Get the free Nz Funds Kiwisaver Scheme

Get, Create, Make and Sign nz funds kiwisaver scheme

How to edit nz funds kiwisaver scheme online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nz funds kiwisaver scheme

How to fill out nz funds kiwisaver scheme

Who needs nz funds kiwisaver scheme?

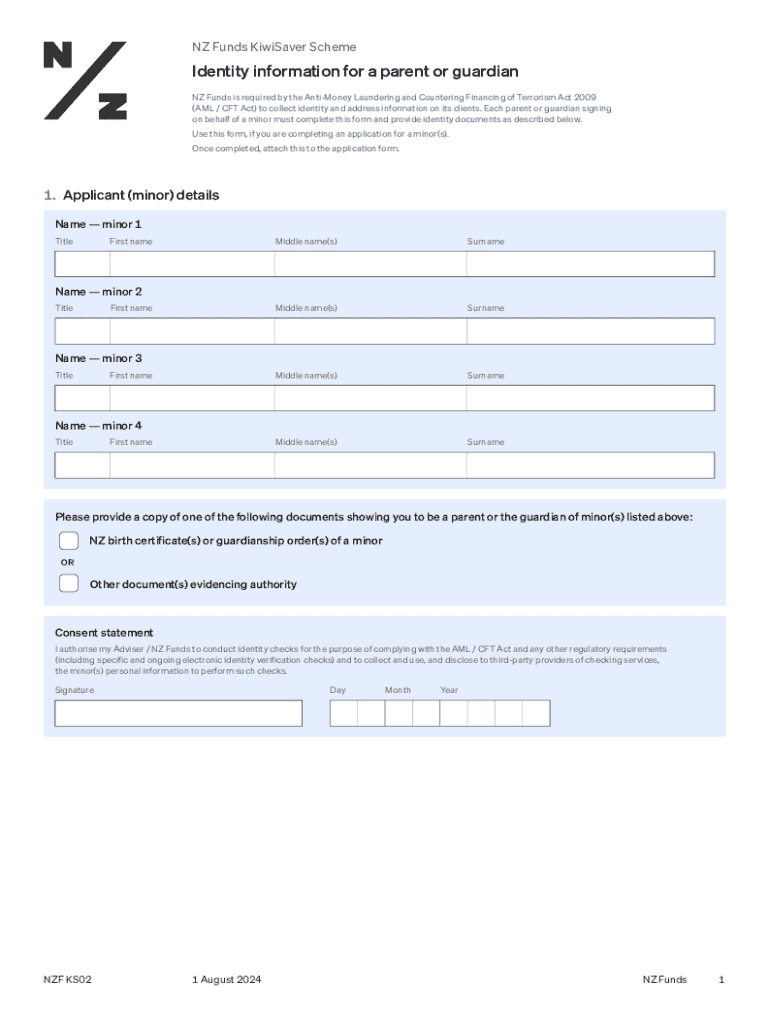

Comprehensive Guide to the NZ Funds KiwiSaver Scheme Form

Understanding the KiwiSaver scheme

The KiwiSaver scheme is a government-initiated initiative designed to encourage New Zealanders to save for their retirement. Launched in 2007, it provides a simple and effective way for citizens to contribute regularly towards a retirement fund, which can greatly enhance their financial security in later years. Members can choose from various investment funds and contribute a percentage of their earnings, often receiving additional contributions from their employers and the government.

The benefits of being a KiwiSaver member extend beyond merely contributing to a retirement fund. Members enjoy tax advantages on their contributions, potential employer contributions, and government matches up to a certain threshold. Furthermore, KiwiSaver accounts can be accessed for purchasing a first home, making it an attractive option for younger New Zealanders.

Importance of the NZ Funds KiwiSaver scheme

The NZ Funds KiwiSaver scheme stands out due to its unique investment options and member support services. Unlike more generic providers, NZ Funds focuses on active management strategies to enhance growth potential for members’ assets. Moreover, they prioritize clear communication and transparency, providing members with easy insights into their investment performance, which contributes to a more engaging experience throughout their savings journey.

When compared with other KiwiSaver providers, NZ Funds differentiates itself through its diligent investment approach and exceptional customer service. Their investment strategies are tailored to reflect the diverse risks and returns, allowing members varying degrees of exposure to different asset classes, making investment decisions easier and more informed.

Types of KiwiSaver forms

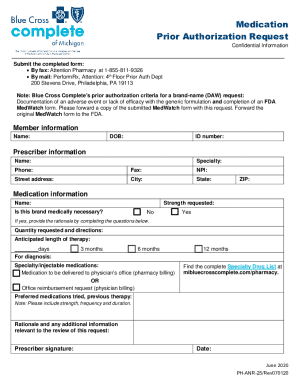

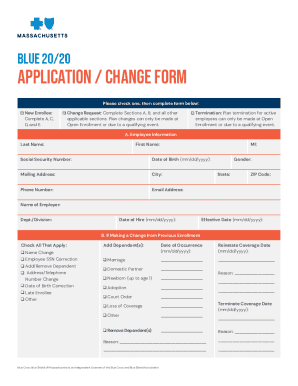

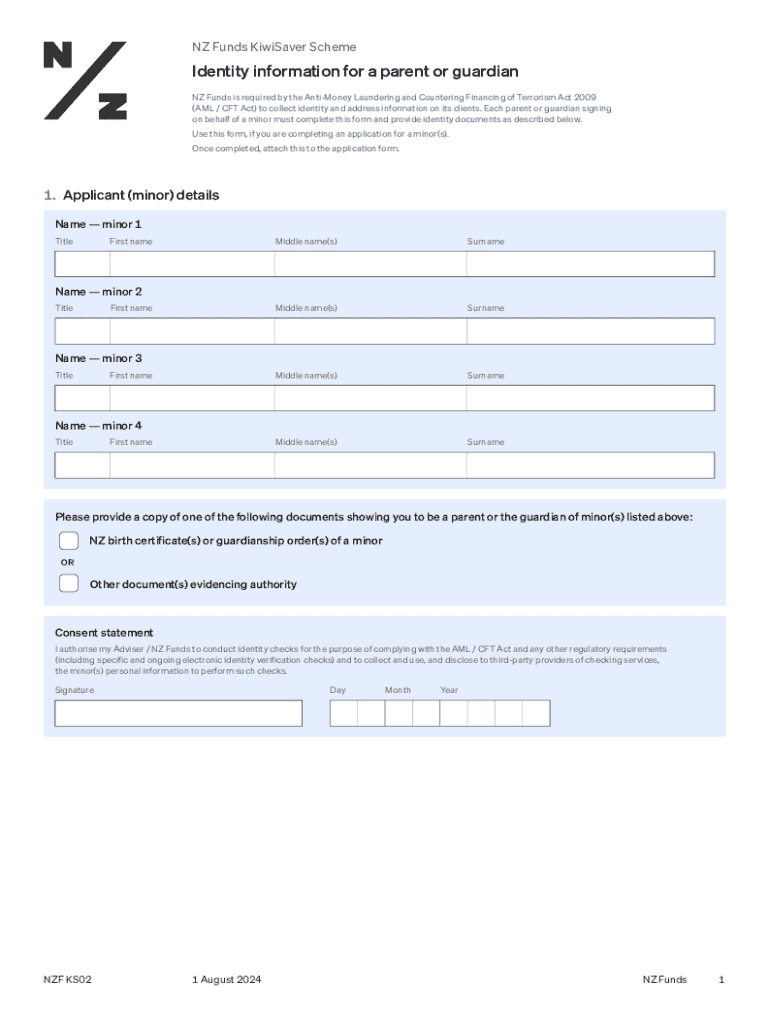

NZ Funds members are required to complete several forms throughout their KiwiSaver journey. One of the most crucial documents is the Sign-Up Form, necessary for initiating participation in the NZ Funds KiwiSaver scheme. This form is essential for setting up your account and includes personal and financial information necessary for your profile.

Members may also need to submit the Contribution Changes Form when they wish to modify their contribution rates. This is particularly important for those aiming to increase their retirement savings as they progress in their careers. Another important form is the Withdrawal Request Form, which is necessary when members wish to access their funds under certain conditions.

For more specialized requirements, such as altering your investment strategy or setting up loan payments, there are also additional forms available. The Investment Strategy Change Form allows members to modify their investment options, while the Loan Payment Arrangement Form assists in managing repayment plans for housing loans funded through KiwiSaver.

Detailed guide to filling out the NZ Funds KiwiSaver scheme forms

Filling out the NZ Funds KiwiSaver Scheme forms accurately is crucial to ensure a smooth onboarding process. Here’s a step-by-step guide to complete the Sign-Up Form effectively:

For the Contribution Changes Form, it’s important to understand the different contribution types, including standard contributions and additional voluntary contributions. Adjusting your employee contribution rate can be done easily online, but remember to check whether your new rate is within the employer contribution matching limits.

Each withdrawal request requires careful consideration of eligibility criteria. Depending on the type of withdrawal—first home purchase, financial hardship, etc.—documentation will vary. Ensure that you provide all necessary evidence to minimize delays.

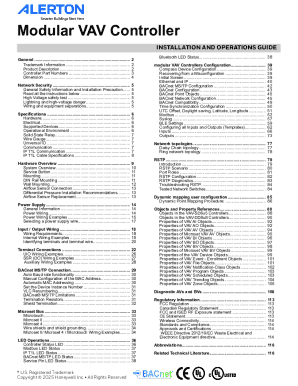

Managing your KiwiSaver account online

Creating and accessing your NZ Funds account online enables efficient management of your KiwiSaver scheme. To sign up for online access, simply visit the NZ Funds website and follow the prompts to set up your user account, entering your personal details and creating a secure login.

Once logged in, you can utilize numerous features such as tracking your contributions, viewing your portfolio, and understanding your fund performance. This platform allows you to see your contribution history, review the growth of your investments, and receive real-time updates, crucial for informed decision-making.

Making changes to your account can also be done seamlessly online. You can update your personal information if any changes occur, such as a change of address or name, and switch investment funds to potentially increase returns as your financial situation evolves.

Tips for maintaining a successful KiwiSaver account

Regularly reviewing your KiwiSaver strategy is a key element in maintaining a successful account. Annual reviews help ensure that your investment choices align with your evolving financial goals and lifestyle changes. For individuals experiencing changes such as a new job, marriage, or children, revisiting your contributions can significantly impact your retirement fund.

Utilizing interactive tools on pdfFiller to fill out and manage documents can significantly enhance your experience. With powerful editing, signing, and collaborative features offered by pdfFiller, users can ensure that forms are completed accurately and submitted promptly. Additionally, collaborating with family or financial advisors online aids in making well-informed decisions regarding your KiwiSaver strategy.

FAQs about the NZ Funds KiwiSaver scheme form

New Zealanders considering joining or currently navigating the NZ Funds KiwiSaver scheme often have common queries. One frequent concern involves dealing with errors on forms. It's crucial to double-check entries before submission as typos can delay processing. If you do spot an error, reach out to customer support for guidance on correcting it.

Another popular question revolves around tracking the status of submissions. Most requests, whether sign-up or withdrawal, can be monitored online through your NZ Funds account. Keep an eye on communication from NZ Funds, as updates will be sent via email or through the portal regarding any required actions or confirmations.

Understanding your rights and responsibilities as a KiwiSaver member is vital. Members should be aware of their consumer rights—such as transparency in fees and clarity of information regarding their funds. Similarly, obligations include regularly reviewing account statements, ensuring details are kept updated, and understanding the ramifications of any changes to contribution levels.

Contacting NZ Funds for support

Reaching out for assistance can remove ambiguity and help streamline the KiwiSaver experience. For inquiries related to your forms or contributions, you can contact NZ Funds through their dedicated support channels or online chat service. Utilizing these resources when faced with complex issues ensures user confidence and clarity in navigating the scheme.

If using pdfFiller's support features for document management, you can take advantage of live chat or email assistance, ensuring that any document-related issues are resolved swiftly. Collaboration tools also enable users to share and refine documents seamlessly with others involved in the decision-making process.

Conclusion

For New Zealanders considering joining the KiwiSaver scheme, understanding the steps involved in filling out the NZ Funds KiwiSaver scheme form is fundamental. After completing the necessary forms, it’s essential to take proactive steps in managing your KiwiSaver account effectively. Regular contributions, monitoring fund performance, and remaining engaged with your investment strategy significantly influence your financial future.

Encouragement for proactive account management cannot be overstated; KiwiSaver is not just a set-and-forget solution. With the right planning and informed decision-making, New Zealanders can better position themselves for a comfortable and secure retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nz funds kiwisaver scheme for eSignature?

How can I get nz funds kiwisaver scheme?

Can I edit nz funds kiwisaver scheme on an Android device?

What is nz funds kiwisaver scheme?

Who is required to file nz funds kiwisaver scheme?

How to fill out nz funds kiwisaver scheme?

What is the purpose of nz funds kiwisaver scheme?

What information must be reported on nz funds kiwisaver scheme?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.