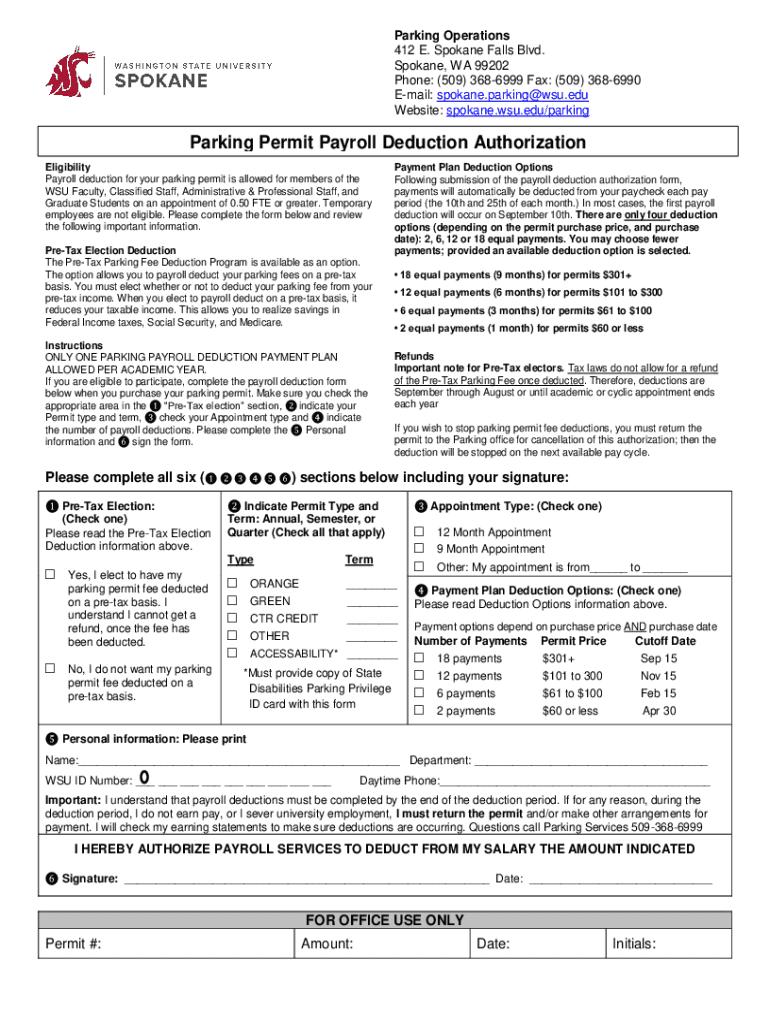

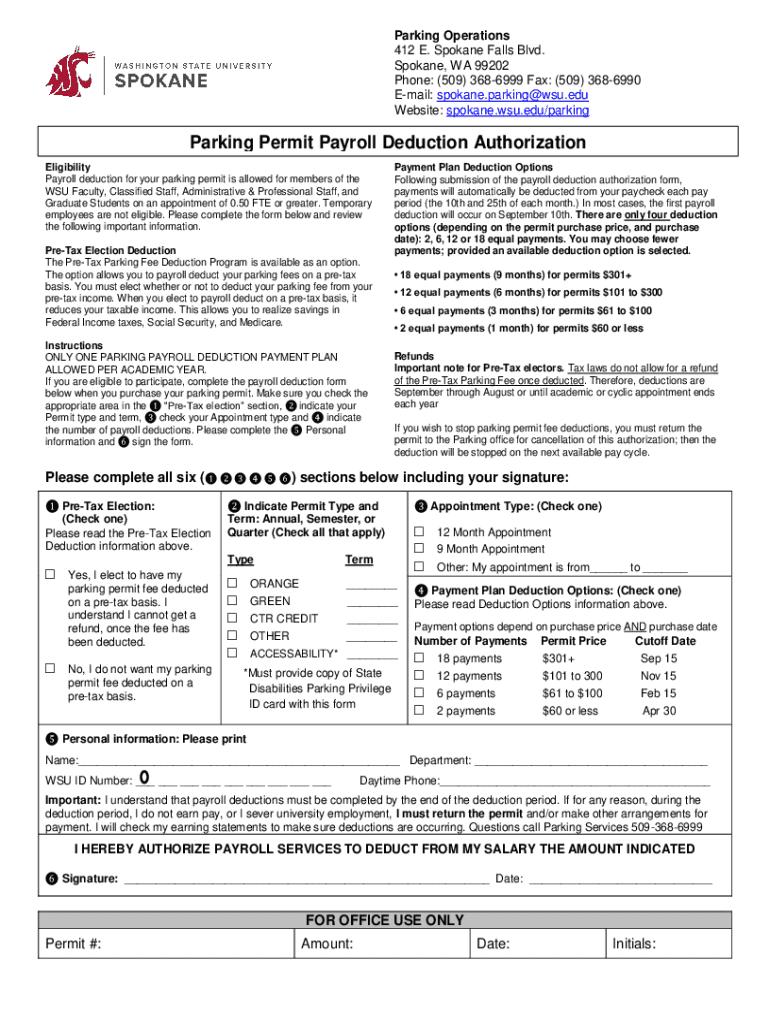

Get the free Parking Permit Payroll Deduction Authorization

Get, Create, Make and Sign parking permit payroll deduction

How to edit parking permit payroll deduction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out parking permit payroll deduction

How to fill out parking permit payroll deduction

Who needs parking permit payroll deduction?

All You Need to Know About the Parking Permit Payroll Deduction Form

Overview of parking permit payroll deduction

A parking permit payroll deduction allows employees to pay for their parking permits through automatic deductions from their salaries. This system streamlines the process of parking management for both employees and employers, ensuring timely payments and reducing administrative burdens.

Using payroll deductions for parking permits offers several benefits, including convenience, affordability, and budgeting ease. By letting employees set aside funds automatically, they can avoid large one-time fees and manage their expenses more effectively.

The importance of the parking permit payroll deduction form can't be understated. For employees, it provides a hassle-free way to secure parking without the worry of missing payments. For organizations, it helps to manage parking resources effectively while providing an added employee benefit.

Eligibility criteria for parking permit payroll deductions

Not everyone qualifies for parking permit payroll deductions, as various factors determine eligibility. Primarily, eligibility depends on an individual’s employment status—typically, only employees of a company are eligible, meaning non-employees, contractors, and interns may not qualify.

Additionally, company-specific policies greatly influence eligibility. Some employers may impose restrictions based on job roles, shifts, or departmental inclusion. Potential applicants should read their company's human resource guidelines to ensure that they fit within the eligibility criteria.

Before applying, employees must consider their employment status and any income criteria set by their employer. Understanding these factors will help prevent misunderstandings and facilitate a smoother application process.

Understanding the payroll deduction process

The payroll deduction process is designed for simplicity. Each pay cycle, a specific amount is deducted from an employee's salary and allocated towards their parking permit. Calculating deductions typically involves determining the total annual parking permit cost and dividing it by the number of pay periods in the year.

For example, if an employee's parking permit costs $600 for the year, and they receive bi-weekly paychecks, the deduction per paycheck would be $25. The process is systematic and only requires the employee to fill out the parking permit payroll deduction form correctly.

Deductions can be made weekly, bi-weekly, or monthly, depending on the company's payroll schedule. Employees must check their pay statements to ensure that deductions reflect accurately.

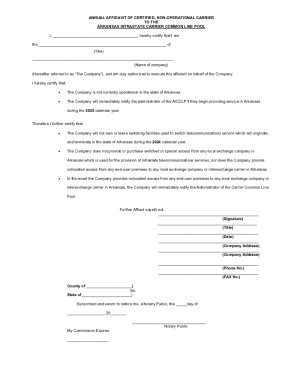

Step-by-step instructions for filling out the parking permit payroll deduction form

Completing the parking permit payroll deduction form requires careful attention to detail. Before you start, gather all necessary documentation, including proof of employment and specifics about your parking permit.

The form typically includes several sections that need to be filled out accurately: Personal Information, Employer Information, Parking Permit Details, and Acknowledgment of Terms and Conditions.

To ensure accuracy, double-check all entries before submitting the form. Common mistakes to avoid include incorrect permit details, missing signatures, and failing to provide supporting documents.

Editing and customizing your form with pdfFiller

pdfFiller offers innovative tools to help users upload and edit their parking permit payroll deduction form. Simply drag and drop your document into pdfFiller's cloud platform to begin editing. The user-friendly interface allows you to modify text, fill in blanks, and adjust formatting with ease.

Incorporating eSignatures is another beneficial feature. By following straightforward steps, you can either add your signature directly or collect signatures from others involved in the approval process.

Using pdfFiller simplifies the form management process, making it easier to keep your documents organized and accessible from anywhere.

Managing your payroll deductions throughout the year

Monitoring your payroll deductions is essential for financial management. Regularly check your pay stub for accuracy, ensuring that the correct amount is being deducted for your parking permit. If discrepancies arise, promptly contact your HR or payroll department.

Life changes can necessitate updates to your deduction, so it's crucial to understand how to amend your payroll deduction form. Typically, this involves filling out a new form and submitting it to your HR department.

Being proactive about managing payroll deductions helps ensure that your financial commitments remain aligned with your current needs.

Common challenges and troubleshooting

It isn’t uncommon for errors to occur in payroll deductions. If you find that your deduction isn’t reflected correctly, the first step is to gather your pay stubs and bring them to your HR or payroll department. They should be able to investigate the issue and provide a resolution.

In scenarios where deductions exceed expectations or where an employee no longer requires a permit, understanding the procedure for deductions and potential refunds is crucial. Keep records of all payment transactions to back up any request for the reimbursement.

Navigating these challenges can be straightforward if approached with the right mindset and documentation.

Frequently asked questions (FAQs)

Employees often have numerous questions about the parking permit payroll deduction process. Common concerns include who qualifies, how payments are processed, and what steps to take when issues arise. Addressing these inquiries upfront can ease the application process and set clear expectations.

Providing clarity on these common concerns helps ensure that employees feel confident in engaging with the payroll deduction process.

Additional tips for navigating your parking permit process

Keeping track of your parking permit and payroll deductions can optimize your overall experience. Consider setting reminders for permit renewals to avoid lapses in parking privileges. Staying organized allows you to plan your finances more comfortably.

If you encounter issues or need assistance, reaching out to your employer's HR department should be your first step. They can provide resources and support to help resolve any confusion related to parking permits or payroll deductions.

Adopting these best practices can mitigate common misunderstandings and ensure a smooth experience navigating the parking permit payroll deduction process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my parking permit payroll deduction in Gmail?

How can I modify parking permit payroll deduction without leaving Google Drive?

How do I complete parking permit payroll deduction on an iOS device?

What is parking permit payroll deduction?

Who is required to file parking permit payroll deduction?

How to fill out parking permit payroll deduction?

What is the purpose of parking permit payroll deduction?

What information must be reported on parking permit payroll deduction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.