Get the free Confidential Credit Application

Get, Create, Make and Sign confidential credit application

How to edit confidential credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confidential credit application

How to fill out confidential credit application

Who needs confidential credit application?

Understanding the Confidential Credit Application Form

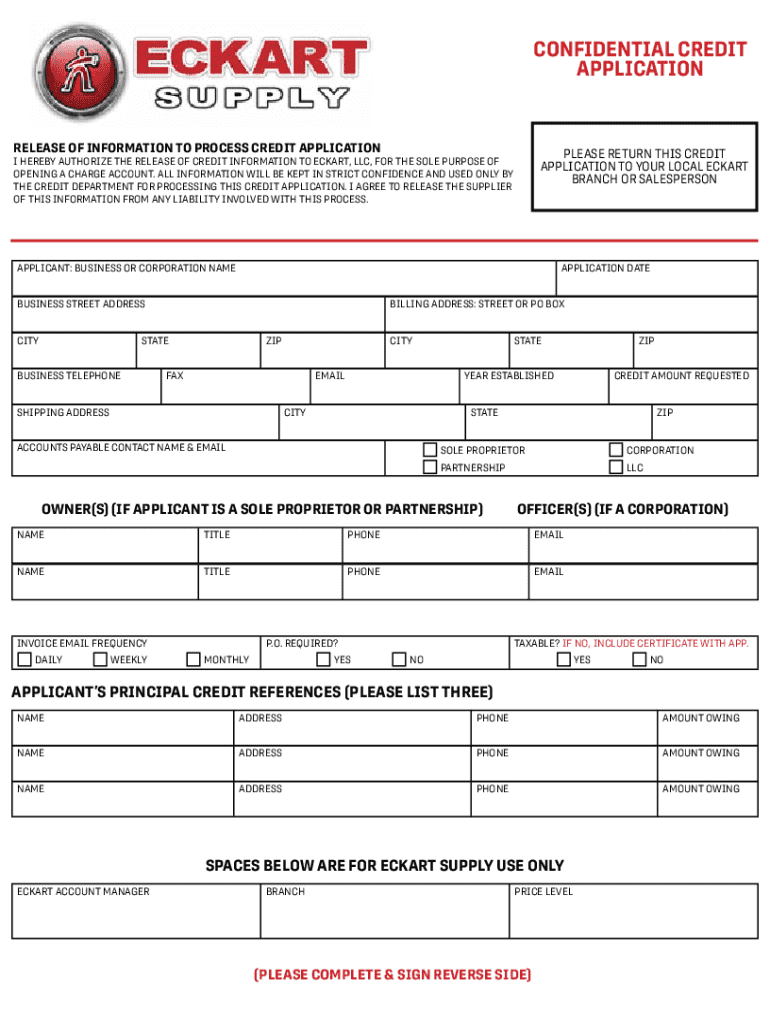

Overview of the confidential credit application form

A credit application is not just a formality; it's a crucial step in securing funds for your needs, whether personal, business, or otherwise. The confidentiality of this document is paramount, as it contains sensitive financial information that must be protected. Ensuring that your credit application form is handled discreetly can help you maintain control over your personal data.

Using a digital confidential credit application form offers several advantages over traditional paper forms. Digital forms, like those available on pdfFiller, provide a level of security through encryption, reducing the risk of data breaches. Furthermore, they streamline the application process, allowing for quick updates and easy document management.

Understanding the structure of the confidential credit application form

When you start filling out a confidential credit application form, understanding its structure is essential. This form typically consists of various sections that gather information essential for evaluating your creditworthiness.

Section 1: Applicant information

This section requires personal details, such as your full name, address, and contact information. You will also need to provide identification verification details, including your social security number and date of birth. Lenders use this information to authenticate your identity and prevent fraud.

Section 2: Employment information

The employment information section captures your current employment status. You will need to supply details about your employer, your position, and how long you have been with the company. Moreover, this section typically requests income details, such as your monthly salary and any additional income sources, to help lenders assess your ability to repay.

Section 3: Financial information

In the financial information section, you’re required to list your existing debts, including credit cards and loans. Additionally, you will need to disclose your assets, which could include bank accounts and property ownership. This information is crucial for lenders to evaluate your overall financial health.

Section 4: Purpose of the credit

The final section outlines the purpose of the credit request. Here, you should specify the credit’s intended use—whether personal, for business needs, or for home improvement. Additionally, you will need to indicate the amount requested and specify potential repayment terms.

Filling out the confidential credit application form

Filling out a confidential credit application form can seem daunting, but a step-by-step approach can simplify the process. Start by gathering all necessary documents and information, ensuring you have everything on hand before you begin.

Step-by-step instructions

It’s advisable to fill out the sections in the order presented—starting with the applicant information and moving sequentially to employment, financial details, and purpose of credit. This logical flow minimizes errors and helps maintain focus.

Common pitfalls to avoid include skipping sections, providing inaccurate information, or not fully understanding the implications of what you're signing. It’s crucial to prioritize honesty and completeness to prevent delays in processing your application.

Tips for accurate information

Accuracy is key when filling out a credit application. Review each section carefully and double-check entered data. Small errors can lead to significant consequences, such as rejection or a prolonged approval process. Furthermore, use tools provided by platforms like pdfFiller to verify the integrity of your submitted information.

Editing and customizing the form

One of the strengths of a digital confidential credit application form is the ability to edit and customize it as needed. With platforms like pdfFiller, users can personalize their forms to better suit their unique situations.

Using pdfFiller's tools to modify your form

pdfFiller offers a range of interactive editing features that allow you to add or remove fields based on your personal circumstances. You can easily modify sections that may not apply to you, streamlining the form completion process.

Incorporating additional documentation

Additionally, you have the option to upload supporting documents, such as pay stubs and tax returns, directly to your credit application form. Adhering to best practices for secure file management, such as encryption and using password-protected documents, will keep your sensitive information safe.

Electronic signature features

Signing a confidential credit application form electronically is crucial for validating the application. This step adds a level of authenticity and is legally recognized in most jurisdictions. The convenience of e-signing can streamline the process considerably.

Importance of signing for validity

An electronic signature holds the same legal implications as a traditional handwritten signature. By comparing e-signing with traditional methods, e-signatures eliminate the logistical delays associated with mailing a physical document, making the process faster and more efficient.

How to sign the form using pdfFiller

Signing your form using pdfFiller is straightforward. Within the platform, a step-by-step guide will direct you through the e-signing process. After signing, always ensure that the document integrity remains intact before submitting.

Submitting the confidential credit application form

Once your confidential credit application form is completed and signed, the next step is submission. Choosing the correct submission method is vital for ensuring that your application reaches the lender promptly.

Choosing the right submission method

You typically have two submission options: online submission or printing and mailing the form. Online submissions are faster, reducing postal delays and facilitating quicker responses, while print-and-mail options may offer more opportunities for personalized follow-ups.

Tracking your application status is also essential. After submission, you should know how to follow up effectively, keeping in mind the typical timeline for approval can vary depending on the lender.

Managing your confidential documents with pdfFiller

Security and organization of confidential documents are integral components of successful document handling, particularly for your credit application. pdfFiller empowers users to access and manage their forms securely from the cloud, ensuring that sensitive information remains protected.

Organizing your sent and received forms

To keep your documents organized, consider establishing a filing system within pdfFiller. This may involve categorizing forms by submission date, type of application, or lender. This organization not only aids in managing your documents but also ensures that you can retrieve them swiftly when needed.

Accessing your forms from anywhere

One of the greatest advantages of using a cloud-based document management system is the ability to access your forms from anywhere. Mobile access features allow for on-the-go management, so you can edit or send documents when necessary, making pdfFiller a valuable tool for both individuals and teams.

Frequently asked questions about the confidential credit application form

Understanding the common concerns surrounding the confidential credit application form can ease the anxiety often associated with the credit application process. Many individuals worry about confidentiality and data protection, wondering how secure their information remains once submitted.

Common concerns regarding confidentiality and data protection

Lenders are required to comply with stringent data protection regulations, and it’s crucial for applicants to choose lenders who offer this assurance. Knowing what to expect regarding form requirements can demystify the process further.

Handling rejections and asking for reconsideration

If your application is rejected, it’s important to understand why and seek clarity from the lender. Many lenders offer avenues for reconsideration, which can be leveraged to your advantage if you can provide additional documentation or clarify misunderstandings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get confidential credit application?

How can I edit confidential credit application on a smartphone?

How do I fill out confidential credit application on an Android device?

What is confidential credit application?

Who is required to file confidential credit application?

How to fill out confidential credit application?

What is the purpose of confidential credit application?

What information must be reported on confidential credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.