Get the free Credit Card Charge Form

Get, Create, Make and Sign credit card charge form

How to edit credit card charge form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card charge form

How to fill out credit card charge form

Who needs credit card charge form?

A Comprehensive Guide to Credit Card Charge Forms

Understanding credit card charge forms

A credit card charge form is a document that allows businesses to collect payment from customers using their credit card information. This form serves a critical role in facilitating a smooth transaction process, ensuring both parties have a clear understanding of the charges involved. By detailing the payment information, authorization, and transaction details, credit card charge forms protect both the business and the customer, making it an essential tool for reliable payments.

Using credit card charge forms significantly reduces misunderstandings and disputes related to payments. They also help businesses maintain accurate records, making it easier to reconcile accounts and trace any issues that may arise during transactions. Understanding key terms associated with credit card charges—such as authorization, chargeback, and disputes—will also empower users to navigate the payment landscape more confidently.

Benefits of utilizing credit card charge forms

Implementing credit card charge forms offers a multitude of benefits for businesses of all sizes. First and foremost, they streamline payment processes. A well-designed charge form minimizes the likelihood of errors while providing a clear path for customer interactions, thereby improving overall customer experience. For instance, many restaurants use these forms to process payments efficiently, enhancing service speed without compromising accuracy.

Another significant benefit lies in security. Credit card charge forms help reduce chargeback risks, which can often lead to financial losses for businesses. By providing a clear authorization signature from the cardholder, companies are better protected against fraudulent claims. Furthermore, clear documentation helps in case of disputes, creating an avenue for further communication that can resolve issues amicably.

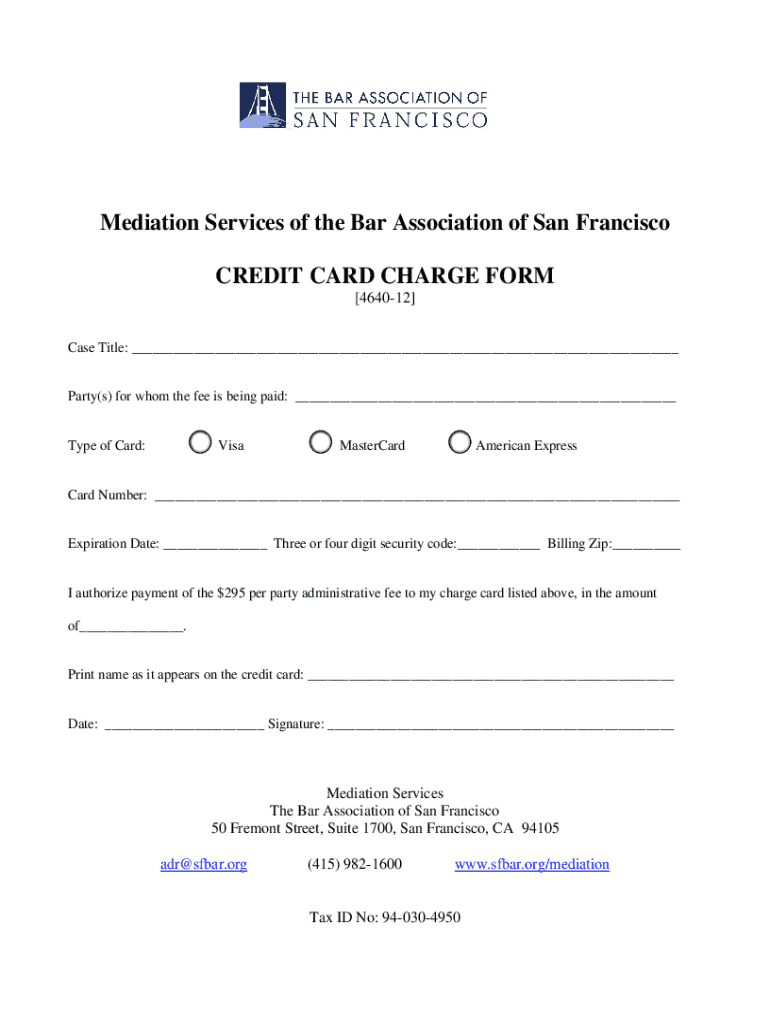

Key components of a credit card charge form

A well-structured credit card charge form includes essential elements that secure the transaction and clarify payment details. The primary components consist of cardholder information, including the cardholder's name, card number, and billing address. This information not only serves to verify the customer but also ensures that the charge is correctly processed in vendor systems.

Payment details should articulate the amount charged, currency, and the date of the transaction. The inclusion of an authorization signature is vital, as it gives the business the authority to charge the card. Additionally, terms and conditions must be clearly stated to inform the cardholder about any relevant policies, such as cancellation and refund procedures. Optional sections may include a dedicated area for special instructions or an additional security feature, like a CVV field, to further protect against fraudulent charges.

How to create your own credit card charge form

Creating a credit card charge form can be a straightforward process, especially with tools like pdfFiller that facilitate the design and customization. Begin by mapping out essential components using a user-friendly template available within the platform. Establish a clear format that includes all necessary fields, ensuring that users can easily navigate and fill in the requested information.

Incorporate compliance features to meet payment regulations. This might involve including a disclaimer about data protection and ensuring that the stored information adheres to laws such as PCI compliance. Additionally, adding eSignature features can streamline the approval process, allowing customers to sign documents digitally without the need for physical interaction, which is particularly useful for businesses that operate remotely.

Best practices for filling out a credit card charge form

Filling out a credit card charge form might seem simple, but attention to detail is paramount. One of the most common mistakes is providing incomplete information, such as missing the card’s CVV number or incorrectly entering the expiration date. Such errors can lead to processing failures, resulting in frustration for both the customer and the business.

To ensure accuracy, use a clean, legible format and double-check entries before submission. Encourage customers to review their information thoroughly. Providing clear instructions on how to fill the form can also help mitigate common issues, promoting a smoother transaction process.

Managing and storing completed credit card charge forms

Once credit card charge forms are completed, proper management and storage of these documents are critical, especially given the sensitive nature of the information they contain. Secure data management protects against potential breaches, which can lead to severe consequences, including financial loss and damage to reputation.

Utilizing cloud-based solutions, such as those offered by pdfFiller, allows businesses and teams to safely store their documents while also facilitating easy access. Implement encryption methods to protect sensitive payment data and consider using access controls to limit who can view or manage these documents.

Interactive tools and resources on pdfFiller

pdfFiller offers a suite of interactive tools aimed at enhancing the user experience with credit card charge forms. From customizable templates to online tutorials, users can easily navigate through the setup process. The platform allows businesses to create and modify charge forms in real-time, which is particularly beneficial for those needing to make quick updates without hassle.

Moreover, pdfFiller's template library offers a variety of charge forms tailored for different industries, ensuring that users can quickly find a suitable option that meets their specific needs. This makes it easier for businesses to adopt the solution effectively and manage customer transactions efficiently.

Frequently asked questions (FAQ)

Understanding the intricacies of credit card charge forms also involves addressing common queries users may have. One frequently asked question is regarding the procedures if a charge is disputed. In cases of disputes, it is crucial to gather all relevant documentation, including the completed charge form, to support your position during discussions with banks or payment processors.

Another concern revolves around processing refunds. Businesses can utilize credit card charge forms to document both initial transactions and any necessary refunds, offering a clear record of payments made. As for legal implications, it’s important to remain updated on local guidelines around credit card processing and data protection laws. Using pdfFiller aids in this regard by providing resources and templates that ensure compliance with applicable regulations.

Case studies: successful implementation of credit card charge forms

Numerous companies have embraced credit card charge forms and can attest to their efficacy. For instance, a local restaurant saw a significant reduction in processing errors after switching to an interactive charge form, streamlining both payment and record-keeping processes. Feedback from customers indicated a higher level of satisfaction due to the speed and efficiency of transactions.

Similarly, an online retail business highlighted how using well-structured charge forms improved their chargeback handling efficiency. By having clear documentation readily available, they were better positioned to respond to disputes and maintain positive customer relationships. Testimonials from businesses demonstrate that proper implementation of these forms not only enhances operational efficiency but also builds trust with customers.

Next steps: moving forward with your credit card charge form

As businesses and individuals look to optimize their payment processes, leveraging interactive tools to create effective credit card charge forms can significantly contribute to operational success. Begin by exploring the templates available on pdfFiller, customizing them to fit your unique requirements, and involving your team in building and managing these forms collaboratively.

Utilize the features provided by pdfFiller to enhance your experience, from secure storage options to easy access across devices. By taking these steps, you’ll not only streamline your payment processes but also establish a robust documentation framework that adapts to your evolving business needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card charge form from Google Drive?

How do I execute credit card charge form online?

Can I create an electronic signature for the credit card charge form in Chrome?

What is credit card charge form?

Who is required to file credit card charge form?

How to fill out credit card charge form?

What is the purpose of credit card charge form?

What information must be reported on credit card charge form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.