Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Fill Out Form 990: A Comprehensive Guide

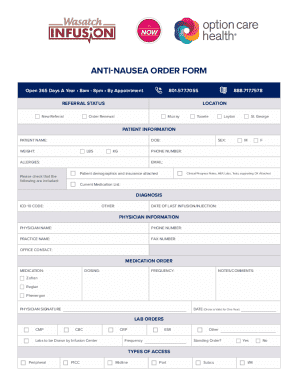

Overview of Form 990

Form 990 is an annual reporting return that tax-exempt organizations, non-profit organizations, and certain other entities must file with the IRS. It provides detailed information on the organization's mission, programs, accomplishments, and financial details. Understanding the purpose and importance of Form 990 is crucial for maintaining tax-exempt status and ensuring financial transparency.

The types of organizations required to file Form 990 include charitable organizations, social clubs, labor organizations, and business leagues. These organizations must demonstrate transparency regarding their income, expenses, and governance, which is essential for donor trust and public scrutiny.

Navigating the Form 990

Understanding the structure of Form 990 is key to ensuring accurate completion. The form is divided into several main sections, each addressing different facets of an organization's activities and financial status.

For those looking to streamline their process, interactive tools such as pdfFiller provide document creation functions that assist in the efficient navigation and filling out of Form 990.

Step-by-step instructions for completing Form 990

Before starting to fill out Form 990, it's essential to gather the necessary documentation. This includes previous year's returns, detailed financial statements, and records of revenue and expenditures. Understanding these financial documents is critical as they directly inform the reporting required by the IRS.

Common mistakes to avoid include failing to sign the return, improper reporting of income, and neglecting required schedules. It's critical to double-check your data and ensure compliance with IRS guidelines to avoid potential issues.

Editing and managing Form 990 with pdfFiller

Once your Form 990 is in progress, using pdfFiller can simplify the editing process. Uploading your document and using its editing features allows for smooth modifications to financial data. This ensures that your return reflects the most accurate and up-to-date information.

With these tools, you can manage your Form 990 more efficiently, enhancing collaboration and reducing the likelihood of errors.

Filing Form 990

When it comes to filing Form 990, choosing the correct method is essential for compliance. Organizations can opt for electronic filing or submit paper forms directly to the IRS.

Be mindful of important deadlines to avoid penalties associated with late filings. After submission, organizations should retain a copy of their filed Form 990 as part of their financial records.

Understanding compliance and record-keeping

Maintaining compliance with IRS requirements for non-profits hinges on accurate reporting and diligent record-keeping. Non-profit organizations must ensure their financial records and Form 990 align with IRS directives to maintain their tax-exempt status.

Implementing these best practices ensures your organization remains in good standing with the IRS and helps foster trust with stakeholders.

Exploring additional resources & tools

Access to additional resources can significantly enhance your understanding and capability to complete Form 990. Platforms like pdfFiller provide customer support for any inquiries, ensuring that you have expert guidance when needed.

Leveraging these resources can simplify the complexities of Form 990 and empower your organization to maintain compliance efficiently.

Form 990 FAQs

Frequent questions regarding Form 990 often center around filing requirements, common mistakes, and governance issues. Addressing these queries not only clarifies the process but also enhances an organization's readiness.

By preparing answers to these common concerns, organizations can navigate the filing process with greater confidence.

Stay updated on changes in regulations

It’s vital for organizations to stay updated on recent changes related to Form 990. Regulatory updates may impact compliance requirements or filing processes, and being informed can help avoid missteps.

This proactive approach to compliance ensures that your organization remains current with evolving regulations.

Get started with pdfFiller

To navigate the complexities of Form 990 efficiently, create an account with pdfFiller today. This platform offers a robust, cloud-based document solution that empowers users to seamlessly edit PDFs, eSign documents, collaborate with teams, and manage all necessary forms.

Utilizing pdfFiller not only simplifies the completion of Form 990 but also enhances organizational efficiency, making it an ideal choice for teams focused on compliance and transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 for eSignature?

How do I edit form 990 on an iOS device?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.