Get the free Ct‑1040v

Get, Create, Make and Sign ct1040v

How to edit ct1040v online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct1040v

How to fill out ct1040v

Who needs ct1040v?

Comprehensive Guide to the CT1040V Form

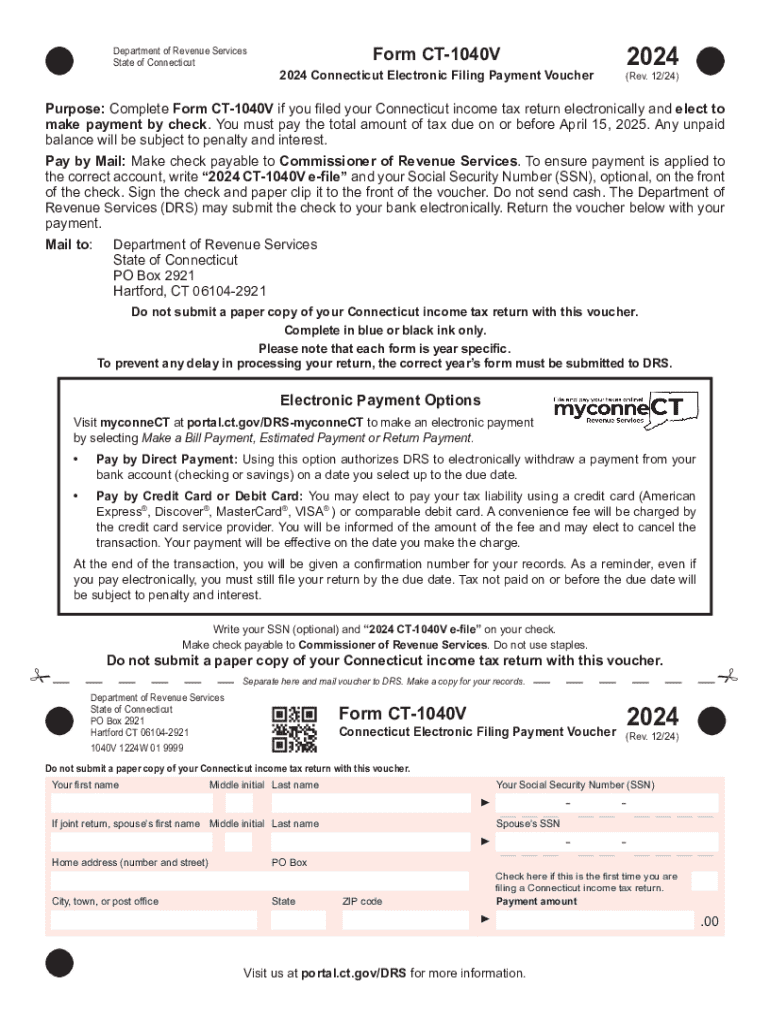

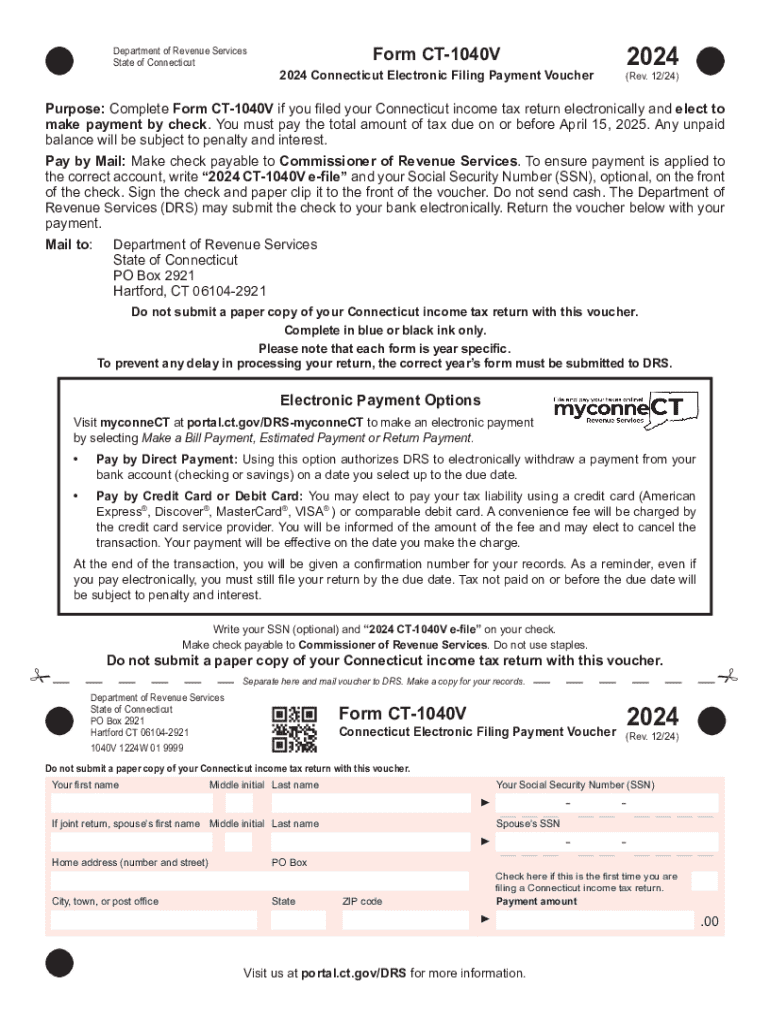

What is the CT1040V form?

The CT1040V form serves as the Connecticut state tax payment voucher. It is a crucial document for taxpayers who owe state income tax and are submitting their tax returns. This form allows individuals and businesses to accompany their tax returns with payments, ensuring that any taxes owed are paid in a timely manner.

The significance of the CT1040V extends beyond merely being a payment method. It streamlines the tax filing process, making it easier for the Connecticut Department of Revenue Services to efficiently process payments. Using this form ensures that taxpayers comply with state regulations and avoid potential penalties for late payments.

Who needs to file the CT1040V form?

Eligibility for filing the CT1040V form primarily hinges on whether a taxpayer owes tax upon submission of their state tax return. Therefore, both individual taxpayers and businesses anticipating a tax liability must complete this form when submitting their returns. Failing to do so may result in delayed processing, leading to complications with the state's tax authority.

Common scenarios necessitating the use of the CT1040V form include last-minute earnings that push a taxpayer into a higher income bracket or any self-employed individuals responsible for making estimated tax payments. Moreover, business owners who experience profits that increase their tax obligation should also utilize the CT1040V to ensure their payments are recorded accurately.

How to obtain the CT1040V form

Accessing the CT1040V form is straightforward, especially via the Connecticut Department of Revenue Services website. You can visit their resource section, where tax forms are readily available for download. This online platform provides a user-friendly experience, allowing taxpayers to find their required forms efficiently.

For those preferring offline options, CT1040V forms can also be obtained through local tax offices or their designated branch locations. To download the form, follow these steps: navigate to the website, locate the 'Forms' section, select 'Individual Income Tax,' and click on 'CT1040V.' From there, you can print it directly.

Step-by-step guide to completing the CT1040V form

Filling out the CT1040V form requires careful attention to detail. Key sections include your personal information, tax identification number, the payment amount, and any corresponding details pertinent to your tax return. Begin by accurately entering your name and address, then proceed to indicate the amount owed, ensuring to double-check calculations.

When completing the form, taxpayers should avoid common mistakes like failing to sign the voucher or mismatching the payment amount with the reported tax return figures. It's critical to review the entire form before submission to minimize errors, thus ensuring successful processing by the Connecticut Department of Revenue Services.

Payment options and submission methods

When submitting payment through the CT1040V form, various methods are available to taxpayers. You can choose to send a check made out to the Connecticut Department of Revenue Services, utilize electronic payment options like direct debit from your bank account, or pay through credit cards via authorized payment processors. Each method has its benefits, so it’s vital to select one that aligns with your circumstances.

For submission, options include mailing the completed CT1040V and your tax return to the address specified on the form or utilizing electronic submission systems available through the state’s website. Pay attention to important deadlines, particularly the submission date for payments, as missed deadlines can lead to penalties and interest accruing on overdue amounts.

Filling out the CT1040V form using pdfFiller

pdfFiller provides a modern solution for filling out the CT1040V form digitally, where you can edit and complete the document entirely online. To utilize pdfFiller, start by uploading the downloaded CT1040V form or access it directly through the pdfFiller platform. Once loaded, you can fill in each required field seamlessly.

The tool also offers convenient features like eSign, allowing you to sign the document electronically, which speeds up submission. Collaboration tools enable multiple users to work on the form simultaneously, enhancing productivity, especially for team members managing tax documents together. The secure document management ensures that your sensitive tax information remains protected.

After submission: what to expect?

After submitting your CT1040V form and the associated payment, the next steps involve verifying that the payment has been processed. Taxpayers can check their payment status directly on the Connecticut Department of Revenue Services website, providing peace of mind that their taxes have been filed correctly.

In the event of payment discrepancies, like a missed payment or incorrect amount, it's important to follow up promptly with the revenue services to rectify any issues. Keeping documentation of your submission can assist in resolving disputes, ensuring that you maintain a clear record of your tax payments.

Frequently asked questions (FAQs) about the CT1040V form

Taxpayers often have several common concerns about the CT1040V form. One frequent question is whether they must submit the form even if they are filing electronically. The answer is yes; the CT1040V is required whenever tax payment is due, regardless of how the return is filed.

Another common misconception is that electronic payments eliminate the need for the CT1040V form altogether. While electronic payments can be quicker, the form must be included for proper tracking and processing by the state. Addressing these concerns accurately is essential for ensuring that taxpayers fulfill their responsibilities efficiently.

Tips for a smooth tax filing experience

Organizing tax documents effectively leads to a smoother filing experience. Using pdfFiller, individuals can manage their documents from a cloud-based platform, making it easier to find and update any pertinent information. Keeping all documents related to your CT1040V and tax returns in one place can drastically reduce the time spent on preparation.

For teams working collaboratively on tax filings, utilizing pdfFiller's collaborative features enables real-time updates and ensures that everyone is on the same page. This facilitates seamless communication, allowing team members to focus on accuracy and compliance when dealing with Connecticut tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ct1040v in Gmail?

How can I send ct1040v to be eSigned by others?

How can I edit ct1040v on a smartphone?

What is ct1040v?

Who is required to file ct1040v?

How to fill out ct1040v?

What is the purpose of ct1040v?

What information must be reported on ct1040v?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.