Get the free Consumer Credit Card Application

Get, Create, Make and Sign consumer credit card application

How to edit consumer credit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit card application

How to fill out consumer credit card application

Who needs consumer credit card application?

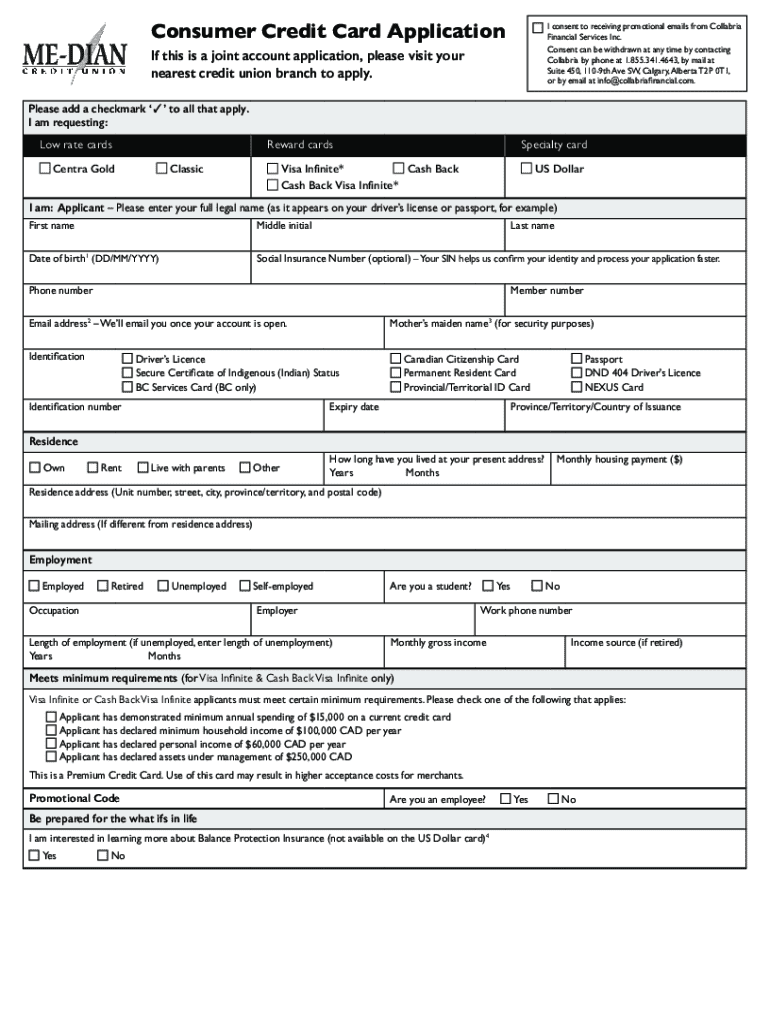

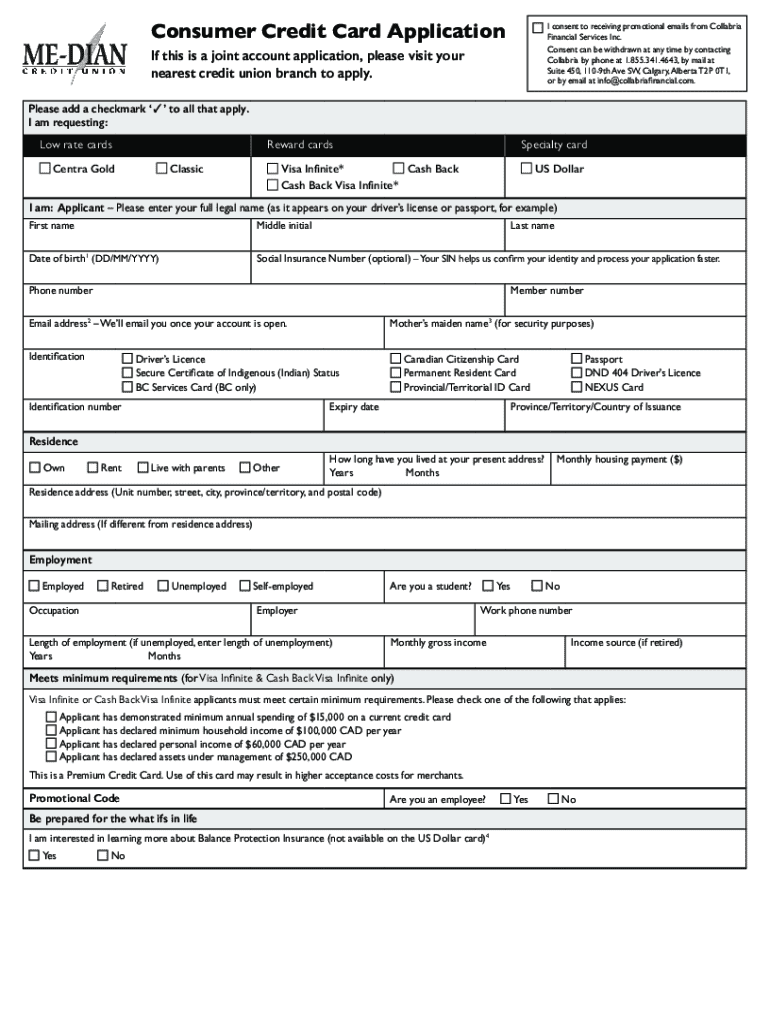

Understanding the Consumer Credit Card Application Form

Understanding the consumer credit card application form

A consumer credit card application form is a vital document used by financial institutions to assess an individual's creditworthiness before issuing a credit card. Completing this form accurately can significantly influence approval chances and the type of credit limit offered. Crucially, it serves as the first step for applicants to gain access to various financial benefits, making it essential for responsible credit use.

Types of credit cards

There are various types of consumer credit cards available, each tailored to meet different financial needs and preferences. Popular options include:

Key sections of the application form

The consumer credit card application form is typically divided into several key sections, each requiring specific information to evaluate an application effectively.

Personal information

The personal information section typically requires you to provide your full name, address, phone number, and Social Security number. It's crucial to ensure all details are accurate, as discrepancies can delay the processing or result in rejection.

Financial information

Financial information is pivotal in evaluating an applicant's ability to manage credit. This section usually demands proof of income, which could include a recent pay stub or tax return. Additionally, you may need to disclose any existing debt, including loans and credit accounts, to give a clear picture of your financial obligations.

Employment information

The employment information section requires details about your current job status, including the name of your employer, your position, and how long you have been employed. A stable employment history can increase your chances of approval as lenders prefer applicants with reliable income sources.

Step-by-step guide to filling out the application

Filling out your consumer credit card application form can seem daunting, but with careful preparation, it’s manageable. Follow this structured guide:

Step 1: Gathering necessary documents

Before starting the application process, gather essential documents that will facilitate filling out the form. Common documents include:

Step 2: Completing the personal information section

Start by entering your full name exactly as it appears on your identification documents. Follow up with your residential address and ensure that your Social Security number is entered without errors, as this is crucial for conducting a credit check.

Step 3: Filling out financial information

When entering your financial details, be honest about your income sources. Include all forms of income, such as salary, bonuses, and any other earnings. Also, list existing debts accurately to maintain transparency; failing to do so might jeopardize your application.

Step 4: Providing employment details

Provide comprehensive information regarding your current employment. This includes your employer’s name, address, and your role within the company. If you are a self-employed individual, include relevant business details.

Step 5: Reviewing your application

Before submitting, review your application thoroughly. Check for any inconsistencies or omissions in the information provided. It’s helpful to have a checklist available that includes verification of personal details, accuracy of financial data, and employment history.

Common mistakes to avoid

Navigating your consumer credit card application form can lead to several pitfalls. Avoid these common mistakes to enhance your chances of securing approval.

Inaccurate personal details

Entering incorrect personal information can severely impact your approval chances. Lenders rely heavily on the details provided to match them with your credit report.

Underreporting income or assets

Being conservative or dishonest about your income may seem harmless but can lead to problems. Lenders develop trust based on the financial information you provide, and underreporting can be perceived as a red flag.

Failing to disclose existing debts

Transparency is essential. Failing to disclose your existing debts could result in your application being denied or revoked after approval, leading to severe financial consequences.

Submitting your application: what to expect

After successfully filling out your consumer credit card application form, the next step is submission. It’s essential to know how this works to prepare for any subsequent processes.

Online submission process

Submitting your application online is typically quick and straightforward. Most banks and credit card issuers provide a dedicated portal where you enter all your information directly. After submission, you may receive confirmation via email and potentially gain access to immediate feedback regarding your status.

In-person submission tips

If you prefer to submit your application in person, ensure that you bring all necessary documents. You may discuss directly with a bank representative, allowing you to clarify any doubts or questions. Furthermore, being prepared will demonstrate your seriousness to the lender.

Post-application: the approval process

Once you have submitted your consumer credit card application form, understanding the approval timeline and what factors influence the decision is important.

Typical timeline for approval

Approval times can vary based on the financial institution and the specifics of your application. Some lenders provide quick decisions within moments, while others may take several days to process.

Understanding credit checks

During the approval process, lenders will conduct a credit check, analyzing your credit score and history. A good credit score typically helps facilitate a smoother approval process and can influence the overall credit limit you are granted.

Tips for improving your chances of approval

To enhance your approval chances when submitting a consumer credit card application form, consider these proactive steps.

Check your credit score

Before applying, check your credit score to assess your eligibility. Many banks and third-party services offer free credit reports which allow you to not only see your credit score but also to identify areas for improvement.

Reduce existing debt

Minimizing your existing debts can have a significant impact. Strategies such as paying off smaller balances or negotiating with creditors may help improve your financial profile, ultimately increasing your approval likelihood.

Consider joint applications

If you have a partner or friend with a stronger credit score, consider applying jointly. This can boost your approval chances; however, it also means both parties share responsibility for the account.

Managing your credit card after approval

Once your consumer credit card application form is approved, it’s crucial to comprehend your responsibilities as a cardholder.

Understanding terms and conditions

Carefully reviewing the terms and conditions laid out by the credit card issuer will provide insight into any fees, interest rates, and features associated with your card. Ensure you understand all functionalities and limitations to maximize your benefits.

Responsible usage of your credit card

Managing your credit responsibly post-approval is vital for maintaining a healthy credit score. Strategies include paying your balance in full whenever possible to avoid interest charges and keeping your utilization low by limiting your spending relative to the credit limit.

Frequently asked questions (FAQs)

As you navigate the world of credit cards, several common questions may arise regarding the application process.

What happens if my application is denied?

If your application is denied, you will receive a letter indicating the reasons. Understanding these reasons can help you address any issues and improve future applications.

Can reapply for a credit card after being declined?

Yes, but it's wise to wait a few months to allow any negative impact on your credit score to diminish. Using this time to repair your credit profile can increase your chances of approval.

How often can apply for credit cards?

While there is no formal limit, applying for multiple credit cards within a short time can negatively affect your credit score. It's best to space out applications and focus on improving your financial situation between applications.

Interactive tools and resources available on pdfFiller

pdfFiller offers a cloud-based platform equipped with tools that simplify the process of filling out and managing your consumer credit card application form.

Document creation and editing solutions

Utilize pdfFiller’s editing tools to create, modify, and finalize your application forms with ease. The platform supports seamless adjustments, preventing any data loss or formatting issues.

eSigning capability

With pdfFiller’s eSigning feature, you can securely sign your application digitally, eliminating the need for physical paperwork and facilitating faster processing times.

Collaboration tools for teams

The platform allows teams to collaborate efficiently, enabling multiple users to work on the application simultaneously. This feature is particularly beneficial for organizations and businesses managing credit card applications on behalf of their employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete consumer credit card application online?

How do I edit consumer credit card application online?

How can I edit consumer credit card application on a smartphone?

What is consumer credit card application?

Who is required to file consumer credit card application?

How to fill out consumer credit card application?

What is the purpose of consumer credit card application?

What information must be reported on consumer credit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.