Get the free Conventional Limited Review Condominium Questionnaire

Get, Create, Make and Sign conventional limited review condominium

Editing conventional limited review condominium online

Uncompromising security for your PDF editing and eSignature needs

How to fill out conventional limited review condominium

How to fill out conventional limited review condominium

Who needs conventional limited review condominium?

A Comprehensive Guide to the Conventional Limited Review Condominium Form

Understanding the Conventional Limited Review Condominium Form

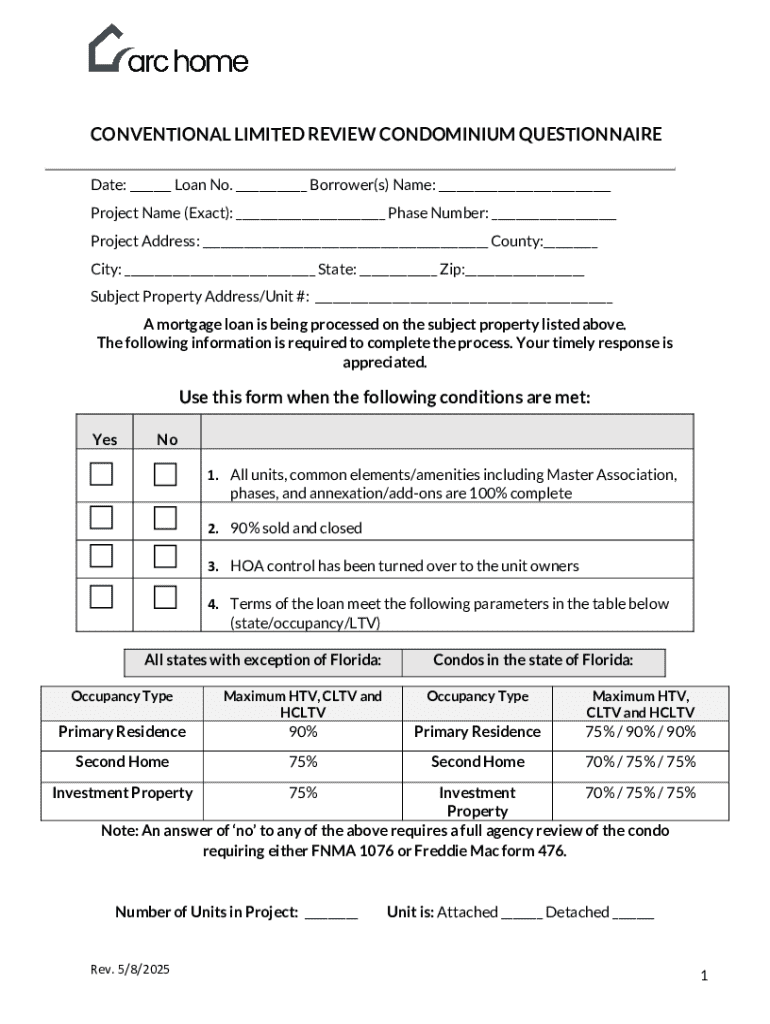

The Conventional Limited Review Condominium Form plays a critical role in streamlining real estate transactions, particularly those involving condominiums. This specialized form expedites the approval process for buyers and lenders by reducing the amount of documentation and vetting typically required in a standard review process. Unlike conventional methods, a limited review focuses on the essential elements of a property and its financial conditions, allowing for quicker transactions, which is essential in today’s fast-paced market.

A key distinction between standard and limited review processes lies in their requirements. While standard reviews demand comprehensive documentation and more extensive scrutiny of the project’s overall health, limited reviews shift the focus primarily onto the buyer's qualifications and the project's basic status. This results in a reduced burden on both buyers and sellers, defining its significance in the real estate landscape.

Eligibility requirements for limited review

For a condominium unit to qualify for the Conventional Limited Review, specific criteria regarding unit and project type must be met. Generally, only certain types of units in FHA-approved projects are eligible. Projects under government assurance that demonstrate good financial health and proper governance can improve approval chances. For example, units within homeowner associations that maintain stable financial records and minimal delinquencies are typically considered.

Beyond the type of unit, buyer eligibility also plays a significant role. Buyers must display adequate financial health, including creditworthiness evidenced by credit scores and a clean financial history. Furthermore, existing homeowners association dues should reflect timely payments without excessive late fees. This minimal scrutiny allows lenders to expedite the review process significantly.

Step-by-step guide to completing the form

Completing the Conventional Limited Review Condominium Form may seem daunting, but following a systematic approach can simplify the process. Start by gathering necessary documentation, such as previous tax returns, W-2 forms, pay stubs, and bank statements. This documentation verifies your financial status and gives a complete picture to lenders.

Next, fill out the basic information in the form, ensuring accurate details regarding the buyer, seller, and property. Then, navigate to the financial section. Entering accurate income, assets, and debts is crucial; any discrepancies could lead to delays or denials.

Upon completion, carefully review the eligibility criteria, ensuring you meet all conditions. The final step is submission. Depending on the lending institution, you may submit the form online, via mail, or through a secured portal, making familiarity with these options beneficial.

Common mistakes to avoid

Mistakes can lead to the rejection of your application or unnecessary delays in the approval process. One common error is providing incomplete information; it’s vital that every section of the form is filled out accurately. Incompleteness can raise red flags for lenders, delaying your transaction.

Another pitfall involves misunderstanding fees and dues associated with homeowners associations. Buyers must clarify any obligations regarding special assessments or ongoing fees; misrepresentation in this area can derail the funding process. Finally, ensure you are aware of submission timelines. Late documents may result in applications being disregarded, impacting purchase agreements.

Tools for managing your document

Utilizing interactive PDF features can significantly enhance the completion of the Conventional Limited Review Condominium Form. Platforms like pdfFiller provide fillable fields, allowing users to navigate forms seamlessly without the hassle of printing and scanning. You can fill out information digitally, reducing mistakes caused by handwriting.

Additionally, eSigning and collaboration capabilities enable you to get signatures from stakeholders quickly, expediting the approval process. Users can easily share documents for review and approval. Lastly, managing your form on a cloud-based platform like pdfFiller ensures that important documents are stored safely and accessible from anywhere, greatly aiding in organization and retrieval.

FAQs about the limited review process

After submitting the Conventional Limited Review Condominium Form, many buyers wonder about the subsequent steps. Typically, you can expect processing timelines to vary, but feedback often comes within a few weeks. It's crucial to stay informed and ready to respond to any additional inquiries from lenders.

In cases of denial, buyers may seek to appeal the decision. This process usually involves addressing the reasons for denial, which can include financial issues or project classification. Submitting additional documentation or seeking clarification can often help facilitate re-evaluation.

For a successful limited review approval, maintaining clear communication with lenders and ensuring all submitted documentation is accurate is paramount. Understanding lender requirements upfront can greatly enhance the approval chances.

Navigating the aftermath of filing

Once your Conventional Limited Review Condominium Form is submitted, understanding post-submission protocols becomes essential. Regularly monitoring the status of your application can provide peace of mind and help you respond swiftly if additional information is mandated by the lender.

Moreover, you may encounter conditional approvals, which place certain stipulations on the approval. It’s critical to manage these carefully by adhering strictly to outlined requirements, as failing to comply may lead to re-evaluations or nullification of the approval.

Final reminders

In summary, successful navigation through the Conventional Limited Review Condominium Form relies heavily on understanding the detailed requirements, eligibility criteria, and the step-by-step completion process. Highlight the importance of thoroughness in documentation and the need for clear communication with lenders. Leveraging platforms like pdfFiller simplifies ongoing document management, allowing you to concentrate on securing your property.

Utilizing the features offered by pdfFiller not only enhances the current process but also establishes a solid foundation for handling any future document needs. By staying organized and informed, users can ensure a seamless experience in both current and future endeavors within the real estate domain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the conventional limited review condominium in Chrome?

Can I create an electronic signature for signing my conventional limited review condominium in Gmail?

How do I edit conventional limited review condominium on an iOS device?

What is conventional limited review condominium?

Who is required to file conventional limited review condominium?

How to fill out conventional limited review condominium?

What is the purpose of conventional limited review condominium?

What information must be reported on conventional limited review condominium?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.