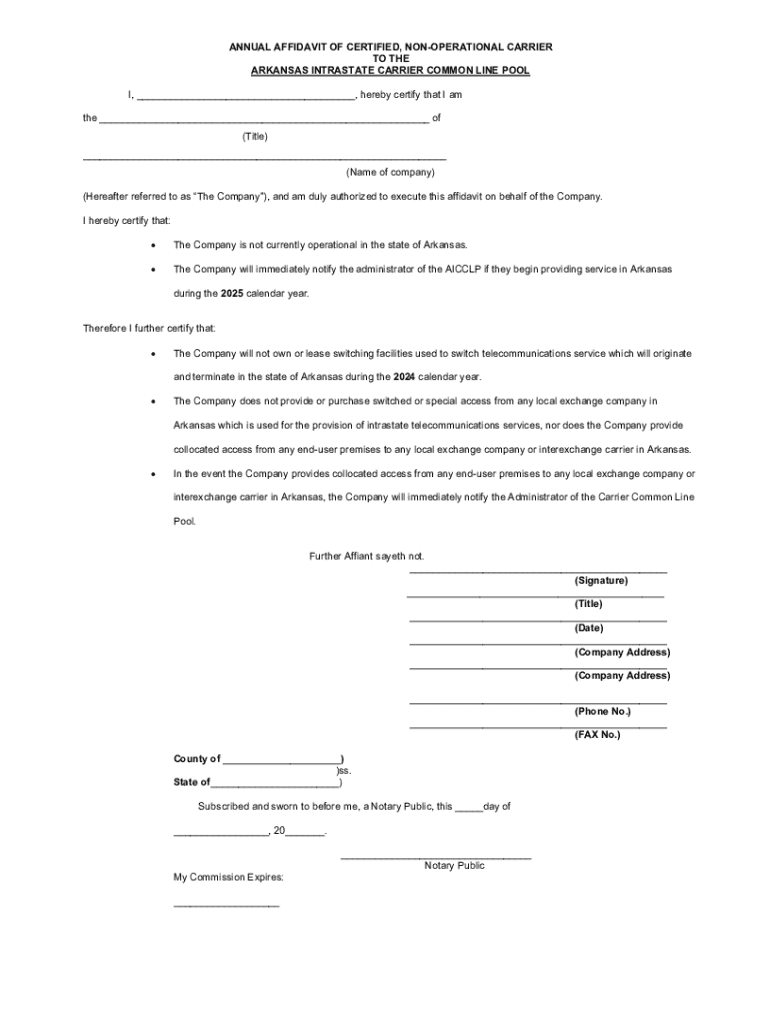

Get the free Annual Affidavit of Certified, Non-operational Carrier

Get, Create, Make and Sign annual affidavit of certified

How to edit annual affidavit of certified online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual affidavit of certified

How to fill out annual affidavit of certified

Who needs annual affidavit of certified?

Annual affidavit of certified form: A comprehensive how-to guide

Understanding the annual affidavit of certified form

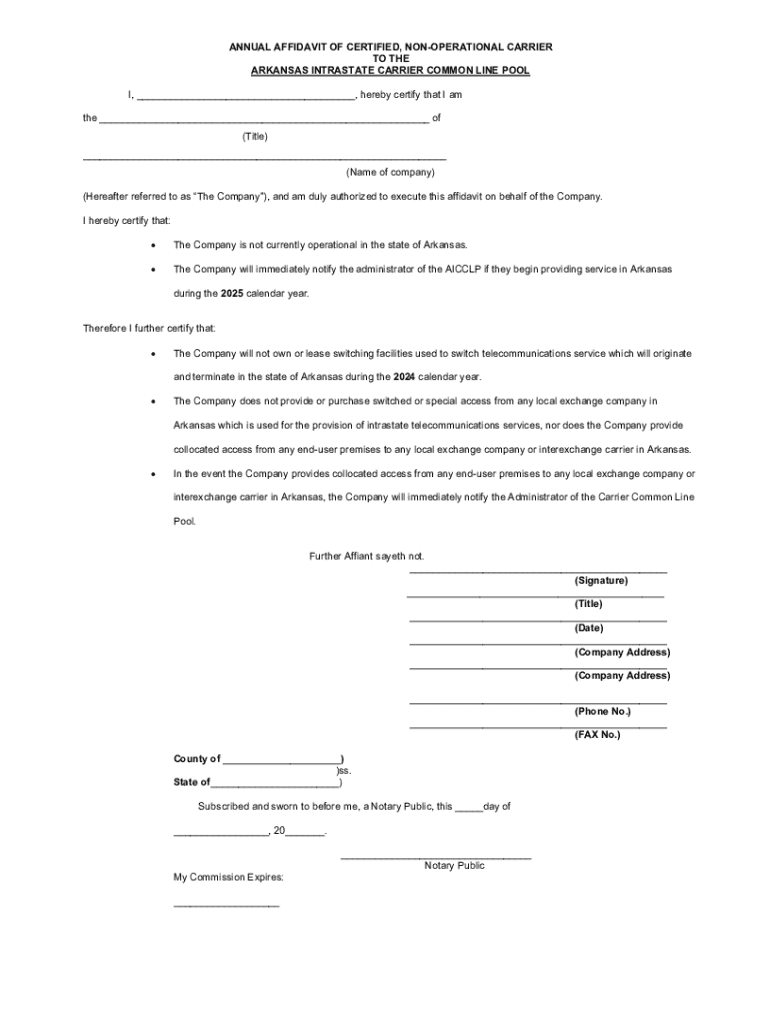

An annual affidavit of certified form serves as a legal declaration that individuals, corporations, and non-profits must submit annually to affirm the accuracy of their financial status and compliance with applicable laws. This document acts primarily as a verification tool, ensuring that all parties involved have access to truthful information regarding the status of income, property taxes, and other financial obligations. Authorities rely on such affidavits to maintain transparency and reduce fraud in financial reporting.

Certification is particularly vital in legal and financial contexts, as it bolsters the integrity of the information provided. It not only enhances trust among stakeholders but also serves as evidence of compliance with local laws and regulations. Consequently, failing to submit a certified affidavit on time or providing false information can result in severe penalties, including audits and fines.

Who needs to file?

Various entities may be required to file an annual affidavit of certified form, with the most common categories including individuals, corporations, and non-profits. Individuals often file such affidavits when applying for loans, grants, or other financial assistance, providing their personal data, financial disclosures, and compliance claims to demonstrate eligibility.

Corporations frequently have stricter requirements, as they must document their financial health to shareholders, creditors, and regulatory bodies. In addition, non-profits are often mandated to submit affidavits to maintain their tax-exempt status and secure funding from grants. Consequently, understanding the unique requirements of each category is essential for proper compliance.

Key components of the annual affidavit

An effective annual affidavit comprises several essential components designed to capture all necessary information while adhering to legal standards. Required information typically includes personal identification details, such as full name, address, and social security number or tax identification number. This ensures that the authority reviewing the affidavit can accurately verify the identity of the filer.

Next, financial disclosures play a crucial role in this process. Filers must outline their income, property tax obligations, and any applicable sales, occupation, or use taxes. Moreover, claims regarding compliance with rules and regulations are vital for demonstrating that the filer is operating within the bounds of the law. The presence of a signature from the filer adds authenticity, but the role of notarization cannot be overstated. A notarized signature attests to the legitimacy of the document and can prevent disputes regarding its authenticity.

Signature and notarization

The signature aspect of an annual affidavit of certified form is crucial, as it signifies the declarant's agreement to the contents of the document. However, simply signing is not enough; the affidavit must also be notarized. An authorized official, usually a notary public, verifies the identity of the signee and affirms that the affidavit was signed willingly and under no duress. Notarization enhances the document's credibility and ensures that the claims made are backed by a legitimate process.

The importance of notarized signatures extends beyond just legal requirements. They serve as a protective mechanism for both the affiant and the entity requesting the affidavit, reducing the potential for fraud and misrepresentation. Thus, filers must be diligent about securing the necessary notarization to avoid complications later on.

How to complete the annual affidavit of certified form

Completing an annual affidavit of certified form might seem daunting, but following a few basic steps can streamline the process and ensure accuracy. Start by gathering all required documentation. This includes any relevant financial records, tax statements, and identification materials. Having these documents readily available will make filling out the affidavit much more manageable.

Next, fill in your personal information carefully. Ensure that all details, such as your full name, address, and identification numbers, are entered correctly to avoid delays or rejections. Providing accurate information upfront can save time and reduce the chances of errors.

When declaring your claims, be forthright about your financial situation. Avoid embellishment; honest representation is key for legal compliance. Finally, complete the process by signing and notarizing the affidavit. This can be done easily by finding a notary public in your area, many of whom are located in banks, law offices, or public institutions. Make sure to bring valid identification when you go for notarization.

Editing and customizing your form

Once your annual affidavit of certified form is completed, you may find the need to edit or customize it for specific requirements. Utilizing pdfFiller tools allows for seamless online editing of your document. You can easily modify sections, such as adding additional declarations or adjusting claims, based on your needs.

In addition to editing, pdfFiller permits users to save their work securely in cloud storage. This feature enables easy access and retrieval at any time, ensuring that you maintain an updated version of your affidavit. Keeping historical records of changes also helps track updates or revisions, allowing for a more organized approach to document management.

Save your work

Making use of cloud storage options is crucial for avoiding loss of important documents. By saving your affidavit in a cloud-based system, you can access it from any device, anywhere you are. Whether you’re at home, at work, or on the go, the convenience of cloud storage allows you to manage your documents effortlessly. This capability also ensures that you can always retrieve the historical records of your filings, so you stay organized and in compliance.

Filing the annual affidavit

Filing your annual affidavit of certified form involves deciding the best submission method. You may have the option to submit your affidavit online or in person at specified locations. Many government agencies now provide portals where users can file documents electronically, making it significantly more convenient. Be sure to verify whether your local jurisdiction supports electronic submissions, as many do increasingly.

Make sure to note important addresses and websites associated with your specific filings. Deadlines are another critical aspect to consider, as different jurisdictions may have varying filing frequencies, from annual to monthly. Missing a deadline can result in penalties, making timely submission essential. Understanding the consequences of late submissions can help avoid pitfalls that could arise from failed compliance.

Common pitfalls to avoid

When preparing your annual affidavit of certified form, beware of common pitfalls that could lead to complications. Incomplete information is one of the most prevalent issues, as missing details can lead to rejected filings. Always review your affidavit to ensure that no crucial sections or data have been overlooked. For instance, failing to disclose all financial obligations properly may trigger audits or penalties.

Misinterpretation of legal terms is another challenge. Many filers may not fully understand specific jargon or requirements, leading to misunderstandings. To mitigate this risk, developing a glossary of key terms can prove invaluable. It can also help to consult with professionals familiar with the affidavit process, particularly for financial or tax-related declarations. Lastly, errors in notarization, such as unsigned or improperly dated sections, can invalidate your affidavit. Ensure all notarization procedures are correctly followed to maintain its legitimacy.

FAQs about the annual affidavit of certified form

Filing an annual affidavit can lead to many questions and concerns among filers. One common query is what to do if a mistake is made on the affidavit. Typically, you can submit an amended affidavit to correct any inaccuracies. It’s crucial to act quickly to prevent further complications, as altered information can signal potential issues to authorities.

Another common question involves tracking the status of a filed affidavit. Many online systems allow filers to check their submission's status, making it easier to confirm that everything is in order. Lastly, individuals often wonder about penalties for failing to file on time. These can vary significantly; however, fines and even legal repercussions for continuous non-compliance are possibilities, underscoring the importance of timely submissions.

Benefits of using pdfFiller for your annual affidavit

Leveraging pdfFiller can enhance your experience with the annual affidavit of certified form. Its cloud-based access allows users to manage and store their documents conveniently from anywhere. This feature significantly reduces the fear of losing important paperwork, as everything is stored securely online. This access-on-the-go is invaluable for users with busy schedules.

Furthermore, pdfFiller offers collaboration features that enable users to work seamlessly with team members or advisors. Whether you’re drafting the affidavit individually or collectively, the ability to share documents in real-time can facilitate better communication and enhance the quality of the submission. Plus, with secure electronic signatures, you can ensure compliance with legal requirements while maintaining the integrity of your submissions.

Additional services and tools for document management

Beyond just completing the annual affidavit of certified form, pdfFiller offers a multitude of functionalities suited for comprehensive document management. Its document storage options are designed to house not just affidavits but various forms and reports you may need. This capability paves the way for a more organized filing system, which can make a world of difference when dealing with multiple forms.

Moreover, pdfFiller provides templates for different types of affidavits and other legal forms, saving users time on document creation. Integrating with popular business tools further enhances its utility. Users need not worry about format discrepancies, as pdfFiller effortlessly adapts to various systems, ensuring a smooth workflow.

Support and assistance

For those new to the annual affidavit of certified form process or experiencing challenges, pdfFiller provides robust customer support options. Live chat, email, and phone support channels are readily available. Users can expect prompt assistance when they require answers to their queries or need help navigating the platform.

Additionally, pdfFiller offers a wealth of tutorials and help articles. These resources deliver step-by-step guides and instructional videos designed to enhance user proficiency. With this support system, navigating the complexities of the affidavit process becomes significantly more manageable, allowing filers to focus on accuracy and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute annual affidavit of certified online?

How do I make changes in annual affidavit of certified?

Can I edit annual affidavit of certified on an Android device?

What is annual affidavit of certified?

Who is required to file annual affidavit of certified?

How to fill out annual affidavit of certified?

What is the purpose of annual affidavit of certified?

What information must be reported on annual affidavit of certified?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.