Get the free Form No. 13

Get, Create, Make and Sign form no 13

Editing form no 13 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 13

How to fill out form no 13

Who needs form no 13?

Form No 13 Form: Your Comprehensive How-to Guide

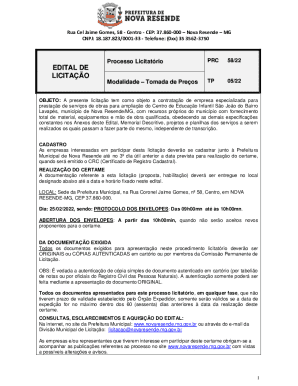

Overview of Form No 13

Form No 13 is a key document used in various administrative and legal processes. It serves multiple purposes, primarily related to regulatory compliance and formalizing transactions. Understanding its definition and purpose is critical for anyone required to complete the form.

Accurate filling of Form No 13 is imperative. An incorrectly submitted form can lead to legal implications, such as penalties or the denial of applications. Furthermore, inaccuracies can significantly impact processing time, delaying critical operations or approvals.

Key features of Form No 13

Form No 13 comprises several distinct sections and fields that need careful attention. The personal information section typically requires your full name, address, contact details, and potentially identification numbers. These details ensure that the form is tied to the right individual or entity.

Another crucial part of the form focuses on financial disclosures. You might need to provide income details or information about any pertinent contracts. Specific fields that require careful attention often involve dates, signatures, and ensuring that all mandatory sections are completed.

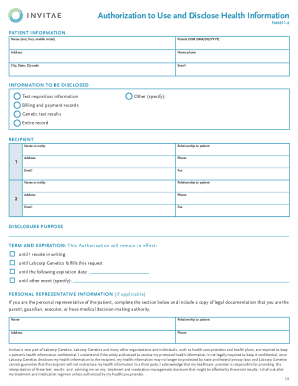

Step-by-step guide to completing Form No 13

To successfully complete Form No 13, start by gathering all necessary information. This might include personal identification, financial documents, and any previous correspondence related to the matter at hand. Verifying the accuracy of this data is crucial to avoid future complications.

Once you've compiled the necessary documents, begin filling out the form. Take your time with each section and follow instructions closely. Ensure that your handwriting is clear, or, if completing it digitally via solutions like pdfFiller, that the formatting is consistent.

After filling out the form, it's vital to review your submission meticulously. Create a checklist to ensure all sections are filled out, and use tools or resources to double-check your provided information against the original documents.

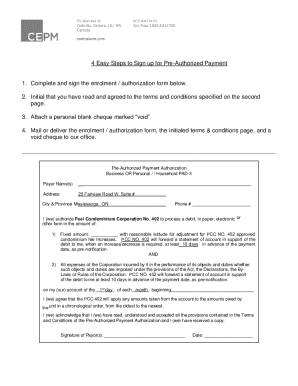

Editing and managing Form No 13 with pdfFiller

pdfFiller offers a robust platform for managing Form No 13 effectively. Its interactive tools allow users to edit forms seamlessly. You can access various features, such as adding, removing, or modifying fields directly on the document.

Additionally, pdfFiller provides convenient eSigning options. To securely eSign the form, follow simple prompts which guide you through the signing process. You can also invite collaborators to review and edit the document, ensuring all inputs are accurate and compliant before submission.

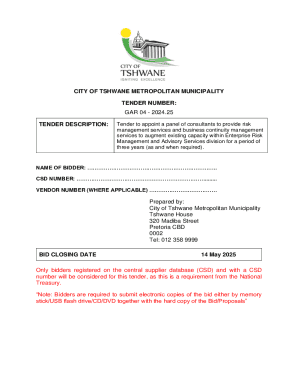

Submitting Form No 13

When it comes to submission, understanding your options is crucial. Form No 13 can typically be submitted both digitally and physically, depending on regulatory requirements. Make sure to identify the correct submission channel, whether it's a specific email address or a physical mailing address.

After submission, it's wise to track the status of your form submission. Implement best practices for following up, like keeping records of submission dates and confirmation receipts, in case any complications arise.

Frequently asked questions about Form No 13

If mistakes are found post-submission, the appropriate course of action is to contact the relevant authority immediately. Depending on their guidelines, you may need to submit a correction or a new form altogether. Knowing the right protocol will save time and potential legal troubles.

Amending Form No 13 after submission can vary by jurisdiction. Always check with your local authority if amendments are permitted and what procedures you must follow. If you're facing complex issues, such as the clarification of specific terms or conditions, seeking guidance from professionals or the issuing authority is advisable.

Real-life applications of Form No 13

Form No 13 is commonly utilized across various scenarios. For instance, individuals may need it for tax-related matters, while organizations might use it for regulatory submissions. Each application highlights the significance of accurately completing the form.

Clients have reported successful resolutions and compliance through the proper use of Form No 13. For example, a small business owner managed to receive a tax refund by ensuring all the needed information was presented thoroughly and correctly.

Best practices for managing documents with pdfFiller

Managing documents like Form No 13 through pdfFiller can streamline the process significantly. To keep your forms organized, implement a systematic filing approach, labeling each document clearly for easy access.

Security is another essential consideration. pdfFiller's compliance features help protect your data privacy, ensuring that sensitive information remains confidential. Leveraging cloud-based functionalities allows you to access your documents anytime, anywhere, which enhances both efficiency and convenience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form no 13 for eSignature?

How do I make edits in form no 13 without leaving Chrome?

Can I create an eSignature for the form no 13 in Gmail?

What is form no 13?

Who is required to file form no 13?

How to fill out form no 13?

What is the purpose of form no 13?

What information must be reported on form no 13?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.