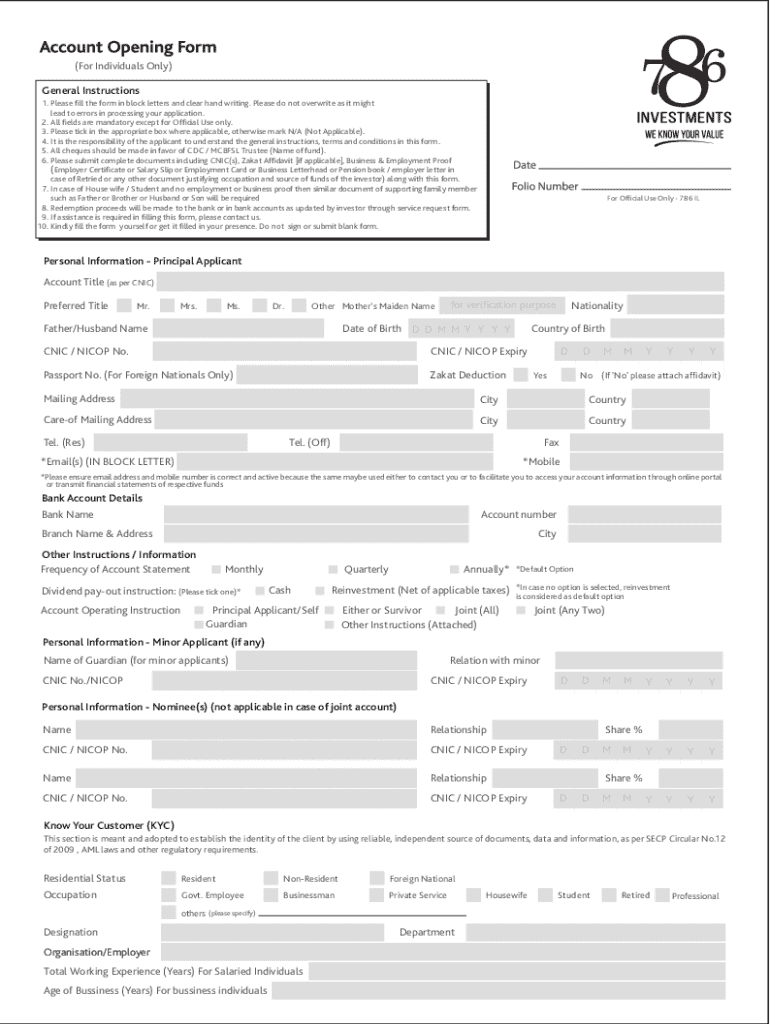

Get the free Account Opening Form (For Individual).ai

Get, Create, Make and Sign account opening form for

Editing account opening form for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account opening form for

How to fill out account opening form for

Who needs account opening form for?

Comprehensive Guide to Account Opening Forms

Overview of account opening forms

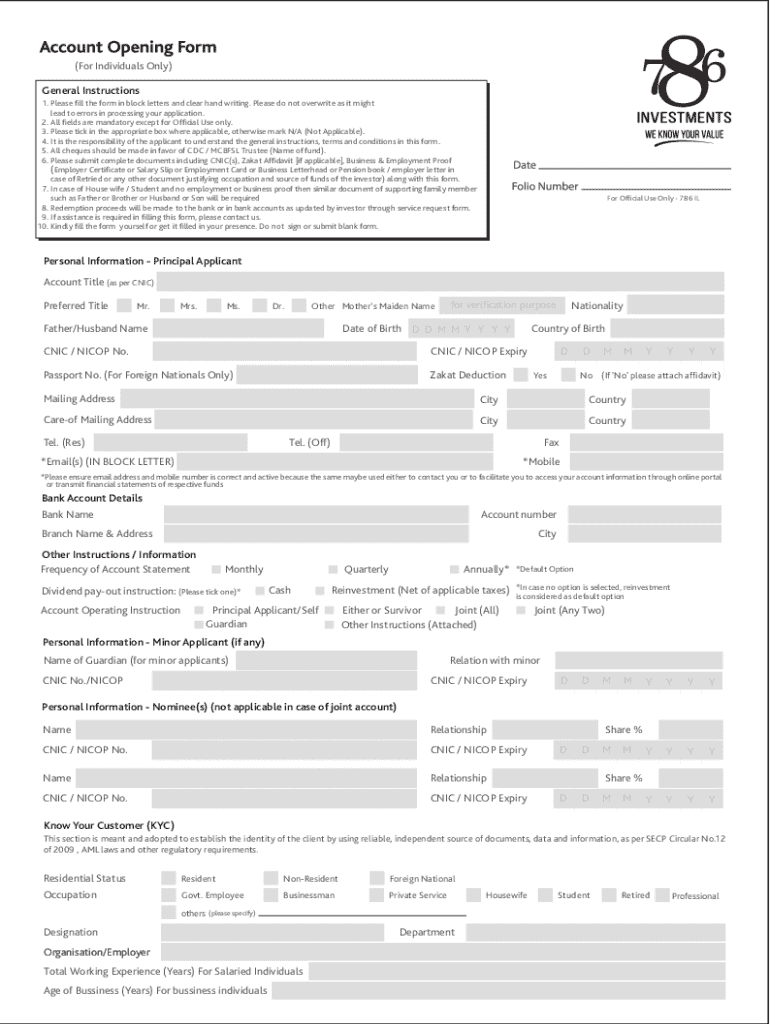

An account opening form is a critical document that individuals or businesses must complete to establish a financial relationship with a bank or financial institution. This form is foundational for opening various accounts such as savings, checking, business, or investment accounts.

Completing an account opening form accurately is vital. Any errors or omissions can delay account setup or even result in denial. A well-filled form ensures that the bank has all the necessary information for compliance with regulatory standards, such as anti-money laundering (AML) regulations.

Preparing to fill out an account opening form

Before commencing to fill out the form, it is crucial to gather all essential information. Personal identification information such as your name, address, and date of birth is the first step. Ensuring that this data is accurate will set a solid foundation for your application.

Financial information, including income details and any existing accounts, also plays a key role. Most forms will require you to disclose source of funds, annual income, and employment status. Additionally, having the necessary documentation ready improves efficiency. You may need proof of identity, like a passport or driver's license, and a utility bill for address verification.

It is essential to understand the purpose and requirements of your chosen account. Different banking institutions may have unique forms and requirements based on account type. For instance, a business account opening form may necessitate tax identification numbers and articles of incorporation when compared to a personal account.

Step-by-step guide to completing an account opening form

The process begins with choosing the right form. It is crucial to select the accounting opening form that aligns with your intended use, whether personal, business, or joint. Links to various account opening forms can generally be found on the selected bank's website. A proactive approach will save you time and ensure the correct processing of your application.

Filling out personal information accurately is paramount. Make sure to double-check details like spelling and numerical accuracy. Incorrect details can cause significant delays. Next, when providing financial information, clarity is key. Present your financial data in a straightforward manner, explicitly stating your income sources and existing assets.

After completing the form, review and edit your entries meticulously. Errors such as missing information can have real consequences, like delayed funding or denial of access. Utilizing tools like pdfFiller can help with easy editing and allow for seamless corrections.

Once everything checks out, you can sign the form electronically. Digital signatures streamline the process, enhancing both convenience and security.

Interactive tools for account opening forms

Utilizing interactive tools can significantly enhance the account opening experience. pdfFiller’s features offer auto-fill capabilities that not only save you time but also reduce the likelihood of errors, allowing you to focus on accurately entering your unique information.

For teams looking to open joint accounts, pdfFiller accommodates real-time collaboration options. Multiple users can share documents instantly, ensuring that they work together efficiently, regardless of location.

Submitting your account opening form

After ensuring that your account opening form is accurate and complete, the next step is submission. Various methods exist for this, starting with online submission through your chosen financial institution's website. This method is often the quickest and most secure way to submit your form.

If online submission isn't possible, options to send the form safely via email or print and mail it are also available. Ensure that you follow the bank’s specified submission protocols to protect your sensitive information.

Once submitted, the verification process begins. Typically, you can expect a response from the bank within a few days. Keeping track of your submission will help you follow up if necessary.

Common mistakes to avoid when filling out an account opening form

While filling out an account opening form, certain mistakes are common but avoidable. One frequent error is missing critical information. Each field is designed for a reason, and neglecting to fill in any part can complicate or invalidate your application.

Another issue arises from inconsistent details across documents. If your name or address is written differently on your ID compared to the form, it may raise flags during verification. Best practices for accuracy and compliance include cross-referencing your documents and response format with the submitting bank's guidelines.

FAQs about account opening forms

One common worry is what to do if you realize you made a mistake after submitting your form. Traditionally, you should contact customer service for guidance. Some banks offer a grace period where modifications can be made post-submission.

Mobile devices are a convenient tool for filling out and signing account opening forms. Most banking apps or mobile websites support this function, allowing flexibility for users.

When it comes to processing times, this can vary by institution. While many banks aim for a quick turnaround, others may take longer based on their internal procedures.

Special considerations for unique situations

Opening an account as a non-resident requires specific forms and documentation, such as visas or local where necessary. Researching the particular requirements of the chosen financial institution will streamline this process.

In cases involving minors or individuals unable to manage accounts due to incompetency, banks typically require custodians or legal guardians to fill out the application and provide additional documentation to prove guardianship.

For accounts established through trusts or partnerships, additional documentation, like trust agreements or partnership agreements, will be required. Each bank provides different requirements for these complex situations.

Leveraging pdfFiller for efficient document management

pdfFiller acts as a comprehensive solution for managing all your document needs related to account opening forms. Users benefit from secure emailing, efficient storage, and management of documents all enclosed in a cloud-based platform. This flexibility ensures your forms can be accessed from anywhere, enhancing your ability to respond to banks in real time.

The benefits include not just convenience but also efficient collaboration among teams opening joint accounts. Being able to store documents securely while offering edit access enhances the user experience significantly.

Conclusion: Unlocking opportunities with account opening forms

In conclusion, the account opening form is not just a bureaucratic hurdle but an essential component that unlocks opportunities for banking services and financial management. Accurate and timely submission streamlines this process, allowing for quicker access to funds, investments, and other banking benefits.

With tools like pdfFiller, the process of filling out, editing, and managing these forms becomes much more straightforward. Whether you're an individual, a team, or a business, understanding how to navigate account opening forms effectively is crucial for establishing a fruitful relationship with financial institutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my account opening form for in Gmail?

How do I execute account opening form for online?

How do I edit account opening form for online?

What is account opening form for?

Who is required to file account opening form for?

How to fill out account opening form for?

What is the purpose of account opening form for?

What information must be reported on account opening form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.