Mortgage Certificate and Affidavit Form - Your Comprehensive Guide

Understanding the mortgage certificate and affidavit form

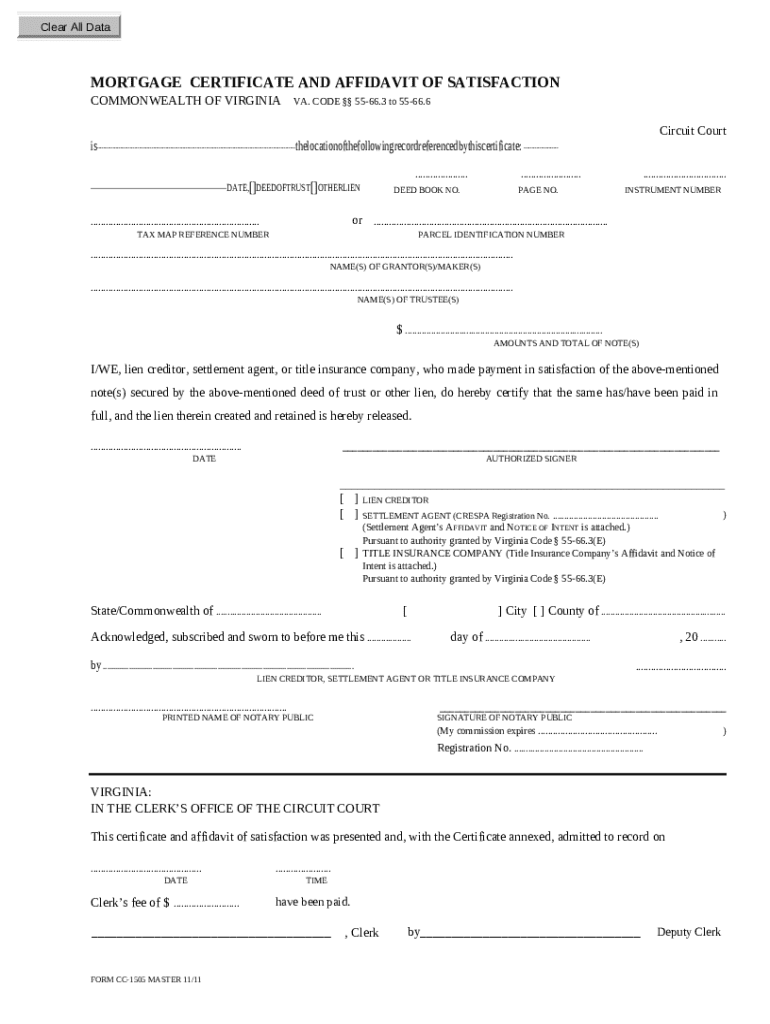

A mortgage certificate and affidavit form is a crucial document in the mortgage process, providing written proof of entitlement, rights, or obligations regarding a mortgage loan. It serves as a legal assertion from the borrower regarding the details of the loan, including the amount borrowed, interest rates, and property information. The importance of this document cannot be overstated. It protects both the lender's and borrower's rights and ensures transparency in the loan transaction.

The mortgage credit certificate program allows eligible borrowers to claim a tax credit on a portion of the mortgage interest paid each year. A well-completed affidavit verifies the authenticity of the information, preventing fraud and misunderstandings. Due to varying laws across different states, it's essential to familiarize oneself with local requirements when filling out this form.

Key components of the form

The mortgage certificate and affidavit form contains crucial information that needs to be filled accurately. Essential components include:

Full names, addresses, contact information, and Social Security numbers of the borrower and co-borrowers.

Information about the property securing the loan, including address, legal description, and type of ownership.

Details about the mortgage loan such as loan amount, interest rate, loan term, and any stipulations regarding the mortgage.

Sections where the borrower declares the truthfulness of the information provided and their legal capacity to enter into the mortgage agreement.

Preparing to fill out the form

Before filling out the mortgage certificate and affidavit form, it's crucial to gather all required documentation. This ensures a smooth process and minimizes the likelihood of errors or omissions. Common documents include:

Government-issued IDs for all borrowers involved.

Proof of income, such as pay stubs, tax returns, or bank statements.

Title deeds, surveys, or prior mortgage agreements related to the property.

Recent credit reports to assess eligibility for the mortgage.

Organizing these documents by category can expedite the completion of the form. Once collected, ensure that all properties and identities are accurately represented in accordance with your documentation. This will save time and help maintain accuracy throughout the form filling.

Navigating the online form

Accessing the mortgage certificate and affidavit form is simple through pdfFiller. Their user-friendly interface allows you to navigate easily and find the specific forms you need. When you access the form, you’ll see sections clearly labeled for filling in your information.

Features worth noting on pdfFiller include:

The platform supports various file formats ensuring ease of access for different users and purposes.

Interactive elements guide you, providing tips on each section and reducing confusion.

You can collaborate in real-time with other team members while filling out the form, enhancing accuracy.

Step-by-step instructions for completing the form

Filling out your mortgage certificate and affidavit form can be simplified by following a methodical approach. Start with the basic information. Under the borrower and co-borrower sections, ensure every name is spelled correctly and all relevant personal information is included.

When detailing property descriptions, include specific information like:

You can find this in prior mortgage documents or tax assessments.

Include the number of bedrooms and size in square feet.

Once basic information is completed, turn your attention to the affidavit section. Here, you must craft a statement that affirms the truthfulness of the information you've provided. It’s vital to be honest, as any misrepresentation could lead to legal complications later. Remember to avoid common mistakes such as vague language or frequently overlooked details.

After completing all required sections, carefully review and be sure you’ve filled every field that is applicable. With pdfFiller’s collaboration features, you can invite other parties to review your statements, providing an extra pair of eyes to catch errors.

Signing and submitting the form

The signing process for the mortgage certificate and affidavit form is straightforward with e-signature capabilities available via pdfFiller. To electronically sign your document, you'll simply click the designated area for your signature, select a preferred signing method, and confirm your signature. The platform ensures that your e-signature carries legal validity, in compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN) and similar state laws.

Once signed, it's time to submit your completed form. Options for submission vary based on your lender’s preferences, which may include:

Directly send the completed document to the lender's designated email address.

Use your lender’s secure online portal to upload the completed document.

In some cases, especially with traditional lenders, a physical copy may need to be mailed.

Always confirm receipt of your document. Using a tool such as email read receipts or tracking for physical mail can afford you peace of mind and assist in record-keeping.

Managing your mortgage certificate and affidavit form

Post-submission, it's important to manage and store your mortgage certificate and affidavit form securely. Keeping a copy in a cloud storage solution, like pdfFiller offers, allows you to access it from anywhere. Organizing your documents into dedicated folders can streamline future retrieval when needed.

Utilizing features like version control and document history in pdfFiller aids in tracking changes. It’s advisable to regularly update your records, especially if there are modifications in mortgage terms or legal stipulations.

Updating your form

You may need to revise your mortgage certificate and affidavit form due to shifts in financial circumstances or updating your contact information. Understanding the necessary legal requirements for revisions is critical; many lenders allow modifications provided they are filed promptly and correctly.

Utilizing pdfFiller's editing capabilities makes revisions simple. You can make changes directly to your existing document and resend it for approval, maintaining up-to-date compliance with mortgage regulations.

Troubleshooting common issues

Despite diligence, issues with forms can arise. A common cause of form rejection is missing required information or discrepancies in provided data. To proactively manage these issues, ensure that:

Review for spelling errors, incorrect property descriptions, or wrong loan amounts.

If a section isn’t applicable, indicate this clearly.

Failure to include necessary documentation can lead to delays.

If your form is rejected, rectify these issues promptly and resubmit. Don’t hesitate to reach out to your lender immediately for clarification on any rejection reasons.

Support options available through pdfFiller

If you encounter difficulties while using pdfFiller, various support options are at your disposal. Customer service can be reached via chat, email, or phone, ensuring assistance is never out of reach. Furthermore, pdfFiller offers a robust help center with articles covering common questions and troubleshooting techniques, empowering users to navigate issues independently.

Frequently asked questions about the mortgage certificate and affidavit form

When filling out forms, borrowers often have queries regarding the process. Notably, many may wonder what actions to take if a mistake is made after submission. In such cases, it’s preferable to communicate with your lender immediately, as they can guide you through rectifying the mistake in the most efficient manner.

Another common concern is about fees associated with filing this form. Generally, most lenders do not charge fees for submitting the mortgage certificate and affidavit form, but it’s wise to verify this ahead of filing to avoid surprises.

Specific queries related to pdfFiller services

Users frequently ask about collaboration options when filling out forms on pdfFiller. Indeed, you can easily share your document with others for collaborative editing. Additionally, security is a primary concern for many users. pdfFiller adheres to industry-leading security protocols, ensuring your personal information remains protected while using their platform.

Further support and resources

For individuals needing assistance, pdfFiller provides multiple channels for support. Whether through chat or email, help is prompt, and response times are designed to minimize wait, keeping your documentation process flowing smoothly.

Moreover, pdfFiller enhances accessibility by including features supporting users with disabilities. Interactive tools aim to enrich the user experience, aiding individuals in successfully completing their mortgage certificate and affidavit forms.

Engage with us

Engaging with pdfFiller on social media platforms is an excellent way to keep informed about updates and news. Links to follow pdfFiller across various platforms are available on their website. Community forums can provide additional insights and tips from fellow users.

Sharing your experience or success story with pdfFiller empowers others and contributes to the community, fostering a sense of connection among users navigating similar processes.