Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding Form 10-Q

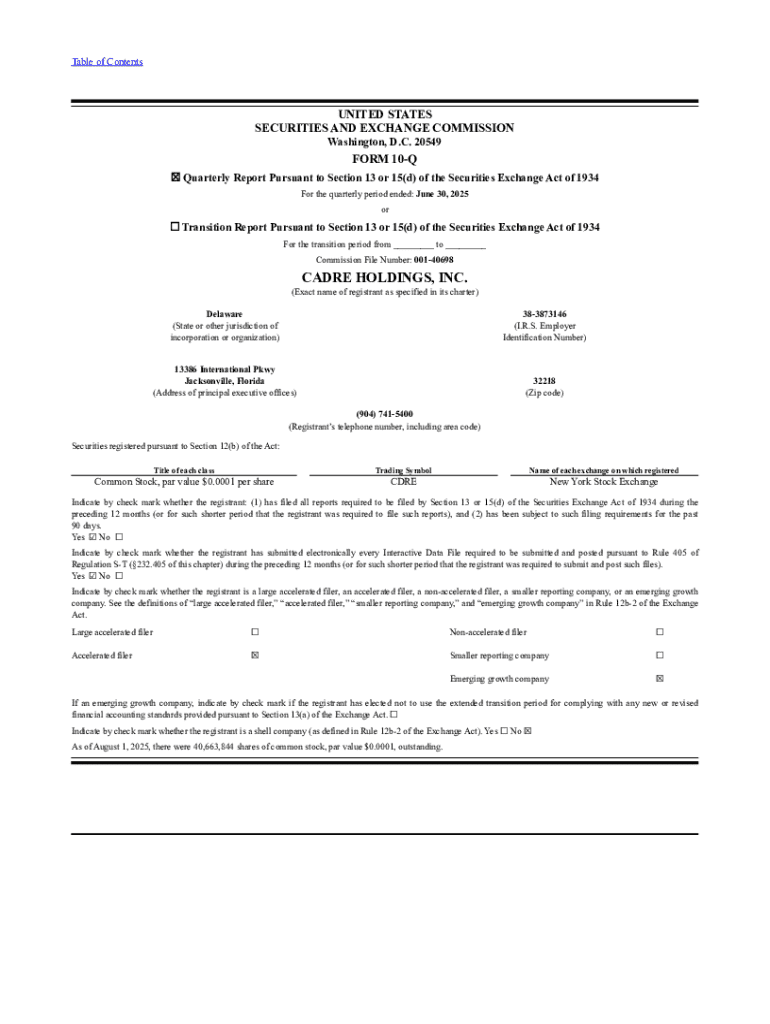

Form 10-Q is a crucial document for public companies in the United States, as mandated by the Securities and Exchange Commission (SEC). It serves as a quarterly financial report that provides detailed insights into a company’s performance, operations, and financial standing. For stakeholders, including investors, analysts, and regulatory agencies, Form 10-Q is significant because it offers a continuous flow of information, enabling informed decision-making throughout the fiscal year.

The importance of quarterly reports cannot be overstated. They allow stakeholders to gauge the ongoing health and profitability of a company—often influencing investment strategies and market perceptions. Furthermore, timely disclosures through Form 10-Q help ensure transparency, which is essential in fostering trust between companies and their stakeholders.

Regulatory requirements

Under SEC regulations, companies must file Form 10-Q within 40 days of the end of each fiscal quarter. However, for companies deemed large accelerated filers, the deadline is reduced to just 35 days. This stringent timeline is designed to ensure that the market has access to current information about companies’ financial health and operational results, thus promoting fairness and efficiency in securities markets.

Failure to file Form 10-Q on time can result in penalties, including fines or other regulatory actions. Such repercussions emphasize the need for companies to be diligent about their reporting processes, ensuring that they adhere to SEC timelines and requirements.

Structure of Form 10-Q

Form 10-Q is structured to provide a comprehensive overview of a company’s financial condition and business operations. The completed form includes several critical components that contribute to a full understanding of the company's quarterly performance. It's imperative for preparers to be aware of these elements while completing the form.

Completing the Form 10-Q

Completing Form 10-Q requires thorough preparation and a keen understanding of the necessary financial data and documentation. Each section of the form must be filled out carefully to ensure compliance with regulatory standards, as inaccuracies can lead to penalties or misinterpretation of the company's financial status.

To begin, gather the financial information compiled over the quarter. This includes updated balance sheets, income statements, and any relevant management reports. It is also the time to consult with equity research professionals to get fresh perspectives and insights on performance metrics and market conditions.

Detailed instructions for each section

1. **Management’s Discussion and Analysis**: Articulate the narrative behind the numbers. Describe operational changes, financial results, and strategic decisions made during the quarter.

2. **Financial Statements**: Present accurate data reflecting your current financial state. Ensure all figures are reviewed and confirmed by a qualified accountant to avoid common pitfalls.

3. **Notes to Financial Statements**: Provide transparent explanations that can help clarify the significance of the numbers presented in your financial statements.

4. **Risk Factors**: Clearly articulate any emerging risks that could impact future performance. This section should not be taken lightly, as it helps set stakeholder expectations.

5. **Internal Controls Over Financial Reporting**: Summarize the effectiveness of your internal controls to assure stakeholders that financial reporting is accurate and reliable.

Filing Form 10-Q

The process for filing Form 10-Q has shifted to a digital format through the SEC’s EDGAR system, which allows for electronic filing. Companies must ensure they register with the SEC and have their documents prepared according to specific formatting guidelines provided by the SEC to facilitate smooth submission.

It is essential to verify all filings before submission, as common errors can compromise the integrity of the document. Among frequent filing mistakes are incorrect data entries, failure to meet deadlines, and inadequate disclosures. Companies should establish a comprehensive checklist that covers key areas to review and confirm before hitting submit.

Important timelines

Timelines play a pivotal role in ensuring that Form 10-Q filings are timely and in compliance with SEC regulations. Companies must adhere to specific filing deadlines following the close of each fiscal quarter—within 40 days for most companies, and within 35 days for large accelerated filers. Being aware of these deadlines is essential for maintaining good standing with the SEC.

Failure to submit Form 10-Q on time can lead to various consequences, including financial penalties and potential issues with regulatory compliance. Additionally, delay in reporting can erode investor trust and negatively impact stock prices. Therefore, establishing a clear timeline and workflow process for completion and filing is critical.

Best practices for managing Form 10-Q

Efficient management of Form 10-Q filings is vital for public companies, and utilizing collaborative tools can significantly streamline the process. pdfFiller is an excellent solution for individuals and teams looking to synthesize document creation, editing, and digital signing into a single cloud-based platform.

With pdfFiller, companies can easily track revisions, facilitate real-time collaboration among stakeholders, and ensure that they possess the latest information needed to complete Form 10-Q accurately. Additionally, using cloud-based storage systems can enhance accessibility and organization, allowing teams to retrieve necessary records quickly when required.

Navigating Form 10-Q challenges

Companies often encounter challenges in completing Form 10-Q due to the complexity of regulations, gathering accurate financial information, and coordinating among team members. The intricate nature of the financial data and the necessity to comply with SEC standards can further complicate the reporting process.

To alleviate these challenges, companies can adopt various tools and solutions geared toward simplifying preparation processes. For example, employing financial software that integrates with reporting standards can help streamline data collection, while regular training sessions can ensure that teams are familiar with updated regulations.

Case studies and examples

Analyzing real-world examples of effective Form 10-Q filings can provide insights into best practices that can be emulated by other companies. These case studies highlight successful strategies companies have employed that resulted in transparent and impactful reporting, improving stakeholder confidence.

Conversely, learning from mistakes can also yield valuable lessons. Notable missteps in Form 10-Q submissions, such as failure to disclose significant risk factors or inaccuracies in financial statements, have led to severe repercussions and loss of trust among investors. By dissecting such cases, companies can develop robust systems to avoid similar pitfalls.

Additional insights

The landscape of corporate reporting is constantly evolving, and Form 10-Q reflects this dynamic. Changes in economic conditions and corporate strategies often lead to adjustments in how companies represent their operations and performance. Stakeholders should remain vigilant and aware of any shifts in reporting trends to maintain a comprehensive understanding of the market.

Looking ahead, discussions among experts hint at potential changes in the requirements for Form 10-Q. As regulatory frameworks adapt to address emerging issues such as digital transformation and sustainability, companies will need to stay proactive in aligning their reporting practices with evolving expectations. This adaptability is critical in fostering continued trust and transparency in corporate finance.

Interactive tools

To further assist companies and individuals in navigating the complexities of Form 10-Q, interactive tools can enhance learning and application. A fillable template for Form 10-Q can provide users with a practical platform to practice completing their filings. This hands-on approach helps bolster familiarity and confidence in the process.

Moreover, including an FAQ section can address common inquiries regarding Form 10-Q, clarifying complex topics and providing additional insight. This way, stakeholders can feel more empowered to engage with the document responsibly and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-q for eSignature?

How do I edit form 10-q on an iOS device?

How do I complete form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.