Get the free Form 4506-c

Get, Create, Make and Sign form 4506-c

How to edit form 4506-c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4506-c

How to fill out form 4506-c

Who needs form 4506-c?

Form 4506- Form: How-to Guide Long-read

Overview of the Form 4506-

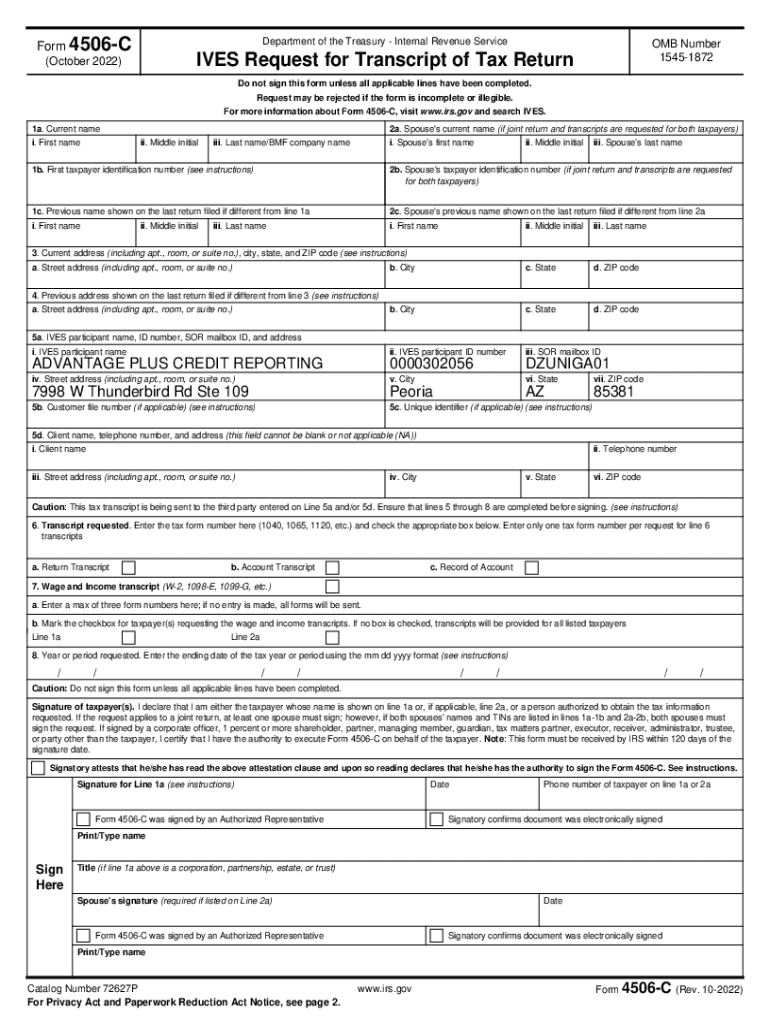

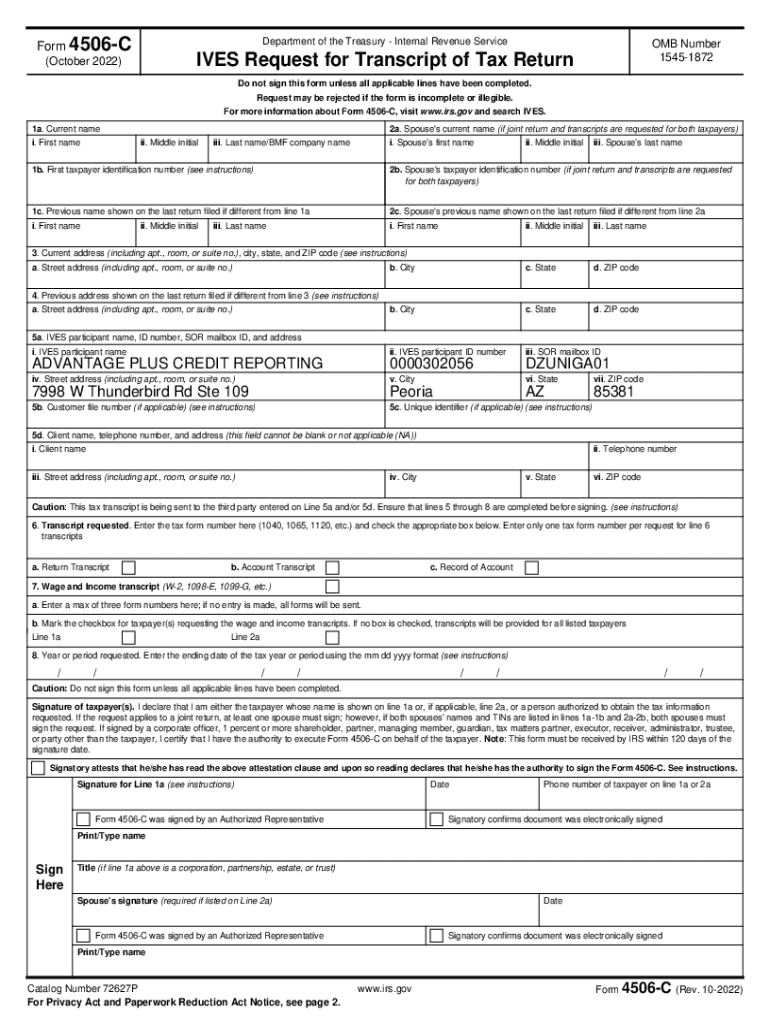

Form 4506-C is a crucial document for taxpayers who need to authorize the IRS to release their tax information to third parties. Specifically designed for financial institutions, this form is often used when applying for loans or other forms of credit. It allows lenders and other parties to verify a taxpayer's income and tax status.

Understanding the utility of Form 4506-C can make a significant difference during financial transactions. While some may opt for the conventional Form 4506 to request a copy of their tax return, the Form 4506-C provides an efficient alternative, streamlining the approval process for loans and aiding in faster financial service delivery.

Key features of pdfFiller

pdfFiller offers a variety of features tailored for users who frequently manage forms like the Form 4506-C. With an intuitive interface, pdfFiller empowers users to fill out, edit, eSign, and share documents directly from the cloud. Access from any device simplifies the process and caters to individuals and teams alike.

The platform ensures that even those unfamiliar with technology can navigate the steps required to successfully manage Form 4506-C. Its capabilities eliminate cumbersome paperwork, allowing users to focus on essential tasks without sacrificing compliance or detail.

User testimonials

Users have praised pdfFiller for its efficiency and user-friendly interface. For instance, John Doe, a small business owner, noted that pdfFiller "streamlined the entire process of submitting my Form 4506-C. I was able to gather and share my tax information quickly, and my loan was approved faster than I anticipated."

Such experiences highlight the value of utilizing a robust document management solution that caters to specific needs. Users appreciate how pdfFiller minimizes paperwork errors and ensures that the entire process is as seamless as possible.

FAQs

Common questions surrounding Form 4506-C often pertain to its usage and processing time. One frequent inquiry is the difference between Form 4506-C and the traditional Form 4506. In essence, while the former is tailored for direct transmission of tax information to financial entities, the latter requires a direct request for a taxpayer's complete return.

Another question involves processing times; typically, Form 4506-C is processed relatively quickly, depending on the IRS workload and the correctness of the submitted information.

About this document and download

What is Form 4506-?

Form 4506-C is a document used by taxpayers to allow the IRS to directly provide their tax information to third-party requesters. It serves as a binding authorization, enabling lenders, mortgage companies, and other institutions to obtain the tax data they need to verify a taxpayer's financial history.

This form is particularly important as it ensures that your financial transactions can proceed without unnecessary delays. For individuals seeking loans, being able to quickly validate income and tax information is critical in today’s fast-paced financial environment.

Downloading the form

To access Form 4506-C, visit the IRS website or pdfFiller. Follow these simple steps to download the PDF: 1. Navigate to the IRS Form 4506-C page. 2. Click on the link to download the PDF version. 3. Save the document on your device. 4. Open it using a PDF editing tool for further processing or to fill it out directly.

Requirements and uses of IRS Form 4506-

Who should use Form 4506-?

Individuals and businesses apply for Form 4506-C in diverse scenarios. For individuals, this form is essential when applying for loans, mortgages, or other financial applications that require income verification. Banks and financial institutions often rely on this documentation to assess the financial health of their clients.

For businesses, this form is equally critical. Organizations may need to provide tax documentation to secure funding, demonstrate compliance during audits, or verify income to stakeholders and partners. Ultimately, anyone needing to provide tax information to a third party should consider using Form 4506-C.

Specific situations requiring Form 4506-

There are distinct situations that necessitate using Form 4506-C, including: - Applying for loans where a lender requests proof of income. - Requesting tax transcripts for personal or business-related verification. - Providing information for financial assessments, audits or compliance checks. - Enabling third parties, such as tax preparers, to access tax details required for preparation or compliance. Understanding these scenarios helps taxpayers recognize the importance of this form.

Instructions for completing IRS Form 4506-

Breakdown of form sections

Completing Form 4506-C involves providing specific information necessary for the IRS to process the request. The key sections include: - Personal Information: This section requires the taxpayer’s name, social security number, and address. Ensuring accuracy in this area is paramount as discrepancies can lead to delays. - Tax Return Information: Indicate what type of return and the year(s) for which you want the information. Be clear and specific here, as it determines the data provided to the requester. - Signature: It is mandatory to sign and date the form for validation. An unsigned form will prompt the IRS to reject the request.

Tips for accurate completion

Accurate completion of Form 4506-C is vital to avoid complications. Here are some tips: - Double-check your social security number and other identifiers to ensure accuracy. - Specify the correct tax year to avoid unnecessary delays. - Review for legibility; avoid using cursive handwriting that may be misinterpreted. - When in doubt, consult pdfFiller's helpful resources or customer support for guidance on filling out the document correctly.

Interactive tools for managing Form 4506-

Utilizing pdfFiller for efficiency

pdfFiller's platform enhances efficiency when filling out Form 4506-C. Its real-time editing features allow users to fill out forms accurately without the hassle of traditional paper forms. Additionally, users can edit and correct mistakes instantly, reducing the time spent on revisions.

With electronic signature capabilities, users can eSign their forms directly within pdfFiller, eliminating the need for printing and scanning. This feature is particularly beneficial for users who are often on the move and require quick access to paperwork.

Cloud-based collaboration tools

For teams managing Form 4506-C, pdfFiller's cloud-based collaboration tools ensure that members can work together seamlessly. Whether it's revisions, sharing the form for input, or tracking changes, collaboration fosters efficient document management processes. Version control features allow users to monitor modifications made to the form, ensuring that the final document is accurate and complete.

Special announcement

Updates on IRS guidelines

It's essential to stay informed about updates regarding Form 4506-C. Recent changes may affect submission guidelines, processing times, and requirements. As of now, the IRS has streamlined processes for efficiency but may introduce deadlines or specifics that future users must adhere to.

Taxpayers are encouraged to verify the latest guidelines before submitting their requests, as this can prevent unnecessary complications and delays. Keeping abreast of these changes will empower users to navigate the IRS system effectively.

Related documents

In addition to Form 4506-C, understanding companion forms can enhance your tax documentation experience. Other related forms include: - Form 4506: Request for a Copy of Tax Return - Form 4506-T: Request for Transcript of Tax Return - Each of these forms serves a unique purpose and caters to specific needs in compliance or verification.

Using a comparison chart can help clarify when to use each form. For example, Form 4506 requests an actual copy of a tax return, while Form 4506-T allows for obtaining just a transcript of the tax information. Being aware of these distinctions enables users to select the right document for their needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 4506-c?

How do I execute form 4506-c online?

How do I edit form 4506-c on an Android device?

What is form 4506-c?

Who is required to file form 4506-c?

How to fill out form 4506-c?

What is the purpose of form 4506-c?

What information must be reported on form 4506-c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.