Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding and Utilizing the Credit Card Authorization Form

Understanding the credit card authorization form

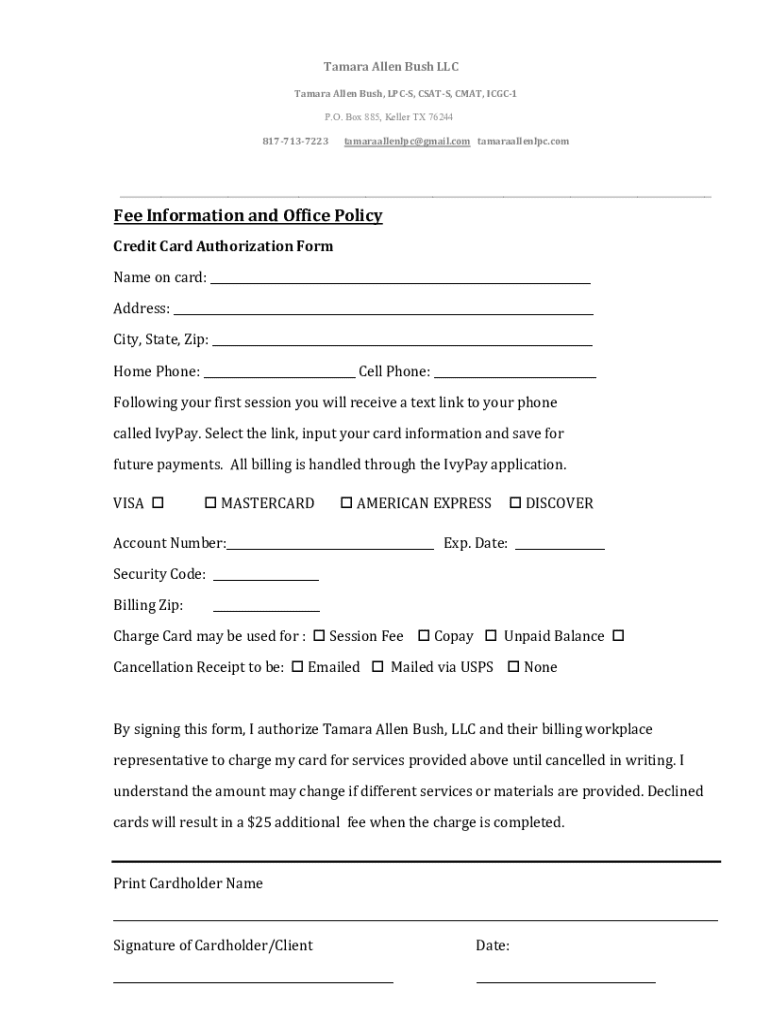

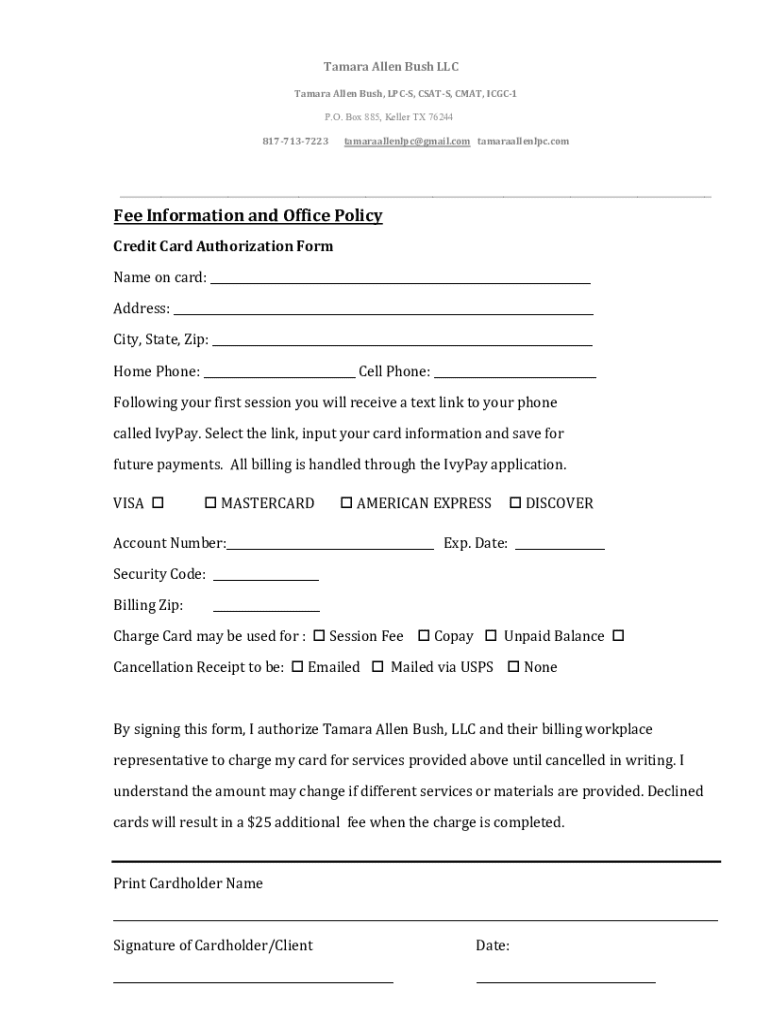

A credit card authorization form is a document designed to grant a merchant permission to charge a customer’s credit card for specified products or services. This form not only serves as a verification tool but also establishes a legal agreement between the cardholder and the business. By requiring this authorization, businesses can ensure that they are protected from fraudulent transactions.

For customers, a credit card authorization form provides peace of mind, as it assures them that their sensitive information is handled securely and used only for the intended purpose. This mutual understanding between businesses and customers underscores the significance of employing a credit card authorization form in any transaction involving card payments.

Do credit card authorization forms help prevent chargeback abuse?

Chargebacks occur when a customer disputes a transaction with their bank, often leading to the reversal of a charge. This can pose significant risks for businesses, as excessive chargebacks can result in penalties from credit card processors or even the loss of the ability to accept credit cards altogether. A credit card authorization form plays a crucial role in mitigating these risks.

By having customers complete this form, businesses can demonstrate that they possess the customer's explicit consent to charge their card, thus providing a defense against unwarranted chargebacks. This proactive approach not only protects the business from financial loss but also fosters a sense of trust and transparency with the customer.

Key components of a credit card authorization form

To be effective, a credit card authorization form must encompass several key elements. Essential information usually includes the cardholder’s personal details (name, address, and contact information), credit card information (card number, expiration date, and CVV), and consent from the cardholder acknowledging the terms of service. These components ensure that the form is clear, comprehensive, and legally binding.

In addition to these essentials, businesses should also consider including clear terms of service and cancellation policies to avoid confusion. Utilizing digital forms can expedite the authorization process, while ensuring compliance with data security regulations is paramount to protect cardholder information.

Step-by-step guide to filling out a credit card authorization form

Filling out a credit card authorization form properly minimizes errors and enhances security. To start, gather the necessary documents including an official ID and the credit card itself. Comprehending the purpose of each section will simplify the process and ensure that nothing gets overlooked.

Completing these steps with attention to detail will help in creating a valid authorization, ensuring that the transaction is executed smoothly.

Editing and customizing your credit card authorization form

Every business has unique needs, which makes customization of the credit card authorization form advantageous. Using tools like pdfFiller, businesses can easily edit standard templates to cater to specific requirements. This includes modifying the layout, adding company logos, or incorporating specific terms of service relevant to the transaction.

Adapting the form allows it to reflect your brand while ensuring compliance with payment processing regulations.

The process of sending and managing credit card authorization forms

Once the credit card authorization form is customized, sending it for signature can be efficiently managed through pdfFiller. Utilizing e-signature tools can streamline the process, enabling businesses to obtain authorization without needing physical paperwork. Tracking forms ensures that responses are managed effectively, allowing businesses to focus on core activities.

Proper management of credit card authorization forms is essential for auditing and future reference.

Frequently asked questions about credit card authorization forms

Despite the clarity that a credit card authorization form brings, several myths persist about its necessity. Some individuals believe that simply providing a credit card number suffices for authorization. However, this assumption overlooks the essential legal backing a signed form provides against potential disputes.

To avoid common mistakes, such as incorrect card details or missing signatures, it is beneficial to instruct customers clearly on how to complete the form.

Enhancing the efficiency of your document management with pdfFiller

pdfFiller stands out by enabling seamless integration with various business tools and platforms. This capability allows teams to collaborate more efficiently while managing multiple document types. The platform's user-friendly interface promotes a streamlined approach to document creation, often resulting in faster turnaround times and improved productivity.

The cloud-based flexibility of pdfFiller presents businesses with the advantage of managing documents from anywhere, allowing for real-time updates and access.

Downloadable templates for credit card authorization forms

Quality templates can significantly accelerate the process of creating credit card authorization forms. pdfFiller offers a library of professionally designed templates readily accessible for customization. Users can quickly modify these templates to suit their specific needs, reducing the time spent creating forms from scratch while ensuring compliance with legal standards.

Ultimately, using pre-made templates not only saves time but also elevates the professional quality of your documentation.

Subscribing to stay updated

Ongoing education in document management is crucial for businesses aiming to stay current with compliance and operational efficiencies. Subscribing to resources from pdfFiller ensures that users receive the latest updates on best practices, trends, and legal changes affecting documentation.

Joining pdfFiller's community facilitates continuous learning and equips businesses to manage their documentation efficiently.

Thank you for engaging with us

Implementing the knowledge you've gained about credit card authorization forms is essential for enhancing your transaction processes. Now is the time to explore more resources and tools available on pdfFiller to streamline your documentation needs. Together, we can foster a more secure and efficient approach to managing payment-related documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization form without leaving Google Drive?

How do I edit credit card authorization form straight from my smartphone?

Can I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.