Get the free Credit Account Application Form

Get, Create, Make and Sign credit account application form

Editing credit account application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit account application form

How to fill out credit account application form

Who needs credit account application form?

A comprehensive guide to credit account application forms

Understanding the credit account application process

A credit account is an arrangement between a borrower and a financial institution that allows the borrower to access funds up to a predetermined limit. This line of credit can be crucial for personal finance management, facilitating purchases, or managing cash flow when unexpected expenses arise. Understanding the credit account application process is vital for anyone looking to establish or expand their credit history.

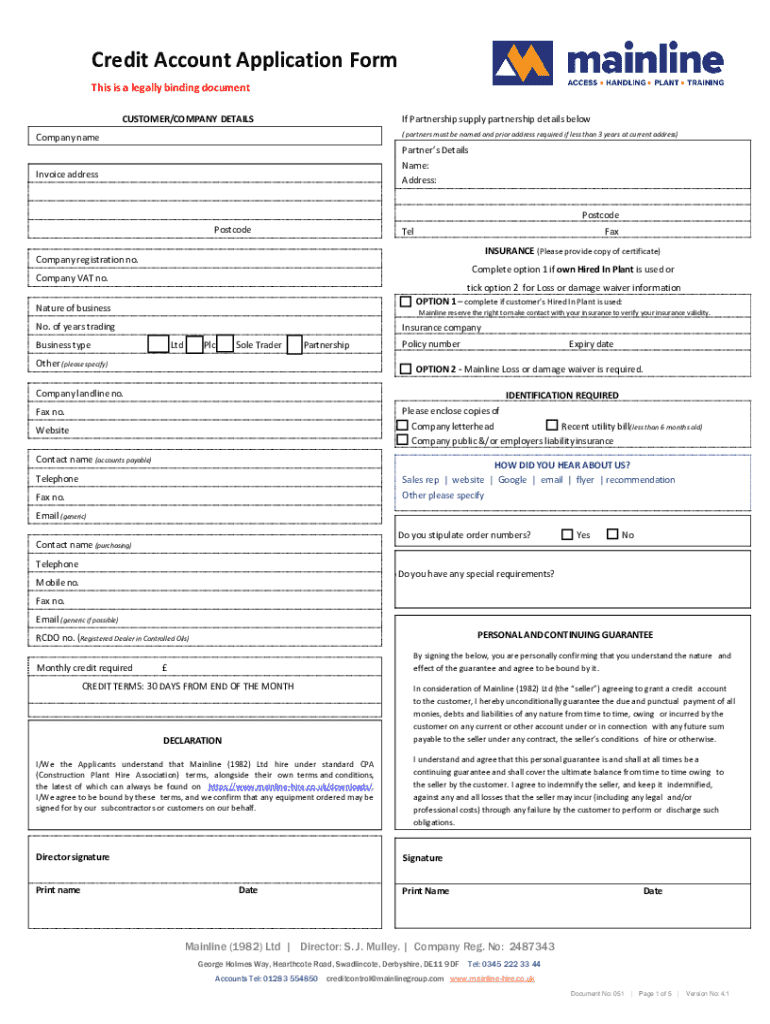

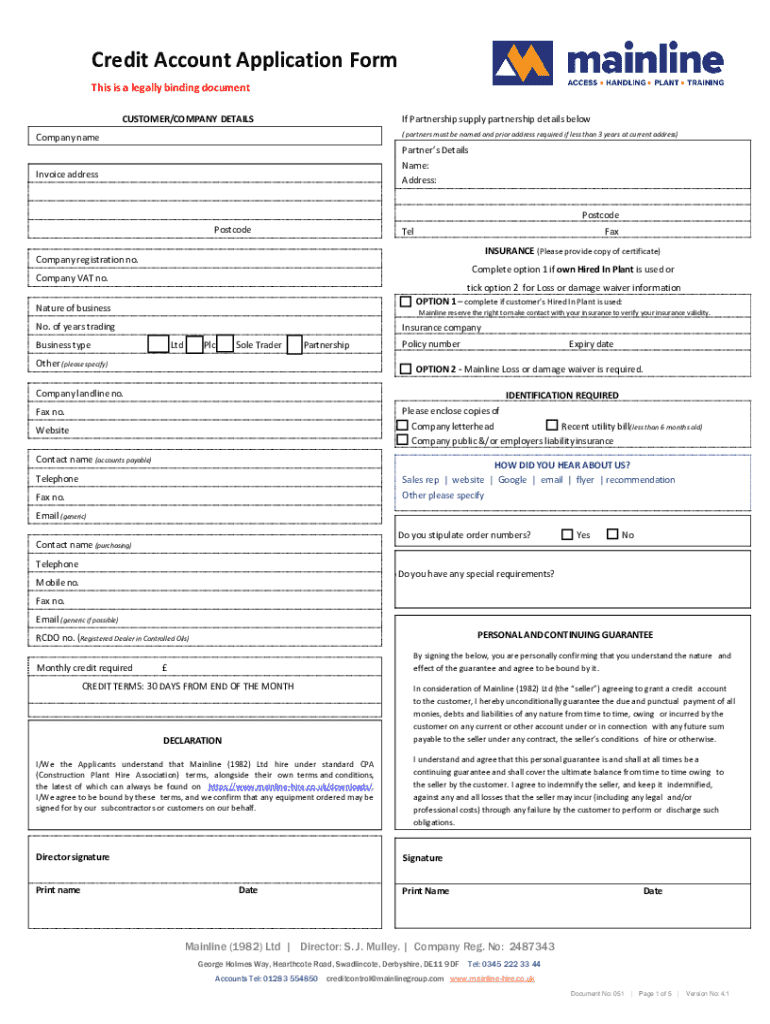

The key elements of a credit account application include personal identification details, financial information, and existing credit accounts. Completing this application is your formal request to access credit and requires comprehensive and accurate details to increase the likelihood of approval.

The purpose of completing a credit account application is twofold. First, it provides lenders with a clear understanding of your financial stability and creditworthiness. Second, it establishes a mutual agreement that outlines the terms of the credit provided, ensuring both parties are on the same page.

Preparing your information

Before you embark on filling out your credit account application form, you need to gather essential personal and financial information to ensure a smooth application process. This preparation will not only make filling out the application easier but will also help you present yourself as a reliable borrower.

Start with your personal identification details. Key items to include are:

Next, focus on your financial information, which typically includes details about your employment and income verification. Key components are your employment details, encompassing:

You will also need to disclose your income for verification purposes. Lastly, compile a list of your existing credit accounts and their balances, ensuring you provide accurate account numbers and corresponding balances.

Downloading the credit account application form

To begin your application, you'll first need to access and download the credit account application form from a reliable source. pdfFiller offers a comprehensive platform that enables users to both download and edit forms seamlessly.

The process is straightforward. Start by visiting the pdfFiller homepage and navigating to the credit account application template. Here, you can find various versions of the form that suit your needs, whether in English or Spanish.

When it comes to downloading the form, consider whether you prefer to fill it out offline or utilize online editing features. pdfFiller allows you to edit directly in your browser, which can save valuable time and streamline the application process.

Completing the credit account application form

Completing the credit account application form accurately is essential to prevent delays and miscommunication. Here’s a step-by-step guide to filling out the necessary sections.

Accurate information entry is vital. Ensure every detail is correct, as mistakes can lead to delays or potential rejection of your application. Common errors to avoid include misspelling your name, inaccuracies in your social security number, or forgetting to provide a current contact method.

Editing and customizing your application

One of the advantages of using pdfFiller for your credit account application is its robust editing tools. After filling out your form, take time to customize and refine it for clarity.

Utilizing pdfFiller's editing features, you can:

Collaboration is also key. If you're completing the application as a team, leverage pdfFiller's sharing feature to get input from your colleagues. Once everyone has contributed, finalize your edits to ensure the application aligns with your goals.

Signing the application

The final step in your application process is signing it. Understanding the legality of eSignatures can alleviate concerns about this step. eSignatures are legally binding, with the same standing as handwritten signatures in most jurisdictions.

To eSign your credit account application using pdfFiller, follow these steps: access the application, navigate to the signature field, and utilize the eSignature option. You can create your own signature or use the built-in options suited to your style.

If your application requires additional signature requests, pdfFiller allows you to manage and send those requests efficiently.

Submitting your application

Once your credit account application form is complete and signed, it's time to submit it. There are various methods for submission to fit your preferences.

After you submit your application, be sure to confirm its status. Most lenders offer tracking options so you can monitor your application’s progress.

Managing your credit account application

Post-application management is an important aspect of the credit account application process. It's advisable to actively monitor your application’s status online through the lender's portal. Many lenders provide real-time updates on the progress of your application.

In the event your application is denied, it's crucial to understand why it happened. This knowledge can help you rectify issues and improve your chances in future applications. A follow-up communication with your lender can provide insights and clarify any misunderstandings.

Establishing a solid rapport with your lender can prove beneficial as you navigate the credit landscape.

FAQ section

When navigating credit account application forms, questions often arise. Here are some common inquiries:

For first-time applicants, take time to familiarize yourself with the details required on the application. Resources, such as guides on credit management and application strategies, can be beneficial to ensure a successful submission process.

Case studies and testimonials

Real-life examples often illuminate the importance of meticulousness in the credit account application process. Many successful applicants have shared their experiences utilizing pdfFiller to manage their forms efficiently.

For instance, one user successfully maneuvered through a complex credit application by using the collaboration tools available in pdfFiller, leading to enhanced approval odds. Testimonials consistently express satisfaction with the ease of customization and the document management features that pdfFiller provides.

Conclusion on effective credit account application management

In summary, navigating the credit account application process requires diligence, accurate information, and effective resource utilization, like pdfFiller. The guide highlights key steps ranging from preparing personal details to monitoring application status post-submission.

By approaching the credit account application with a well-structured plan and leveraging the functionalities offered by pdfFiller, applicants can significantly enhance their opportunities for successful credit approval and responsible credit management in the long term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit account application form straight from my smartphone?

How do I fill out the credit account application form form on my smartphone?

How do I edit credit account application form on an Android device?

What is credit account application form?

Who is required to file credit account application form?

How to fill out credit account application form?

What is the purpose of credit account application form?

What information must be reported on credit account application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.