Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

A comprehensive guide to credit application forms

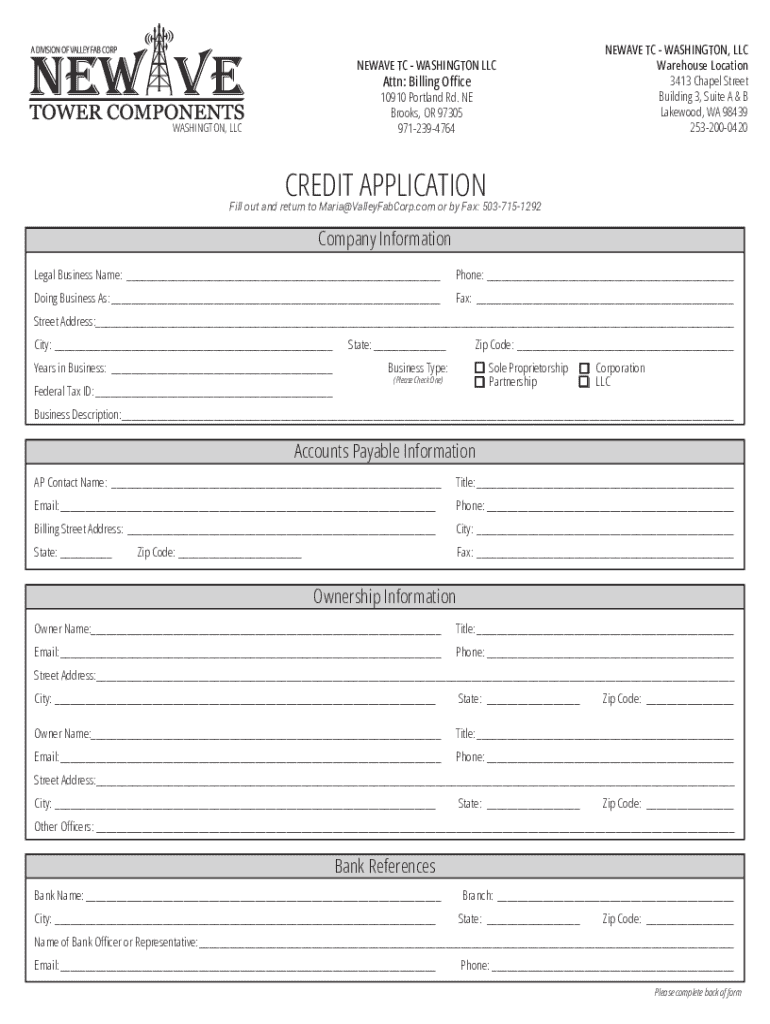

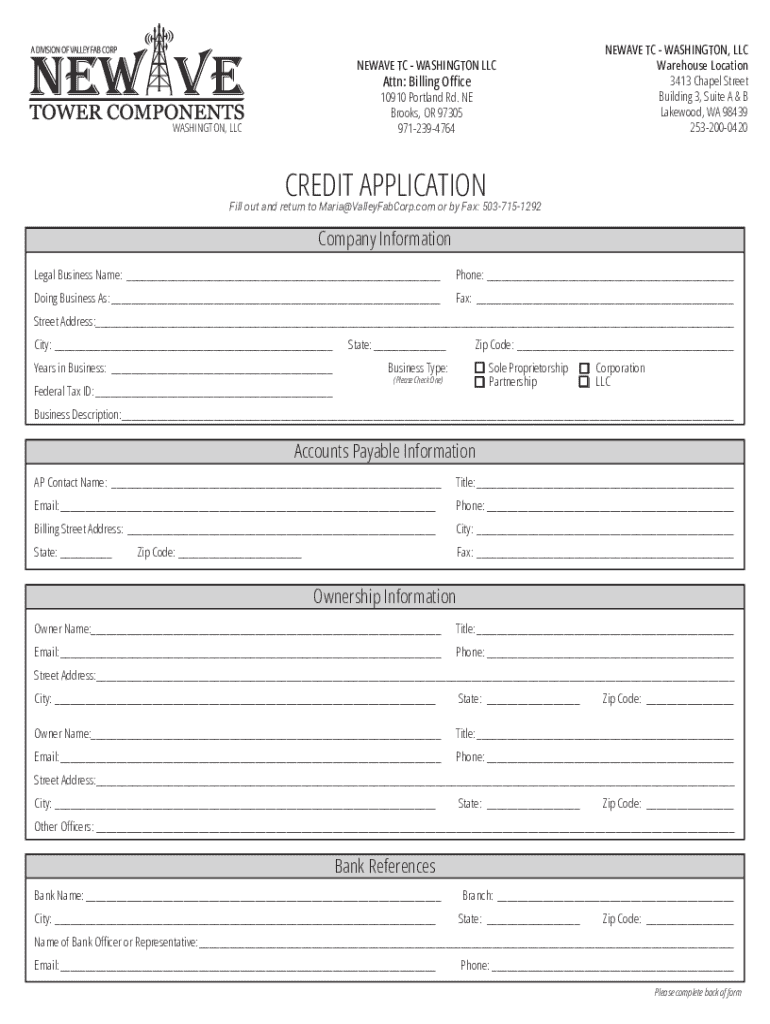

Understanding the credit application form

A credit application form is a crucial document that individuals and businesses use when seeking credit from lenders. This form typically collects essential personal and financial information needed for a lender to evaluate an applicant's creditworthiness. The primary purpose of the credit application form is to provide lenders with a comprehensive overview of the borrower's financial profile and history, allowing them to make informed lending decisions.

The credit application form plays a vital role in financial transactions, whether you're applying for a credit card, auto loan, mortgage, or any other form of credit. This importance extends to all stakeholders involved, including borrowers, lenders, and regulatory bodies. Thorough understanding and accurate completion of this form can significantly influence the outcome of a credit request.

Common types of credit application forms

Credit application forms come in various types, tailored to meet different financial needs. The most common are personal credit application forms, used by individuals seeking loans or credit lines for personal use. These forms typically require basic personal information, income details, and credit history.

Business credit application forms, on the other hand, are specifically designed for business loans or credit lines. They differ from personal applications in that they request additional documentation like business tax returns, profit and loss statements, and business credit history. Furthermore, specialized forms may be needed for specific credit types, such as auto loans, mortgages, or student loans, each demanding distinct information tailored to the nature of the credit sought.

Essential information required in a credit application form

Filling out a credit application form requires substantial information to ensure a thorough evaluation. The personal identification section captures essential details like your full name, address, date of birth, and contact information. It's crucial to be accurate and provide up-to-date information to avoid any delays in processing your application.

Next comes financial history, where you'll need to detail your employment status, income sources, and other relevant financial data. Most lenders also require information about your credit history, including any past loans, credit accounts, and payment histories. Additionally, providing supporting documents such as proof of income and identification can strengthen your application and expedite its processing.

Step-by-step guide to filling out a credit application form

Filling out a credit application form can be straightforward if approached systematically. Here’s a step-by-step guide:

Editing and customizing your credit application form

Once you have your credit application form, editing it can greatly enhance your chances for success. Using tools like pdfFiller allows you to make changes seamlessly, from adjusting personal information to updating financial data. User-friendly editing features simplify the process, allowing you to modify existing forms or build new ones tailored to specific lender requirements.

Customization can significantly impact the impression your application leaves on lenders. Utilizing templates ensures consistency and enables you to present your information clearly and professionally, meeting all necessary guidelines.

Signing the credit application form

The signing process has evolved, with eSigning becoming a standard part of credit applications. Incorporating eSignatures not only speeds up the submission process but also enhances the convenience for both you and the lender. Any credible credit application platform, like pdfFiller, supports eSigning, ensuring a smooth and legally accepted signature for your documents.

To eSign your credit application form, simply follow the platform’s instructions to add your signature electronically. This is particularly advantageous for remote applications, reducing the need for physical paperwork.

Submitting your credit application form

Submitting a credit application form can be done through various methods, including online and offline options. Many lenders now allow easy online submissions through their portals or email, which can lead to faster responses. Some may prefer receiving paper forms via traditional mail, which could take longer for processing.

After submission, tracking your application status becomes essential. Most lenders provide a timeframe within which they will respond. Waiting can be nerve-wracking, but understanding this process can help temper expectations. Regular follow-ups can also be beneficial as they show your continued interest in the application.

Managing and storing your credit application forms

Effective management of credit application forms is vital for both individuals and teams. Utilizing cloud-based storage solutions, such as those provided by pdfFiller, can offer significant advantages. Not only do these platforms facilitate ease of access to documents from anywhere, but they also provide robust security features to protect sensitive information.

Moreover, collaboration tools integrated into cloud solutions enhance teamwork on applications. Multiple users can work on a single credit application form together, ensuring all necessary changes and inputs are captured effectively.

Troubleshooting common issues with credit application forms

Despite careful planning, applicants often encounter common issues when completing credit application forms. There can be errors such as incorrect financial details or missing required documents that can delay processing. Familiarizing yourself with potential pitfalls can help you avoid these issues. Checking each section and ensuring all fields are filled can make a well-rounded application.

FAQs from lenders often illuminate common applicant concerns, whether related to credit history inquiries or income verification. Support resources, like those available through pdfFiller, can provide immediate answers and assistance when needed.

Interactive tools for credit application success

Leveraging interactive tools can significantly enhance your experience in completing credit application forms. For example, calculators to determine potential credit limits can provide clarity before you apply. Additionally, checklists for required documents ensure you come fully prepared, saving both time and effort.

Comparison tools for different lending options help you make informed decisions based on your financing needs. By utilizing such tools, you can navigate the credit application process smartly and more efficiently.

Best practices for credit application success

Improving your chances of credit application approval involves strategic planning. Start by refining your financial profile prior to applying. This may include paying down existing debts, ensuring your credit report is accurate, and having a stable income source. Researching lender criteria can provide insights into what information is most critical to include.

Understanding the lender's decision-making process can also empower you during the application phase. Factors like credit score, income stability, and existing debt levels play a significant role. By preparing your credit application with these aspects in mind, you increase your likelihood of obtaining the credit you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute credit application online?

How do I fill out the credit application form on my smartphone?

How do I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.