Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

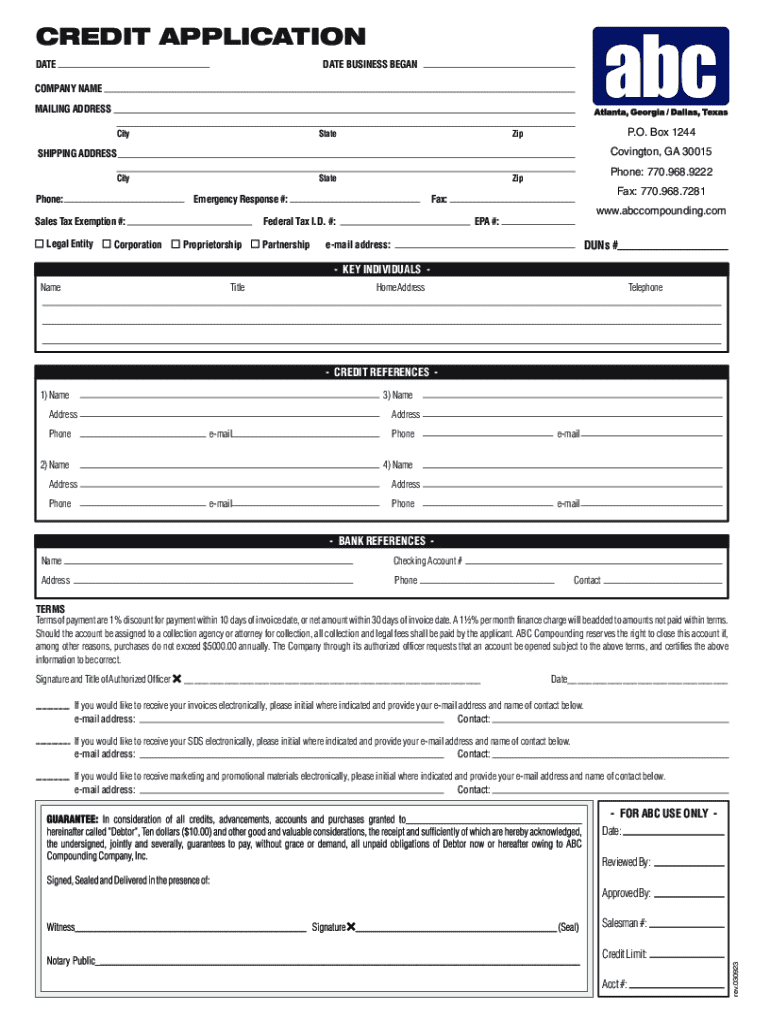

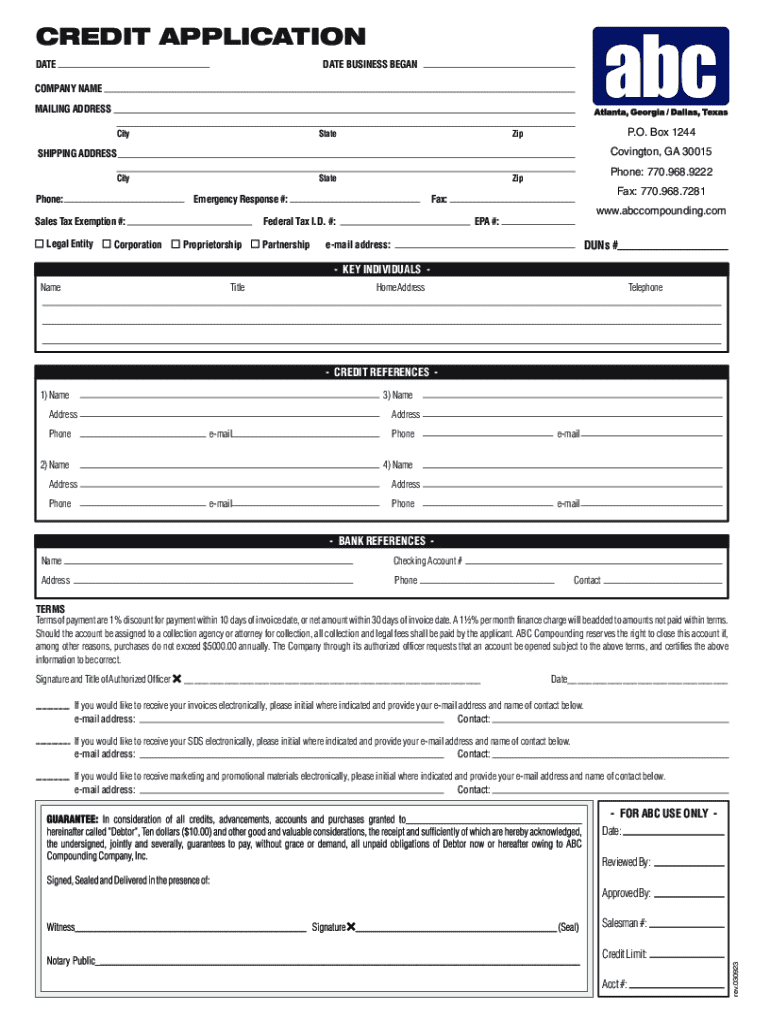

Comprehensive Guide to Filling Out Your Credit Application Form

Understanding the credit application process

A credit application form is a fundamental document that dictates the landscape of borrowing and lending. It serves as the primary tool for lenders to assess a borrower's creditworthiness and ultimately decide whether to approve a loan or credit line. Both borrowers and lenders have a vested interest in this process, as it can significantly impact not only financial outcomes but also the larger economics of lending.

Understanding the variations between personal and business credit applications is essential. Personal credit applications focus on individual financial behavior, while business applications dive into company finances, ownership structures, and operational history. Moreover, each financial institution may have distinctive requirements, which can add layers of complexity to the application process.

Key components of a credit application form

A well-crafted credit application form has several key components, which are crucial for a comprehensive assessment of an applicant's financial state. Each section holds significance in offering lenders a complete picture of the borrower’s financial health.

Step-by-step guide to filling out your credit application form

Filling out your credit application form accurately is vital. Here’s a step-by-step guide to simplify the process and enhance your chances of a successful application.

eSigning and submitting your credit application form

eSigning has transformed the way individuals and organizations handle documentation. With pdfFiller, electronically signing your credit application form is both secure and legally binding.

Managing your credit application after submission

Once your credit application has been submitted, maintaining awareness of its status is crucial. With pdfFiller’s suite of tools, users can effectively manage their applications post-submission.

Additional tools and features on pdfFiller

pdfFiller goes beyond just serving as a document editing tool; it offers advanced features tailored for teams and individual users alike. Collaboration and efficiency are key.

Frequently asked questions about credit application forms

As individuals navigate the credit application process, several inquiries often arise. Understanding common misconceptions can pave the way for a smoother experience.

Appendix

For your convenience, we've included an appendix that offers additional resources. These can help you further understand credit application forms, their nuances, and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit application without leaving Google Drive?

How do I complete credit application online?

Can I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.