Get the free Investment Policy

Get, Create, Make and Sign investment policy

How to edit investment policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investment policy

How to fill out investment policy

Who needs investment policy?

Investment Policy Form: A Comprehensive Guide for Investors

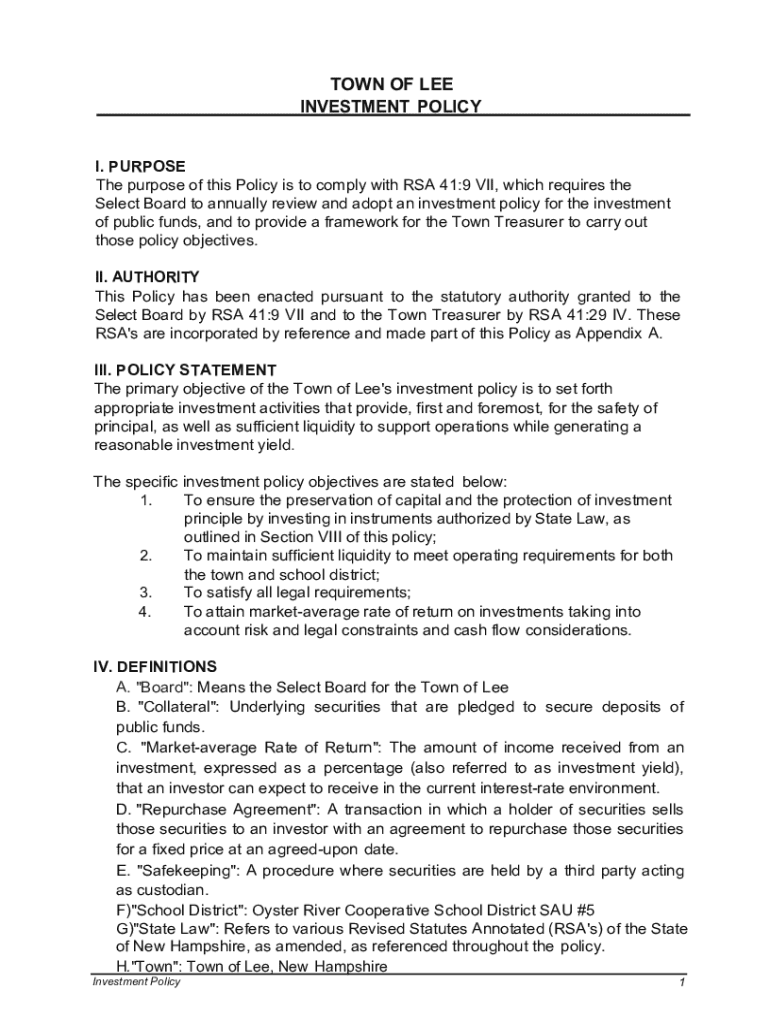

Understanding the Investment Policy Form

An Investment Policy Form (IPF) is a crucial document that outlines an investor's approach and strategy for managing assets. Whether for individuals or organizations, an IPF helps ensure that investment decisions align with financial goals and risk tolerance. It clearly defines how investments will be handled, offering a structured framework to guide financial practices.

The importance of an Investment Policy Form cannot be overstated. It serves as a roadmap for investors, dictating how to respond in various market conditions while standardizing processes that can prevent impulsive decisions. Additionally, a well-constructed IPF provides a formalized means to communicate strategy with financial advisors and stakeholders.

The benefits of having an Investment Policy Form

One of the key benefits of having an Investment Policy Form is the clarity and direction it provides in investment strategies. By laying out distinct investment goals and analytical benchmarks, investors can measure success and make informed decisions without exceeding risk parameters. This promotes discipline and consistency in portfolio management.

Moreover, the IPF facilitates better communication between investors and financial advisors, ensuring that everyone is on the same page regarding expectations and strategies. This collaboration is particularly beneficial during market fluctuations, where emotional decision-making can often lead to undesirable outcomes. With a documented strategy, investors are more likely to stick to their plan and maintain a level-headed approach.

Essential components of an Investment Policy Form

A well-rounded Investment Policy Form contains several essential components that define how an investment portfolio will be managed. Each element should be carefully considered to create a concrete framework for decision-making.

Step-by-step guide to filling out the Investment Policy Form

Filling out the Investment Policy Form is a systematic process that involves several steps, each requiring careful consideration. This guide will help investors efficiently complete their IPF, ensuring all necessary information is recorded.

Tips for successfully utilizing the Investment Policy Form

A well-constructed Investment Policy Form is not static; it requires regular updates to remain relevant as circumstances and goals change. This flexibility will ensure that the document continues to serve its intended purpose effectively.

Furthermore, collaborating with financial advisors can provide critical insights, especially in volatile markets. These experts can help navigate complex decisions and suggest appropriate adjustments. Another way to facilitate this is by utilizing pdfFiller’s interactive tools, which streamline document management to ensure that your IPF remains accessible and up to date.

Common mistakes to avoid when filling out an Investment Policy Form

Filling out an Investment Policy Form is a responsibility that demands attention to detail. One common mistake is underestimating the significance of detailed guidelines. Vague guidelines can lead to confusion and misalignment in investment strategies.

Additionally, a lack of clarity in investment goals can derail an otherwise reliable investment policy. Investors should take the time to articulate their goals clearly and ensure that all stakeholders understand them. Finally, failing to communicate the policy with relevant stakeholders can lead to discrepancies in execution, compromising the effectiveness of the IPF.

Real-world examples of effective Investment Policy Forms

Various organizations and individuals have successfully implemented Investment Policy Forms that align their investments with their overarching goals. For example, a non-profit dedicated to education could employ an IPF that restricts investments to socially responsible funds, ensuring that financial growth supports their mission.

Case studies demonstrate that well-structured Investment Policy Forms can lead to sound investment strategies, ultimately yielding higher returns while minimizing risks. Testimonials from individuals who have benefited from using an IPF consistently highlight improved decision-making processes and better alignment between investment portfolios and financial objectives.

FAQs about Investment Policy Forms

Addressing questions and misconceptions surrounding the Investment Policy Form can enhance understanding and utilization. One commonly asked question is how the IPF differs from an Investment Policy Statement (IPS). While both serve similar functions, the IPF is primarily about formulating investment strategies, whereas the IPS provides preset guidelines for operational investment decisions.

Another question pertains to the applicability of the IPF. Individuals often wonder if they can use an IPF for personal investing, and the answer is yes; it's suitable for personal and institutional use. Regarding revisions, it is advisable to review and update your Investment Policy Form at least annually or whenever there are significant changes in financial circumstances.

Tools and resources for managing your Investment Policy Form

To facilitate the effective management of your Investment Policy Form, pdfFiller offers robust capabilities that simplify the creation and modification of such documents. The platform allows users to edit PDFs directly, ensuring that any updates can be made quickly and efficiently.

In addition, pdfFiller supports eSigning and collaboration features which enable teams to work together seamlessly. This is particularly useful for organizations that require multiple stakeholders to contribute to or approve the IPF, ensuring everyone is aligned in their investment strategies.

Next steps after creating your Investment Policy Form

Once your Investment Policy Form is created, the next step involves its implementation into your investment practice. This means taking the strategies defined in the IPF and putting them into action when making investment decisions.

Additionally, engage with financial advisors and stakeholders to discuss the specifics laid out in your IPF. This dialogue can ensure that everyone is on board and can address any questions or concerns regarding investment practices. Ongoing education and training options should also be considered, as the investment landscape is always evolving and refining strategies is key to ongoing success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my investment policy in Gmail?

How do I edit investment policy in Chrome?

Can I create an electronic signature for the investment policy in Chrome?

What is investment policy?

Who is required to file investment policy?

How to fill out investment policy?

What is the purpose of investment policy?

What information must be reported on investment policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.