Get the free Debit Mandate Form

Get, Create, Make and Sign debit mandate form

How to edit debit mandate form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out debit mandate form

How to fill out debit mandate form

Who needs debit mandate form?

Debit Mandate Form: A Comprehensive How-to Guide

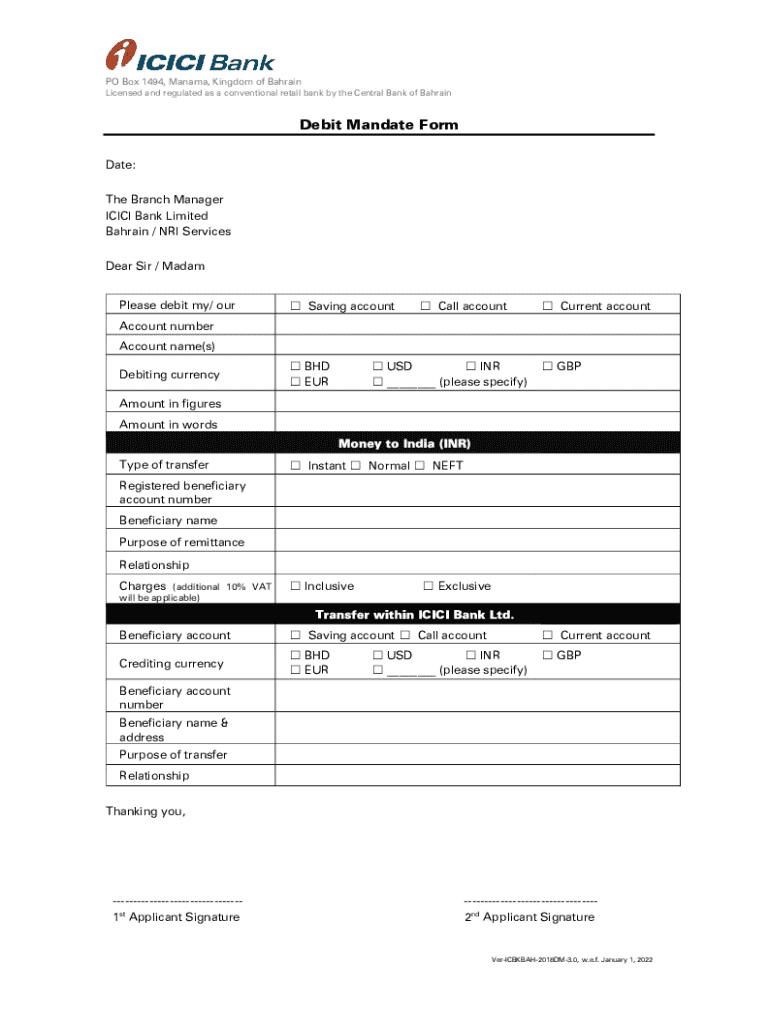

Understanding the debit mandate form

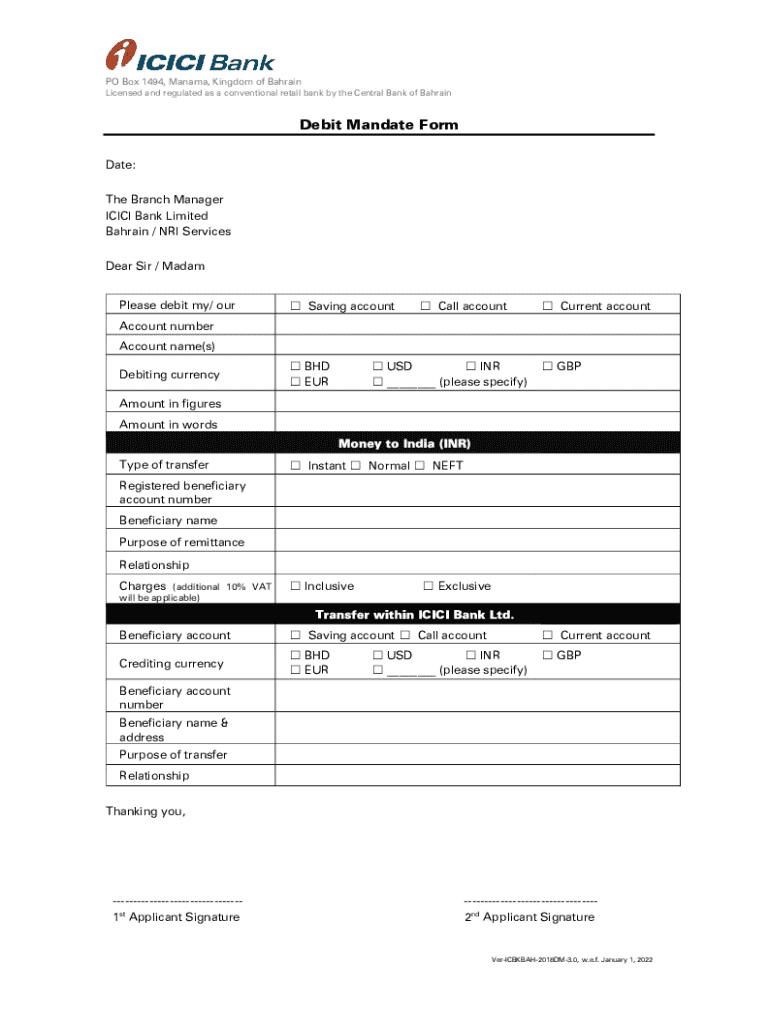

A debit mandate form is a crucial document used to authorize a third party to withdraw funds directly from an individual's or business's bank account. This form plays a key role in facilitating various transactions, such as ensuring timely payment for subscriptions, utility bills, and salaries, among others.

The essential purpose of a debit mandate form lies in its ability to streamline payment processes, making them more efficient and less prone to delays or missed payments. For both individuals and businesses, this form simplifies budgeting and expense tracking by automating recurring transactions.

Key elements of a debit mandate form

Filling out a debit mandate form accurately is essential to ensure smooth transactions. There are several key elements required, including personal identification details such as name, address, and contact information. These details help verify the identity of the account holder and ensure that transactions are authorized.

Additionally, bank account details are crucial. This includes the account number and sort code. These figures must be correctly entered to avoid any payment issues. Most importantly, the form must include authorizing signatures, which serve as a confirmation that the account holder agrees to the debit arrangements.

Steps for filling out a debit mandate form

To fill out a debit mandate form effectively, follow these step-by-step instructions to ensure accuracy: First, begin by detailing your personal information in the provided fields. This includes your full name, address, and contact number, which will later assist in verification processes. Next, proceed to enter your bank account details, ensuring that you double-check the account number and sort code to avoid potential issues.

Once you've completed these sections, take a moment to review the entire form before signing. Properly adding your signature indicates your consent to authorize the debits. It’s critical to further ensure that your signatures are compliant with your bank's identification policies, as some institutions may have specific guidelines.

Editing and customizing your debit mandate form

Utilizing tools for editing PDF forms can enhance your experience of filling out a debit mandate form. For instance, platforms like pdfFiller allow for seamless document editing and customization. Users can easily upload their forms and modify any information that may need alteration without needing to start from scratch.

Furthermore, if you're creating forms for corporate use, you can add branding elements such as company logos and specific terms or notes. This not only reinforces your brand's identity but also provides clarity on payment terms and conditions, leading to improved communication between parties.

Signing the debit mandate form

Choosing between digital signatures and traditional signatures can significantly impact the efficiency of your transactions. Digital signatures have gained legal validity in many jurisdictions, offering a convenient method to sign documents from anywhere. Utilizing tools like pdfFiller allows users to eSign their forms quickly, streamlining the overall process.

Security and compliance are paramount when dealing with sensitive financial information. By using reputable platforms for eSigning, users can ensure that their data is protected and that they remain compliant with any necessary regulations, providing peace of mind for both parties involved.

Submitting your debit mandate form

After filling out and signing your debit mandate form, the next step is submission. There are various methods of submission available. Online submission options have become increasingly popular, allowing users to send documents directly through email or specialized platforms such as pdfFiller, which simplifies the submission process.

Alternatively, one can also opt to send the form via traditional methods, such as mailing or faxing. Regardless of the method chosen, users should be prepared to encounter confirmation processes after submission. This may include receiving notification from the service provider or bank, which ensures that your form has been received and is being processed.

Managing and revoking debit mandates

Managing existing debit mandates is vital for maintaining control over financial transactions. Most individuals and businesses can access their records through their respective banks or service providers. This access allows users to review active mandates and ensure they align with their current needs and preferences.

If you need to revoke a debit mandate, there are specific steps to follow. Typically, this involves submitting a formal request to your bank or service provider to cancel the mandate. Be mindful that revoking an ongoing mandate can have implications, such as missing payments that could lead to service interruptions.

Frequently asked questions

Several common queries often arise concerning debit mandates. One frequent question is regarding the implications of insufficient funds. In such cases, the debit may be rejected, potentially leading to overdraft fees or service interruptions, emphasizing the need for careful monitoring of account balances.

Another common inquiry involves the ability to change a debit mandate once submitted. Amendments may be possible, but they typically require a formal request to the service provider. Clarifying misconceptions surrounding debit mandates helps users navigate their financial commitments with greater confidence.

Conclusion: The benefits of using a debit mandate form

Incorporating a debit mandate form into financial management routines can significantly streamline payment processes. This approach alleviates the stress of manual payments, ultimately contributing to more effective budgeting and planning. Services like pdfFiller enhance the user experience, allowing seamless editing, eSigning, and document management from any device.

Transitioning to a paperless environment is not only environmentally friendly but also practical, saving time and resources. Embracing digital solutions such as those offered by pdfFiller encourages efficiency and fosters positive outcomes in financial accountability and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete debit mandate form online?

How do I edit debit mandate form straight from my smartphone?

How do I fill out debit mandate form on an Android device?

What is debit mandate form?

Who is required to file debit mandate form?

How to fill out debit mandate form?

What is the purpose of debit mandate form?

What information must be reported on debit mandate form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.