Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: How-to Guide

Understanding credit card authorization forms

A credit card authorization form serves as a crucial tool for businesses and clients in managing payment transactions safely and securely. This form allows businesses to request permission from customers to charge their credit card for goods or services rendered. Understanding this process is vital for both parties involved.

The primary purpose of a credit card authorization form is to protect against unauthorized transactions. By requiring explicit consent from the cardholder, businesses can mitigate risks associated with fraud and chargebacks. Moreover, for customers, it establishes a sense of trust and security when they provide their sensitive payment information.

The authorization process itself is straightforward. After the form is filled out and signed, businesses then send this request to their payment processor or bank, which verifies the card’s validity and available credit before approving or denying the transaction.

Key parties involved in this process include merchants who require payment, customers who provide their credit card information, and banks that facilitate the financial transactions. Together, they ensure that every purchase is authorized and secure.

Common uses of credit card authorization forms

Credit card authorization forms are widely utilized across various scenarios, each reflecting a unique need for customer consent. For instance, in online purchases, businesses often request this form to ensure a secure transaction process, protecting both seller and buyer from potential fraud. Similarly, subscription services rely on these forms to safely charge monthly fees to clients, so they can enjoy continuous access to services without interruption.

In-person transactions, such as at restaurants or retail shops, may also require customers to sign a credit card authorization to confirm their purchases. Moreover, businesses that manage rentals or require security deposits often use these forms to guarantee payment for any potential damages or late check-outs.

The benefits of using credit card authorization forms are plentiful. They not only enhance security and trust in transactions but also prevent fraudulent activities by ensuring that every payment is authorized by the rightful cardholder. Additionally, managing recurring payments becomes effortless, as users can expect seamless transactions without the risk of being caught off-guard by unapproved charges.

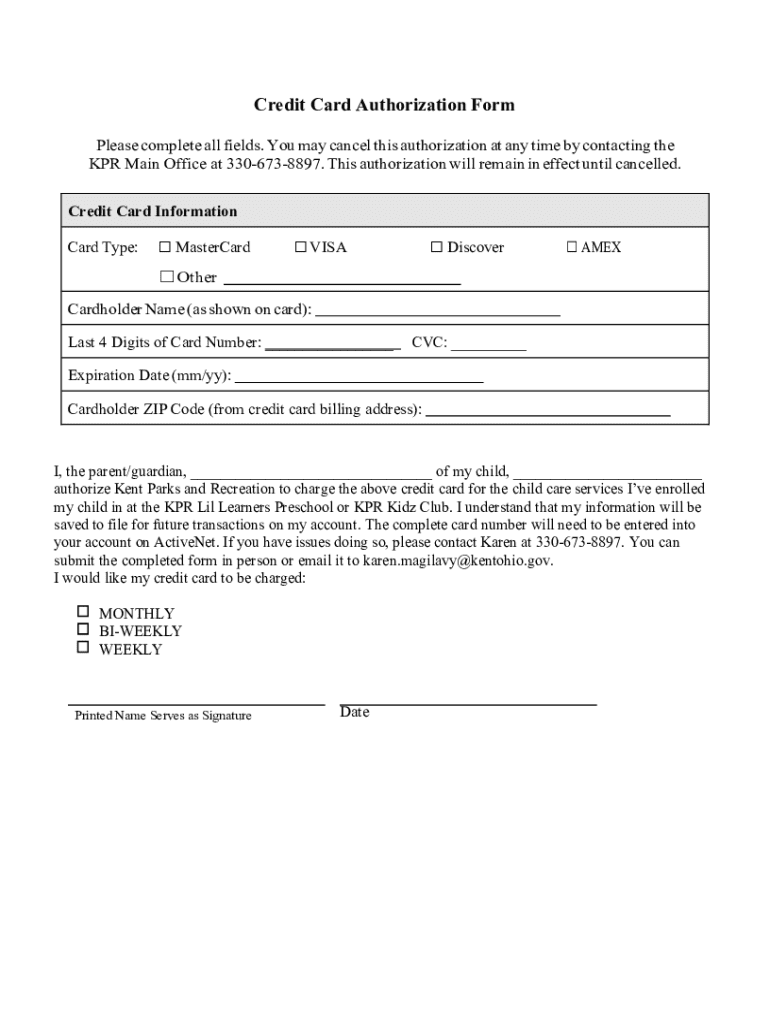

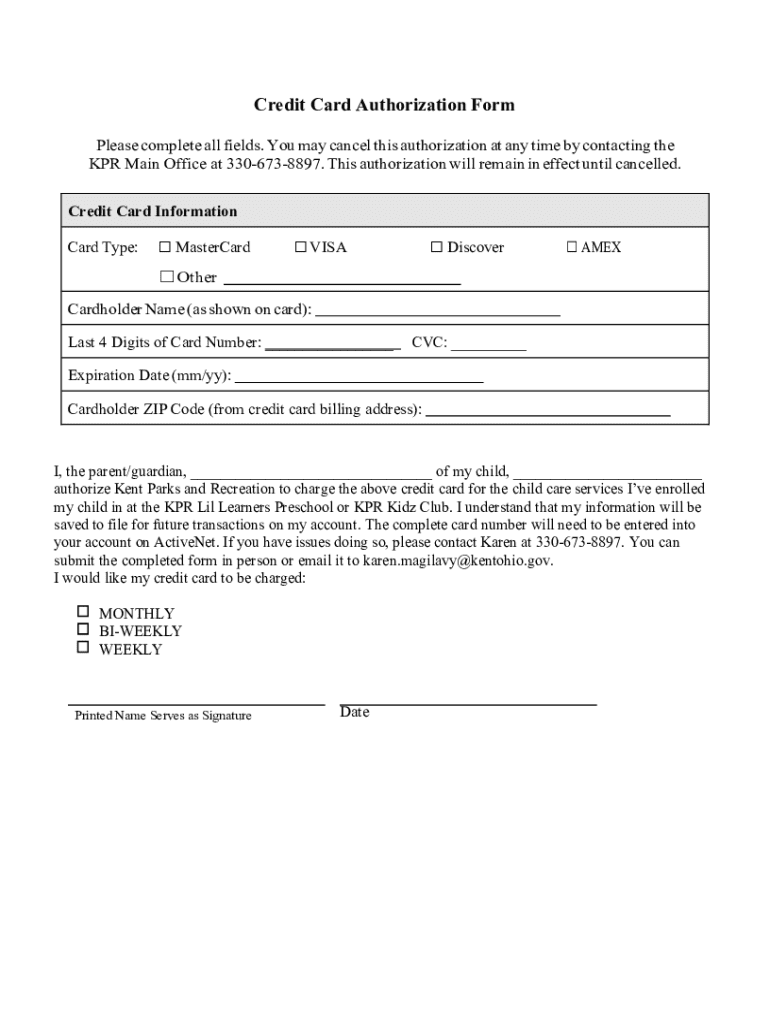

Components of a credit card authorization form

Creating a robust credit card authorization form requires including essential information. This starts with the cardholder's details, such as their name, address, and email. These components verify who is using the card and help maintain communication regarding the transaction.

Next comes the payment card information, which includes the card number, expiration date, and CVV. This data is vital for the transaction to proceed and should be handled with utmost care to ensure security. Billing address verification should also be incorporated to cross-check against data provided by the card's issuing bank, enhancing fraud protection.

Beyond the essential components, an authorization statement is critical, clearly stating that the cardholder agrees to the charges. Optional sections that can add value include the terms and conditions regarding the transaction and contact information for dispute resolution, providing cardholders with confidence that their payments are secure.

How to create a credit card authorization form with pdfFiller

Crafting a credit card authorization form using pdfFiller is a straightforward process that empowers users to create professional documents efficiently. Start by accessing your pdfFiller account or signing up if you don’t have one yet. Once logged in, you can either browse existing templates or create a new form from scratch.

Editing the form is intuitive. Users can add necessary fields such as text boxes for personal information, dropdowns for options, and checkboxes for agreements. Customizing the layout and design allows businesses to align the document with their brand, making the process feel personalized.

Saving documents securely in the cloud provides peace of mind, ensuring that forms are safely stored and easily accessible. Once your document is created, share it effortlessly with clients or team members through various methods, maximizing efficiency in your workflow.

Utilizing interactive tools like the e-signature feature enhances the form's functionality, allowing for quick and secure signing. Additionally, collaboration options with teammates ensure that the form meets all necessary requirements before it reaches the cardholder.

Tips for filling out a credit card authorization form

Filling out a credit card authorization form correctly is imperative for both customers and businesses. For customers, accuracy is key. Ensuring that all information is entered accurately protects against declined transactions and potential disputes. Double-checking for security features, such as ensuring that the website is secure and that you are communicating with an established business, also enhances safety.

For business users, creating a user-friendly experience is crucial. Make the form easy to navigate and straightforward to fill out. Transparency with cardholder options, such as outlining what the authorization entails and how the information will be used, builds trust and reassures customers regarding their sensitive data.

Addressing chargebacks and fraud prevention

Chargebacks can pose significant challenges for businesses, leading to financial losses and reputational harm. Credit card authorization forms play a critical role in mitigating this risk by providing an official record of customer consent. This documentation becomes essential in dispute resolution scenarios, offering evidence that a transaction was authorized, which can help avert chargeback abuse.

To strengthen payment security further, companies should incorporate additional verification steps. Multi-factor authentication, for example, ensures that the person making the transaction is indeed the cardholder. It's also vital to comply with PCI standards to protect customer data and minimize the risk of fraud. Best practices involve encrypting sensitive information and regularly updating security protocols.

Frequently asked questions about credit card authorization forms

Understanding the intricacies of credit card authorization forms can lead to a smoother transaction process. Below are some frequently asked questions that clarify common concerns related to this topic.

Each question plays a role in demystifying the authorization process, serving as a guiding resource for both customers and businesses navigating payment transactions.

Downloadable templates and resources

pdfFiller offers a variety of customizable credit card authorization form templates to meet diverse business needs. These templates come in various formats, including PDF, Word, and Google Docs, providing flexibility in usage. To make the most of these resources, users can easily access and modify the templates to fit their company branding and specific requirements.

Instructions for effective usage of these templates assist users in navigating the document filling and signing processes seamlessly, ensuring that every transaction is secure and legit.

Stay informed

Subscribing to our newsletter is an effective way to stay updated on best practices and evolving trends in document management. Engaging with a community of users discussing form management and document security strategies allows you to stay ahead of the curve, helping your business thrive.

Feedback and user experience

We invite users to share their experiences with credit card authorization forms. Feedback provides valuable insights that can lead to improvements in the form creation process. Collaborative input helps refine features on pdfFiller, ensuring that we continue to meet the needs of individuals and teams seeking a comprehensive, cloud-based document creation solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

How do I complete credit card authorization form online?

How do I make changes in credit card authorization form?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.