Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Your comprehensive guide to credit card authorization forms

Understanding credit card authorization forms

A credit card authorization form is a document that allows a merchant to charge a customer's credit card for a specific transaction. It acts as a written agreement that the cardholder approves the payment, providing both the merchant and customer with peace of mind. The importance of using an authorization form cannot be overstated; it helps in documenting consent, reducing disputes, and preventing unauthorized charges. In an age where identity theft and fraud are rampant, having a formalized authorization process adds a layer of security to financial transactions.

The role of credit card authorization forms in e-commerce

In the realm of e-commerce, credit card authorization forms serve as a vital tool for protecting merchants and customers alike. These forms help prevent chargeback abuse, where customers falsely claim they did not authorize a transaction. By having a signed authorization form, businesses can defend themselves against unwarranted chargebacks, making it more difficult for fraudulent claims to succeed. Furthermore, utilizing credit card authorization forms fosters customer trust, as they ensure that payment protocols are secure, reassuring customers that their sensitive information is being handled responsibly.

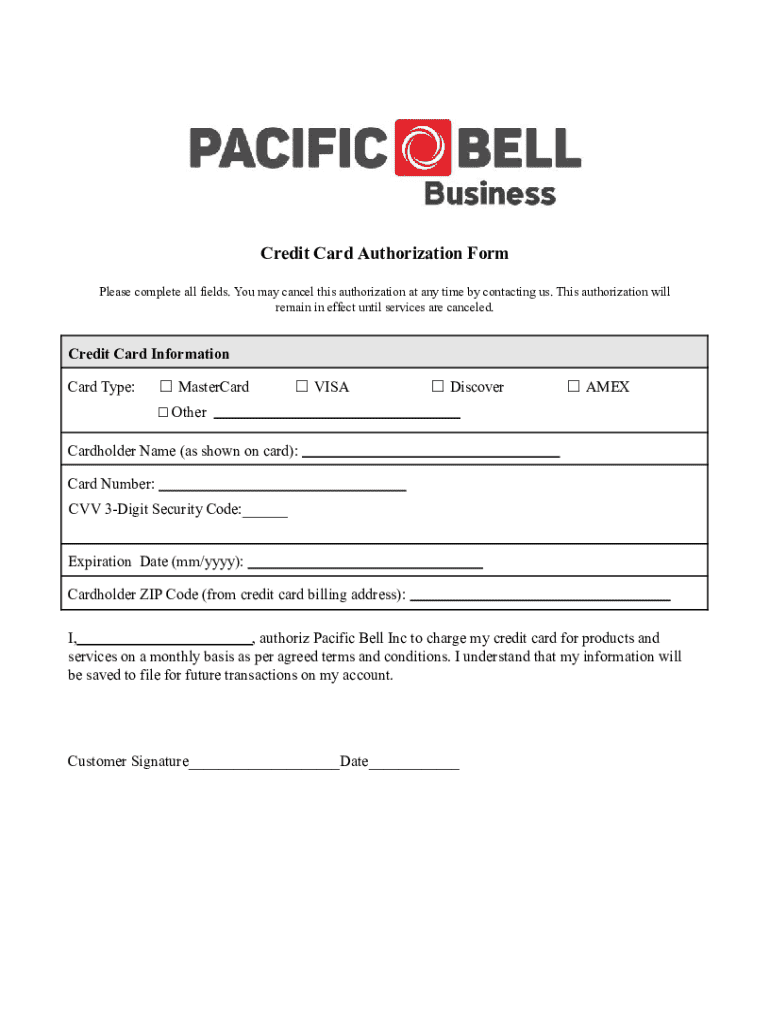

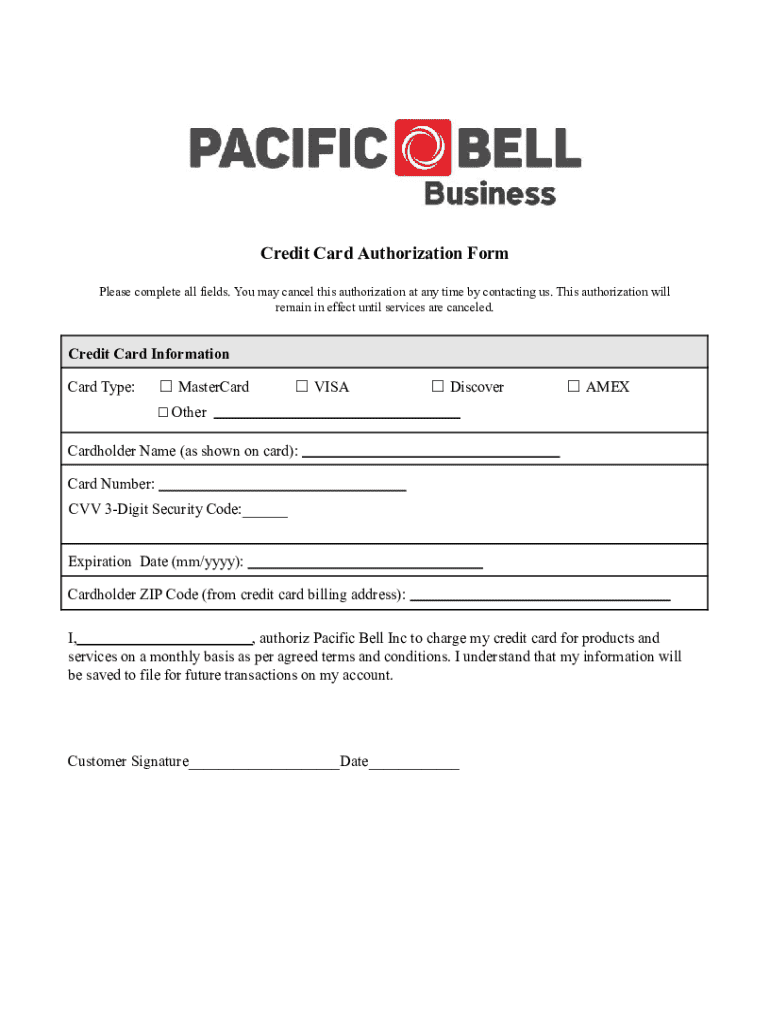

Key components of a credit card authorization form

A well-structured credit card authorization form includes several essential fields that capture necessary transaction details. The primary fields include:

Optional fields can also enhance security, providing further verification against unauthorized transactions. These fields may include the billing address and additional contact information.

Benefits of using a credit card authorization form

Implementing a credit card authorization form is an effective way to safeguard against unauthorized transactions. By obtaining explicit permission from the cardholder, businesses minimize their liability in the event of disputes. This documentation is vital for legal protection should customers dispute charges after receiving services or products. Moreover, using these forms streamlines payment processes, making transactions smoother and more efficient for both businesses and their customers.

Step-by-step guide to filling out a credit card authorization form

To ensure that the credit card authorization form is completed accurately, follow this step-by-step guide:

Editing and customizing your credit card authorization form

pdfFiller provides the necessary tools to create and edit credit card authorization forms seamlessly. Users can personalize forms to reflect specific business needs, incorporating branding elements or altering fields to gather additional information as required.

Additionally, integrating eSignature capabilities simplifies the signing process, allowing cardholders to sign the document electronically. This not only accelerates transaction processing but also maintains a clear audit trail, which can be crucial during disputes or audits.

Best practices for using credit card authorization forms

To maximize the security and effectiveness of credit card authorization forms, it's crucial to adhere to best practices. Here are some key recommendations:

Frequently asked questions (FAQs)

As businesses and individuals navigate the intricacies of credit card transactions, certain common queries arise. Here are a few answers to help clarify crucial points:

Downloadable resources and templates

To assist you in creating credit card authorization forms, we offer customizable templates accessible through pdfFiller. These templates can serve as a starting point, allowing you to create fully tailored documents suited for your business needs. Users can also find step-by-step guides for creating forms, ensuring clarity throughout the process.

In addition, promotional materials and use cases can be reviewed to discover effective strategies for implementing these forms within various industries.

Get started with pdfFiller

pdfFiller streamlines the management of credit card authorization forms, offering an easy-to-use platform that enables editing, eSigning, and collaboration from anywhere. By leveraging our document management system, users can enhance their workflow with interactive tools designed specifically for the needs of modern businesses.

Testimonials from satisfied users highlight the convenience and efficiency gained through pdfFiller, emphasizing its role in simplifying document-related tasks.

Share your experience

We invite our community of users to share feedback and experiences regarding the effective use of credit card authorization forms. Your insights about tips, best practices, and challenges encountered can aid fellow users in navigating this essential aspect of payment processing. Engage with our community and contribute to building a resourceful database that benefits everyone.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card authorization form?

How do I make changes in credit card authorization form?

How do I fill out the credit card authorization form form on my smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.