Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form How-to Guide

Understanding the credit card authorization form

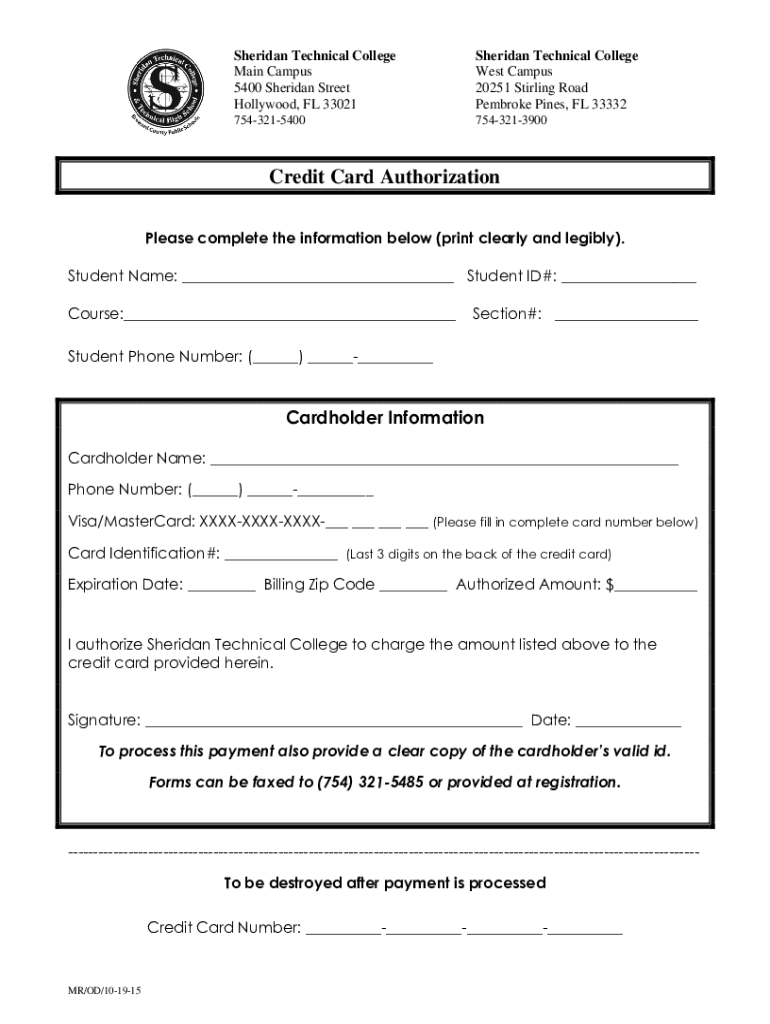

A credit card authorization form is a vital document that facilitates secure transactions between a cardholder and a business. This form allows businesses to obtain permission from a cardholder to charge their credit card for specified amounts, ensuring a clear understanding of the financial agreement. Industries such as hotels and car rentals often use these forms to confirm a customer's payment method and reserve services, reinforcing the legitimacy of the transaction.

The importance of this document can't be overstated. It serves not only to authorize payments but also to create a legally binding agreement between the customer and the business. This is particularly crucial in preventing fraud and chargeback disputes, which can occur if unauthorized transactions take place.

Why use a credit card authorization form?

Businesses benefit immensely from using a credit card authorization form. Firstly, it minimizes the risk of unauthorized transactions. By securing written consent from the cardholder, businesses can deflect potential chargebacks, which can otherwise burden a business financially. The mechanism of pre-authorization establishes a level of integrity in financial transactions, ensuring that both parties are protected.

For consumers, these forms offer clarity on payment terms. When a customer fills out a credit card authorization form, they are explicitly agreeing to the charges outlined, which can enhance trust in the business. Additionally, consumers can feel secure knowing their personal financial information is safeguarded through established security protocols, resulting in peace of mind during transactions.

Key components of a credit card authorization form

A well-crafted credit card authorization form includes several essential fields to ensure clarity and avoid disputes. The key components consist of the cardholder’s name and contact information, the card details (including number, expiration date, and CVV), the amount to be authorized, and the cardholder's signature along with the date of signing. These elements are critical for validating the authorization and ensuring all necessary information is captured.

Optional features may also be included in the form to enhance transparency and ensure compliance with business policies. These could consist of terms and conditions, company policy disclosures, and options for recurrent payments if applicable.

Steps to create a credit card authorization form using pdfFiller

Creating a credit card authorization form utilizing pdfFiller's intuitive platform is straightforward. Start by accessing pdfFiller’s extensive library of templates, which provides a quick way to find pre-designed forms tailored to your needs. These templates can save time by eliminating the need to create a form from scratch, allowing for a more efficient workflow.

Once you've located a suitable template, logging into your pdfFiller account is the next step. From there, you can customize the form to align with your business's branding by adding your company’s logo and adjusting colors. This personalization not only enhances the form's appearance but helps to establish trust with your customers.

After customizing, take advantage of the eSignature functionality as well as collaboration tools within the platform, which enable secure approvals and streamline team operations. This ensures that all parties involved in the transaction can easily manage and sign the document, enhancing the efficiency of the payment process.

Best practices for using credit card authorization forms

To ensure ongoing compliance and maintain operational integrity, businesses must adhere to PCI-DSS (Payment Card Industry Data Security Standard) guidelines when collecting card details. These standards are essential for safeguarding cardholder information and preventing data breaches, which could lead to severe consequences for both businesses and their customers.

Additionally, document security is paramount. Organizations must employ best practices for protecting sensitive information. This includes utilizing secure storage options (such as encrypted cloud storage), restricting access to authorized personnel only, and regularly updating security protocols to adapt to evolving threats. By implementing strong security measures, companies can reinforce trust with their customers, ensuring that payment processes remain safe.

Tips for managing your credit card authorization form

Once your credit card authorization forms are complete, it is crucial to have a system in place for storing them securely. Utilizing reliable methods such as cloud storage not only provides easy access from anywhere but also helps maintain necessary confidentiality. Establish clear guidelines for how teams should handle these documents to minimize risk and uphold privacy.

Moreover, businesses should regularly review and update their credit card authorization forms. Keeping forms accurate and relevant requires monitoring changes in business policies, as well as incorporating user feedback to improve functionality. Periodic updates will ensure that the form remains effective in addressing both customer and business needs efficiently.

Frequently asked questions (FAQs)

Addressing common customer questions can enhance clarity and build trust. For instance, if a charge is disputed, businesses must have a clear policy in place. Understanding how long an authorized payment remains valid is also important, as it directly affects how billing issues may be resolved.

Having ready answers to these FAQs can improve customer interactions, streamline processes, and enforce a reliable customer service experience, making your business stand out.

Downloadable resources

pdfFiller offers users easy access to downloadable templates for credit card authorization forms. Users can navigate through the platform to locate editable templates that suit their specific needs. These resources promote efficiency and convenience, allowing users to quickly customize and implement the forms in their operations with little fuss.

For further reading, pdfFiller also provides a wealth of articles focused on payment security and fraud prevention, equipping business owners with the knowledge to protect themselves and their customers effectively.

Engage with the pdfFiller community

By subscribing to the pdfFiller newsletter, users can receive updates on new features and tips on optimizing document management techniques. This engagement offers continual learning opportunities that can enhance the way businesses handle forms like the credit card authorization form.

Insights from other users on effective form management can also provide valuable perspectives. Sharing experiences within the pdfFiller community fosters collaboration and allows users to refine their processes for managing credit card authorization forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card authorization form in Gmail?

How can I send credit card authorization form to be eSigned by others?

How do I edit credit card authorization form online?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.