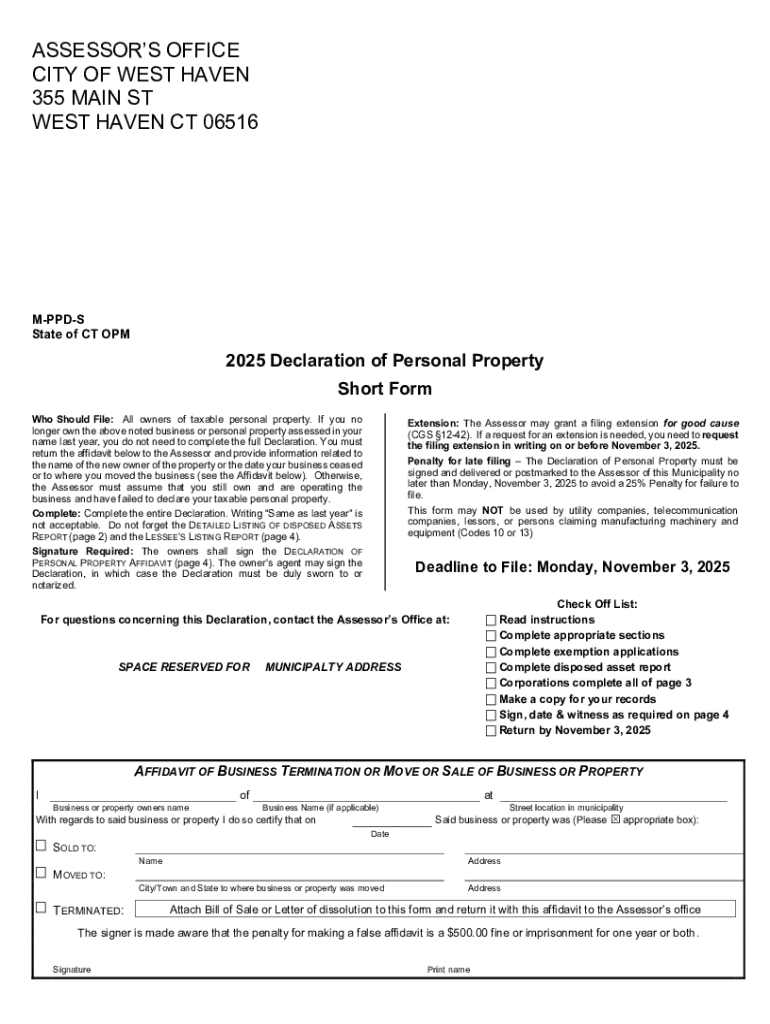

Get the free 2025 Declaration of Personal Property

Get, Create, Make and Sign 2025 declaration of personal

How to edit 2025 declaration of personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 declaration of personal

How to fill out 2025 declaration of personal

Who needs 2025 declaration of personal?

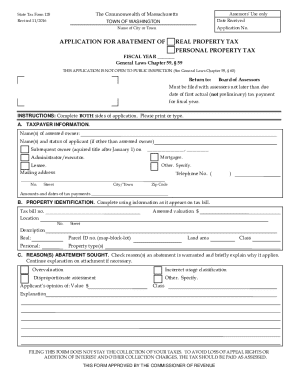

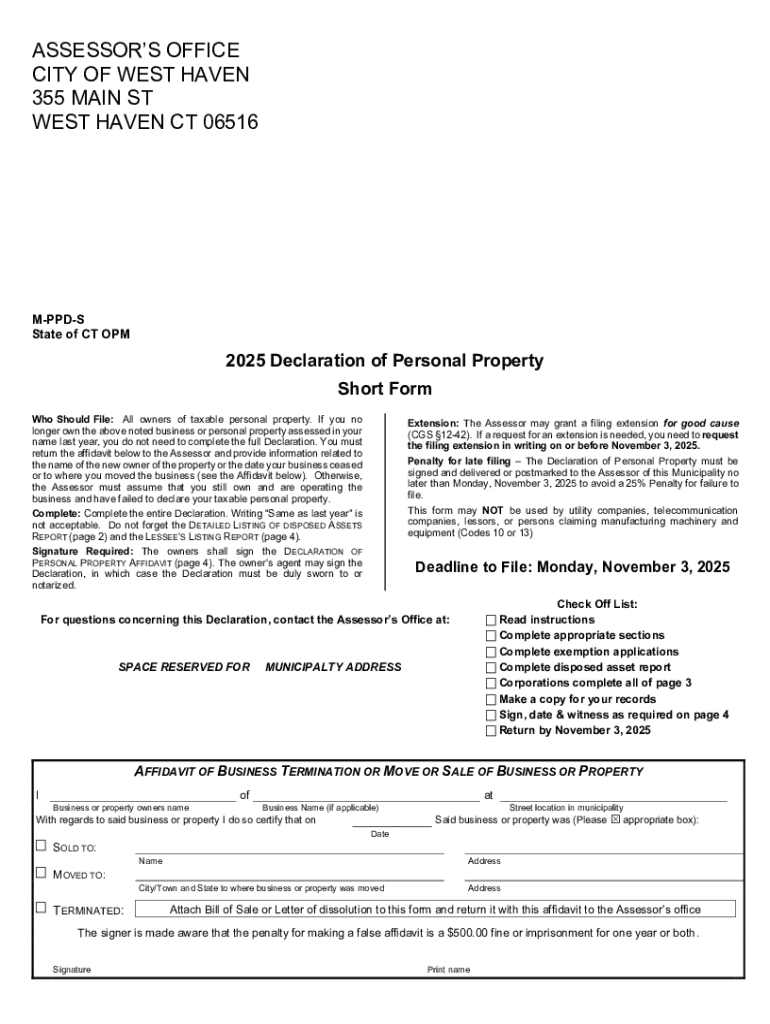

Understanding the 2025 Declaration of Personal Form

Understanding the 2025 declaration of personal form

The 2025 Declaration of Personal Form is a critical document that reflects an individual’s or organization’s personal, financial, and professional circumstances as of the year 2025. The significance of this declaration cannot be overstated, as it plays a pivotal role in various applications, ranging from banking to legal proceedings. In 2025, the importance of this declaration is heightened due to updated regulations and compliance requirements that require transparency and accuracy in representation.

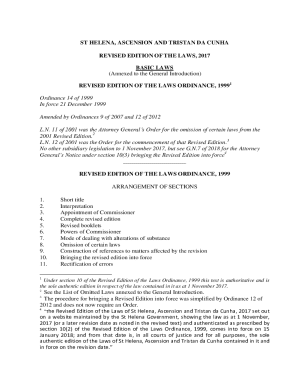

The updates from previous years primarily focus on enhancing data security and simplifying the submission process. These changes were prompted by the growing complexities of financial transactions and the need for governments and organizations to maintain accurate records. Key changes include more robust verification methods and additional sections that address specific compliance issues pertinent to the year.

Who needs to complete the 2025 declaration?

In 2025, a wide range of individuals and teams are required to complete the 2025 Declaration of Personal Form. For individuals, anyone applying for loans, grants, or government assistance must accurately report their personal circumstances. This requirement impacts individuals such as students applying for educational funding, homeowners seeking refinancing options, or even those looking to establish small businesses.

For teams and organizations, compliance is equally critical. Businesses must fill out the declaration to ensure their operations abide by local or national laws. Factors that necessitate completion for organizations include changes in ownership, restructuring of teams, and updates in property holdings. Companies must ensure that they understand the specific requirements relevant to their sector, as various regulations may apply.

Key components of the 2025 declaration of personal form

The 2025 Declaration of Personal Form consists of several key components, each designed to capture essential information thoroughly and accurately. The breakdown of the form’s sections includes personal information, financial data, and employment and educational background. Each section is crucial for ensuring that the declaration reflects the true circumstances of the individual or organization.

In the personal information section, you'll be required to provide basic identifying details, including your full name, address, and contact information. The financial information segment demands disclosure of your assets—particularly your property and other valuables—as well as any outstanding debts. Lastly, the employment and education background section calls for details about your current job, past employment, and educational qualifications.

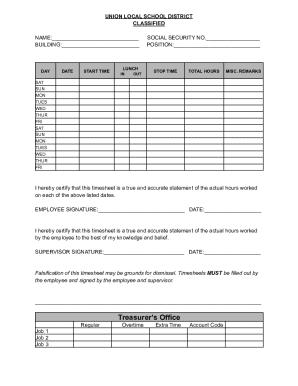

Step-by-step guide: Filling out the 2025 declaration of personal form

Preparing to fill out your 2025 Declaration of Personal Form involves several preliminary steps. Start by gathering all necessary materials, including your identification, financial statements, and any relevant documentation concerning your employment and education. It’s prudent to familiarize yourself with the form’s layout as well as any instructions provided.

When addressing the personal information section, ensure all entries are accurate and up-to-date. This includes verifying spellings and addresses. For the financial information segment, be aware of common pitfalls such as underreporting debts or failing to disclose property accurately, both of which could lead to complications later on. Lastly, when detailing your employment and education history, aim for completeness—don’t skip over relevant jobs or qualifications.

Once you complete the form, clear and precise communication is vital. Make sure to review and revise your entries before finalizing them to avoid misunderstandings about your financial status or professional background.

Editing and reviewing your 2025 declaration of personal form

The importance of proofreading your 2025 Declaration of Personal Form cannot be underestimated. Common errors can lead to rejection, delays, or even legal issues. Common mistakes include incorrect personal information, math errors in financial sections, and missing required documentation. To mitigate these risks, take the time to review each section methodically, ensuring all answers are consistent and complete.

pdfFiller's editing tools can greatly assist in this process. Utilize these features to highlight concerns, add notes, or make corrections directly on your electronic form. This ensures clarity and precision, enabling you to submit the most accurate version of your declaration.

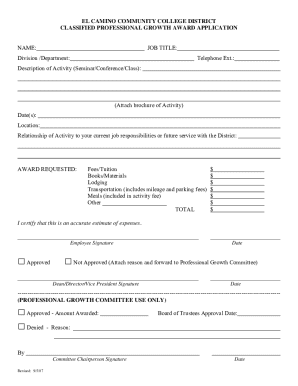

Signing the 2025 declaration of personal form

Signing your 2025 Declaration of Personal Form is the final step before submission, and with the advent of technology, electronic signatures are now widely accepted. The process of eSigning is straightforward: once you’ve completed the form, you can use various digital tools to sign it securely.

In 2025, eSignatures hold full legal validity, aligning with laws that recognize electronic agreements. This eliminates the need for physical signatures and allows for faster processing times. When completing your eSignature, ensure that your signature is clear and matches your identification to avoid complications.

Submitting your 2025 declaration of personal form

The methods for submitting your 2025 Declaration of Personal Form are designated to be convenient and efficient. Online submission is the preferred method due to its ease and speed. Ensure you follow the online guidelines precisely, uploading any required documents alongside your form.

If opting for physical mailing, confirm the correct address for submission and take precautions to ensure secure sending — consider tracking your mail for peace of mind. After submission, it's advisable to follow up to confirm that your form has been received successfully and to inquire about any next steps in the process.

Managing your 2025 declaration of personal form after submission

After submitting the 2025 Declaration of Personal Form, managing your document effectively is vital. Tracking the status of your submission helps ensure that all necessary steps are being executed and allows you to address any issues that arise promptly. Keeping a record of your form, including copies of all submissions and confirmations, is crucial for your records.

If you find that you need to make amendments after submission, understanding the process for amendment requests is essential. Typically, this requires submitting a formal request along with any supporting documentation. Ensuring your records are secured is equally important; utilize cloud storage solutions to keep copies of your completed forms safe.

Common FAQs about the 2025 declaration of personal form

Many people have typical concerns regarding the 2025 Declaration of Personal Form. Common questions include: What happens if I make an error on my form? Generally, you can submit a request for amendment if you realize a mistake after submission. Another common query pertains to documentation: What if I can’t provide proof of income? If you have trouble offering certain documents, note that there usually are alternates accepted, like recent bank statements.

Furthermore, individuals often express concern about the timeframe for processing their forms. While this can vary, maintaining contact with the authority handling your submission can provide clarity on your status and next steps, alleviating some of these worries.

pdfFiller: Your go-to solution for document management

pdfFiller stands out as a comprehensive solution for document management, including the 2025 Declaration of Personal Form. With features that allow for seamless editing of PDFs, users can easily navigate through the complexities of form completion. The cloud-based platform ensures that documents are accessible from anywhere, making collaboration with teams efficient and straightforward.

Users have reported significant improvements in their document processes thanks to pdfFiller. Success stories highlight how individuals have benefited from the platform’s flexibility in document management during crucial financial decisions, including property sales or seeking loans. The collaborative tools enable teams to work together on documents in real-time, a feature that proves invaluable in complex compliance scenarios.

Engaging with the pdfFiller community

Engagement with the pdfFiller community provides users with additional support and resources. Connecting with other users can facilitate sharing tips and best practices, enhancing your experience with document management. Participating in forums fosters a collaborative environment where feedback can drive improvements and updates.

Staying informed on updates and changes regarding the 2025 Declaration of Personal Form is crucial. Regularly visiting the pdfFiller website ensures that users remain up-to-date on legal compliance and the latest tool releases that can streamline document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025 declaration of personal online?

How do I make edits in 2025 declaration of personal without leaving Chrome?

Can I create an electronic signature for signing my 2025 declaration of personal in Gmail?

What is declaration of personal?

Who is required to file declaration of personal?

How to fill out declaration of personal?

What is the purpose of declaration of personal?

What information must be reported on declaration of personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.