Get the free 424b3

Get, Create, Make and Sign 424b form

How to edit 424b3 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 424b3 form

How to fill out form 424b3

Who needs form 424b3?

The comprehensive guide to form 424B3

Understanding the form 424B3

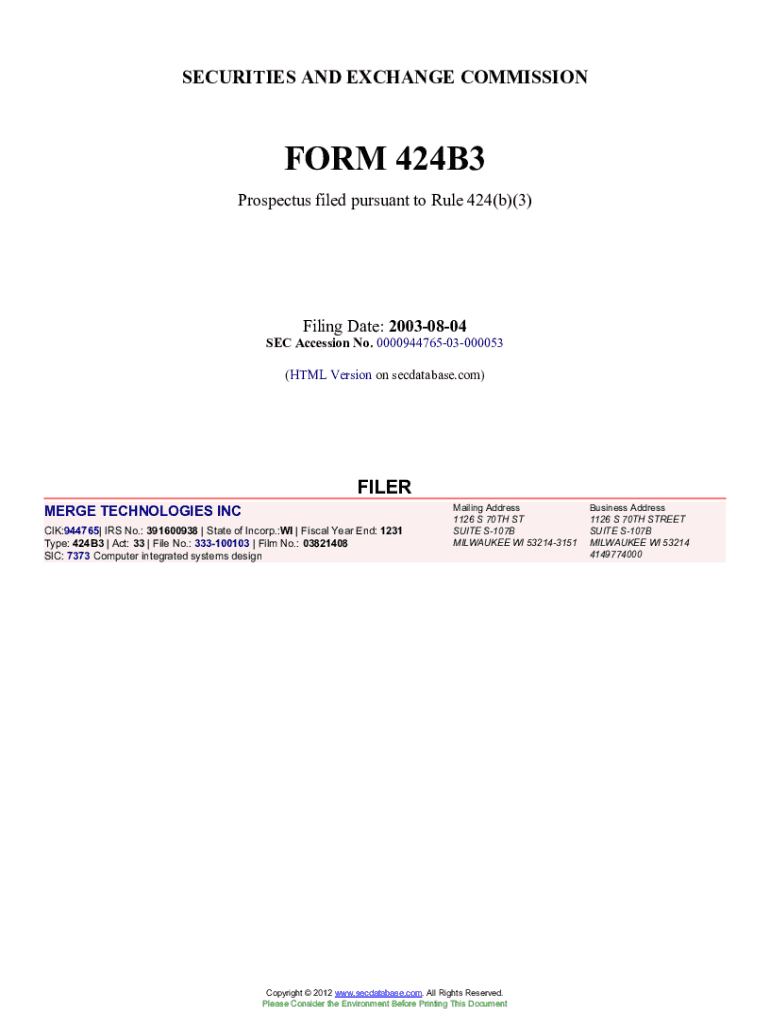

Form 424B3 is a critical document in the landscape of securities filings regulated by the Securities and Exchange Commission (SEC). Primarily used by companies making initial public offerings (IPOs) or follow-on offerings, this form serves to provide potential investors with essential information about the investment product being offered. Its primary purpose is to ensure that all necessary disclosures are made, thereby supporting the investment decision-making process.

The importance of form 424B3 extends beyond just basic compliance; it plays a vital role in fostering transparency within the financial markets. Investors look for complete and reliable information before committing funds, and the form helps meet this need. As a result, companies utilizing this form can cultivate investor confidence, which is essential for successful fundraising.

Historical background

Initially introduced in the early 1990s, the form has evolved to keep pace with regulatory changes and investor expectations. Significant reforms, such as the Sarbanes-Oxley Act and subsequent SEC amendments, have shaped the requisite disclosures within the form. As markets became more globalized and complex, the need for precise and comprehensive reporting became increasingly apparent.

Historically, the form was less standardized, leading to inconsistencies in filings. However, updates to regulations have mandated specific formats and content, helping companies focus on the critical data that investors need while also streamlining the review process by regulators.

Types of filings related to form 424B3

Form 424B3 is one of several related filings under the 424 family. While forms 424B1 and 424B2 serve distinct purposes, 424B3 is used primarily to amend offerings that have been previously filed. Understanding the distinctions is crucial for compliance and investor disclosure expectations.

For instance, form 424B1 is typically used for new offerings and includes the fundamental terms of the securities. Conversely, form 424B2 provides more specific details, often related to stockholder meetings or proxy statements. In contrast, companies utilize form 424B3 to provide updates or changes to previously filed prospectuses.

When to use form 424B3: Case studies

Several scenarios necessitate the use of form 424B3. A common case is when a company experiences significant changes prior to offering, such as altering the underwriter’s terms or adjusting the pricing of its shares due to market conditions. Another frequent situation occurs when companies must disclose new financial information that may impact investor perspectives.

Real-world examples include multinational companies that faced significant fluctuations in their stock prices leading up to an IPO. They used form 424B3 to update investors about these changes and communicate associated risks, thereby maintaining transparency and fostering trust.

Purpose and importance of form 424B3

Form 424B3 holds critical significance in the realm of regulatory compliance and investor relations. First, it enhances transparency, ensuring that investors have access to all pertinent information necessary to make informed decisions. By adhering to SEC regulations, companies can improve their credibility in the eyes of potential investors, leading to a more successful fundraising process.

Furthermore, the form impacts company strategy by offering insights into market positioning and operational performance. By articulating risk factors and potential challenges within their disclosures, businesses can strategically position themselves to mitigate perceived risks, thereby influencing investor confidence and securing necessary capital for future growth.

Key information required on the form 424B3

Completing form 424B3 requires specific information crucial to communicating effectively with investors. The form consists of several core components including a summary prospectus, detailed financial information, and risk factors associated with the offering. Each segment serves a vital purpose in presenting a clear and comprehensive picture of the offering.

The summary prospectus outlines the offering terms, while the financial information section requires historical data, projected earnings, and other relevant metrics. Risk factors disclose potential pitfalls, educating stakeholders on possible market volatility and other uncertainties that could affect their investments.

Best practices for completing each section

To enhance clarity and precision, companies should follow best practices while completing form 424B3. It’s essential to maintain straightforward language that is accessible to potential investors who may not have an extensive background in finance. Avoiding jargon and ensuring all terms are well-defined can help mitigate misunderstanding.

Additionally, thoroughly reviewing each section before submission is vital. Common pitfalls include providing incomplete financial disclosures or vague risk factors, both of which can undermine the document's integrity and lead to potential regulatory scrutiny.

Filing requirements and timing for form 424B3

Understanding filing requirements and timing is vital for maintaining compliance with SEC regulations while utilizing form 424B3. Companies must file this document in a timely manner, especially when significant changes impact the offering's terms. Filing deadlines vary based on the type of offering, with some requiring immediate disclosure, making it critical to stay informed.

Regulatory considerations include ensuring all necessary disclosures align with SEC regulations, avoiding any omissions that could lead to penalties or loss of investor confidence. By integrating ongoing monitoring practices regarding market conditions and company performance, businesses can prepare timely updates and effectively manage their filing process.

Common filing mistakes and how to avoid them

Form 424B3 submissions are not immune to errors; frequent mistakes can occur that jeopardize compliance and investor trust. Common pitfalls often include incomplete sections, incorrect financial figures, or outdated risk factor disclosures. In some cases, businesses have faced regulatory scrutiny due to these oversights, leading to reputational damage.

To mitigate these mistakes, companies should employ a checklist approach that ensures thorough reviews are conducted before submission. Utilizing collaborative workspaces can also facilitate efficient information sharing and allow multiple stakeholders to verify data, significantly reducing the likelihood of errors.

Utilizing interactive tools for form 424B3

Utilizing digital tools can enhance the efficiency and ease of completing form 424B3. Platforms like pdfFiller empower users to edit, eSign, and collaborate seamlessly, ensuring all necessary components are completed accurately. These features allow teams to work on the document collectively, facilitating real-time updates and reducing the time between drafting and submission.

pdfFiller offers user-friendly interfaces that simplify complex processes. Collaboration tools enable multiple team members to contribute and review, while features for easy signing ensure that all approvals are secured without unnecessary delay.

Step-by-step guide to using pdfFiller for form 424B3

To make the most of pdfFiller when completing form 424B3, users can follow a straightforward process. First, upload the existing form to the platform. Utilize the editing tools to input the necessary information in each section, ensuring clarity and accessibility. Next, invite team members to review collaboratively, tracking changes in real-time. Finally, once all edits are complete, utilize the eSigning functionality to secure electronic signatures from all relevant parties.

By leveraging the full suite of pdfFiller features, companies can ensure a more efficient filing process while maintaining compliance with SEC regulations. The platform’s cloud-based accessibility allows teams to manage documents from anywhere, facilitating a smoother workflow tailored to their specific needs.

Additional considerations for form 424B3 users

After submitting form 424B3, companies should prepare for post-filing actions including effectively communicating with shareholders. Managing shareholder communications is vital; businesses must update their stakeholders on any changes outlined in the form while monitoring investor sentiments regarding their offerings.

Long-term implications of such filings involve ongoing reporting obligations and compliance measures. Companies must remain vigilant in keeping stakeholders informed about performance metrics and any regulatory changes that may impact their offerings. This ongoing communication not only fosters goodwill but also positions companies favorably in the eyes of current and potential investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 424b3 form to be eSigned by others?

How do I edit 424b3 form straight from my smartphone?

How do I fill out 424b3 form on an Android device?

What is form 424b3?

Who is required to file form 424b3?

How to fill out form 424b3?

What is the purpose of form 424b3?

What information must be reported on form 424b3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.