Get the free Iowa Sales/use/excise Tax Exemption Certificate

Get, Create, Make and Sign iowa salesuseexcise tax exemption

How to edit iowa salesuseexcise tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out iowa salesuseexcise tax exemption

How to fill out iowa salesuseexcise tax exemption

Who needs iowa salesuseexcise tax exemption?

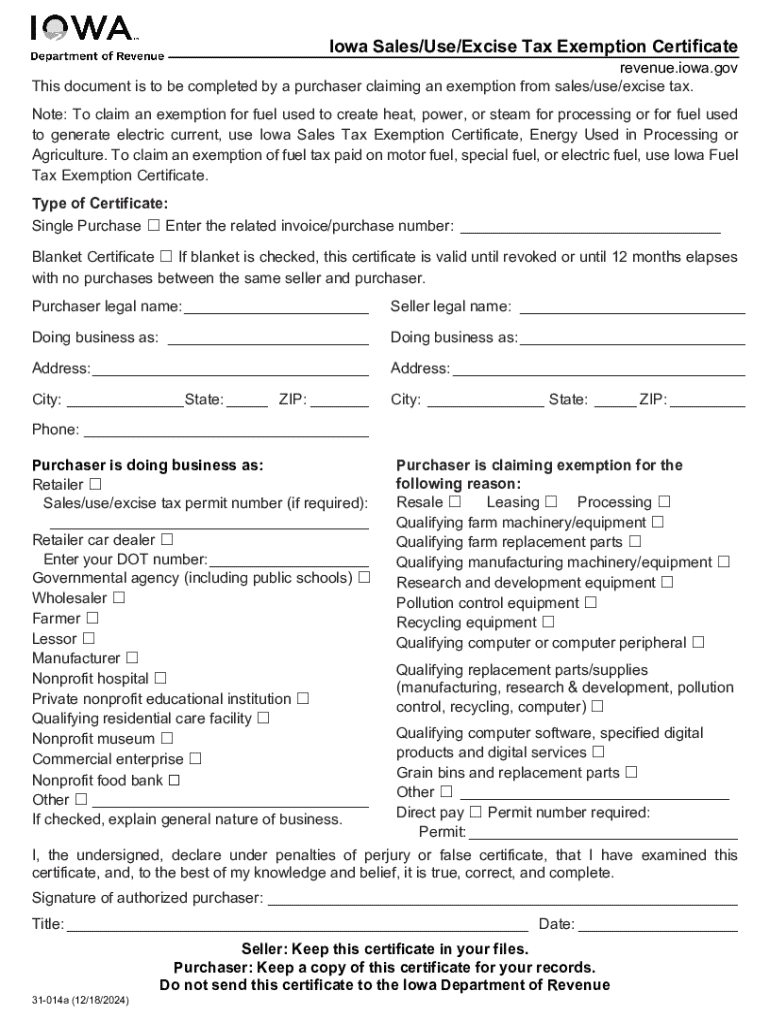

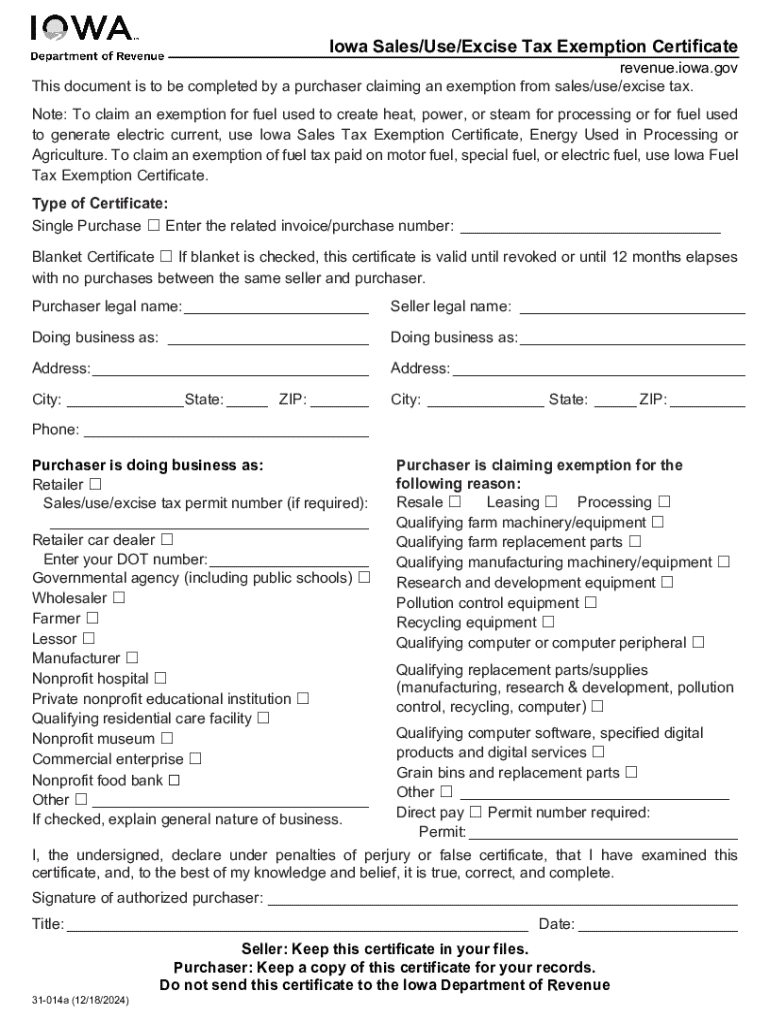

Iowa Sales/Use/Excise Tax Exemption Form: Your Comprehensive Guide

Understanding Iowa Sales/Use/Excise Tax Exemptions

Sales and use tax in Iowa serves as a crucial revenue source for various state and local programs. Essentially, it is a tax imposed on the sale of goods and services to consumers and the use of these goods consumed within the state. Iowa has developed a range of exemptions for certain goods, services, and entities, allowing businesses and individuals to save on these taxes when applicable.

Tax exemptions can be vital for entities like non-profits, government agencies, and educational institutions, as they reduce overall operational costs. Additionally, exemptions are important for businesses that engage in purchasing materials for manufacturing or resale. Understanding these exemptions can lead to substantial savings and aid in budget management.

Types of exemptions

The Iowa Sales/Use/Excise Tax Exemption Form Explained

The Iowa Sales/Use/Excise Tax Exemption Form is a critical document designed for individuals and businesses seeking exemption from sales and use tax obligations. This form essentially provides a structured way to declare eligibility for various tax exemptions, making it easier for sellers not to collect tax on exempt sales.

Filling out this form is essential in scenarios where certain purchases qualify for tax exemption. It is commonly used during purchases pertaining to manufacturing, education, or in transactions involving governmental and nonprofit organizations.

Key information required on the form

Detailed step-by-step guide to filling out the exemption form

Filling out the Iowa Sales/Use/Excise Tax Exemption Form requires attention to detail and proper documentation. The first step is to gather all necessary information and documents related to the exemption.

Step 1: Gather required information

Step 2: Completing the form

As you complete the form, start with entering accurate taxpayer details. Next, clearly state your reason for the exemption and provide a detailed description of the items involved. Ensure that all required fields are satisfactorily filled, rather than leaving any section incomplete.

Step 3: Review and edit your submission

Before submitting the exemption form, careful review is paramount. Check for accuracy in the information provided and ensure all fields are completed. Common mistakes include providing incorrect taxpayer identification or omitting documentation.

Tools and resources for managing your tax exemption documents

Digital solutions can streamline the management of your Iowa Sales/Use/Excise Tax Exemption Form. Platforms like pdfFiller provide a seamless way for users to edit, sign, and manage documents from anywhere, enhancing efficiency in your tax-related processes.

Digital solutions for document creation

With pdfFiller, users can easily edit PDF forms, including the Iowa Sales/Use/Excise Tax Exemption Form. Its user-friendly interface simplifies the process, allowing for quick adjustments to the document based on your needs.

Editing and signing the form electronically

To finalize your exemption form electronically using pdfFiller, simply upload the necessary document, input your information, and use the eSignature feature to sign it. This digital process is not only convenient but also reduces printing costs and minimizes the risk of loss associated with physical documents.

Frequently asked questions (FAQs)

Despite the clarity of the exemption process, questions often arise concerning the Iowa Sales/Use/Excise Tax Exemption Form.

For any inquiries regarding specific situations or complications, the Iowa Department of Revenue's contact information is readily accessible online.

Additional considerations when filing for tax exemptions

Understanding the implications of tax exemptions on businesses is crucial. While these exemptions can lead to cost savings, businesses must also meet their responsibilities regarding tax compliance.

Implications of tax exemptions for businesses

For businesses, tax exemptions can allow for savings on inventory purchases, lowering overall operating costs. However, it’s essential to use these exemptions judiciously, ensuring compliance with state laws to avoid penalties.

Keeping records of tax exempt transactions

Maintaining a solid record of all tax-exempt transactions is pivotal for both compliance and operational transparency. Best practices include storing copies of the exemption forms, invoices from tax-exempt purchases, and communication with suppliers.

Leveraging the pdfFiller platform for future tax needs

As you navigate tax obligations, having an efficient document solution is paramount. pdfFiller not only offers tools for the Iowa Sales/Use/Excise Tax Exemption Form but also features a comprehensive library of other tax-related forms.

Exploring other tax-related forms on pdfFiller

Users can access a variety of forms for sales, excise, and use taxes through the pdfFiller platform, allowing for streamlined document management across different tax needs.

Benefits of using pdfFiller as an all-in-one document solution

pdfFiller empowers users to efficiently create, edit, eSign, and manage documents from a cloud-based platform. With its robust features, users can optimize their workflow and ensure compliance with state regulation, all while saving time in the document handling process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit iowa salesuseexcise tax exemption from Google Drive?

How can I send iowa salesuseexcise tax exemption to be eSigned by others?

How do I make changes in iowa salesuseexcise tax exemption?

What is iowa salesuseexcise tax exemption?

Who is required to file iowa salesuseexcise tax exemption?

How to fill out iowa salesuseexcise tax exemption?

What is the purpose of iowa salesuseexcise tax exemption?

What information must be reported on iowa salesuseexcise tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.