Get the free Credit Agreement

Get, Create, Make and Sign credit agreement

Editing credit agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit agreement

How to fill out credit agreement

Who needs credit agreement?

Comprehensive Guide to Credit Agreement Forms

Understanding credit agreements

A credit agreement is a legally binding document that outlines the terms and conditions between a borrower and lender. The primary purpose of this agreement is to ensure that both parties clearly understand their obligations and rights regarding the borrowed funds. Depending on the type of loan or credit, these agreements can vary significantly in terms of duration, repayment conditions, and interest rates.

The legal implications of credit agreements are significant, as failing to uphold the terms can result in default, penalties, or even foreclosure. Therefore, understanding your credit agreement is crucial for informed decision-making in borrowing.

Importance of a credit agreement form

A credible credit agreement form is essential for both borrowers and lenders. It acts as protection for both parties involved, ensuring that the terms are transparent. Without a proper credit agreement, parties may misunderstand their repayment obligations, which can lead to disputes or financial losses.

Common scenarios for using a credit agreement form include personal loans between friends or family, formal business loans from institutions, and even credit card agreements with banks. Each of these situations emphasizes the necessity for a documented agreement to safeguard interests.

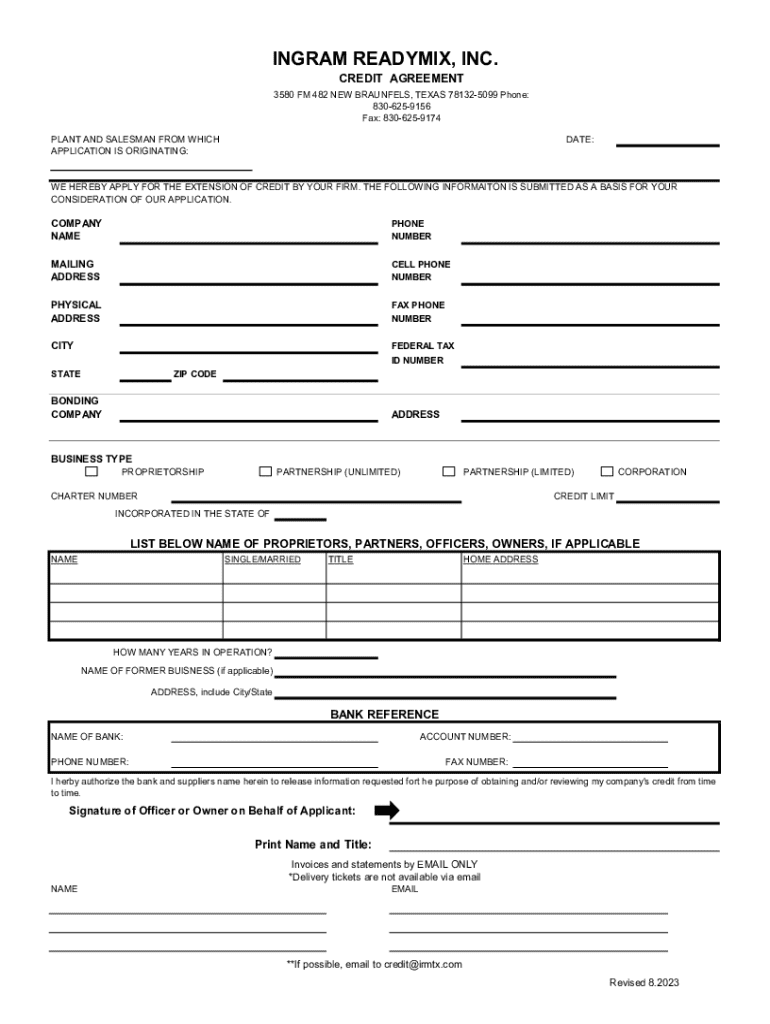

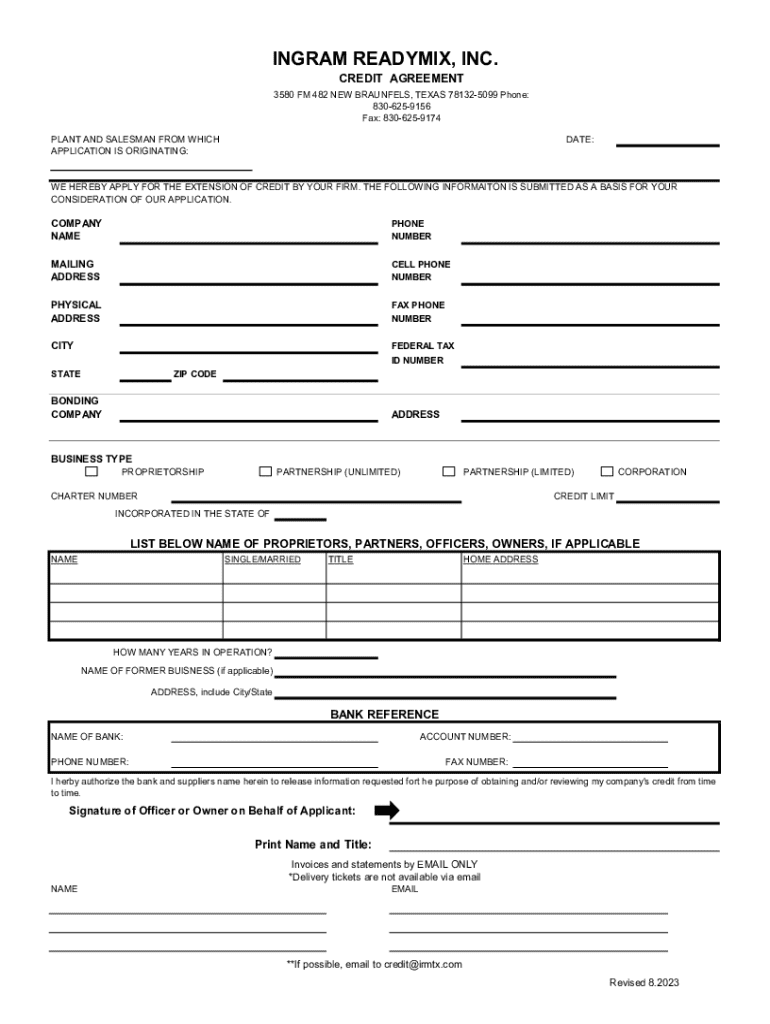

Essential components of a credit agreement form

A comprehensive credit agreement form should include several core components to ensure clarity and legal enforceability. Key elements include borrower and lender information, loan amounts, interest rates, payment schedules, and clauses that address default and collateral security.

Customizing your credit agreement form can also reflect specific needs or conditions. Factors such as repayment flexibility or additional fees can be tailored based on the context of the agreement. Including customized terms may address unique situations that arise between lenders and borrowers.

How to fill out a credit agreement form

Filling out a credit agreement form involves several specific steps to ensure that all necessary information is captured accurately. Start with gathering required documents, including personal identification and financial statements to provide proof of income and affiliation.

To ensure that the completion process is accurate and effective, double-check that all fields are filled out completely and comprehend the implications of each term. This prevents misunderstandings later on regarding repayment obligations.

Editing and finalizing your credit agreement form

Before finalizing the credit agreement form, editing is crucial. Utilizing tools like pdfFiller, you can make necessary modifications, add or remove clauses, and ensure that all components align with your initial intentions. This tool is particularly helpful for easy text editing and modifications.

Following your edits, review the form carefully before signing. Look out for common mistakes such as miscalculated amounts or incomplete sections. Confirming legal compliance is crucial, especially in safeguarding against potential disputes.

Signing the credit agreement form

The manner of signing a credit agreement can significantly impact its authenticity. eSignatures have become a popular choice due to their convenience, yet traditional signatures retain their importance. Utilizing applications such as pdfFiller allows you to eSign easily, ensuring your digital signature is secure and compliant.

When signing, be mindful of the implications of your signature, as it conveys agreement to the terms stipulated in the credit agreement.

Managing your credit agreement: Post-signing procedures

After signing the credit agreement form, storing and organizing the document is vital. Utilize cloud-based solutions like pdfFiller to access your agreement anytime, ensuring that you can refer back to it whenever necessary. This practice also aids in managing loans effectively.

A systematic approach to managing your credit agreement can help mitigate risks associated with missed payments or misunderstandings that may arise later on.

Frequently asked questions (FAQs)

Engaging in the world of credit can prompt various questions and misunderstandings regarding credit agreements. For instance, a common concern revolves around the enforceability of oral agreements compared to written contracts. Credit agreements are typically more enforceable in writing, minimizing potential disputes.

Ensuring clarity on these aspects can alleviate concerns and promote a smoother borrowing experience.

Best practices and tips for using credit agreements

Understanding your rights and responsibilities is paramount when engaging with credit agreements. Familiarizing yourself with the terms not only helps avoid pitfalls but also enhances your decision-making process. Communicating effectively with lenders can foster a healthier relationship and often lead to better terms or adjustments when necessary.

Adopting these best practices ensures that you are well-equipped to navigate the complexities of credit agreements effectively.

Additional tools and templates available on pdfFiller

pdfFiller offers a variety of related forms and templates that enhance your document management experience. Interactive tools for document creation and editing provide users with the flexibility they require in today's fast-paced environment. Resources and community support further enrich the learning experience, making it easier to find solutions to specific credit-related queries.

Leveraging these resources provides a much smoother and efficient approach to handling credit-related documentation.

Contact support for further assistance

Should you have any inquiries or need assistance regarding your credit agreement form, reaching out to pdfFiller’s customer support team can help. With dedicated professionals ready to assist with document-related queries, you can navigate the complexities of credit agreements with confidence.

Effective support is crucial for maximizing the benefits of using credit agreement forms and ensuring compliance with relevant regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the credit agreement in Chrome?

How can I edit credit agreement on a smartphone?

How do I edit credit agreement on an iOS device?

What is credit agreement?

Who is required to file credit agreement?

How to fill out credit agreement?

What is the purpose of credit agreement?

What information must be reported on credit agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.