Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide

Understanding credit card authorization forms

A credit card authorization form is a vital document that allows businesses or service providers to obtain permission from a cardholder to charge their credit card for specific transactions. This form acts as a safeguard against unauthorized payments, ensuring accountability in the payment process.

The importance of your authorization cannot be overstated. By providing authorization, you mitigate the risk of misuse of your card information. If a business attempts to charge your card without this explicit consent, any disputes may lead to complications, including potential chargebacks. Therefore, using a credit card authorization form provides clarity and protection for both parties involved.

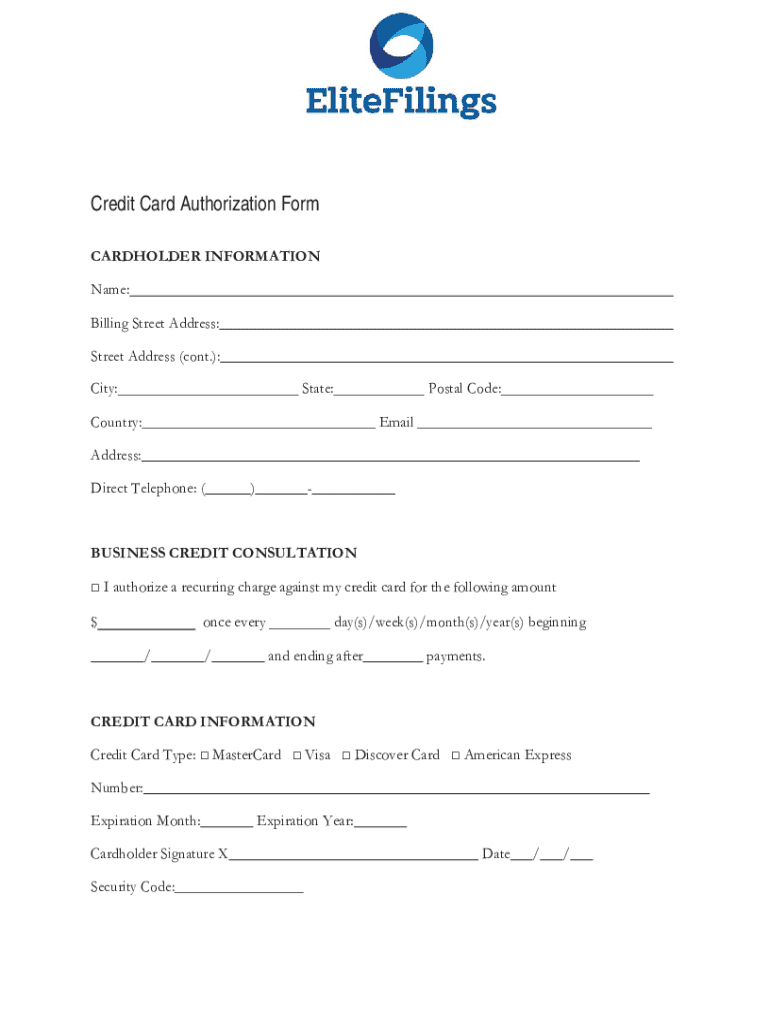

Components of a credit card authorization form

A well-structured credit card authorization form typically comprises several key sections. These ensure that all necessary information is collected to facilitate secure and legitimate transactions.

The personal information section must include the cardholder’s full name, billing address, and contact information. This data verifies the identity of the cardholder and ensures any correspondence is directed correctly.

The credit card information section captures specifics about the card, including its type (Visa, MasterCard, etc.), the card number, expiration date, and CVV code. This information is essential for processing the payment.

Furthermore, the transaction details section outlines the amount authorized, the purpose of the charge, and the dates of authorization. This section clarifies the intent behind the transaction and can also be a point of reference in case of disputes.

How to fill out a credit card authorization form

Filling out a credit card authorization form is a straightforward process, but attention to detail is necessary to ensure accuracy and legitimacy.

Begin by gathering all necessary information, including card details and personal identification. When filling in the form, take care to complete each section accurately. Once everything is filled out, review the form for any errors that might delay processing or lead to disputes.

Lastly, provide a signature. This can be done electronically or printed, depending on the format of the form being used.

For businesses, it is crucial to standardize the use of authorization forms. Establish internal processing procedures to ensure all staff are trained in the proper completion and handling of these documents.

The role of credit card authorization forms in preventing chargeback abuse

Chargebacks occur when a cardholder disputes a charge with their bank, usually claiming unauthorized transactions. These claims can severely affect businesses, leading to financial loss and reputational damage. Implementing a credit card authorization form is a strategic approach to minimizing this risk.

By requiring customers to authorize transactions via a signed form, businesses can substantiate that services were agreed upon and that the charge was legitimate. This can serve as evidence in the event of a chargeback dispute, demonstrating the customer's consent to the transaction.

For instance, a restaurant issuing a credit card authorization form before booking a large group can protect itself from potential disputes. Should a chargeback occur, the authorization serves as proof that the transaction was legitimate, thereby substantially reducing the possibility of losing the dispute.

Interactive tools for creating and managing your authorization forms on pdfFiller

pdfFiller offers an easy-to-use document editor that allows both individuals and teams to create, edit, and manage credit card authorization forms seamlessly. Visualization and customization features help streamline the document creation process.

Utilizing eSigning features for secure transactions is essential in today's fast-paced world. With pdfFiller, you can ensure that signature collection is simple and efficient, enabling quick approval times for authorizations.

Collaboration is also made easy with shared documents. Team members can work together on a credit card authorization form, ensuring that everyone involved is aligned. Furthermore, tracking changes and performing audits are essential features for businesses needing to maintain accountability and compliance.

Exploring pdfFiller’s credit card authorization form templates

Accessing pdfFiller's template library opens opportunities for customization that fit your organizational needs. These professionally designed templates ensure collected data is comprehensive and meet industry standards.

Customization features allow you to tailor forms according to your specific requirements. You can add your company logo, adjust text fields, or even reorder sections to enhance usability and relevance.

Using professional templates also brings the benefit of saving time while ensuring accuracy. Users can download completed forms in various formats, such as PDF or DOCX, making it easy to manage across different platforms.

Frequently asked questions (FAQ) about credit card authorization forms

When dealing with credit card authorization forms, several questions often arise regarding their usage or security. One common question is, 'What happens if I lose my credit card authorization form?' In this case, it is advisable to contact the service provider immediately to mitigate any potential risks.

Another query is whether users can cancel an authorization after sending the form. Generally, this depends on the terms set by the business. Understanding these terms is crucial for ensuring clarity and avoiding unintended charges.

As for legal requirements, while there may not be universal mandates, ensuring that your form includes essential features such as clear terms is pivotal for compliance and consumer protection.

Share your experience or need more help?

We encourage users to engage with our community and share experiences with credit card authorization forms. Your feedback is invaluable in enhancing our services and offerings.

If you have further questions or require assistance, our experts are here to help. Don't hesitate to reach out! Additionally, subscribing to our newsletter provides insights into the latest tips and updates regarding document management and security.

Thank you!

We appreciate your use of pdfFiller for managing your credit card authorization forms. After engaging with our tools, you will receive a confirmation email containing resource access details.

Feel free to explore more templates and tools available on pdfFiller to enhance your document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card authorization form?

How do I edit credit card authorization form in Chrome?

How do I fill out credit card authorization form using my mobile device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.