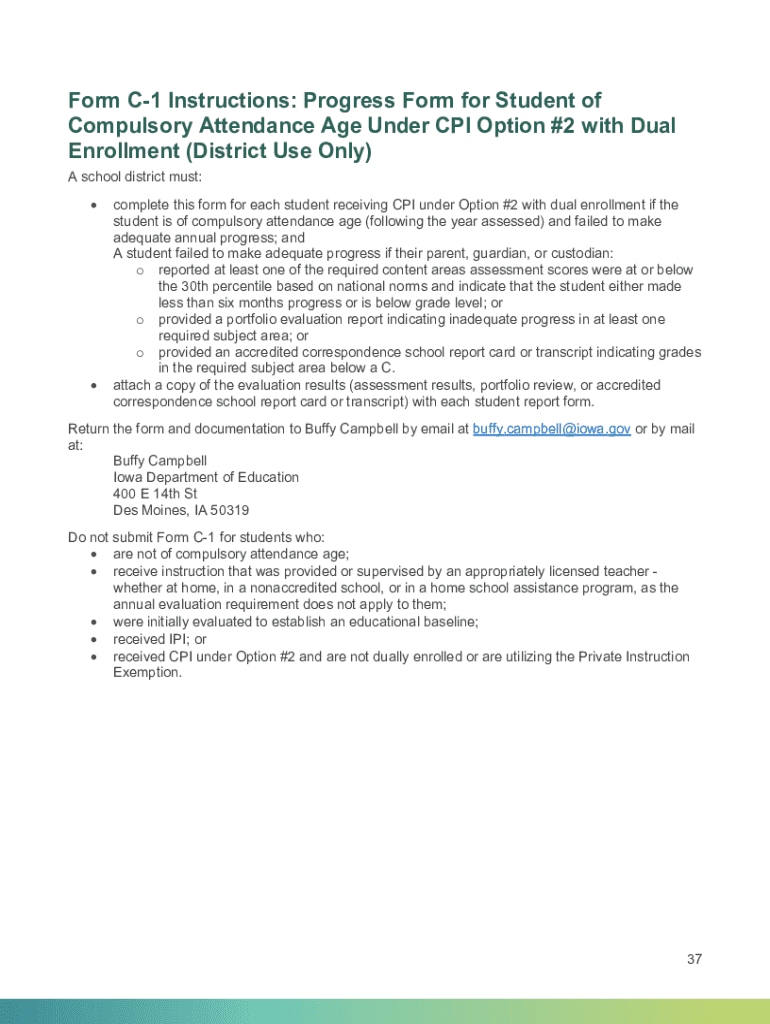

Get the free Form C-1 Instructions

Get, Create, Make and Sign form c-1 instructions

How to edit form c-1 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form c-1 instructions

How to fill out form c-1 instructions

Who needs form c-1 instructions?

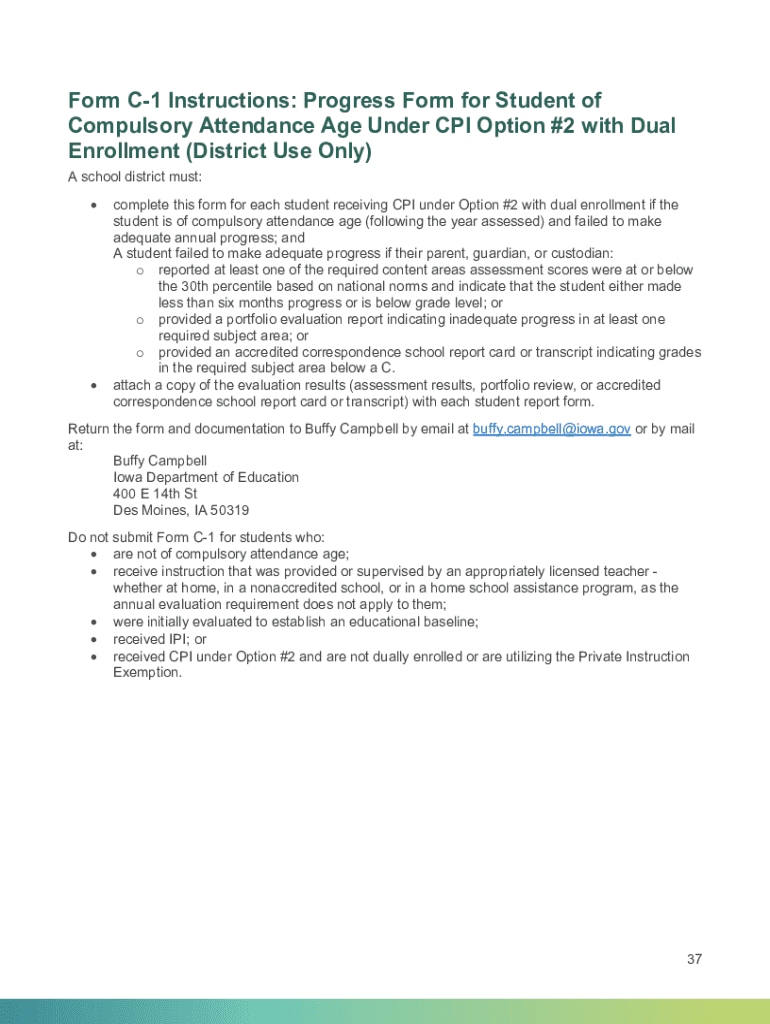

Form -1 Instructions: A Comprehensive Guide

Understanding Form -1

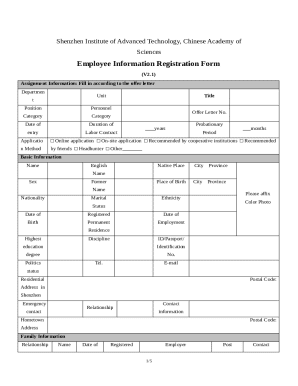

Form C-1 is a critical document utilized by employers for the effective management of wage reports and other related tax reporting functions. Its primary purpose is to facilitate the reporting of wages paid to employees, ensuring compliance with unemployment tax registration requirements set by government organizations. Employers must be familiar with this form to avoid penalties and maintain their tax accounts in good standing.

Various situations may demand the completion of Form C-1, including but not limited to the reporting of newly hired employees, claiming certain tax credits, or addressing discrepancies in previous filings. Understanding the nuances of when and why to submit this form is essential for anyone involved in payroll management or tax compliance.

Preparing to fill out Form -1

Before tackling Form C-1, it's vital to gather all necessary information to ensure a seamless completion process. This includes up-to-date employee records, past wage reports, and any documentation related to unemployment tax registration. Organizing this data beforehand helps in minimizing the potential for errors and increases the efficiency of completing the form.

While gathering information, employers may encounter challenges such as outdated records or missing data. To address these issues, having a reliable system for maintaining employee records and ensuring regular updates can significantly streamline the process. Using tools like pdfFiller can simplify these tasks, as it offers comprehensive capabilities for keeping information organized.

Step-by-step instructions for completing Form -1

Filling out Form C-1 can seem daunting, but following these detailed steps can simplify the process. To begin, you will need to access Form C-1 from an appropriate source, preferably through pdfFiller, which makes it easy to download and fill out.

Once you have the form open, your first task is to fill out the personal information section. Be meticulous in entering details such as the employer name, address, and contact information. Accuracy here is critical, as any discrepancies can lead to delays or complications with your submissions.

Editing and signing Form -1

Utilizing pdfFiller, editing your entries on Form C-1 is straightforward. Should you make a mistake, simply access the editing features to adjust or update information as needed. It's advisable to familiarize yourself with the interactive tools available in pdfFiller, which enhances your ability to make necessary modifications quickly.

Once you've completed the form, you'll need to sign it. PdfFiller allows for convenient electronic signatures, which can significantly expedite the submission process. Follow the step-by-step instructions for signing electronically to ensure your submission is finalized.

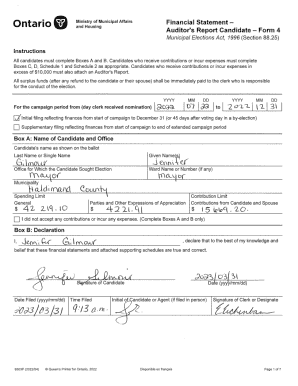

Submitting Form -1

Submitting Form C-1 involves understanding the various guidelines related to submission channels and deadlines. Typically, forms can be submitted electronically via state tax websites or printed and mailed to the relevant government organization. Familiarizing yourself with the submission options available in your area is essential for timely compliance.

Tracking your submission is crucial to ensure that it has been received and is being processed. PdfFiller offers a robust submission tracking feature that can help you keep tabs on your C-1 form. This is particularly useful for maintaining records and ensuring that all filing requirements are met.

Managing Form -1 with pdfFiller

Once you've completed and submitted Form C-1, it's important to manage your documents effectively. PdfFiller provides secure storage solutions, allowing users to keep their forms organized and easily accessible. This means you can quickly retrieve your C-1 reports whenever necessary, without the risk of misplacement.

Furthermore, pdfFiller enables collaboration on Form C-1. If you're working as a team or alongside payroll specialists, you can share the form directly through the platform, facilitating real-time collaboration. This feature is essential for ensuring everyone involved is on the same page and can make necessary updates collaboratively.

Common issues and troubleshooting

While filling out Form C-1, you might encounter several common issues, such as entering incorrect information or misunderstanding certain fields. It's important to recognize these frequent mistakes, as they can lead to delays in processing. A well-structured review process prior to submission is invaluable.

To address such challenges, utilize resources that provide step-by-step guidance like this. In addition, pdfFiller offers excellent customer support, which can assist you in resolving any issues related to Form C-1—whether it’s about technical problems or understanding the specific requirements.

Advanced features of pdfFiller for Form -1

Advanced tools within pdfFiller further streamline the management of Form C-1. Automation features eliminate the burden of repetitive tasks, such as manually inputting common data fields. By setting up templates, users can save time and reduce the likelihood of errors, making compliance a smoother process.

Additionally, pdfFiller can integrate with various platforms, enhancing document management capabilities. This means your Form C-1 and related documents can be seamlessly connected to your payroll systems or financial management tools, creating a more cohesive workflow and ensuring better data accuracy.

FAQs about Form -1

Even with careful preparation, questions often arise regarding the use and submission of Form C-1. Common inquiries include what to do when mistakes are made on the form. In most cases, the best approach is to contact the state tax authority for specific guidance on corrections.

Another frequent question pertains to the ability to save your progress while filling out the form. Certainly, pdfFiller allows users to save drafts and return to them later, making the process flexible. Lastly, many wonder what happens after submission, and typically, you will receive a confirmation either via email or the pdfFiller tracking system to assure you that your form has been received.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form c-1 instructions from Google Drive?

How can I send form c-1 instructions for eSignature?

How do I edit form c-1 instructions on an iOS device?

What is form c-1 instructions?

Who is required to file form c-1 instructions?

How to fill out form c-1 instructions?

What is the purpose of form c-1 instructions?

What information must be reported on form c-1 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.