Get the free Balance Due

Get, Create, Make and Sign balance due

How to edit balance due online

Uncompromising security for your PDF editing and eSignature needs

How to fill out balance due

How to fill out balance due

Who needs balance due?

Balance Due Form: A Comprehensive Guide

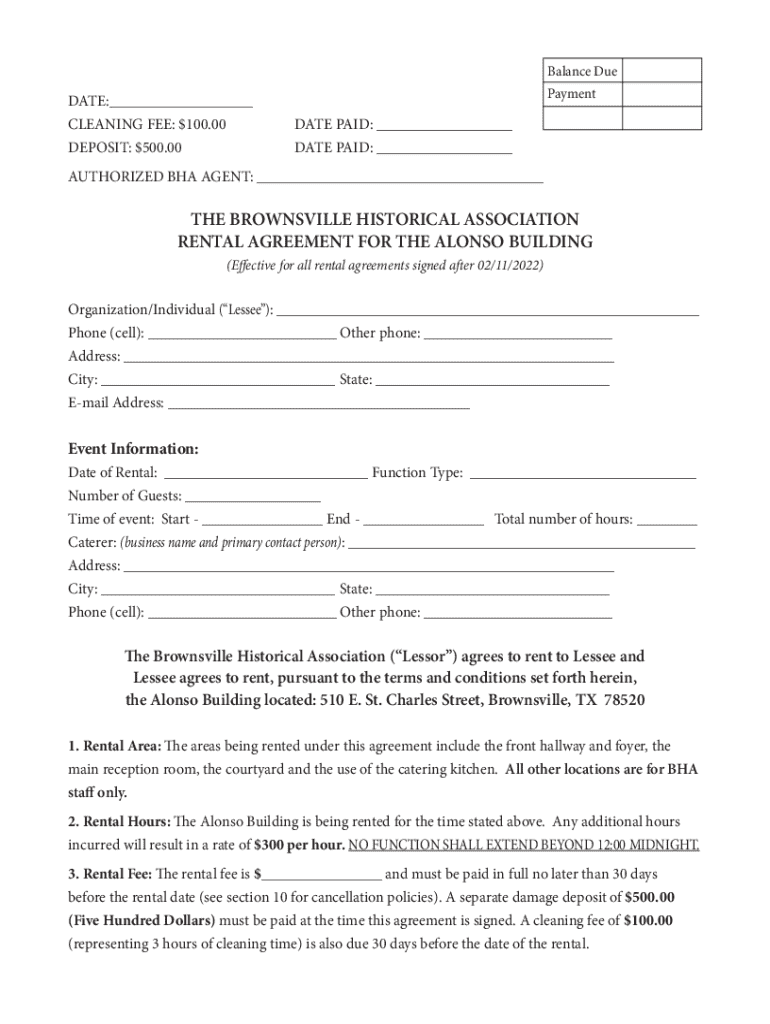

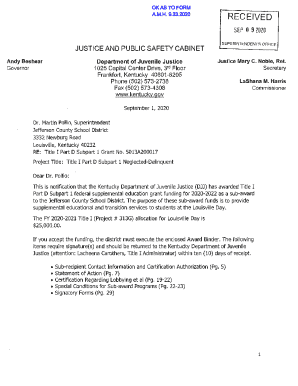

Understanding the balance due form

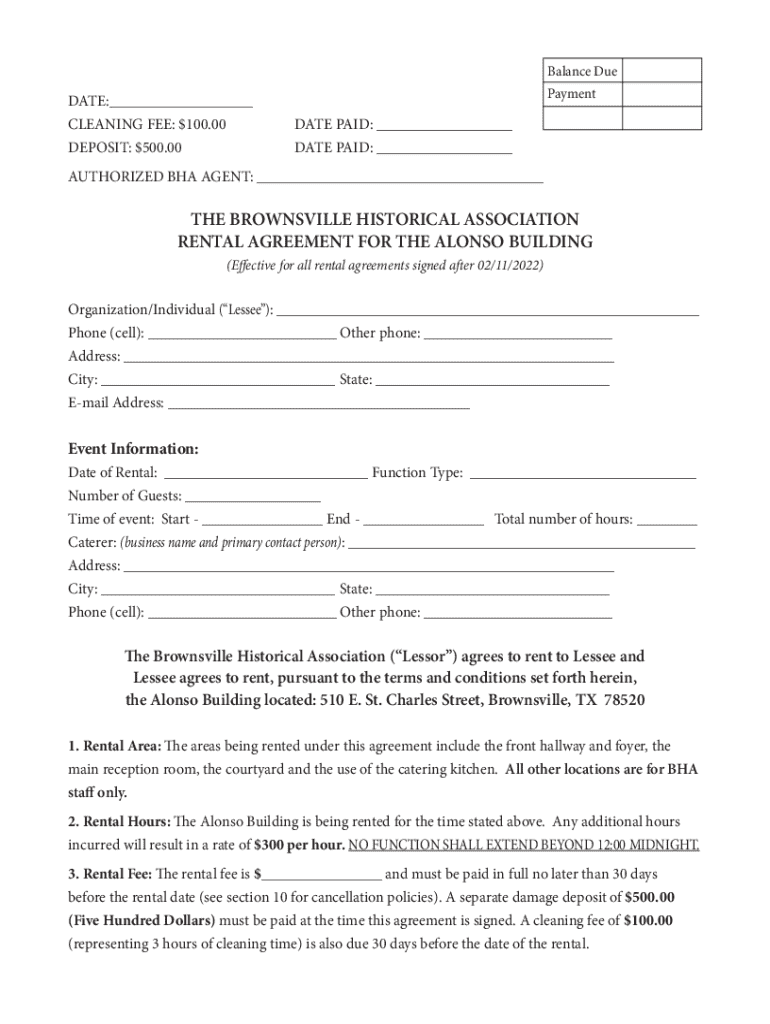

A balance due form is a financial document that outlines the amount owed by an individual or business for services rendered or products delivered. It serves as a formal request for payment, ensuring both the payer and payee are on the same page regarding outstanding balances.

The importance of balance due forms cannot be overstated, as they play a critical role in personal and business finances. For individuals, they help manage personal debts and obligations effectively, while for businesses, they serve as vital tools for tracking payments, managing cash flow, and maintaining healthy client relationships.

Common scenarios where a balance due form is utilized include freelance work, where contractors submit these forms to clients for payment, as well as service industries like healthcare and education where recurring payments are common. Overall, it ensures clarity and accountability in transactions.

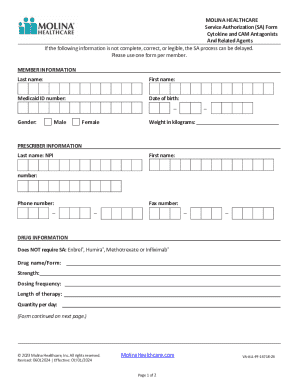

Key components of a balance due form

Creating an effective balance due form requires understanding its essential elements. Here are the key components:

Formatting the balance due form professionally also enhances clarity. Utilize clean lines, readable fonts, and structured layouts to ensure all information is easily accessible and presented in an organized manner.

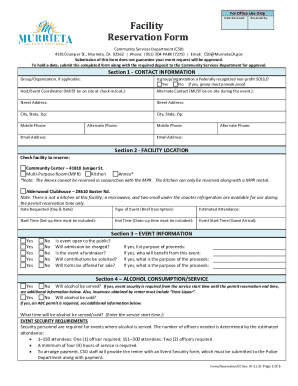

When and why to use a balance due form

Balance due forms can be relevant in various personal finance situations. Freelancers and contractors often use these forms to remind clients of payments owed for their work. These forms serve to clarify the exact services rendered and the amount due, minimizing misunderstandings that could arise over payments.

In familial settings, services like babysitting or pet care also benefit from balance due forms, providing a straightforward record of services and associated costs. This is particularly useful among family members or friends, where informal agreements can lead to disputes. Having a written balance due form helps clarify obligations.

For businesses, balance due forms are essential in invoicing clients, especially for recurring services such as subscriptions or retainers. They streamline the payment process and establish a clear due date, which is crucial for maintaining cash flow. In time-sensitive scenarios, having a balance due form can prompt quicker payment and reduce the risk of late payments.

Step-by-step guide to completing a balance due form

Completing a balance due form requires careful attention to detail. Here’s a step-by-step guide:

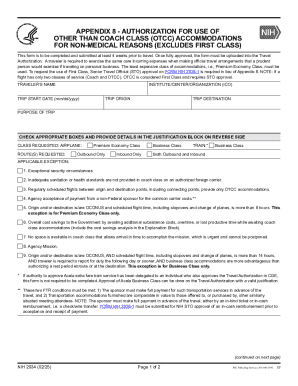

Editing and customizing your balance due form

To make your balance due form more effective, consider customizing it. Tools like pdfFiller allow you to edit and refine your forms with ease. Start by adding professional branding elements such as logos and color schemes that reflect your business aesthetics.

Saving templates for future transactions can save time and ensure consistency. Creating a visually appealing design can reflect professionalism, fostering trust with clients and ensuring timely payments.

Electronic signatures and submission

The role of electronic signatures in validating balance due forms is crucial in the digital age. eSignatures offer a streamlined way to authorize a document without the need for physical copies, making transactions faster and more efficient.

With pdfFiller, you can electronically sign your form securely and submit it directly to the payer. Best practices include ensuring that all fields are correctly filled out before sending, and utilizing secure channels for sharing completed forms to maintain confidentiality.

Managing your balance due forms with pdfFiller

Using pdfFiller, you can organize your balance due forms effectively. The platform allows you to access your documents from anywhere, facilitating quick edits or updates as necessary. Its user-friendly interface helps keep your documents structured and easy to locate.

Additionally, pdfFiller offers collaboration features, allowing you to share forms with teams or clients directly. You can also track the status of sent forms to ensure follow-ups on payments happen in a timely manner, mitigating potential issues.

Common questions and troubleshooting

Encountering issues is common when dealing with balance due forms, so it's essential to have a plan for troubleshooting. One frequent concern is disputes over charges. Keeping detailed records and communicating openly with clients can often resolve these disagreements amicably.

Another common issue arises when payments are not received by the due date. In such cases, sending a reminder along with a copy of the balance due form can prompt quicker action. If unauthorized modifications occur post-submission, you can use pdfFiller to send updated versions or address the changes quickly.

Additional considerations

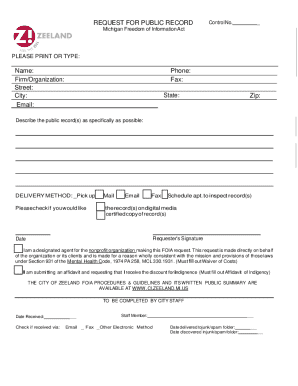

It's important to be aware of state or region-specific regulations regarding balance due forms. Depending on your location, there may be certain legal requirements for how these forms should be structured or provided, particularly concerning tax regulations or income reporting.

Ensuring compliance with such regulations is crucial—failing to do so can lead to tax audits or fines. Therefore, be thorough in your documentation and stay informed about changes in local laws that may impact how you present your balance due forms.

Conclusion: Maximizing efficiency with balance due forms

Using a balance due form can significantly improve the efficiency of financial transactions. This straightforward document not only clarifies payment expectations but also strengthens the professional image of freelancers and businesses alike.

Leveraging tools like pdfFiller can simplify the document management process. By utilizing their capabilities, users can create, edit, and send forms securely, ensuring they maintain healthy financial practices while minimizing complications.

Explore more with pdfFiller

In addition to balance due forms, pdfFiller offers various other forms that complement your financial management needs, such as receipts and invoices. These templates streamline your documentation process, allowing you to focus more on your work.

Explore the collection of relevant templates and tools available on pdfFiller to enhance your document handling and streamline payments effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get balance due?

How do I edit balance due straight from my smartphone?

How do I edit balance due on an Android device?

What is balance due?

Who is required to file balance due?

How to fill out balance due?

What is the purpose of balance due?

What information must be reported on balance due?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.