Get the free Customer Credit Account Application Form

Get, Create, Make and Sign customer credit account application

How to edit customer credit account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer credit account application

How to fill out customer credit account application

Who needs customer credit account application?

Understanding the Customer Credit Account Application Form

Understanding the customer credit account application form

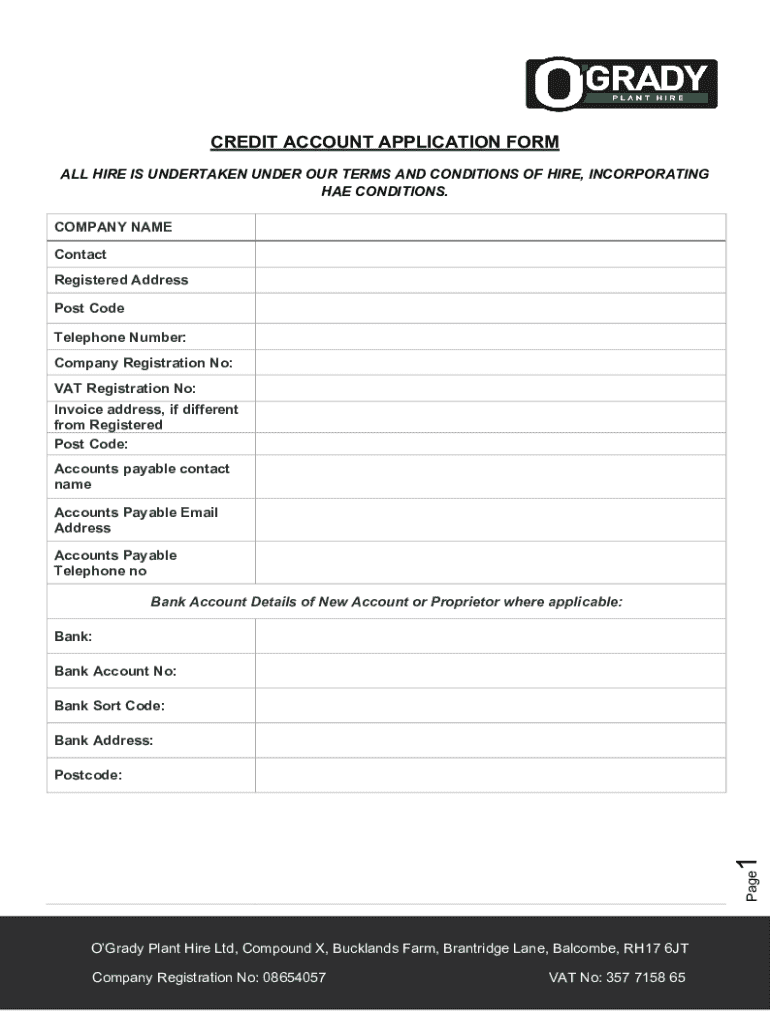

A customer credit account application form is a vital document used by individuals and businesses to establish a line of credit with a retailer or financial institution. The purpose of this form is primarily to assess the creditworthiness of an applicant, thus enabling the lender to determine whether to approve the application. Credit accounts offer flexibility to consumers and businesses, allowing them to make purchases on credit rather than at the point of sale. This can help individuals manage their cash flow and enable businesses to stock up on inventory without immediate payment.

Various segments of society can benefit from using this form, including consumers seeking to purchase goods over time, freelancers needing supplies for their work, and small businesses wanting to manage their expenses effectively. By having a credit account, users can improve their purchasing power and strengthen their credit scores over time, provided they manage their payments responsibly.

Essential components of the application form

Completing a customer credit account application form involves several key components that applicants should be prepared to provide. These sections collectively play a critical role in assessing one's ability to repay the credit extended.

Step-by-step guide to filling out the customer credit account application form

Filling out the customer credit account application form may seem straightforward, but attention to detail is essential to avoid pitfalls. The following steps will guide you through the process.

Editing & signing the application form

After filling out the customer credit account application form, it's important to review and edit it carefully. Using options like pdfFiller can simplify the process, allowing you to modify details effortlessly. Editing tools can help rectify errors or update information without the hassle of starting from scratch.

Once you have completed the application, signing it becomes imperative for validation. eSigning your application not only legitimizes your submission but also ensures a speedy processing time. It's essential to familiarize yourself with the specific eSigning process required by the lender.

Submitting the application form

After completing and signing your customer credit account application form, the next step is submission. There are multiple ways to submit the application, and knowing the options can offer convenience.

Managing your customer credit account post-application

Once your application has been submitted, you can expect to receive emails or letters announcing whether you’ve been approved or denied. Understanding the factors behind these decisions can be crucial for future applications. If approved, familiarize yourself with the terms, limits, and due dates related to your credit account to avoid missteps.

Best practices in managing your credit account include making timely payments, monitoring your credit utilization ratio, and understanding the consequences of late payments. Ensure to review your account statements regularly, which will help keep your financial health in check.

FAQs about the customer credit account application form

When applying for a customer credit account, many questions may arise. Here are some frequently asked ones:

Why choose pdfFiller for your document management needs?

pdfFiller stands out as a versatile document management solution that can greatly simplify the process of handling forms like the customer credit account application. It offers seamless editing tools that allow users to modify documents quickly and efficiently, enhancing collaboration among teams and ensuring that every document is accurate.

Real-life examples and case studies

Numerous users have successfully navigated the customer credit account application process, showcasing the effectiveness of this form and the advantages of utilizing platforms like pdfFiller. For instance, many freelancers have reported smoother operations in their businesses post-approval, as the credit accounts allowed them to invest in necessary tools and inventory without immediate financial strain.

Additionally, small businesses that utilized the form often highlight the importance of maintaining a good credit score to ensure ongoing trust from lenders. They’ve learned through experience that managing their accounts responsibly not only aids in building credit history but also opens up more opportunities for financing in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the customer credit account application in Chrome?

How do I complete customer credit account application on an iOS device?

Can I edit customer credit account application on an Android device?

What is customer credit account application?

Who is required to file customer credit account application?

How to fill out customer credit account application?

What is the purpose of customer credit account application?

What information must be reported on customer credit account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.