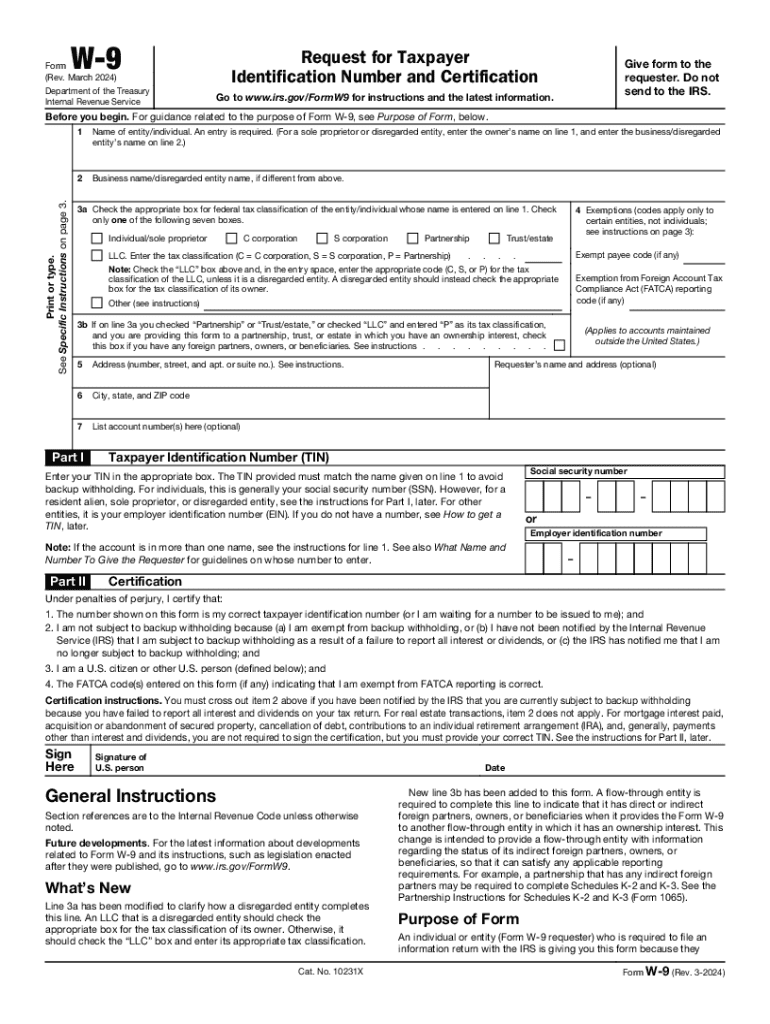

Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

Comprehensive Guide to the W-9 Form: Everything You Need to Know

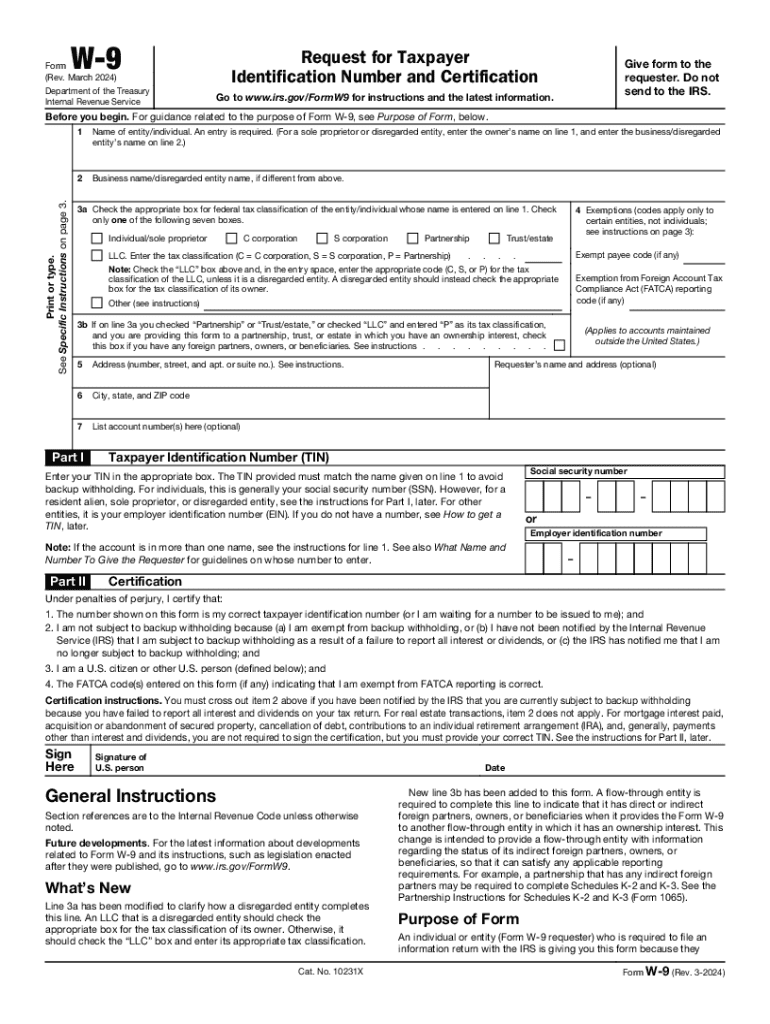

Understanding the W-9 form

The W-9 form is a crucial tax document required by the Internal Revenue Service (IRS) in the United States. It is primarily used by individuals and entities to provide their Taxpayer Identification Number (TIN) to a requester, which can be a business or an individual who intends to report payments made to the person or entity on tax returns. The importance of the W-9 form cannot be overstated; it facilitates the accurate reporting of income and ensures compliance with federal tax laws.

In its simplest form, the W-9 serves as an information return. It is typically filled out by freelancers, independent contractors, and vendors who receive taxable income from a business. Without this form, businesses may face challenges in meeting their tax obligations, and individuals may struggle with getting correctly taxed on their earned income.

The purpose of the W-9 form

So, why do you need a W-9 form? For independent contractors, freelancers, and businesses, completing a W-9 is essential for various reasons. It helps businesses report payments made to contractors to the IRS accurately. Furthermore, the W-9 form serves to establish the correct tax identification for tax withholding and reporting purposes. This is especially important because incorrect information can lead to penalties or unexpected tax bills.

Common scenarios necessitating a W-9 include engagements where payments are made for services, such as consulting or legal work. Additionally, businesses often request W-9 forms when setting up vendor relationships, thereby ensuring compliance and proper reporting practices from the outset.

Who should fill out the W-9 form?

Identifying who needs to complete a W-9 form is straightforward. Typically, independent contractors, self-employed individuals, and businesses must fill out this form. This includes sole proprietors, partnerships, and corporations that bill for their services or products. Nonprofit organizations can also be required to complete a W-9, especially if they're receiving payments that need reporting to the IRS.

Interestingly, there are exemptions. Some individuals, such as certain foreign entities or individuals who are not subject to U.S. tax withholding, may not need to submit a W-9. It's crucial to understand these nuances to ensure compliance with IRS regulations.

Step-by-step guide to filling out the W-9 form

Filling out the W-9 form is not overly complex if you follow the guidelines. The first section requires your personal information, including your name and business name (if applicable). You must then enter your address accurately, as this information is vital for tax reporting. The next step includes selecting your federal tax classification, which is crucial for determining how your income will be taxed.

Essentially, the Taxpayer Identification Number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN), completes your form. This number is highly significant as it links your income and tax responsibility. Accuracy in this section is paramount; errors can lead to penalties or incorrect tax submissions.

Where the W-9 form is used

The W-9 form is utilized in various key applications. One common circumstance is when a client or business requests a W-9 to fulfill income reporting requirements for services rendered. Payees must furnish a W-9 to ensure that the business can accurately report payments to the IRS via Form 1099—something that becomes imperative when payments exceed $600 in a calendar year.

Moreover, filing requirements for tax returns hinge on the information provided in the W-9. This form establishes your identity for tax reporting and ensures compliance with IRS regulations. Understanding its role in your tax dealings is essential for maintaining clarity in your financial engagements.

The importance of the W-9 form

Accurate completion of the W-9 form is paramount. Errors on this form can lead to complications during tax season, including potential audits or incorrect withholding of taxes. Businesses that fail to report accurately based on a W-9 form can face hefty penalties from the IRS, thus underscoring the significance of ensuring every detail is correct.

Furthermore, the W-9 form plays a vital role in financial transactions. A correctly filled out W-9 fosters trust and compliance between contractors and clients. This trust is essential in business relationships, as transparency in financial documentation protects both parties and can prevent legal implications that arise from incomplete or incorrect submissions.

Tips for effectively managing your W-9 form

Managing your W-9 form efficiently is crucial for minimizing tax-related issues. First and foremost, double-check all entries for accuracy before submission. A simple mistake can lead to extended delays in payment or complications in tax reporting. Keeping copies of all submitted forms is also a smart practice. This documentation provides a reference point in case discrepancies arise later on.

When sharing your W-9 form, prioritize security and privacy. Since it contains sensitive personal information, transmit it through secure methods, such as encrypted PDFs. Additionally, consider limiting the distribution of your form to only necessary parties, ensuring that your sensitive data remains safeguarded.

Frequently asked questions about the W-9 form

Navigating the W-9 form often comes with questions. One of the most common queries is what to do if you notice an error post-submission. In such cases, reach out to the requester immediately and provide them with the correct information. They may request an updated W-9 with accurate details. Another frequent question is how often a new W-9 must be submitted; generally, a new W-9 is required if there are changes in your address, name, or tax classification.

It's also important to clarify some tax terminology that is related to W-9 forms. Understanding terms like TIN, IRS, and 1099 can enhance your grasp of the importance of this document in your tax situation.

Using pdfFiller for your W-9 form needs

pdfFiller simplifies the process of managing your W-9 form. The platform allows users to edit and manage PDFs with ease, enabling you to fill out your W-9 accurately and efficiently. Its cloud-based features offer the ability to edit, sign, and collaborate from anywhere, ensuring that form completion does not become a tedious task.

With pdfFiller, you have access to interactive tools that provide step-by-step assistance during the filling process. The ability to create templates for future W-9 usages means you can save time for subsequent submissions, ensuring your financial documentation remains organized and easily accessible.

Engaging with the W-9 form process

Effective collaboration and communication concerning the W-9 form can greatly enhance your professional relationships. Discuss W-9 requirements with clients or stakeholders upfront to avoid any delays in payment processing and tax reporting. Transparency in these transactions fosters trust and can lead to smoother business dealings.

Moreover, creating a streamlined workflow for managing your W-9 forms will reduce the hassle involved in future submissions. Setting reminders for when to update and resend forms can ensure that your documentation remains current. Utilizing pdfFiller’s resources can further enhance the efficiency of your document handling process, making it easier to manage your paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get w-9?

Can I create an eSignature for the w-9 in Gmail?

How do I fill out w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.