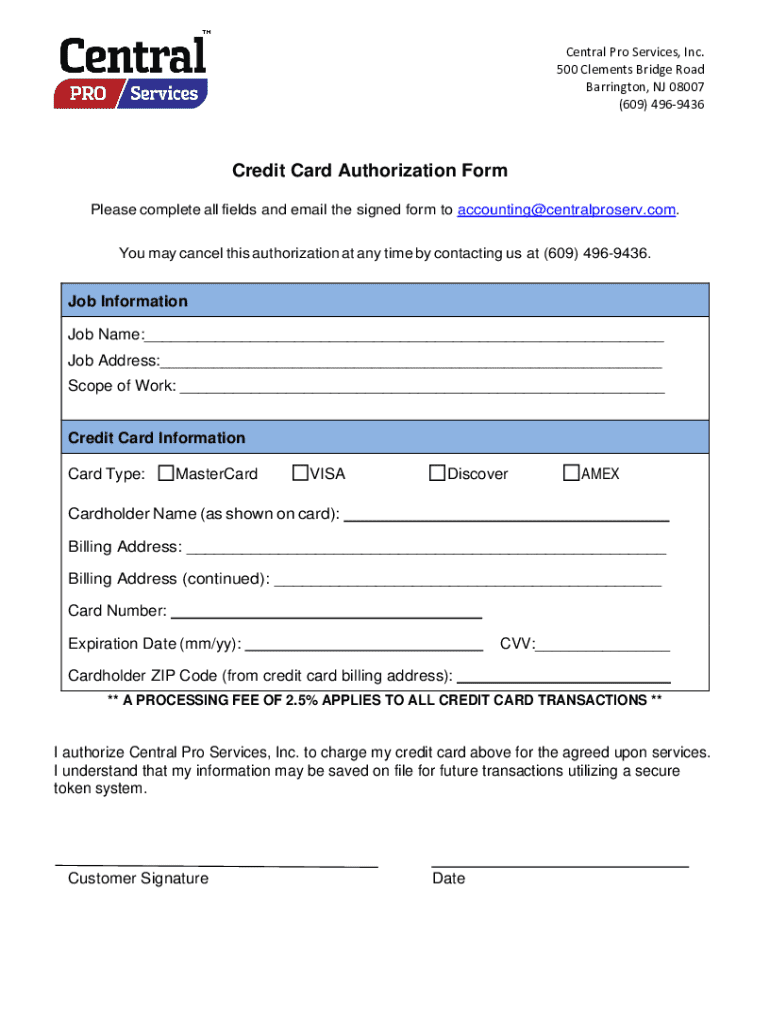

Key components of a credit card authorization form

To create an effective credit card authorization form, several essential elements must be included. These components ensure that all necessary information is documented and can be referenced in the event of disputes or chargebacks. First, the form should capture cardholder information, including the name, billing address, and contact details. Next, payment details such as the amount being charged, transaction date, and type of transaction should be explicitly stated.

Additionally, merchant information, including the company name and contact details, is critical for accountability. Terms and conditions should outline the expectations and obligations of both parties. Optional elements can enhance the form's effectiveness, such as a customer signature field to provide an explicit authorization, an expiration reminder for recurrent transactions, and instructions for secure storage of the form post-transaction.

Filling out a credit card authorization form

Completing a credit card authorization form properly is crucial for its validity. Start by gathering the necessary information, which includes the cardholder's details and transaction specifics. Make sure to input the cardholder details accurately, as any errors can lead to complications. Next, clearly specify the payment amount and the type of transaction, whether it’s a one-time charge or recurring payment.

Additional terms may be necessary to protect both the merchant and the cardholder. Once you have filled in the form, take a moment to review it thoroughly for accuracy before submission. Common mistakes to avoid include not fully completing the form, placing the signature in the wrong place, or misstating the transaction amounts, as these oversights can lead to disputes.

Editing and customizing your credit card authorization form

Editing your credit card authorization form can enhance its usability and effectiveness. Utilizing tools like pdfFiller, users can upload their existing forms and edit them as needed. The platform allows users to add fields or notes, making it easier to accommodate specific business requirements. Collaboration is also made simpler with cloud-based functionality, enabling team members to work together on form customization.

Best practices for customizing the form include ensuring clarity and professionalism in the layout and language used. Additionally, priority should be given to accessibility; creating a mobile-friendly form ensures that it is accessible to customers on various devices, making the payment process seamless.

Signing and managing your credit card authorization form

E-signature options through pdfFiller further streamline the signing process, allowing businesses and customers to complete the authorization form electronically. It's crucial to ensure that the identity of the signer is verified to maintain security. Once signed, managing the credit card authorization form involves proper storage and sharing practices. Using cloud storage not only provides a backup but also facilitates easy access for both the merchant and cardholder.

When sharing processed forms, employ best practices such as creating secure links and setting appropriate permissions. This ensures that sensitive information remains protected, especially in businesses where multiple staff members require access to transaction documentation.

Downloadable resources and templates

Access to well-crafted credit card authorization form templates can save significant time for businesses. Templates cater to various industries, allowing for customized usage according to specific needs. Users can download these templates and tailor them to reflect their business branding and transaction details while maintaining the essential components required for an effective authorization form.

Utilizing templates can streamline the form-filling process, particularly in scenarios such as subscription services or recurring payments. Tailoring templates to specific business needs enhances efficiency and ensures compliance, making transactions smoother and safeguarding against potential disputes.

Frequently asked questions (FAQ)

Understanding the difference between credit card authorization forms and invoices is vital for businesses. While both documents involve payment processes, an authorization form secures upfront consent, whereas an invoice requests payment after services have been rendered. Moreover, businesses often have questions regarding the legality and enforceability of electronic signatures. In many jurisdictions, e-signatures hold the same legal standing as traditional handwritten signatures, making them a viable option for modern transactions.

Selecting the right template variation is also crucial; different industries may have unique requirements. Considerations should include whether the business is a small startup or a large corporation, as this can influence the template’s complexity and customization needs.

Gain insights and stay updated

For individuals and businesses seeking to stay informed, subscribing to a newsletter centered on document management and payment processing can be extremely beneficial. Subscribers gain access to tips, updates, and resources that help streamline their operations and stay compliant with the latest regulations around document usage.

Engagement opportunities also abound, encouraging users to share their experiences with credit card authorization forms. This feedback can lead to the development of additional resources, ensuring that all users remain equipped with the tools necessary for effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How can I send credit card authorization form to be eSigned by others?

How can I edit credit card authorization form on a smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.