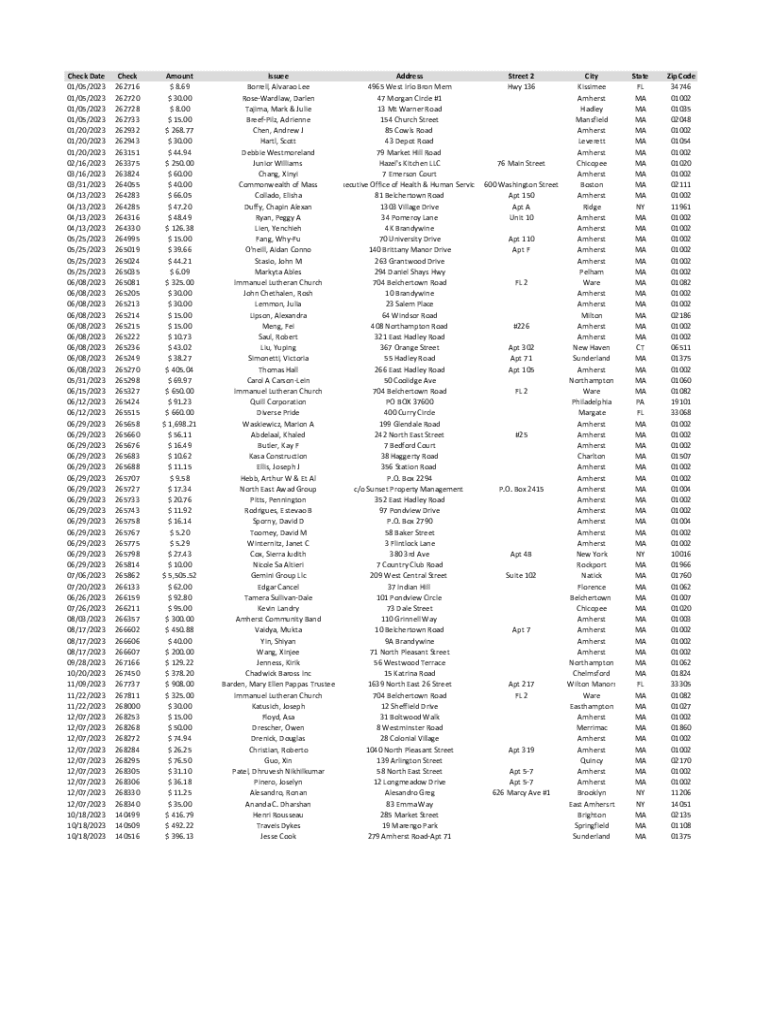

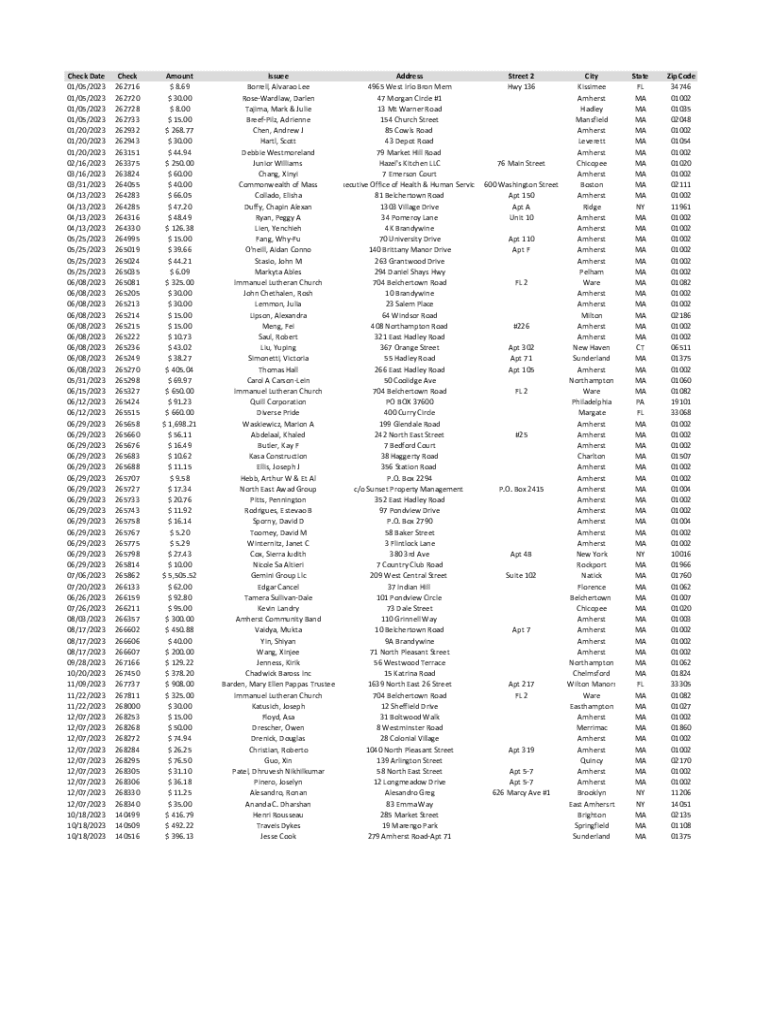

Get the free Check Date Check Amount Issuee Address Street 2 City State Zip ...

Get, Create, Make and Sign check date check amount

Editing check date check amount online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check date check amount

How to fill out check date check amount

Who needs check date check amount?

Understanding the Check Date and Check Amount Form

Understanding the check date

The check date is a fundamental element of any check, representing the date on which the check is issued. This date has significant implications in financial transactions, serving as a recorded timestamp that helps both the payer and payee track the timing of the payment. Knowing the check date is critical for accounting purposes and aids in managing cash flow efficiently.

When selecting a check date, consider several factors such as payment deadlines, internal accounting practices, and tax implications. Depending on the financial arrangements, the chosen date may also affect the timing of when the funds become available to the recipient.

Importance of accurate check amounts

The check amount denotes the monetary value of the check, playing a crucial role in bookkeeping and financial reporting. An accurate amount ensures that the financial records represent true liabilities and asset movements. Errors in the check amount can lead to discrepancies in accounts, affect cash flow, and lead to potential disputes between the payer and payee.

Common mistakes associated with check amounts include overpayment and underpayment. These oversights can stem from simple calculation errors, misinterpretations, or data entry mistakes. Avoiding these pitfalls requires diligence at every step of the check-writing process.

Filling out the check date and amount: step-by-step guide

Filling out a check might seem straightforward, but accuracy is paramount. Here’s a step-by-step guide to ensure you fill out the check date and amount correctly.

Step 1: Prepare your materials

Start with all necessary materials, including a checkbook, a pen (preferably blue or black ink), and any documentation that details the reason for the payment. Clarity and legibility are crucial when filling out checks to avoid any misinterpretations.

Step 2: Writing the check date

The date should be placed in the top right corner of the check. Use a common date format (e.g., MM/DD/YYYY or DD/MM/YYYY) to avoid confusion. For example, writing '05/01/2023' is clear and unambiguous.

Step 3: Entering the check amount

The check amount needs to be written both in numbers and letters. In the numeric box, input the total amount (e.g., '$150.00'). In the line below, write it out in words (e.g., 'One hundred fifty and 00/100'). This dual entry helps to prevent alterations or fraud.

Step 4: Double-checking your entries

After filling in the date and amount, review your entries. An effective checklist includes verifying the date, ensuring the check amount is consistent in both figures and words, and confirming the payee’s name is spelled correctly.

Advanced tips for managing check transactions

In the current financial landscape, using technology can significantly improve check management processes. Leveraging digital tools for creating and editing checks can simplify tasks, allowing for quicker turnaround times and reduced errors.

pdfFiller provides an excellent platform for users to create and manage checks seamlessly. The platform allows for editing, e-signing, and collaboration on documents, which enhances transparency and efficiency.

Common scenarios involving check dates and amounts

Various scenarios frequently arise in check management that users need to navigate. Handling post-dated checks, for instance, requires an understanding of banking policies and practices, as checks dated for the future may not be processed immediately.

Returned checks are another common issue, often due to insufficient funds or discrepancies in the account information. Knowing how to respond to a returned check, including understanding bank policies and communicating with the payee, can mitigate repercussions.

Troubleshooting check date and amount errors

Errors may occur during the check-writing process, so it’s vital to recognize and correct mistakes promptly. Common issues include incorrect dates and misspelled names, as well as discrepancies in the check amount. Spotting such errors requires careful scrutiny.

Should a mistake arise on a check, the appropriate course of action is to void and reissue the check. Maintaining a voided check record for reconciliations is advisable and can help in tracking errors in your financial documentation.

Best practices for check management

Keeping track of checks written is essential for maintaining accurate financial records. Implementing a systematic approach, such as using checkbooks with carbon copies or digital check management systems, can simplify this process significantly.

Additionally, protecting your sensitive financial information is paramount. Keeping checks and records in a secure location helps prevent identity theft and related financial issues. Consider the timing to transition to digital payment solutions to enhance tracking and reduce the risks associated with physical checks.

Collaborating with your team on check processing

In team settings, it’s crucial to maintain effective communication throughout the check processing workflow. Adopting a cloud-based solution like pdfFiller ensures that all members can collaborate in real-time on documents, facilitating a clear understanding of financial obligations.

To ensure that everyone is aligned, regular meetings to discuss payment schedules and outstanding checks can foster cooperation and prevent scheduling conflicts.

Case studies: successful check practices

Several organizations have improved their financial management by refining check practices. For example, implementing systematic check tracking and auditing processes has led to fewer discrepancies in financial reporting, resulting in safer and more efficient financial operation.

On the other hand, a lack of systematic practices can lead to financial mismanagement and costly penalties. A notable example involved an organization that struggled with penalties due to unpaid checks that were overlooked due to poor tracking methods, highlighting the importance of diligent check management.

Additional tools and resources

To effectively manage check processes, leveraging interactive features such as pdfFiller enables users to edit, e-sign, and manage check forms conveniently from anywhere. Utilizing templates specifically designed for varying types of checks can streamline operations and enhance efficiency.

Furthermore, other resources and templates related to check writing are readily available, empowering users with the necessary tools to handle their check-related tasks without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete check date check amount online?

Can I create an eSignature for the check date check amount in Gmail?

How do I fill out check date check amount using my mobile device?

What is check date check amount?

Who is required to file check date check amount?

How to fill out check date check amount?

What is the purpose of check date check amount?

What information must be reported on check date check amount?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.