Get the free Ach Credit Payment Authorization Request

Get, Create, Make and Sign ach credit payment authorization

How to edit ach credit payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach credit payment authorization

How to fill out ach credit payment authorization

Who needs ach credit payment authorization?

Comprehensive Guide to ACH Credit Payment Authorization Forms

Understanding ACH credit payment authorization

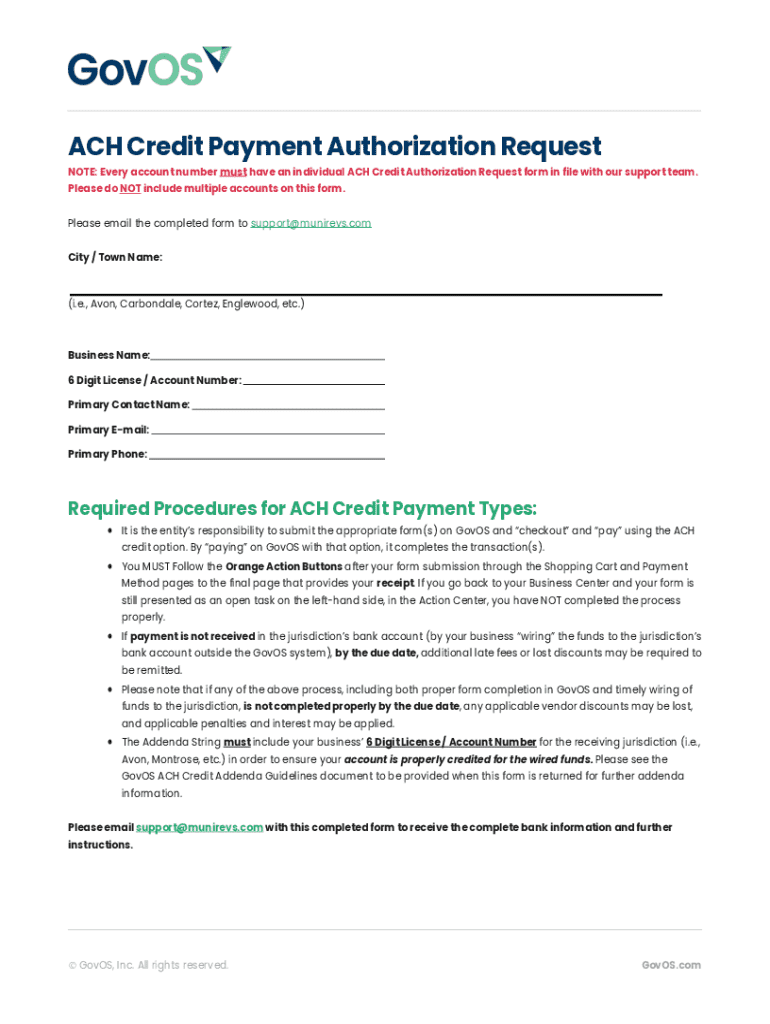

An ACH Credit Payment Authorization Form is a crucial document that enables a payer to authorize a specific entity, usually a payee, to initiate electronic fund transfers from the payer's bank account. This form acts as a formal agreement, ensuring the integrity of the payment process while significantly streamlining transaction management. Unlike an ACH debit authorization, which allows a payee to withdraw funds directly from a payer’s account, an ACH credit authorization empowers the payer to send funds proactively, minimizing potential misunderstandings or disputes.

This type of authorization is especially beneficial for businesses that offer recurring payments or payroll disbursements, enabling them to maintain consistent cash flow while eliminating the time-consuming process of check writing or manual transfers. The importance of using this form lies not just in convenience but also in its legal standing, offering both parties a layer of protection. The signed authorization serves as a binding agreement and can be referenced in the event of discrepancies.

Components of the ACH credit payment authorization form

Filling out the ACH credit payment authorization form accurately is paramount. The essential components include detailed information about the parties involved and the payment specifics. Key information required comprises of the account holder details, where names and addresses are listed; bank information, including the routing number and account number; and payment details, specifying the amount to be transferred, the frequency of payments, and the start date. Collectively, these elements create a comprehensive overview of the transaction or series of transactions authorized.

Optional components of the form can enhance clarity, such as specifying the purpose of the payment and including contact information for further inquiries. However, mistakes can jeopardize transactions. For instance, incorrect account information can result in failed transfers, and missing signatures can invalidate the authorization. Thus, careful attention during form completion is crucial.

How to fill out an ACH credit payment authorization form

Filling out the ACH credit payment authorization form can seem daunting, but following a straightforward guide can simplify the process. Begin by gathering all the necessary details regarding your bank, payment specifics, and recipient information. Ensure that you have accurate routing and account numbers on hand, as this forms the backbone of the authorization process.

Next, complete the account holder section by entering all enclosed fields with precise information. Once that is done, proceed to the payment details section, carefully specifying the amount, frequency, and start date of the payment to avoid any confusion. Before submitting the form, it is prudent to review for any errors or omissions that could impede the transaction process. Double-checking every detail can save time and avoid complications later on.

When managing documents, employ best practices such as securely saving and sharing forms, particularly due to the sensitive information they contain. Utilize cloud storage solutions to keep your documents organized and easily retrievable, allowing for streamlined access when needed. Document retention is just as critical; keeping a detailed log of all authorizations aids in monitoring payments and fostering transparency in financial arrangements.

Options for creating your ACH credit payment authorization form

Creating an ACH credit payment authorization form can be accomplished in a few ways. Customizing a template offers convenience; for example, pdfFiller provides user-friendly templates that simplify the process. These templates are designed for ease of access, allowing for quick edits and ensuring that no critical components are overlooked.

Alternatively, if you prefer building a form from scratch, ensure you include all key components as outlined earlier. Utilize tools available on pdfFiller to enhance form creation; the platform enables users to design tailored forms that suit their unique requirements. With the correct combination of features, creating an effective, compliant ACH credit payment authorization form can be an efficient process.

Managing your ACH credit payment authorizations

Proper management of ACH credit payment authorizations is vital for ongoing financial operations. Secure storage of signed forms in the cloud is essential, as this minimizes the risk of loss or unauthorized access to sensitive information. Organizing payments for easy access and tracking aids in maintaining clarity and accountability, particularly for businesses handling multiple transactions.

If modifications are necessary, understanding how to amend existing authorizations is critical. Notify all involved parties to ensure transparency in payment processes. The ability to update or cancel authorizations when situations change will prevent financial errors and retain trust among stakeholders.

Frequently asked questions (FAQs) about ACH credit payments

Common queries surrounding ACH credit payments often include concerns about the revocability of authorizations. In general, ACH credit authorizations can be revoked by the payer, but this usually requires formal notification to the payee and may involve submitting a cancellation or amendment form. Additionally, individuals may wonder how long an ACH credit authorization remains valid; terms can vary, but typically, the authorization remains in effect until revoked or until a specified end date has passed.

Troubleshooting issues, such as payment failures, is another vital aspect to address. If payments fail, review the authorization details for inaccuracies, and coordinate with the financial institution to resolve the problem. In the event that a payer needs to cancel an ACH credit authorization, following the proper procedures outlined in the initial form is essential to ensure compliance and efficiency.

Leveraging pdfFiller for seamless document management

Employing pdfFiller for managing ACH credit payment forms introduces several advantages. The platform allows for seamless eSigning and collaboration in real-time, empowering users to obtain quick approvals and move forward with transactions without delay. Furthermore, with cloud storage capabilities, accessing documents from anywhere ensures that users can manage and share critical forms from any location.

Developing team strategies for document creation fosters collaboration among users. Teams can utilize pdfFiller's tools to draft, edit, and finalize documents collectively, providing a conducive environment for feedback and revision. By establishing effective workflows for document management, teams can enhance productivity and ensure that every detail is attended to, reducing the likelihood of errors and omissions in the form-filling process.

The future of ACH payments

The landscape of electronic payments is continually evolving, with ACH transactions gaining wider acceptance. As businesses and individuals recognize the benefits of electronic payments, the demand for ACH payment methods is likely to increase. Technological advancements are impacting how payment authorizations are processed, particularly in terms of security and efficiency. The integration of machine learning and AI into payment systems also presents new opportunities to enhance transaction processing and fraud detection.

Preparing for these changes means staying informed about regulatory developments that may impact the ACH transaction process. Businesses should remain proactive by updating their authorization processes to embrace the latest tools and technologies available. In adapting to these transformations, companies will not only maintain compliance but also improve the overall user experience for both payers and payees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ach credit payment authorization from Google Drive?

How can I send ach credit payment authorization for eSignature?

Can I create an electronic signature for the ach credit payment authorization in Chrome?

What is ach credit payment authorization?

Who is required to file ach credit payment authorization?

How to fill out ach credit payment authorization?

What is the purpose of ach credit payment authorization?

What information must be reported on ach credit payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.