Get the free Calhfa Conventional Program Matrix

Get, Create, Make and Sign calhfa conventional program matrix

Editing calhfa conventional program matrix online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calhfa conventional program matrix

How to fill out calhfa conventional program matrix

Who needs calhfa conventional program matrix?

CalHFA Conventional Program Matrix Form: Your Comprehensive Guide

Overview of CalHFA Conventional Program

The California Housing Finance Agency (CalHFA) offers a range of programs aimed at providing affordable housing finance solutions to Californians. The CalHFA Conventional Program specifically targets homebuyers looking for conventional loan options, allowing them to benefit from lower mortgage rates and reduced down payment requirements. This program is essential for individuals and families working towards their dream of homeownership in high-cost areas.

Key features of the CalHFA Conventional Program include competitive interest rates, flexible credit score requirements, and accessibility to first-time homebuyer assistance options. Borrowers can leverage these features to navigate the complexities of obtaining a home loan, significantly easing the burden on their finances.

Choosing CalHFA Conventional Loans can offer numerous benefits, including streamlined loan processing and the potential for better overall loan performance. These loans cater to the unique financial challenges many Californians face, making home ownership a more attainable goal.

Program eligibility criteria

To qualify for the CalHFA Conventional Program, applicants must meet specific eligibility criteria. Firstly, candidates should be first-time homebuyers or have not owned a home in the past three years. This increases access for individuals who have previously faced barriers to homeownership.

Income limits are another crucial factor in determining eligibility. CalHFA usually sets a cap on household income, which varies by county and household size, ensuring that assistance focuses on those who need it most. Applicants must also expect certain credit score minimums, typically starting from the low 600s, allowing more flexibility for borrowers with varying credit histories.

Understanding these eligibility requirements is critical. It allows potential homebuyers to prepare adequately, ensuring they meet the necessary standards before applying for the loan.

The conventional program matrix explained

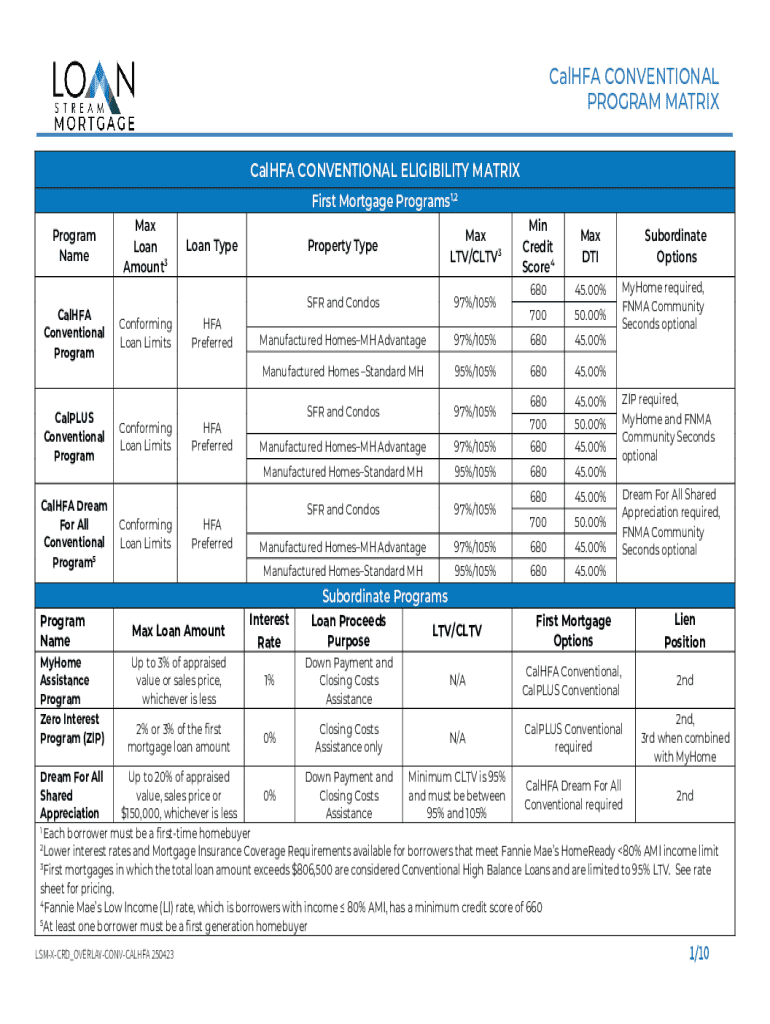

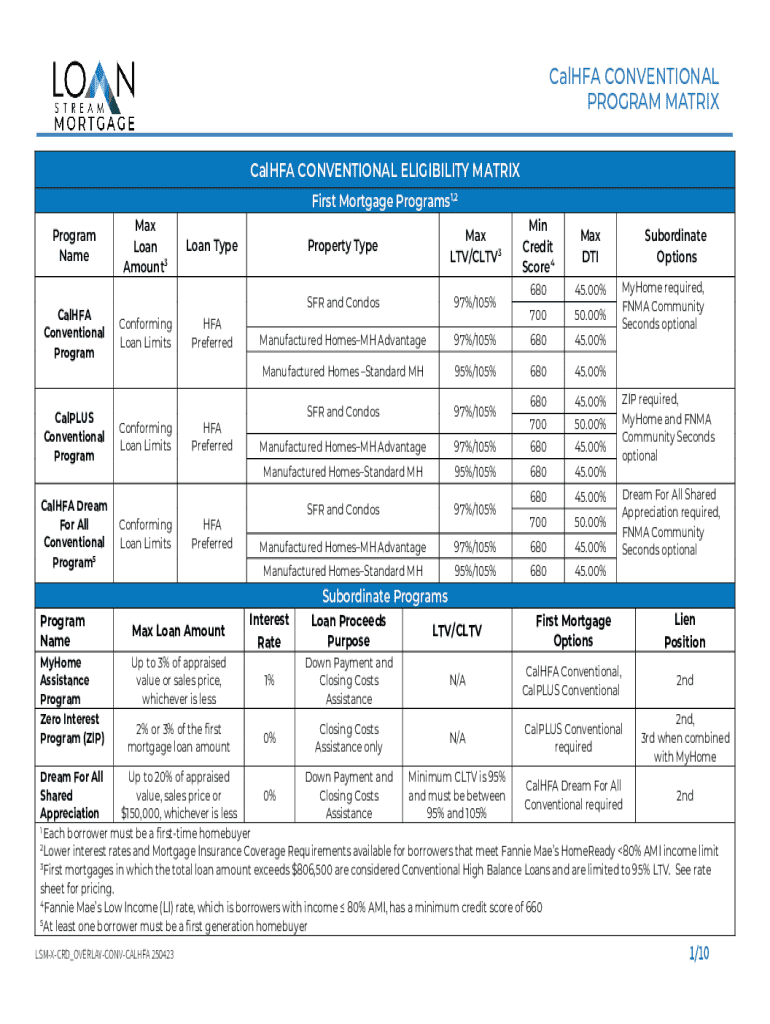

The CalHFA Conventional Program Matrix is an essential tool that summarizes the various parameters and options available to potential borrowers. It provides clear insights into loan types, limits, terms, and funding options tailored to meet diverse financial needs.

To break it down further, the program matrix features several components like loan limits, down payment options, and applicable income limits by region. Understanding how to interpret the data within the matrix is crucial for clients and loan officers alike, as it can directly influence loan choice.

For example, if a borrower is looking at loan options in San Francisco, they may find different criteria compared to someone in a rural part of California. Understanding these nuances ensures borrowers select the optimal program for their personal financial situation.

Step-by-step guide to filling out the CalHFA conventional program matrix form

Filling out the CalHFA Conventional Program Matrix Form may seem daunting, but breaking it down into manageable sections can simplify the process. Start by preparing all required documents, including identification, income statements, and asset reports.

Each section of the form allows you to provide specific details necessary for approval, such as personal information, income details, and asset reports. Understanding each item can prevent common issues later in the application process.

Common errors often arise from missing or inaccurate information. Double-checking your entries can save time and reduce frustration when your form is submitted. Each detail matters, and ensuring accuracy enhances your chances of swift approval.

Utilizing digital tools for efficient completion

Utilizing digital tools, such as pdfFiller, can drastically streamline the process of completing the matrix form. This platform features interactive editing capabilities that allow you to fill in your information quickly and accurately, ensuring no detail is overlooked.

Additionally, eSignature capabilities enable you to add your signature electronically, expediting the submission process. Thus, completing forms has never been easier or more efficient.

Once your form is completed, managing your documents becomes a breeze. pdfFiller allows you to store your forms securely and access them anytime. This ensures that all your information is organized and available when needed.

Resources and tools for enhanced understanding

Understanding the nuances of the CalHFA Conventional Program can be enhanced through various resources available online. Tools like loan scenario calculators provide visual aids that help potential borrowers gauge their eligibility and understand the impact of various loan amounts.

Program compliance tools and processing checklists ensure that applicants adhere to regulatory requirements, protecting them from unforeseen issues. Accessing video tutorials can serve as an excellent visual learning tool, guiding users through complex information with practical demonstrations.

Embracing these resources not only clarifies what to expect but arms potential borrowers with the knowledge needed to navigate the home-buying journey confidently.

Frequently asked questions

Navigating loan applications often comes with questions. Addressing frequently asked inquiries can clarify concerns for many potential borrowers. Common queries typically revolve around eligibility criteria, the form submission process, and troubleshooting credit issues.

Questions about loan approval timelines also frequently arise, as applicants wish to understand how long the overall process takes. Being prepared with answers ensures smoother communication and aids in maintaining applicant confidence throughout the process.

By having this information at hand, applicants can expediently resolve potential issues and progress smoothly through the loan process.

Program updates and changes

Staying informed about recent modifications to the CalHFA Conventional Program is key for applicants. These updates can impact eligibility criteria, available funding, and overall loan processing times. Keeping an eye on important dates gives borrowers a strategic edge in their home-buying process.

Regular updates via CalHFA bulletins or newsletters ensure you’re always in the loop regarding this dynamic program. Being proactive not only streamlines personal application processes but fosters better communication with loan officers as well.

By being informed, potential borrowers can take timely action, ensuring that they don’t miss out on opportunities to secure funding that fits their needs.

Success stories

Real-life success stories from applicants who have successfully navigated the CalHFA Conventional Program provide inspiration and tangible evidence of the program’s effectiveness. Many have shared their journeys, highlighting the vital role that thoughtful preparation and the right assistance played in achieving their homeownership goals.

Testimonials from satisfied users reveal how pdfFiller supported them during their application process. From completing complex documents to resolving issues promptly, users emphasize the advantages of using integrated tools to simplify their experience.

These narratives reveal the importance of persistence and the right resources in turning aspirations into reality.

Connect with experts

Navigating the CalHFA Conventional Program can be overwhelming at times, but connecting with experts is crucial for personalized assistance. Whether through local agencies, financial advisors, or community resources, building a network of support can provide invaluable insights into the home-buying process.

Engaging with professionals who understand the intricacies of the program can enhance one's journey—offering guidance tailored to unique financial situations. Subscribing to newsletters or local housing seminars can also keep you informed about the latest developments.

By fostering connections and seeking assistance, potential borrowers can enhance their chances of a successful application and subsequent home purchase.

Interactive demonstration

An engaging way to familiarize yourself with the CalHFA Conventional Program Matrix Form is through interactive demonstrations. These sessions can provide hands-on experience, guiding applicants through each section of the form with real-time assistance.

A live demonstration on pdfFiller shows how to effortlessly complete the matrix form, integrating tools and tips to optimize your submission. Coupled with an engaging Q&A session, this approach addresses immediate concerns while empowering borrowers with knowledge.

This immersive experience can transform potential borrowers' understanding, providing clarity in navigating the application process and ultimately, achieving their homeownership ambitions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find calhfa conventional program matrix?

How do I edit calhfa conventional program matrix straight from my smartphone?

How do I fill out the calhfa conventional program matrix form on my smartphone?

What is calhfa conventional program matrix?

Who is required to file calhfa conventional program matrix?

How to fill out calhfa conventional program matrix?

What is the purpose of calhfa conventional program matrix?

What information must be reported on calhfa conventional program matrix?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.