Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-to Guide

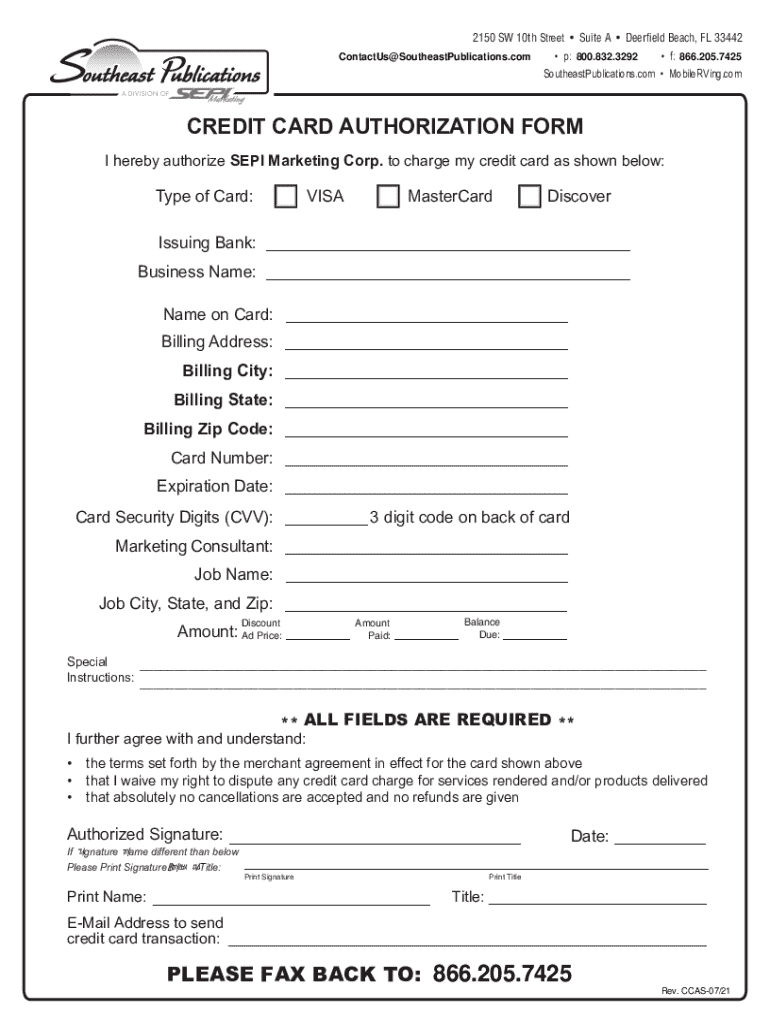

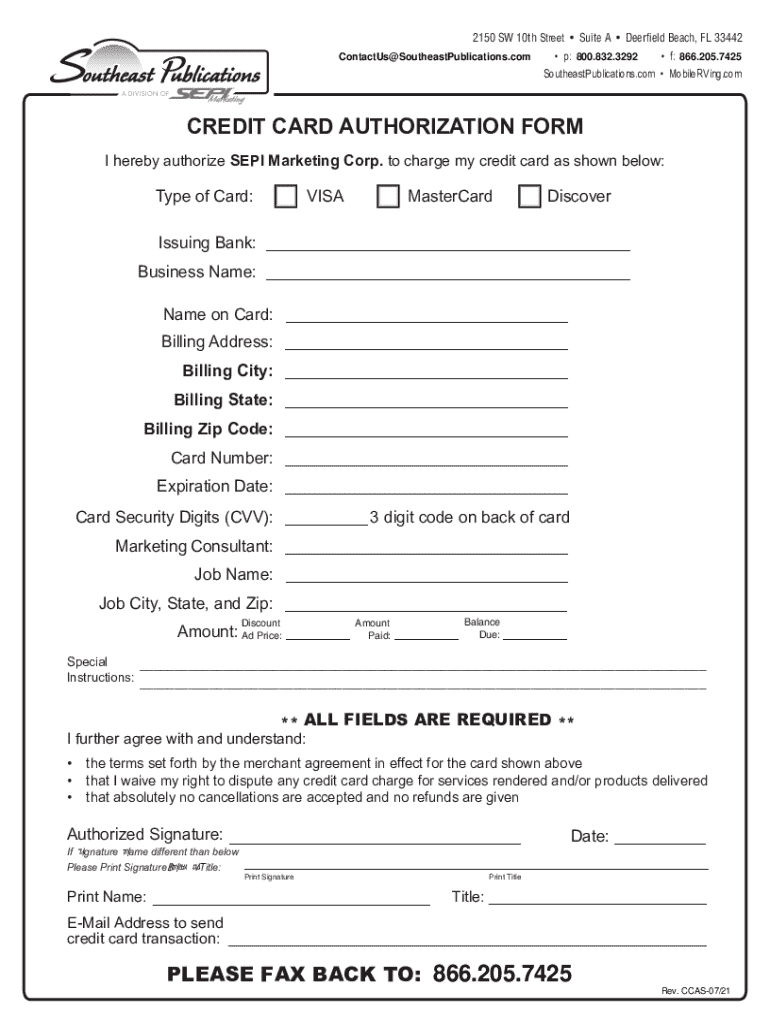

Understanding credit card authorization forms

A credit card authorization form serves as a crucial tool for businesses processing payments. It allows merchants to obtain formal permission from customers to charge their credit cards for goods or services. While it might seem straightforward, the implications of these forms are significant, safeguarding both the business's and the customer's interests.

The importance of the credit card authorization form in payment processing cannot be overstated. By ensuring that a customer has explicitly granted permission for charges, businesses can minimize the risk of chargebacks and disputes. Without this authorization, companies might face increased financial risks and a potential loss of customer trust.

Types of credit card authorization forms

Credit card authorization forms come in various types, primarily differentiated by purpose. The two most common are one-time authorizations for singular transactions and recurring authorizations for subscription or installment payments. Understanding these distinctions is vital for businesses seeking to tailor their payment processes.

The necessity of credit card authorization forms

Credit card authorization forms play a pivotal role in protecting businesses against chargeback abuse. Chargebacks can occur for numerous reasons, such as fraud or dissatisfaction with a product. When a customer disputes a charge, the absence of an authorization form can leave a business vulnerable to financial losses.

These forms act as a protective barrier, establishing documented consent from the customer before transactions. They can help resolve disputes more effectively, demonstrating that a cardholder willingly engaged in the purchase. Furthermore, safeguarding cardholder information enhances security and promotes trust, which is essential in any customer-business relationship.

Enhancing security for businesses and customers

Security is a top priority in the realm of payment processing. By utilizing credit card authorization forms, businesses can secure sensitive payment information and comply with security standards such as PCI-DSS. These measures not only protect the business from fraud but also reassure customers that their financial data is managed responsibly.

Key components of a credit card authorization form

A comprehensive credit card authorization form includes several critical elements that ensure clarity and legality. Basic information is required from the cardholder, including their name, address, and contact information. Additionally, the payment details must be clearly outlined, including the card number, expiration date, and CVV code.

The legal aspects surrounding credit card authorization forms are crucial. Compliance with the Payment Card Industry Data Security Standard (PCI-DSS) is essential for maintaining the integrity and security of customer transactions. Additionally, businesses must understand local regulations concerning consumer protection to avoid legal complications.

Creating your own credit card authorization form

Creating an effective credit card authorization form can streamline your payment processes. Here’s a step-by-step guide to help you develop a form that suits your business needs.

Step 1: Choose the right template

Begin by selecting a suitable template. Platforms like pdfFiller offer customizable templates that cater to various business sectors. Choosing a template that aligns with your specific needs is crucial, as it saves time and ensures accuracy.

Step 2: Customize your template

Once a template is chosen, customize it to fit your business requirements. This could include adding fields for specific charges or additional authorizations. Utilize pdfFiller's intuitive editing tools to ensure seamless enhancements and clarity.

Step 3: Testing the form

After customization, it’s essential to test the form. Ensure that all fields function correctly and are easy to understand. Gathering feedback from a test group can help identify any areas of confusion or required improvements.

How to use a credit card authorization form effectively

To maximize the benefits of a credit card authorization form, businesses need to adopt best practices for distribution. Consider whether to deliver forms digitally or physically. Digital submissions can streamline the process and provide convenience for both customers and businesses.

Regardless of the submission method, tracking submissions is critical for maintaining records. Securely store completed forms to ensure compliance with privacy regulations. pdfFiller offers secure storage solutions that help businesses manage their documents efficiently.

Managing and storing completed forms

After forms are collected, managing and storing them poses its challenges. Implementing secure storage practices is paramount for protecting customer information. Solutions like pdfFiller ensure that sensitive data maintains privacy while being easily accessible for future reference.

Common FAQs about credit card authorization forms

Users often have questions regarding credit card authorization forms, particularly concerning security and cancellations. One frequent inquiry is, 'What happens if a credit card authorization form is lost?' In such cases, businesses should establish a contingency plan, ensuring that alternative verification methods can be implemented where necessary.

Templates and tools to get started

To facilitate your journey in creating credit card authorization forms, many platforms like pdfFiller provide downloadable templates. Accessing a library of pre-designed templates helps ensure a professional presentation that can be modified to suit your specifications.

In addition, you can utilize interactive tools for efficient document management. Features such as eSigning, collaboration tools, and tracking capabilities refine the overall process of managing credit card authorization forms, making it more efficient.

Additional tips for businesses and teams

Educating staff on proper form usage is essential. Training them on compliance and security practices ensures that they understand the importance of maintaining high standards in payment processing. By familiarizing teams with the intricacies of credit card authorization forms, businesses can significantly reduce errors.

Future-proofing payment processes can involve adapting to ongoing technological changes and exploring new trends in digital payments. Staying informed about advancements, such as contactless payments and mobile wallets, helps businesses remain competitive and secure.

Engage with us

By staying connected with resources focused on credit card authorization forms and payment processing, you can ensure that your knowledge remains updated. Consider subscribing to relevant newsletters that provide insights and tips tailored to your needs. Engaging with a community of users encourages shared experiences and best practices that can be invaluable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in credit card authorization form without leaving Chrome?

How can I edit credit card authorization form on a smartphone?

How do I complete credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.