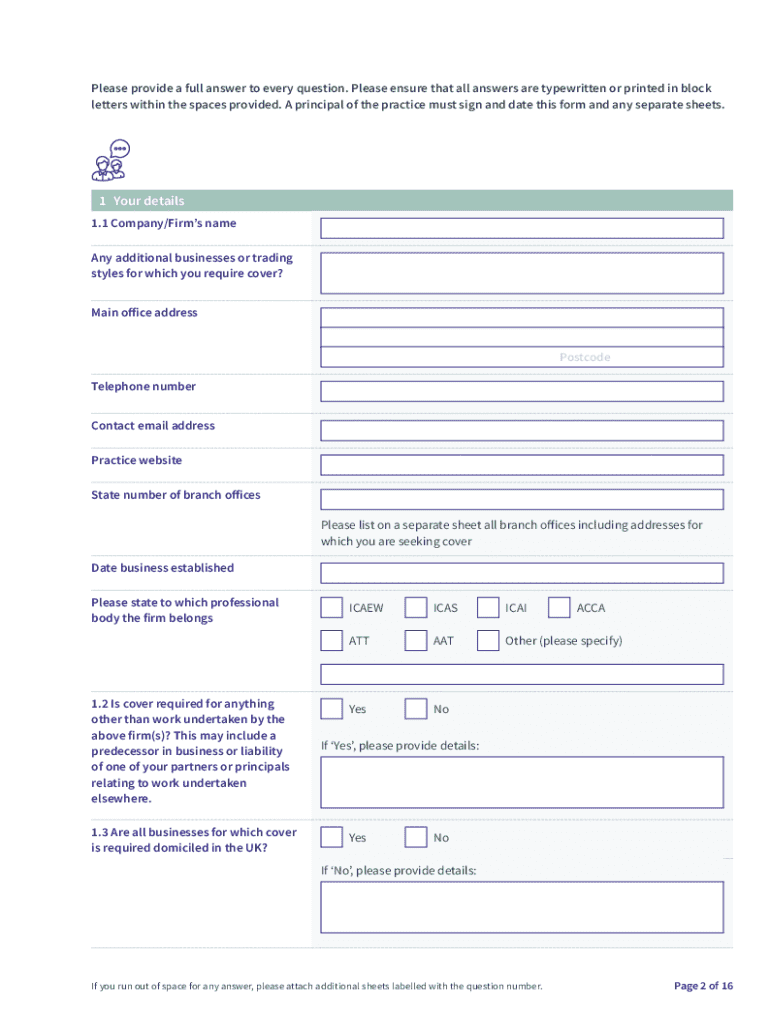

Get the free Professional Indemnity Proposal Form (accountants)

Get, Create, Make and Sign professional indemnity proposal form

Editing professional indemnity proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out professional indemnity proposal form

How to fill out professional indemnity proposal form

Who needs professional indemnity proposal form?

Professional Indemnity Proposal Form: Your Comprehensive Guide

Understanding professional indemnity insurance

Professional indemnity insurance is a vital coverage for individuals and organizations that offer professional services. It safeguards against claims of negligence, errors, omissions, or malpractice that might arise from your professional conduct. The coverage protects both your financial interests and your professional reputation, which is invaluable in today’s competitive environment.

This type of insurance is indispensable for professions such as doctors, lawyers, consultants, and IT professionals, where the risk of providing faulty advice or making errors can lead to significant financial losses for clients. By securing a professional indemnity insurance policy, you not only shield your assets but also give your clients peace of mind, knowing they are protected from potential mishaps.

The role of the proposal form

The professional indemnity proposal form serves as a vital tool when applying for insurance coverage. It provides insurers with detailed insights into your professional background, the nature of services offered, and your claims history, forming the basis for determining whether coverage can be provided and at what cost.

Unlike generic insurance applications, the proposal form specifically addresses the unique risks associated with your profession. Filling it out correctly is crucial to ensure you obtain the right coverage and avoid pitfalls that may arise from incomplete or inaccurate information.

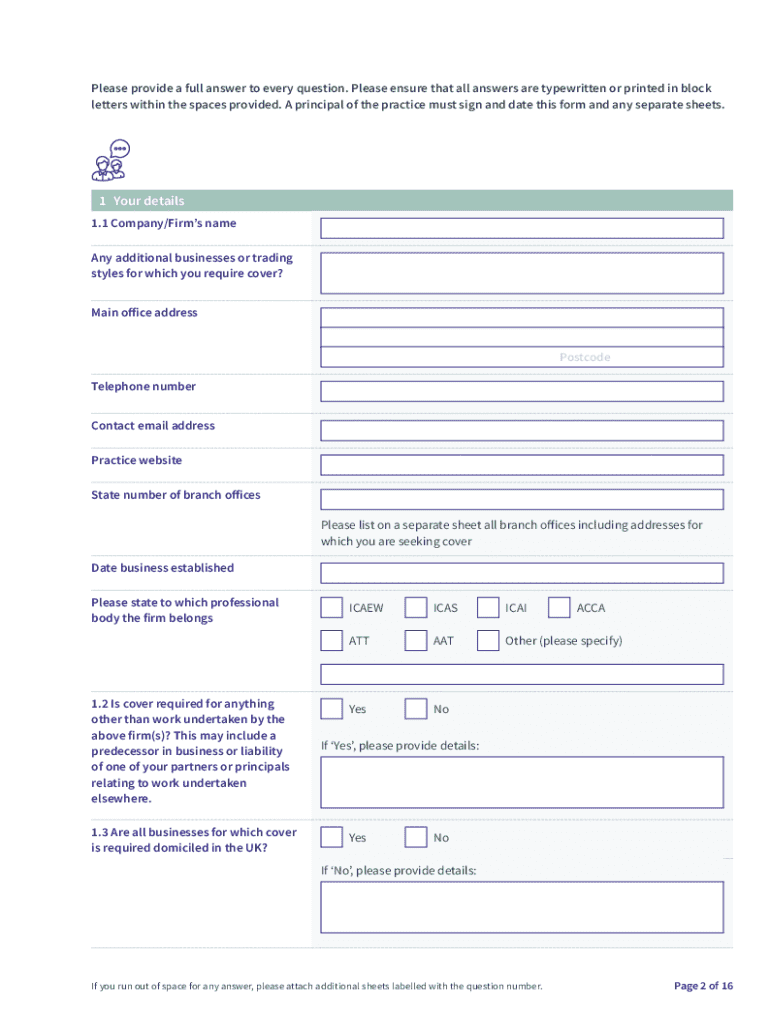

Key information required

Completing the professional indemnity proposal form requires a variety of detailed information that helps insurers assess your risk level. Key sections typically include personal information, business details, a description of services provided, a summary of your claims history, and an overview of your financial stability.

Each of these sections plays a pivotal role in shaping your application. Providing accurate information fosters trust with your insurer and facilitates a smoother claims process in the future.

Step-by-step guide to filling out the proposal form

To ensure your proposal form is thorough and accurate, follow this structured, step-by-step guide.

Interactive tools for enhanced completion

Utilizing tools like pdfFiller can significantly streamline the completion of your professional indemnity proposal form. This user-friendly platform allows for seamless editing and filling out PDFs from anywhere, utilizing cloud-based functions.

Through pdfFiller, users can benefit from features such as digital signatures, which not only add a level of convenience but also ensure your submissions are legally valid. The ability to collaborate with team members on document completion further enhances efficiency.

Common mistakes to avoid

Filling out the professional indemnity proposal form can be intricate, and it's easy to make mistakes. Being aware of common errors can help you avoid pitfalls that could impact your coverage.

Frequent mistakes include providing outdated information, being vague about services offered, or failing to disclose claims history fully. Each of these errors can lead to misinterpretation of your risk profile, potentially resulting in invalid coverage.

Frequently asked questions (FAQs)

After submitting your proposal form, you may have several questions regarding the next steps in the process.

Client testimonials and success stories

Hearing from individuals who have successfully navigated the professional indemnity proposal form can provide valuable insights. Many users have reported that thorough attention to detail in their submissions resulted in faster approvals and appropriate coverage.

For example, one satisfied pdfFiller client emphasized how utilizing the platform simplified the process, stating, 'The ease of editing and filling out my proposal form through pdfFiller not only saved me time but also ensured that I didn't overlook essential information.'

Additional tools and features of pdfFiller

Beyond managing individual proposals, pdfFiller also offers document management capabilities that can help users keep track of their insurance documents. This feature is particularly useful for professionals managing multiple clients and policies, allowing for better organization.

Collaboration tools enable teams to work together efficiently, ensuring that proposals are filled out with input from various team members when necessary. PdfFiller further allows for easy access to previously submitted proposals, enhancing your ability to manage ongoing relationships with insurers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in professional indemnity proposal form?

How do I fill out professional indemnity proposal form using my mobile device?

How do I fill out professional indemnity proposal form on an Android device?

What is professional indemnity proposal form?

Who is required to file professional indemnity proposal form?

How to fill out professional indemnity proposal form?

What is the purpose of professional indemnity proposal form?

What information must be reported on professional indemnity proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.