Get the free Cfs 718-e

Get, Create, Make and Sign cfs 718-e

Editing cfs 718-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cfs 718-e

How to fill out cfs 718-e

Who needs cfs 718-e?

Your Comprehensive Guide to the CFS 718-E Form

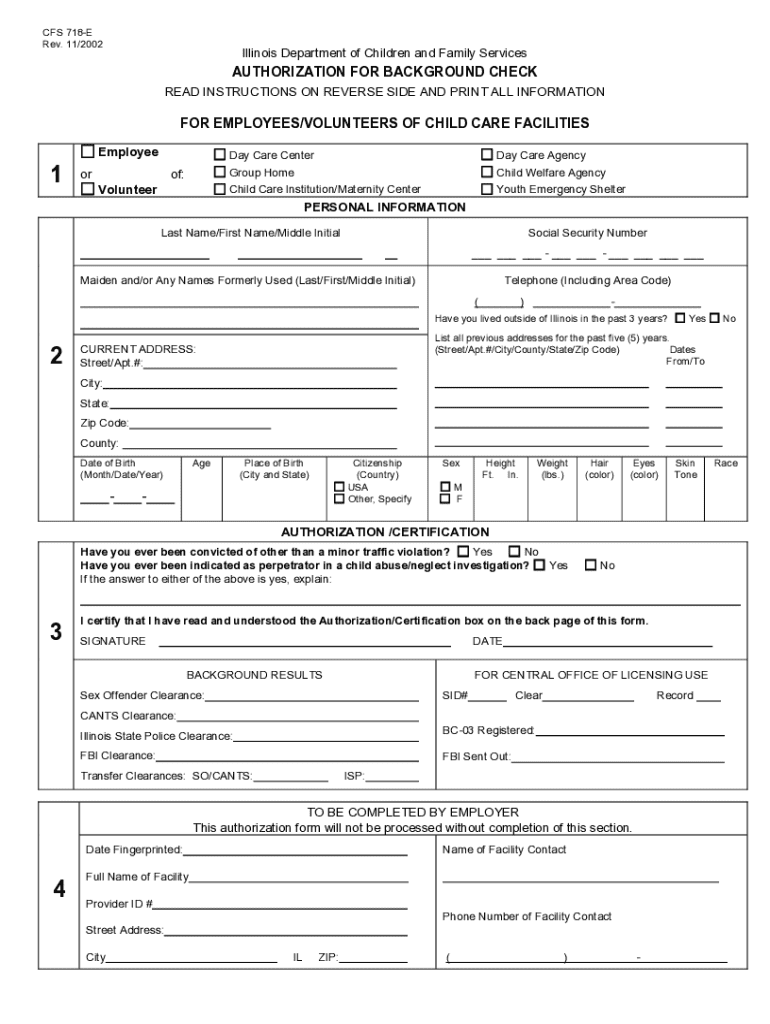

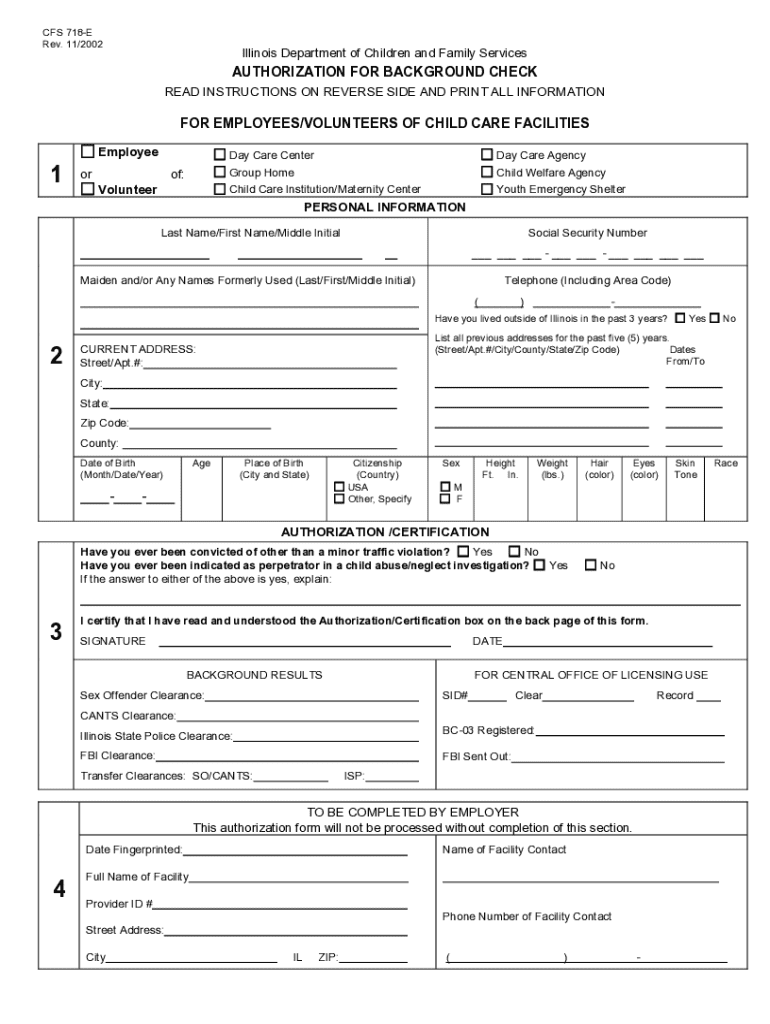

Understanding the CFS 718-E Form

The CFS 718-E Form is a critical document utilized by individuals providing financial services, allowing for the proper reporting of information related to various financial transactions. This form plays a vital role in ensuring compliance with federal regulations and enables accurate tax reporting and assessment.

Understanding its purpose is essential not only for proper documentation but also for safeguarding your financial interests. The CFS 718-E empowers users to convey necessary data comprehensively, fulfilling regulatory obligations and ensuring transparency in financial dealings.

Step-by-step guide to completing the CFS 718-E Form

Completing the CFS 718-E Form can seem daunting, but breaking it down into manageable steps simplifies the process. Here's a detailed, step-by-step guide to efficiently filling out your form.

Step 1: Gather necessary information

Before diving into the form, ensure you have all the necessary personal and financial information at your fingertips. You will need your full name, address, and relevant financial documentation, including income statements, bank information, and tax identification numbers.

Step 2: Accessing the CFS 718-E Form

The CFS 718-E Form is readily available for download from pdfFiller. Simply visit their website, navigate to the forms section, and locate the CFS 718-E Form for download. Alternatively, you can also check official government websites that host these forms.

Step 3: Filling out the CFS 718-E Form

Now it’s time to fill out your form. Pay careful attention to each section:

Step 4: Reviewing your completed document

Accuracy is paramount when submitting the CFS 718-E Form. Take a moment to review your completed document for errors or omissions. Utilize pdfFiller’s editing features to rectify any issues before finalizing your submission.

Step 5: Electronic signature options

Consider signing your form electronically for convenience. With pdfFiller, you can easily eSign the CFS 718-E Form. Explore options for digital signatures versus traditional handwritten ones, depending on your preference.

Common pitfalls when filling out the CFS 718-E Form

Many individuals make mistakes when filling out the CFS 718-E Form. Frequently made errors include missing information in essential fields, incorrect financial data, and failing to provide a valid signature. Being aware of these common pitfalls can help you avoid costly mistakes.

To steer clear of these issues, double-check every section of the form before submitting and ensure you have fully understood each requirement. Reaching out for clarification on specific items can also prevent misunderstandings.

Best practices for managing your CFS 718-E Form

Once completed, it’s crucial to manage your CFS 718-E Form properly. Here are some best practices:

These practices help ensure you can quickly share the form with stakeholders while also safeguarding sensitive information.

How pdfFiller enhances your CFS 718-E Form experience

pdfFiller significantly streamlines the process of managing the CFS 718-E Form. With cloud-based access, you can work on your form from anywhere, making it ideal for remote teams or individuals.

The platform offers collaboration tools that allow multiple users to edit or review the document simultaneously, ensuring efficiency and clarity in the process. The benefits of using pdfFiller include seamless editing, easy signing, and better document tracking, which reduces paper usage and enhances overall productivity.

Alternative forms related to the CFS 718-E

While the CFS 718-E is essential for certain financial reporting needs, other forms may be more appropriate for different situations. Some of these alternative forms include CFS 718-A and the CFS 718-B.

Knowing when to use each form can save time and ensure compliance with applicable regulations. It's beneficial to assess your specific reporting requirements before deciding on the right form.

Troubleshooting common issues with the CFS 718-E Form

If your CFS 718-E Form is rejected or flagged for errors, know how to troubleshoot the issue effectively. Start by reviewing any feedback provided by the reviewing authority to understand the discrepancies.

If further assistance is needed, contacting support can guide you through resolving these issues, ensuring your form is accepted on the next submission.

Real-world examples of CFS 718-E use cases

In practice, the CFS 718-E Form is utilized across diverse financial sectors. For instance, financial advisors often use it to provide detailed reports to clients, ensuring all income is accurately declared and reported. Similarly, small business owners rely on the CFS 718-E to assist in their tax filings.

Testimonials from users reveal how crucial the CFS 718-E is in maintaining transparency and compliance, showcasing its impact in various financial contexts.

Interactive tools for managing your CFS 718-E Form

pdfFiller offers a host of interactive tools designed to simplify managing your CFS 718-E Form. These tools include intuitive editing features, collaboration options, and easy document sharing capabilities.

Familiarizing yourself with these features can enhance your efficiency and help you maximize your experience on pdfFiller, ensuring you get the most out of this comprehensive document management solution.

Is the CFS 718-E Form what you need?

Determining whether the CFS 718-E Form is applicable to your situation is crucial. Assess your financial circumstances and reporting needs thoroughly before proceeding. In some cases, other forms may better suit your specific requirements.

Consulting with a financial professional can provide insight into which forms are most suitable based on your financial activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cfs 718-e to be eSigned by others?

How do I execute cfs 718-e online?

Can I create an eSignature for the cfs 718-e in Gmail?

What is cfs 718-e?

Who is required to file cfs 718-e?

How to fill out cfs 718-e?

What is the purpose of cfs 718-e?

What information must be reported on cfs 718-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.