Get the free Special Assessment Roll 2025 - Sad #3

Get, Create, Make and Sign special assessment roll 2025

Editing special assessment roll 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out special assessment roll 2025

How to fill out special assessment roll 2025

Who needs special assessment roll 2025?

Special Assessment Roll 2025 Form: A Comprehensive Guide

Overview of special assessment roll 2025

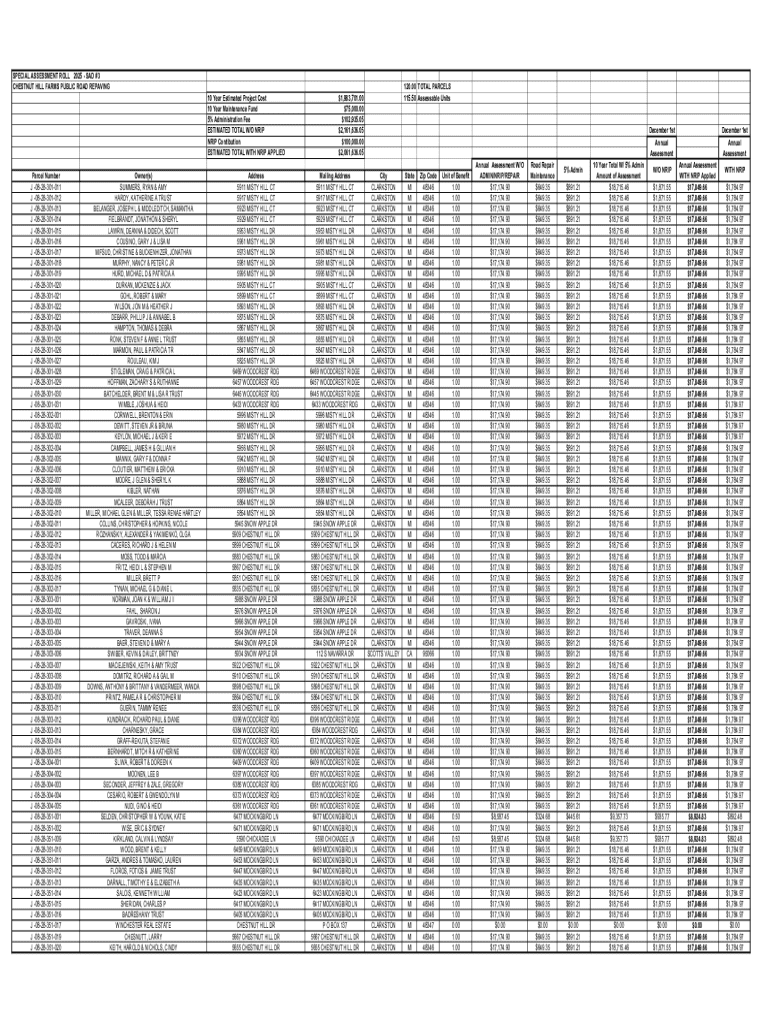

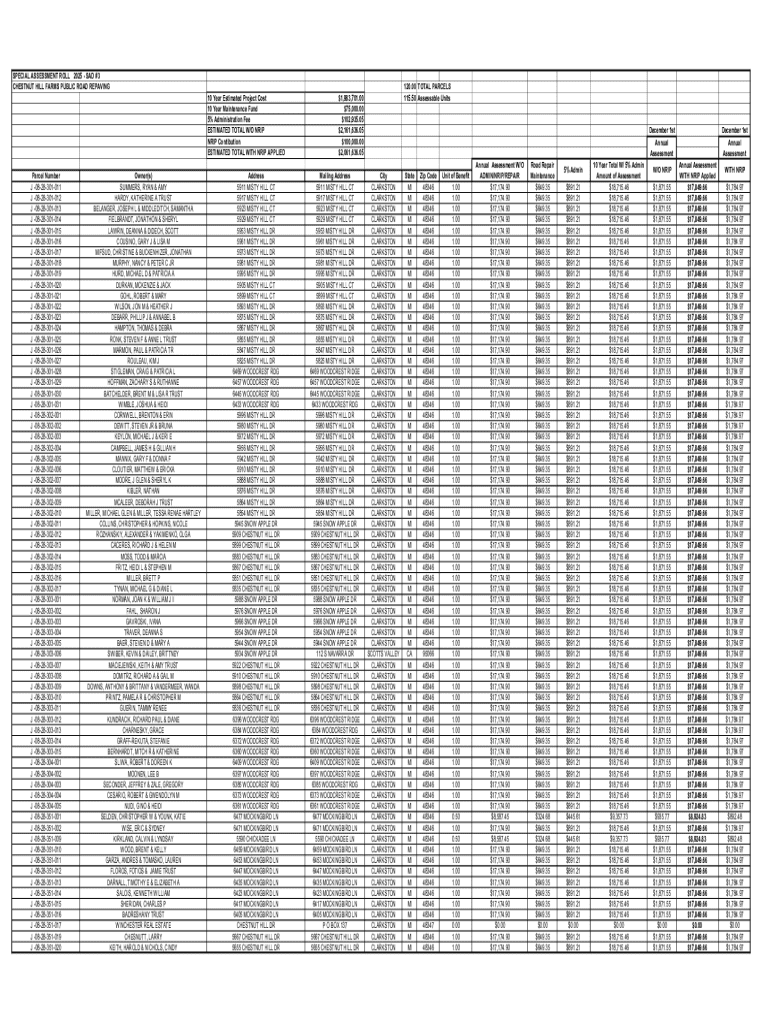

The Special Assessment Roll 2025 is a key document that outlines assessments levied by municipalities for specific improvements deemed beneficial to properties within the community. Special assessments are distinct from regular property taxes, as they specifically fund designated projects, such as road improvements, sewer upgrades, and stormwater management programs, directly impacting the value of adjacent land parcels.

The 2025 Assessment Roll holds particular importance, as local governments depend on it to allocate funding for essential public works projects that enhance community infrastructure. Unlike general property taxes, which fund a broad range of city services, special assessments target specific improvements, ensuring that property owners contributing to and benefiting from these enhancements share equitably in the costs.

Understanding the special assessment roll

The 2025 Special Assessment Roll comprises several key components that detail the nature and extent of the assessments applied to each property. Important elements include the type of special assessments, such as those for fire service improvements or infrastructure upgrades, and the calculation methods used to determine individual fees based on the assessed value of the property.

Reviewing the Assessment Roll offers numerous benefits. It fosters transparency in how public funds are allocated and ensures that property owners are well-informed about the charges impacting their real estate decisions. This empowers property owners to manage their investments strategically, allowing them to anticipate changes in their financial obligations related to land parcels they own.

Accessing the special assessment roll 2025 form

To access the Special Assessment Roll 2025 form, users can navigate to the pdfFiller website, known for its user-friendly interface. The form is available in various formats, including PDF and Word, to accommodate the preferences of different users.

Downloading the 2025 Assessment Roll Form is straightforward; simply visit the designated section on pdfFiller’s platform, select the appropriate file format, and follow the prompts to download. This accessibility ensures that individuals and teams can readily access necessary documentation when preparing their assessments.

Step-by-step guide to filling out the special assessment roll 2025 form

Before starting the form, collecting relevant personal and property information is crucial. Required details typically include the property owner’s name, property identification numbers, and specific ordinances relevant to the assessment. Having this information handy will streamline the filling-out process.

Filling out the form fields requires attention to detail. Key sections include property identification, owner information, and assessment details, which outline the nature of the special fees. It's vital to pay close attention to these areas to avoid common mistakes, such as misreporting parcel numbers or omitting required signatures.

After filling out the form, using pdfFiller’s tools for editing and revising your submission can significantly enhance accuracy. This platform allows for easy collaboration, enabling you to involve others in reviewing the assessment details and making necessary adjustments based on their feedback.

Signing and submitting the form

Once the form is completed, users can take advantage of pdfFiller’s eSignature options. Setting up an account for electronic signing is quick and straightforward, and it ensures your signatures hold legal validity in most jurisdictions. This digital approach not only speeds up the process but also enhances compliance without the need for physical paper.

The submission process can vary; you have options for online submission through pdfFiller or traditional mail-in methods. Be mindful of important deadlines to avoid penalties or missed opportunities for adjustment, and ensure compliance with any associated regulations regarding special assessments.

Post-submission management

After submitting your special assessment, it's essential to track the status of your submission. Monitoring updates can help you stay informed about any changes or actions required on your part. pdfFiller provides resources for managing this process effectively.

In the event of errors or issues post-submission, knowing how to amend the assessment is vital. The platform helps users navigate this process seamlessly, offering guidance for resubmitting and rectifying any mistakes that could impact property assessments or fees.

Additional tools and features on pdfFiller for document management

pdfFiller comes equipped with interactive tools that enhance document handling and management. Features like commenting and review functions allow users to leave notes or request changes, fostering better communication among team members when collaborating on documents.

Moreover, pdfFiller’s integration with cloud storage services enriches the accessibility of your documents, ensuring they're available for review or editing at any time. Teams can manage permissions and access, enabling sensible collaboration on the special assessment roll 2025 form, which is especially useful for groups managing multiple properties or large projects.

Frequently asked questions (FAQs)

Many individuals often wonder who can access the Special Assessment Roll 2025 form. Generally, property owners, local businesses, and municipal employees are granted access. It is a public document designed to ensure transparency in the assessment process.

If you disagree with your assessment, there are typically procedures in place to contest it. This might involve filing a formal appeal or requesting a reassessment based on new data. Additionally, users often inquire about whether changes can be made after submission; many jurisdictions do allow for amendments, although these processes may involve timelines and specific criteria.

User testimonials and case studies

Numerous users have shared success stories about how pdfFiller has simplified their experience managing special assessment forms. Testimonials often highlight the platform’s ease of use and the efficiency gained from using the electronic format over traditional paperwork.

For example, one user noted that by using pdfFiller, their workflow for submitting the special assessment roll was expedited dramatically, reducing time spent waiting for approvals and feedback. This kind of feedback underscores the value of adopting modern document management solutions for property owners and local governments alike.

Troubleshooting common issues with the special assessment roll form

While using the pdfFiller platform, users may occasionally encounter technical difficulties, such as issues accessing or filling out the Special Assessment Roll Form. In these cases, it’s helpful to consult the help resources available on the pdfFiller website or reach out to their support team for prompt assistance.

Common technical issues can often be resolved quickly, and having the right support can alleviate frustrations related to the electronic submission process. pdfFiller’s dedicated assistance ensures that users stay compliant and informed during their assessment management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit special assessment roll 2025 on a smartphone?

How do I edit special assessment roll 2025 on an iOS device?

How do I complete special assessment roll 2025 on an Android device?

What is special assessment roll?

Who is required to file special assessment roll?

How to fill out special assessment roll?

What is the purpose of special assessment roll?

What information must be reported on special assessment roll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.