Phased Retirement: What It Is and How to Navigate the Process

Understanding phased retirement

Phased retirement is an innovative approach in the modern workforce that allows employees to gradually transition from full-time work to full retirement. This method enables seasoned professionals to reduce their workload while still remaining engaged in their careers, offering them the flexibility to balance personal aspirations and financial stability.

The importance of phased retirement is underscored by demographic shifts and evolving workplace dynamics. As baby boomers age and many opt to stay active longer, phased retirement provides a structured pathway for both retaining valuable talent and addressing the increasing demand for diverse work arrangements.

Flexibility for employees transitioning into retirement.

Retention of skilled employees within organizations.

Knowledge transfer from experienced workers to younger generations.

Phased retirement options

There are several models of phased retirement, allowing organizations to tailor arrangements based on individual needs and operational capacities. Each variant serves the purpose of transitioning employees into retirement without compromising on their productivity or value to the workplace.

One popular option is the gradual reduction of hours. Employees can start by reducing their weekly hours, allowing them to acclimate to the changes in their work-life balance while still contributing meaningfully to their organizations. Another common model includes job-sharing opportunities, where two part-time employees manage a single full-time role, thereby maintaining operational effectiveness.

Finally, transitioning into part-time roles is also a viable option for phased retirement, allowing employees to define their work schedules while still being eligible for benefits. This flexibility can significantly enhance job satisfaction and retention rates.

Eligibility criteria for phased retirement

While the appeal of phased retirement is evident, not all employees may qualify. Common eligibility criteria often hinge on factors such as age, length of service, and company-specific policies regarding phased retirement.

Typically, employees must be of a certain age or have reached a specific duration of service to be eligible. Many organizations set the bar at 55 years or older with a minimum of 10-15 years of service. Additionally, the employment type matters; full-time employees are usually prioritized over part-time staff, but company policies can vary widely.

Age requirement, often 55 years or older.

Minimum service duration of 10-15 years.

Adherence to company policies on phased retirement options.

Steps to initiate phased retirement

Embarking on a phased retirement requires careful assessment. Employees should start by evaluating their financial readiness, taking into account their savings, pension plans, and any potential adjustments to their retirement income. Understanding personal goals is equally important; whether it’s spending more time with family, pursuing hobbies, or travel, clarity on these aspects will guide the transition.

Once the internal groundwork is laid, the next crucial step is to communicate with the employer. Preparing for this discussion means gathering relevant information about the phased retirement policies and being ready to articulate one's proposed plan clearly. It's essential to consider key points such as preferred hours, desired roles, and potential impacts on team dynamics.

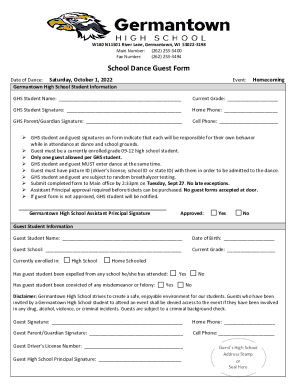

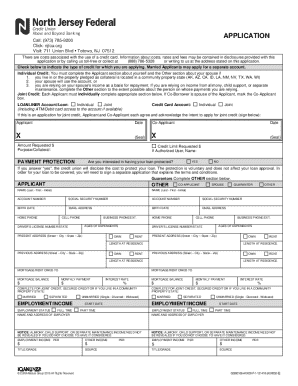

Filling out relevant forms for phased retirement

Navigating the bureaucratic landscape of phased retirement requires attention to detail, specifically in terms of paperwork. Common forms involved in this process usually include Retirement Request Forms, Health Benefits Enrollment Forms, and Pension Benefit Selection Forms.

To ensure smooth processing, it's vital to fill out each form accurately. Start by carefully reading each document to understand its requirements. For instance, when completing the Retirement Request Form, include essential information such as your employment details, proposed retirement date, and workload preferences. Additionally, utilizing document management tools available on pdfFiller can simplify the filling, editing, and signing of these documents.

Retirement Request Forms: Indicate your desire to transition.

Health Benefits Enrollment Forms: Choose your continued health coverage.

Pension Benefit Selection Forms: Specify your desired pension options.

Managing your plans during phased retirement

Balancing work and leisure during phased retirement is crucial for maintaining well-being. Employees must define their new schedules while ensuring they allocate sufficient time for personal pursuits. This balance is vital since too much work can lead to burnout, while too little can result in feelings of isolation or lack of purpose.

Setting new professional goals during this transition can also foster a sense of fulfillment. Whether it includes mentoring younger employees, volunteering for special projects, or pursuing additional training, staying engaged enriches the work experience and leverages the valuable skills acquired over a career. It’s a time to embrace new opportunities while still contributing meaningfully to the workforce.

Understanding tax implications of phased retirement

Transitioning into phased retirement can have significant tax implications. As reduced hours typically lead to lower incomes, individuals need to understand how their retirement income, including pensions and annuities, may affect their tax liabilities. Strategic financial planning should consider these changes to ensure you are not taken by surprise come tax season.

Moreover, it’s prudent to explore benefit structures available during phased retirement. Many organizations, especially in the United States, adjust benefits based on employment status. This shifting landscape requires ongoing dialogue with human resources for guidance on the latest options tailored for your needs.

Consider the tax impact of retirement income.

Understand pension and annuity taxation rules.

Engage with HR for clarification on benefit adjustments.

Practical considerations post-transition

Adjusting to a new schedule after transitioning into phased retirement necessitates mindfulness. The shift in daily routines can be both liberating and somewhat disorienting, especially when employees have spent decades in structured work environments. Hence, developing a daily routine that incorporates both work and leisure can foster a smooth adjustment.

Furthermore, being proactive about benefits enrollment and maintenance is crucial. Employees should take the time to review their health benefits, retirement plans, and any changes stemming from their new employment status. Utilizing available resources today, such as government websites and official agencies, can aid in ensuring that benefits remain intact and relevant.

Case studies: Successful phased retirement transitions

Learning from real-life examples can provide valuable insights into how phased retirement can work effectively. For instance, one employee transitioned from a high-stress managerial role to a part-time consulting position, successfully maintaining their professional identity while freeing up significant personal time for community involvement.

Analyzing strategies that worked for individuals in various fields can highlight the necessity of customizing phased retirement plans. Successful transitions often involve a clear understanding of personal goals combined with thorough communication with employers to craft the ideal arrangement.

Interactive tools and resources

To simplify the journey through phased retirement, interactive tools provide great value. Websites like pdfFiller offer retirement calculators that help individuals assess their financial readiness, estimate future income, and determine optimal retirement options.

Engaging with online communities or forums can also enhance understanding. Sharing experiences and tapping into collective wisdom can open doors to shared strategies and success stories. For easy access, downloadable templates for common forms can streamline document completion, ensuring organizational compliance and ease of management.

Frequently asked questions about phased retirement

As employees begin to explore phased retirement, several common concerns arise. Questions regarding eligibility criteria, potential income changes, and healthcare options often top the list. It’s critical to understand what to do if your employer doesn’t offer phased retirement; looking into alternative work arrangements or consulting with a financial advisor can provide viable paths forward.

Understanding how to manage healthcare during this transition is equally important. Many employees worry about losing coverage or facing higher costs. Familiarizing oneself with government organizations and their policies on healthcare during retirement can provide clarity and reassurance.

Contact support for assistance

Personalized guidance is essential for navigating the complexities of phased retirement. Most organizations offer HR support or dedicated resources to assist employees through this transition. Employees should reach out to HR or consult with financial advisors to obtain tailored advice regarding retirement plans, benefits, and necessary documentation.

Additionally, many companies and community organizations offer workshops and webinars dedicated to phased retirement, helping employees prepare effectively for the shift.

Related topics to explore

Exploring further aspects of retirement planning can enrich the overall understanding of the transition phase. Topics such as transitioning to full retirement and planning ahead, alternative work arrangements for older employees, and the significant role of financial advisors in retirement planning deserve attention.

These discussions contribute to a comprehensive understanding of the retirement landscape, enabling individuals to craft personalized retirement strategies that align with their lifestyle and financial needs.