Get the free Computation of Trustee’s Compensation

Get, Create, Make and Sign computation of trustees compensation

Editing computation of trustees compensation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out computation of trustees compensation

How to fill out computation of trustees compensation

Who needs computation of trustees compensation?

Computation of Trustees Compensation Form - How-to Guide Long-read

Understanding trustees compensation

Trustees compensation refers to the fees paid to individuals or entities tasked with managing a trust. These compensations are not only a reflection of the time and efforts trustees expend but also serve as a necessary acknowledgment of their fiduciary responsibilities. Accurate computation of trustees compensation is critical, as it ensures fairness for trustees while complying with legal standards and maintaining trust integrity.

The importance of accurate computation cannot be overstated. Miscalculating or omitting necessary compensation can lead to disputes among beneficiaries and, in more severe instances, result in court interventions to resolve remuneration disagreements.

Legal framework governing trustees compensation

Trustees compensation is guided by various laws and regulations that differ from state to state. Typically, these laws outline the acceptable rates of compensation, the responsibilities of trustees, and how fees should be calculated. For instance, most jurisdictions require that compensation be reasonable and commensurate with the services rendered.

Trustees are also held accountable for adhering to the trust document, which may detail how compensation should be structured or allowed. Understanding these legal frameworks is essential for trustees to ensure they are complying with all regulations while executing their roles effectively.

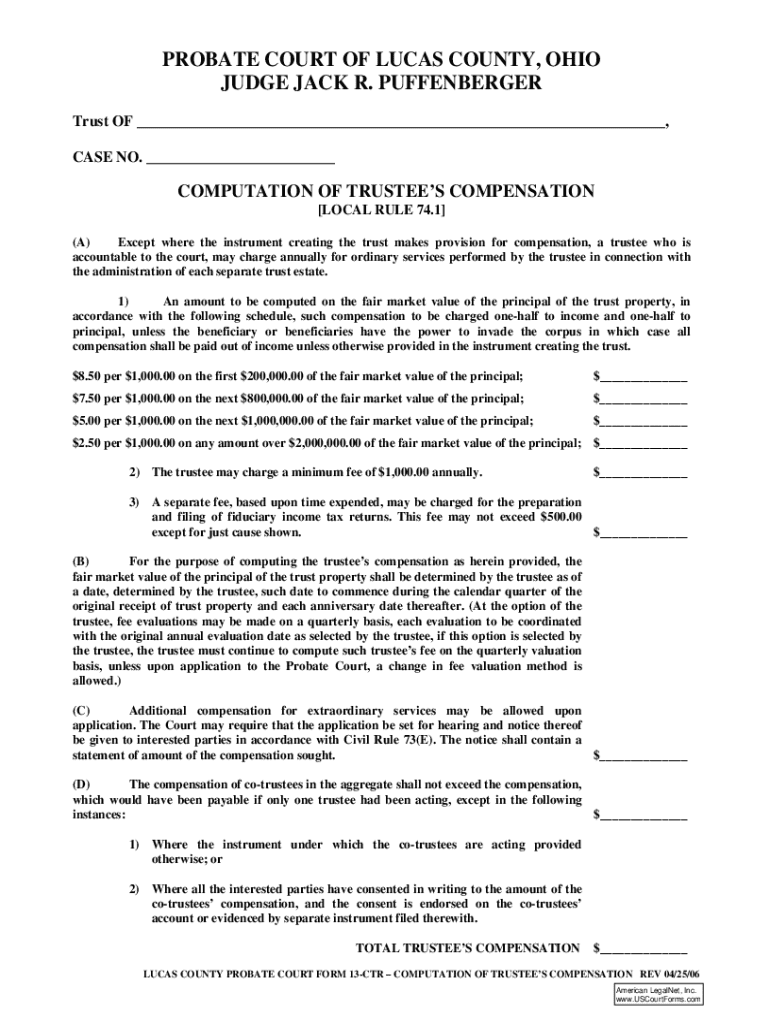

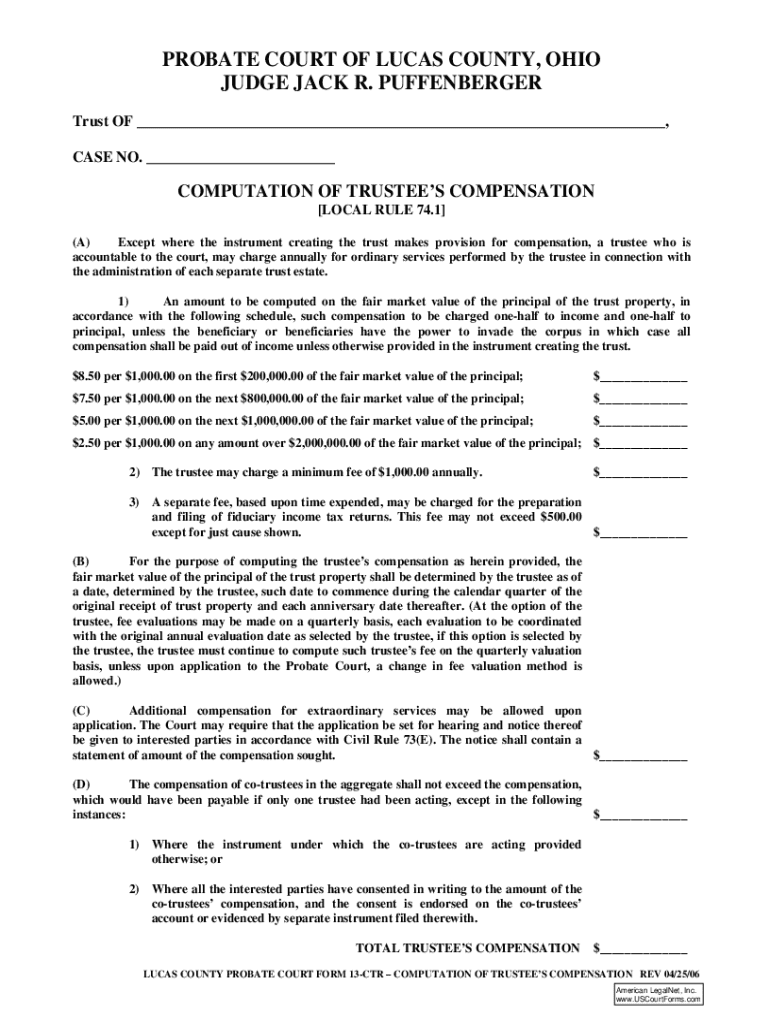

Key components of the trustees compensation form

The trustees compensation form is a critical document including various essential sections that provide a straightforward framework for compensation computation. Each section plays a vital role in accumulating the necessary details required for an accurate remuneration calculation.

Critical components of the form include:

Calculating compensation

Several factors affect compensation rates for trustees. The complexity of the trust, its nature, and geographic location all play a significant role in determining the compensation amount.

Additionally, trustees can choose between hourly rates or flat fees depending on the trust type and their preferences. Here is a general overview of the calculation methods:

Step-by-step guide to filling out the compensation form

Filling out the trustees compensation form requires careful attention to detail and organization. Here’s a step-by-step approach to ensure you provide all necessary information accurately.

Start by gathering required documentation, which includes:

Detailed instructions for each section of the form

1. **Completing personal and trust information:** Accurately fill out your name, contact details, and essential trust-related details. This establishes the groundwork for the rest of the document.

2. **Detailing trustee responsibilities:** Clearly outline your duties and any significant decisions made regarding the trust, ensuring transparency.

3. **Estimating time spent on trust activities:** Reflect on the tasks undertaken and calculate the hours devoted consistently to avoid misunderstandings regarding the cost of services.

4. **Finalizing the compensation calculation:** Use the formulas described earlier to calculate total compensation based on your recorded hours or the predetermined fee.

Common pitfalls to avoid include inaccurate reporting of hours and misunderstanding the compensation guidelines, which could lead to complications during submission.

Editing and finalizing the form

Once the form is filled out, using pdfFiller can greatly help in editing and finalizing the document. Its user-friendly interface provides various features that make the editing process seamless.

To ensure validity and security, pdfFiller offers electronic signature features. Here's how to make the most of these tools:

Collaborating with co-trustees and beneficiaries

Collaborating effectively with co-trustees and beneficiaries is vital for ensuring transparency. pdfFiller allows users to share documents effortlessly, facilitating feedback and discussion.

Tracking changes, comments, and suggestions is made easy, which helps clarify any potential issues early in the process.

Submitting the trustees compensation form

Submitting the completed trustees compensation form requires understanding where and how the document must be sent. Each jurisdiction may have different submission protocols and deadlines.

It’s crucial to adhere to deadlines to prevent any complications that may arise from late submission. Typical steps include:

Record-keeping is critical for future reference and can assist in making adjustments in annual computations as necessary.

Interactive tools and resources

Utilizing pdfFiller’s interactive tools can significantly simplify the process of preparing the trustees compensation form. Custom templates are available specifically tailored for this purpose, streamlining your efforts.

In addition, automatic compensation calculation tools can help you quickly determine the right amount owed for services rendered.

FAQs related to trustees compensation

Common questions surrounding trustees compensation often address issues such as standard rates, acceptable documentation, and submission procedures. Engaging with resources like pdfFiller provides thorough answers and links to legal support if needed.

Case studies and examples

Real-life examples of trustee compensation calculation can serve as educational illustrations of best practices. One notable case involved a trustee who failed to track hours properly, leading to significant discrepancies in compensation calculations. This resulted in beneficiaries filing a complaint, culminating in court intervention.

This case underscores the importance of accurate record-keeping and thorough understanding of compensation guidelines to avoid such inconveniences in the future.

Navigating changes and updates in compensation guidelines

Trustee compensation laws can change, and staying updated is vital for compliance. Various resources, including legal newsletters and local bar associations, can provide timely updates.

Adapting to these changes often necessitates adjustments in computation methods or fee structures, underscoring the role of ongoing research and networking within the trustee community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my computation of trustees compensation directly from Gmail?

How can I send computation of trustees compensation to be eSigned by others?

How do I edit computation of trustees compensation on an Android device?

What is computation of trustees compensation?

Who is required to file computation of trustees compensation?

How to fill out computation of trustees compensation?

What is the purpose of computation of trustees compensation?

What information must be reported on computation of trustees compensation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.