Get the free Gain Report Rs1583

Get, Create, Make and Sign gain report rs1583

How to edit gain report rs1583 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gain report rs1583

How to fill out gain report rs1583

Who needs gain report rs1583?

Understanding the Gain Report RS1583 Form: A Comprehensive Guide

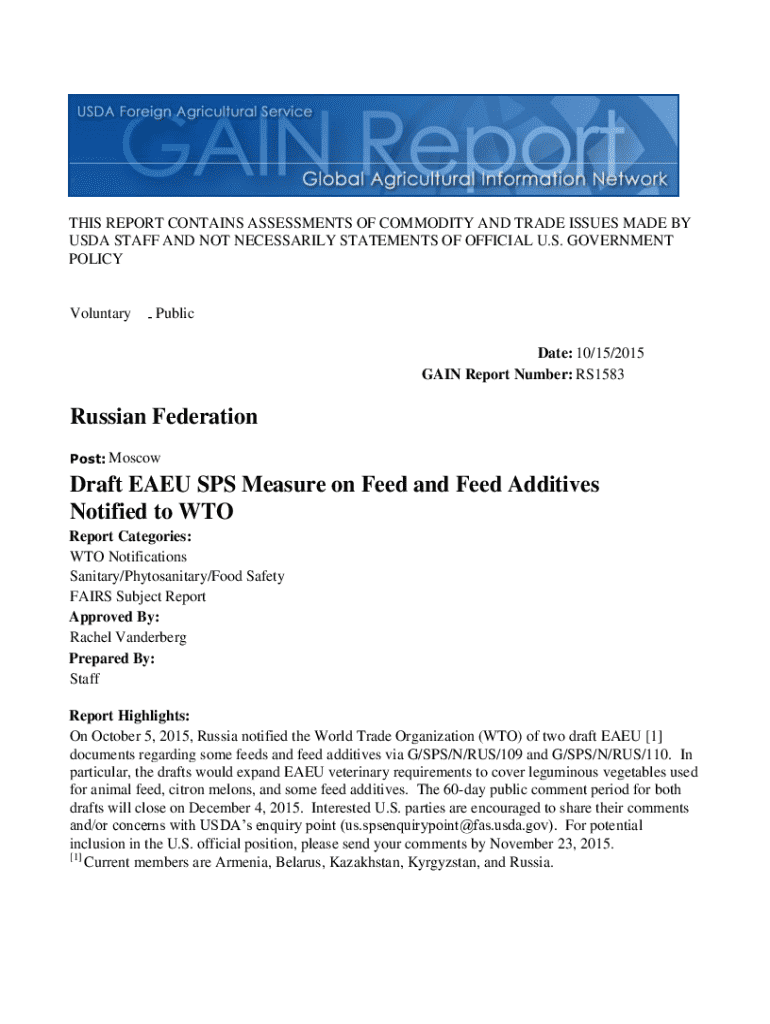

Understanding the Gain Report RS1583 Form

The Gain Report RS1583 Form is a specialized document utilized primarily in financial reporting, particularly for individuals and businesses preparing tax submissions. Its main purpose is to report gains arising from the sale of capital assets, ensuring accurate representation of taxable income. Financial compliance regulations mandate that this form be filled out thoroughly to avoid complications with tax authorities.

Importance of the Gain Report in Financial Management

Accurate financial reporting is crucial for any entity, be it an individual or a business. Errors in reporting can lead not only to substantial financial penalties but also long-term repercussions on credibility with tax authorities. The Gain Report RS1583 Form plays a significant role in ensuring that gains from asset sales are reported correctly, providing a clear picture of fiscal responsibility.

This form is vital for tax compliance, simplifying the process of reporting capital gains. A correctly filled RS1583 provides transparent documentation, aiding in fulfilling compliance requirements. With legislation constantly evolving, keeping your financial reporting aligned with the RS1583 ensures you meet current tax standards, thereby minimizing potential audits and liabilities.

Preparing to fill out the Gain Report RS1583 Form

Before you begin filling out the Gain Report RS1583 Form, it’s critical to gather all the necessary information. Essential documents include itemized records of transactions, previous tax returns, and any supporting documentation that substantiates the gains reported. Keeping your financial records organized will greatly enhance the accuracy of your reporting, ultimately expediting the submission process and mitigating the risk of errors.

Additionally, adhering to submission timelines is crucial. The RS1583 Form must be submitted by the designated deadlines to avoid penalties. Missing these deadlines can result in fines, increased scrutiny from tax authorities, or even interest penalties on unpaid taxes. Understanding these critical timelines ensures you maintain compliance and preserves your financial integrity.

Detailed step-by-step instructions for completing the RS1583 Form

Completing the RS1583 form can initially seem daunting, but it can be simplified into clear sections. Start with personal information at the top; this includes your name, address, and identification number. Following this, detail your income sources, ensuring that calculations reflect total gains accurately.

Next, document any deductions or credits you may qualify for, as this can significantly affect your taxable income. Finally, review all information for accuracy before signing the form. Incomplete or misleading information can lead to audits or penalties, making a careful review imperative.

Common mistakes to avoid include incorrect personal details, missing income sources, and improperly calculated deductions. Always verify your math and read the guidelines thoroughly to ensure compliance.

Editing and managing your Gain Report RS1583 Form

Utilizing tools like pdfFiller can enhance your experience when dealing with the RS1583 form. pdfFiller allows users to edit and customize the RS1583 form seamlessly online. Its user-friendly interface means you can make changes directly without needing extensive knowledge of document editing software.

Moreover, collaboration with team members becomes straightforward. Sharing the form with others can be done in just a few clicks, ensuring everyone involved stays informed. With pdfFiller, team input can be integrated easily, which is particularly useful for businesses managing multiple documentation tasks.

The e-signature feature provides an additional layer of convenience. Users can securely sign the RS1583 digitally, which not only saves time but also ensures that the document is managed securely and efficiently.

Post-submission - understanding the aftermath

After submitting the RS1583 Form, the review process by tax authorities usually begins soon after. Be prepared for possible inquiries from tax agents seeking clarification or further documentation. Having your records accurately organized can expedite this process and reduce stress during follow-up.

If you find yourself facing an audit or questions related to your Gain Report RS1583 submission, respond promptly and professionally. Maintain open communication with authorities, providing requested documentation without delay, as this will demonstrate good faith and transparency on your part.

Frequently asked questions (FAQs) about the Gain Report RS1583 Form

Even after understanding the details of the Gain Report RS1583 Form, questions may arise. For instance, if an error is discovered after submission, promptly contact the relevant tax authority to understand the amendment process. It's essential to address any discrepancies swiftly to avoid penalties.

You can amend your Gain Report RS1583 if needed; always check the guidelines for the correct procedure. Regarding record keeping, best practices suggest retaining your financial records for at least three to seven years, depending on jurisdiction and the complexity of your situation.

Conclusion on managing your Gain Report RS1583

Accurate reporting through the Gain Report RS1583 Form is not merely a bureaucratic task; it's a foundational aspect of responsible financial management. Utilizing resources like pdfFiller can streamline the process, making it easier to create, edit, and manage your reports. By staying informed and using effective tools, you can ensure compliance and maintain your financial integrity with confidence.

As you prepare to handle your financial documents, consider leveraging the capabilities of pdfFiller for enhanced document management. This ensures you are prepared, accurate, and compliant throughout your financial reporting journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gain report rs1583 without leaving Google Drive?

How do I edit gain report rs1583 straight from my smartphone?

Can I edit gain report rs1583 on an Android device?

What is gain report rs1583?

Who is required to file gain report rs1583?

How to fill out gain report rs1583?

What is the purpose of gain report rs1583?

What information must be reported on gain report rs1583?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.