Get the free Minimum Wage / Paid Sick Leave Employee Interview Form

Get, Create, Make and Sign minimum wage paid sick

Editing minimum wage paid sick online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minimum wage paid sick

How to fill out minimum wage paid sick

Who needs minimum wage paid sick?

Understanding the Minimum Wage Paid Sick Form: A Comprehensive Guide

Understanding minimum wage paid sick leave

Minimum wage laws define the lowest amount an employer can pay their employees for labor performed. These laws are crucial for ensuring that workers receive a fair wage that meets basic living costs. Compliance with minimum wage laws not only protects employees but also promotes economic stability and fairness in the workplace.

Paid sick leave is a policy that allows employees to take time off while still receiving their regular wages when they are unwell. This policy offers significant benefits, not only by supporting employees during health-related absences but also by fostering a healthier workforce and reducing the spread of illness in workplaces. Employers who implement paid sick leave see increased employee satisfaction and retention, which can ultimately enhance productivity and company morale.

Who is eligible for paid sick leave?

Eligibility for paid sick leave often varies based on an employee’s status, such as full-time or part-time. Typically, full-time employees, who work a set number of hours per week, are more likely to qualify for paid sick leave compared to part-time staff. Additionally, factors such as the length of employment can affect eligibility, with many organizations requiring a minimum tenure before benefits are accessible.

Employers bear the responsibility of adhering to sick leave laws, ensuring that eligible employees are informed about their rights and the provisions of sick leave policies. However, there are exceptions, particularly among small businesses; these may not be required to provide paid sick leave due to specific limitations set by local laws. It's essential for both employees and employers to review their local sick leave laws to understand who qualifies for this benefit.

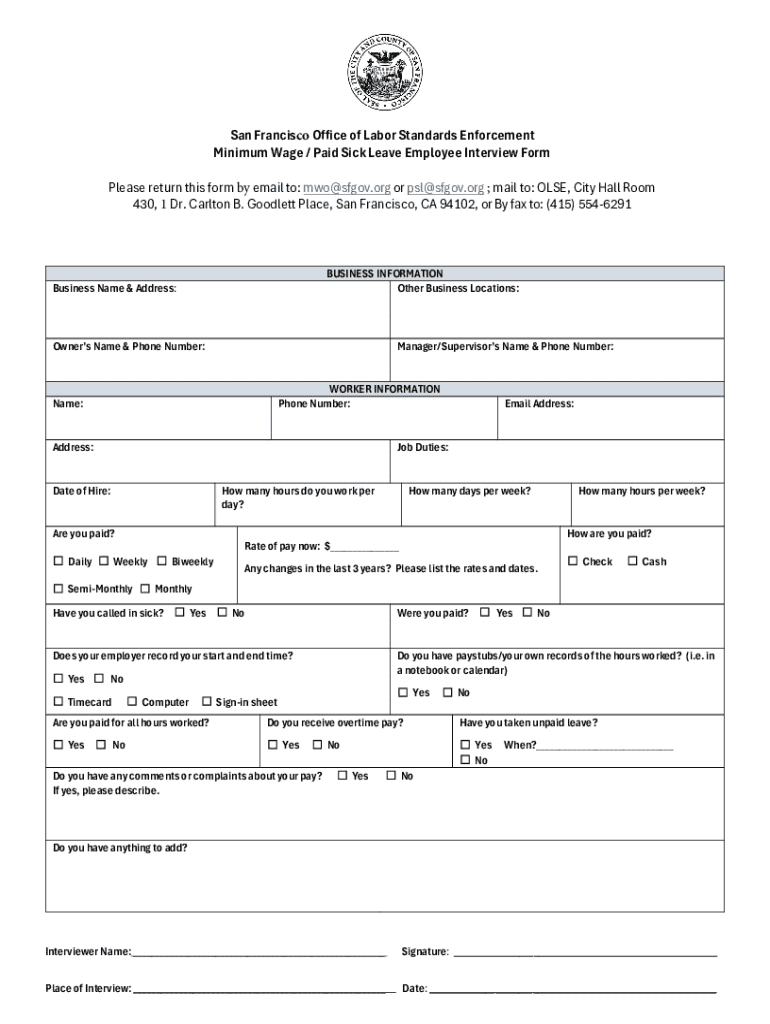

The importance of minimum wage paid sick form

The minimum wage paid sick form serves a critical purpose in documenting requests for sick leave. This form ensures both employees and employers adhere to the sick leave policies established within an organization and remain compliant with relevant labor laws. Through proper documentation, issues surrounding sick leave can be handled more transparently, reducing potential conflicts between employees and management.

Using the minimum wage paid sick form can streamline the process for employees, making it easier to submit requests while allowing employers to manage attendance and absence records effectively. By reducing misunderstandings related to sick leave entitlements, both parties can foster a more harmonious work environment.

How to access the minimum wage paid sick form

Accessing the minimum wage paid sick form can vary by employer, but several common methods exist. Many organizations provide this form through their human resources department, where employees can request a hard copy or an electronic version. Alternatively, full-time and part-time employees can check the company's intranet or employee portal if one is available, which often houses necessary documents and forms.

The minimum wage paid sick form is typically available in various formats, such as PDFs or Word documents. Utilizing standardized forms is vital, as they ensure consistent data collection and make it easier for human resources personnel to process requests. Having a clear, well-structured form also minimizes the chances of overlooking critical information in the submission process.

Step-by-step guide to filling out the minimum wage paid sick form

To ensure a successful submission of the minimum wage paid sick form, employees should provide essential details. Required information typically includes the employee's full name, address, position, and direct supervisor. It’s also crucial to include the specific dates and duration for which sick leave is being requested, as clarity in this section aids in proper planning for workplace needs.

Each section of the form tends to have specific instructions, which can help avoid common pitfalls. For example: 1. **Patient information**: Fill in details about the medical condition or appointment. Be sure to respect privacy laws and refrain from disclosing sensitive personal health information. 2. **Medical professional verification**: Some employers may ask for verification from a healthcare provider; proper documentation sometimes must be attached. 3. **Employee acknowledgment**: Signing and dating the form is crucial; this confirms that all the information provided is accurate and that the employee understands the company’s sick leave policies.

Common mistakes to avoid when completing the form include omitting crucial information, failing to sign and date the document, and not following submission protocols. Additionally, waiting until the last minute to submit requests can cause delays in obtaining approval.

Submitting the minimum wage paid sick form

When you’ve completed the minimum wage paid sick form, knowing how to submit it is essential. Employers generally provide preferred methods of submission, with common options including electronically via email or submitting a hard copy to the HR department. Make sure to follow instructions provided by your employer closely, as these can vary between organizations.

After submission, employees can expect to receive confirmation regarding their sick leave status. The timeline for approval may vary depending on the company’s policies and the volume of requests processed. Employees should track their submissions and communicate with HR to gauge their sick leave request's approval or denial status, ensuring that they have a clear understanding of their leave situation.

Monitoring and managing paid sick leave requests

Both employees and employers should prioritize effective record-keeping practices when it comes to tracking sick leave. Best practices include maintaining clear documentation of sick leave requests, the approval process, and the reasons for taking leave. This formal record can serve future needs or clarifications and provide valuable insight during performance evaluations or attendance reviews.

In instances of disputes or requests being denied, there should be a clear protocol established for appealing decisions. Employees are encouraged to address their concerns directly with HR, which should have resources or guidelines in place to assist in resolving conflicts. Support resources, such as legal advice or the labor commissioner’s office, can also provide guidance on understanding rights related to sick leave laws and policies.

Interactive tools and resources

Navigating paid sick leave can become more manageable through various online tools and resources. For example, there are online calculators available to help employees determine their sick leave accrual based on their hours worked or company policy. Additionally, templates can assist both employees and HR departments in maintaining accurate records of sick leave and attendance.

For further assistance, it is crucial for employees to have access to contact information for HR representatives who can assist with questions or concerns related to sick leave. Linking to local state labor department resources can also prove beneficial, as these entities provide essential information regarding labor laws, rights, and employer obligations regarding paid sick leave.

Best practices for employers

Creating an employee-friendly sick leave policy hinges on clarity and compliance with labor laws. Employers should ensure that their sick leave policies are inclusive, transparent, and easy to understand. Essential elements that should be included in these policies comprise eligibility criteria, the process for requesting sick leave, and provisions outlining any necessary documentation.

Training managers and staff on the content and application of the minimum wage paid sick form is critical for fostering a workplace culture that values employee health and well-being. By encouraging open dialogue regarding health and creating an encouraging environment for employees to exercise their rights to sick leave, employers can significantly enhance employee morale and productivity.

Frequently asked questions

There are numerous questions surrounding minimum wage and paid sick leave. For instance, many individuals are often unclear about the differences between sick leave and other forms of leave, such as vacation or personal days. A common misconception is that all employees automatically qualify for paid sick leave; in reality, eligibility often depends on various factors, including company policy and local laws.

Troubleshooting specific scenarios can lead to clarity on unique situations, such as rights of out-of-state workers or seasonal employees who may not have a consistent status within the company. Addressing these scenarios requires careful examination of both company policies and applicable sick leave laws to ensure compliance and uphold employee rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send minimum wage paid sick for eSignature?

How do I complete minimum wage paid sick online?

How do I fill out minimum wage paid sick using my mobile device?

What is minimum wage paid sick?

Who is required to file minimum wage paid sick?

How to fill out minimum wage paid sick?

What is the purpose of minimum wage paid sick?

What information must be reported on minimum wage paid sick?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.