Get the free California Tractor Bill of Sale Form

Get, Create, Make and Sign california tractor bill of

Editing california tractor bill of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california tractor bill of

How to fill out california tractor bill of

Who needs california tractor bill of?

California Tractor Bill of Form - How-to Guide

Overview of the California Tractor Bill of Form

The California Tractor Bill of Form is a crucial document for the registration and ownership of tractors within the state. This form serves multiple purposes including ensuring compliance with state vehicular regulations and facilitating the legal transfer of ownership. Given California's diverse agricultural landscape and robust construction industry, it is essential for both individuals and businesses operating tractors to understand its significance and the regulations therein.

The importance of this form is underscored by California's stringent vehicle registration laws, which aim to maintain accurate records and promote safe operation among tractor owners. Key regulations governing tractor ownership and operation include adherence to safety standards, environmental compliance, and tax obligations, ensuring that each vehicle on California roads is registered and operational within legal parameters.

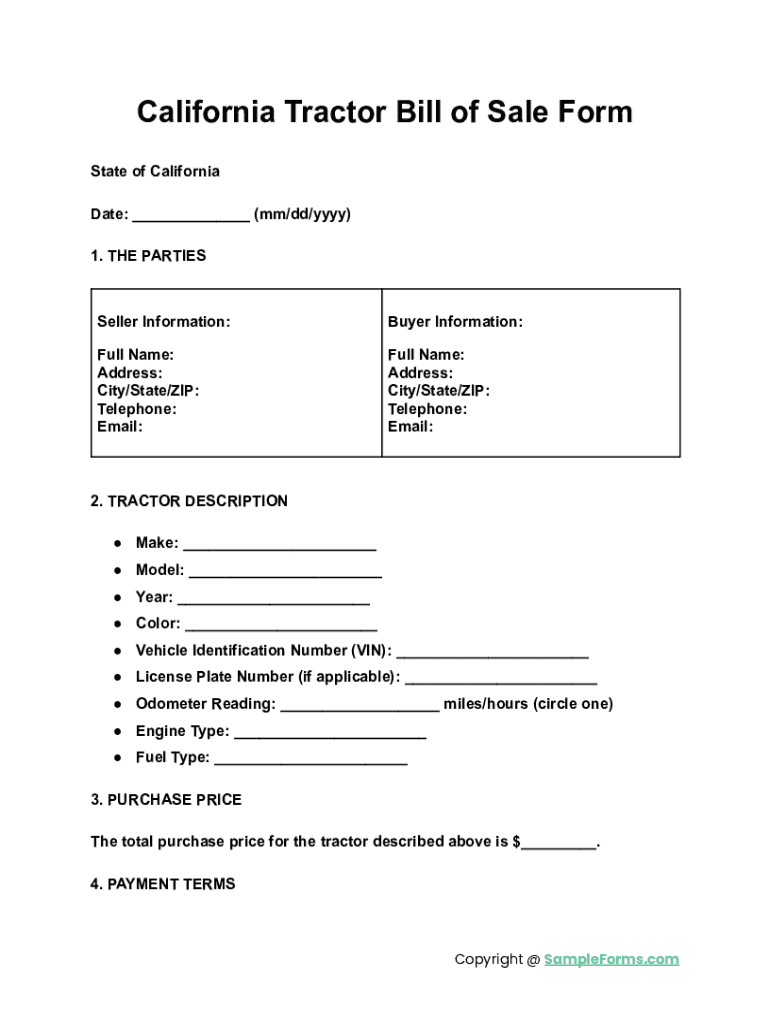

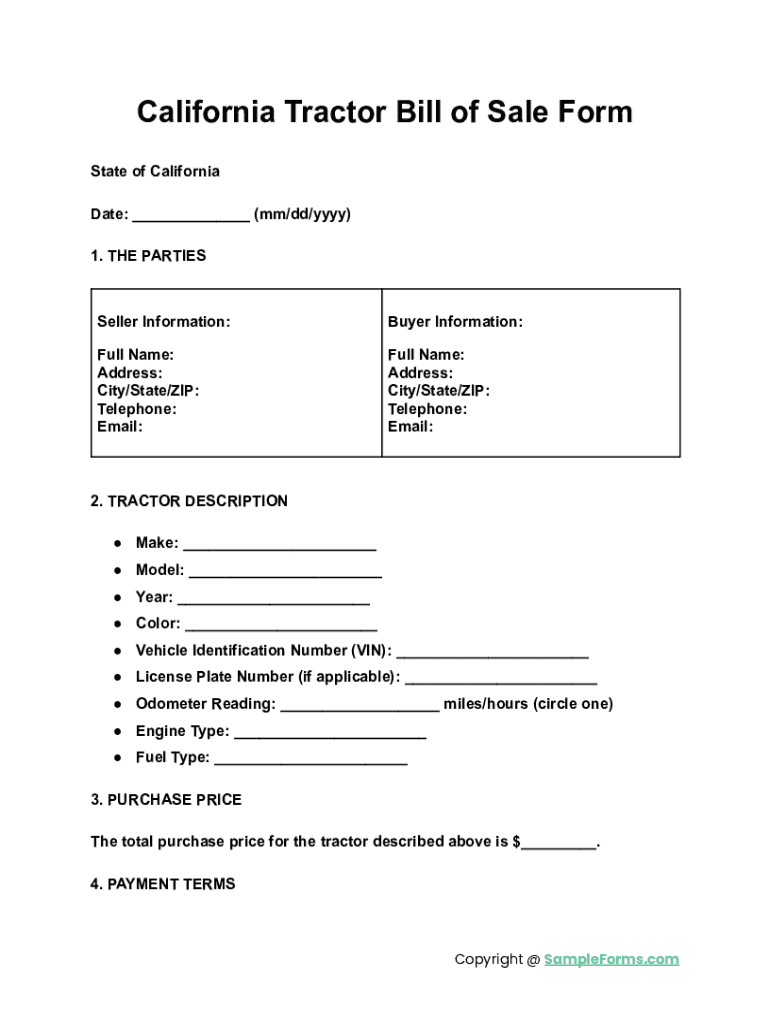

Understanding the components of the Tractor Bill of Form

The Tractor Bill of Form consists of several key sections that need careful attention. Firstly, the vehicle information section captures essential details such as the make, model, year of manufacture, and even the Vehicle Identification Number (VIN). This information is critical for the Department of Motor Vehicles (DMV) to identify the specific tractor being registered.

Next, the owner information section divides into categories for individual owners and businesses. For individuals, personal details need to be provided like full name, address, and contact information. For businesses, additional details such as the business name and employer identification number (EIN) are necessary. Lastly, the tax and fee information section outlines the financial responsibilities associated with registration, including sales tax based on the purchase price and any applicable state fees. Familiarity with common terminology such as 'gross weight' and 'farm-use exemption' is advantageous while completing this form.

Who needs to complete the Tractor Bill of Form?

Completing the California Tractor Bill of Form is typically required for a variety of stakeholders. Primarily, this includes farmers utilizing tractors for agriculture, contractors involved in construction projects, and commercial operators who rely on heavy machinery for various business operations. Individuals or businesses purchasing new tractors, transferring ownership, or re-registering an existing tractor due to changes in status are all required to fill out this form.

Furthermore, even those seeking to import tractors from out of state must adhere to the form requirements to comply with California's unique registration protocols. Therefore, effectively understanding who needs to complete the form not only aids in compliance but also streamlines the process of vehicle management for all those involved in agricultural or commercial operations.

Step-by-step guide to filling out the Tractor Bill of Form

Filling out the Tractor Bill of Form can be straightforward if you follow a well-structured approach. Start by gathering necessary documentation which typically includes previous registration documents, proof of ownership such as a bill of sale, and identification for the owner. Having these documents on hand makes the process smoother and ensures all information can be accurately captured in the form.

Next, access the form through the California DMV website or visit a local DMV office. The form can usually be found in the forms section, and it’s essential to have the latest version to ensure compliance with any recent changes in regulations.

When completing the form, take your time filling out each section carefully. Pay close attention to details like VIN and ownership information. Common mistakes include incorrect VIN entries or missing signatures, which can delay processing. After filling out the form, conduct a thorough review to check for accuracy. A proposed checklist for review might include verifying all personal and vehicle information, ensuring all required signatures are present, and confirming payment amounts for taxes and fees.

Filing options for the Tractor Bill of Form

Once the California Tractor Bill of Form is completed, you have several options for submission. The most efficient method is online submission. Utilizing platforms like pdfFiller allows for electronic submission of the form directly to the DMV. This method not only speeds up the registration process but also provides tracking features to see the status of your submission.

Another option is to submit the form by mail. If you choose this route, ensure that you send it to the correct DMV office and consider using a tracked mailing service to avoid common pitfalls like lost documents. Lastly, in-person filing is also possible at DMV locations across California. For this method, be sure to bring all relevant documents and extra copies, if required, to minimize any delays during your visit.

Using pdfFiller to edit and manage your form

In today’s fast-paced environment, pdfFiller is a game-changer for managing your Tractor Bill of Form. This cloud-based platform comes with a plethora of features that facilitate not only the editing of PDF documents but also electronic signing and collaboration among team members. Users can access the form from any device, edit and fill it out seamlessly, and even invite colleagues to review or sign the documents.

In fact, many users have reported successful and hassle-free experiences when utilizing pdfFiller for their submissions. From interactive tools that guide you through completion to its ability to save recurring forms, pdfFiller takes the stress out of document management, especially for those involved in agriculture and logistics where efficiency is key.

Post-submission steps

After submitting the California Tractor Bill of Form, tracking its status is crucial. You can do this through the DMV's website, where a tracking tool allows you to check if your form has been processed. If there are any issues or if your filing is rejected, the DMV typically provides clear instructions on what steps to take next for resolution.

It’s important to be aware of critical deadlines related to tractor registration as well. These can include initial registration periods for newly purchased tractors and renewal deadlines for existing registrations. Maintaining an organized system for tracking registration statuses will ultimately aid in compliance and avoid unnecessary penalties for late submissions.

Frequently asked questions about the California Tractor Bill of Form

Many users have common inquiries regarding the California Tractor Bill of Form. These include questions such as: 'What should I do if I lose the form after filling it out?' or ‘Are there additional fees for online submission?’ Clarifying these points can save time and create a smoother experience for applicants. It's advisable to consult the DMV website for up-to-date answers and guidance.

Additionally, certain scenarios may require further clarification or documentation, such as if you need to submit additional proof of insurance or specific forms for agricultural use exemptions. Contacting the DMV directly or utilizing customer service chat options can provide answers tailored to your specific situation.

Tips for ongoing compliance and record-keeping

To maintain good standing with tractor registration requirements, it’s essential to keep all documentation organized. This includes not just the California Tractor Bill of Form, but also any correspondence with the DMV, receipts of fees paid, and proof of ownership documents. A well-structured filing system—whether digital or physical—can help in quickly retrieving necessary documentation when needed.

Routine checks on your vehicle registration status are equally important. Setting reminders for renewal deadlines and periodic reviews can prevent lapses in registration, thereby avoiding fines or enforcement actions. Utilizing a virtual assistant or calendar app to mark important dates can further facilitate compliance, ensuring that tractor owners stay informed about their legal obligations.

Conclusion of the guide

Completing the California Tractor Bill of Form is an essential step for anyone looking to operate a tractor legally in the state. By using tools like pdfFiller, users can streamline their submission processes, ensuring compliance while managing their documents effortlessly. This guide serves as a resource for ongoing compliance and efficient document management, empowering individuals and teams to navigate the registration landscape smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california tractor bill of directly from Gmail?

How can I edit california tractor bill of from Google Drive?

How do I edit california tractor bill of online?

What is california tractor bill of?

Who is required to file california tractor bill of?

How to fill out california tractor bill of?

What is the purpose of california tractor bill of?

What information must be reported on california tractor bill of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.