Get the free Financial Aid for Students

Get, Create, Make and Sign financial aid for students

How to edit financial aid for students online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid for students

How to fill out financial aid for students

Who needs financial aid for students?

Understanding the Financial Aid for Students Form: A Comprehensive Guide

Understanding financial aid for students

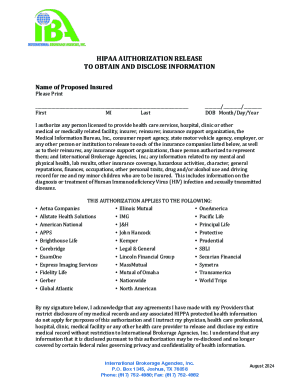

Financial aid is a crucial resource for many students pursuing higher education. It offers various types of support to cover educational expenses, making college more accessible. The main categories of financial aid include grants, loans, and scholarships. Grants are typically need-based and do not require repayment, whereas loans must be paid back with interest. Scholarships, on the other hand, are awarded based on merit or specific criteria and are also available as non-repayable aid. The importance of financial aid cannot be overstated, as it allows students to focus on their studies rather than financial burdens.

Understanding what financial aid encompasses is only the first step. To effectively navigate this complex system, students must also be aware of the eligibility criteria for receiving aid. This varies widely between federal, state, and private sources, often leading to confusion. By familiarizing themselves with these criteria, students can determine their qualifications and maximize their financial support.

Eligibility criteria for financial aid

Eligibility for financial aid varies significantly depending on the source. Federal aid often adheres to strict guidelines but remains broadly accessible to many students. To qualify, applicants typically must be U.S. citizens or eligible non-citizens, possess a valid social security number, and demonstrate financial need. State and private funding sources may have additional requirements, such as residency, enrollment status, or specific academic achievements.

Key factors influencing eligibility include family income, the number of dependents, and the cost of attendance (COA). Students are encouraged to review all available financial aid types and ensure they meet the specific criteria for each one. This preparation can significantly increase the chances of securing much-needed funding.

Key components of the financial aid application process

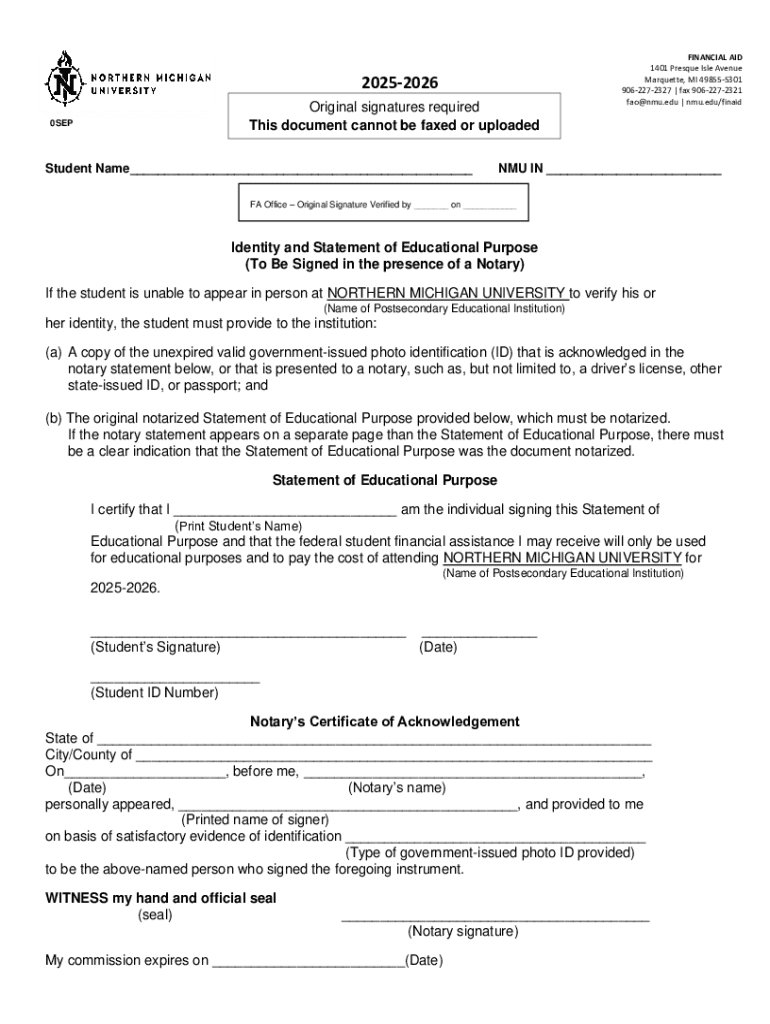

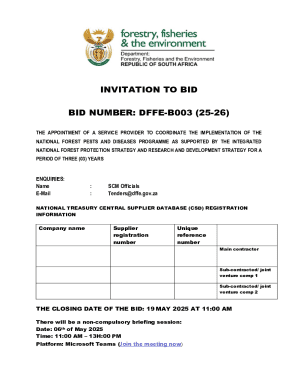

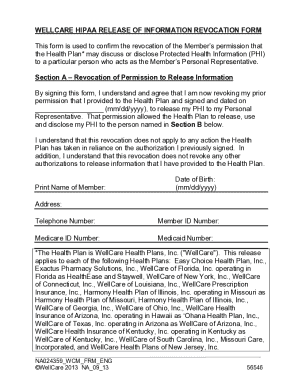

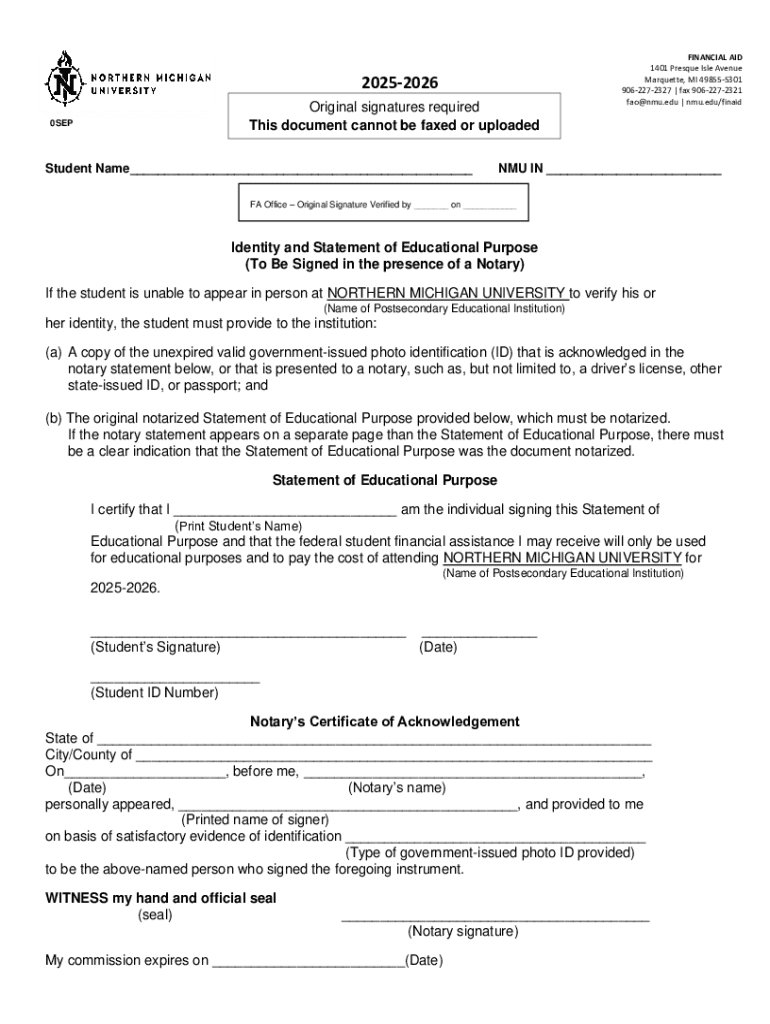

Completing the financial aid application process begins with understanding the various forms available. The FAFSA (Free Application for Federal Student Aid) is widely recognized and critical for accessing federal and state funds. It allows students to apply for multiple programs simply by filling out one form. The CSS Profile is another essential document required by some colleges, primarily for need-based scholarships. Many institutions also have their own forms that must be filled out to qualify for additional financial support.

Before starting any application, gathering the necessary documentation is essential. This documentation typically includes tax returns, bank statements, and information about assets. Organizing these documents beforehand can streamline the process and help avoid complications during submission.

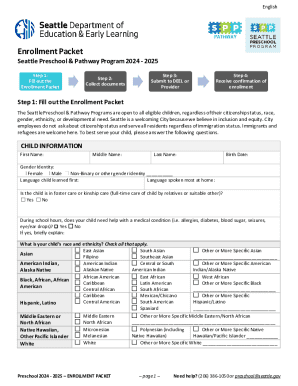

Step-by-step guide to completing the financial aid form

Accessing the financial aid forms is straightforward. The FAFSA can be completed online at the official website, while the CSS Profile can be found on the College Board's portal. Utilizing online platforms such as pdfFiller simplifies document access and editing. This tool allows students to fill out forms digitally, ensuring that they can manage their paperwork efficiently.

When filling out the financial aid form, it’s vital to approach the task methodically. Start with personal information, which includes demographics and contact details. Follow this by providing detailed financial information, such as income, assets, and any untaxed income. Additionally, students must select the schools they wish to apply to, as this information determines where the aid goes. Keeping an eye out for common mistakes—like entering incorrect information or missing deadlines—is crucial to ensuring smooth processing.

Review and submission process

Once the form is completed, review and submission are the next critical steps. Tools like pdfFiller enhance this process by providing real-time editing and feedback, ensuring that applicants can make necessary adjustments before finalizing their submission. Before submitting the form, it’s crucial to double-check all entries for accuracy. Even minor mistakes can lead to delays in funding or complications in receiving financial aid.

After submission: What to expect

After submitting the financial aid form, students will receive a financial aid package detailing their eligibility. Award letters typically include a breakdown of different types of aid, such as grants, loans, and work-study opportunities. Understanding these components is essential for making informed decisions about which offers to accept. When comparing financial aid offers from different institutions, students should consider the total cost of attendance (COA) and how much of the aid is in the form of grants versus loans.

Additional terms like Expected Family Contribution (EFC) are also important. EFC is an estimate of how much a student’s family can contribute to college costs, impacting the amount of aid a student might receive. Taking the time to review and understand these packages' intricacies helps students make the best choices for their education.

Managing your financial aid throughout college

Monitoring the status of your financial aid throughout your college journey is crucial. Students should regularly check their financial aid profiles to ensure all documentation is up to date. Additionally, renewal processes for grants and scholarships often require reapplication, so staying organized is vital. This vigilance allows students to spot any potential issues or necessary updates.

Life can bring changes that affect your financial situation, such as changes in income or enrollment status. It's essential to report these changes promptly to avoid losing aid eligibility. Resources are available for students seeking additional funding opportunities, including scholarships that may become available during their studies.

Utilizing interactive tools and resources on pdfFiller

pdfFiller serves as more than just a form-filling tool; it streamlines document management significantly for students. The platform's cloud-based environment allows for seamless document creation, editing, and eSigning. This ease of use enables students to keep all their important financial aid documents organized and accessible.

Additional interactive tools offered by pdfFiller include deadline tracking and reminders, ensuring students do not miss important submission dates. Moreover, financial aid calculators can help estimate how much aid students might be eligible to receive, providing valuable insights into their funding opportunities.

Advanced tips for maximizing financial aid

Timing your financial aid applications can significantly affect the amount of aid received. Many institutions operate on a first-come, first-served basis, so submitting applications early can improve the chances of receiving more funding. Understanding priority deadlines is equally important, as missing these could result in a loss of funds.

Negotiating financial aid offers is another strategy students should consider. If a student's financial situation changes or if they receive a more favorable offer from another institution, reaching out to the financial aid office can sometimes yield additional support. Additionally, being proactive in seeking scholarships and grants not limited to state and federal resources can greatly enhance your financial aid package.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial aid for students for eSignature?

How do I edit financial aid for students online?

How do I complete financial aid for students on an iOS device?

What is financial aid for students?

Who is required to file financial aid for students?

How to fill out financial aid for students?

What is the purpose of financial aid for students?

What information must be reported on financial aid for students?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.