Get the free Multilateral Agreement on Investment

Get, Create, Make and Sign multilateral agreement on investment

How to edit multilateral agreement on investment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out multilateral agreement on investment

How to fill out multilateral agreement on investment

Who needs multilateral agreement on investment?

Understanding and Navigating the Multilateral Agreement on Investment Form

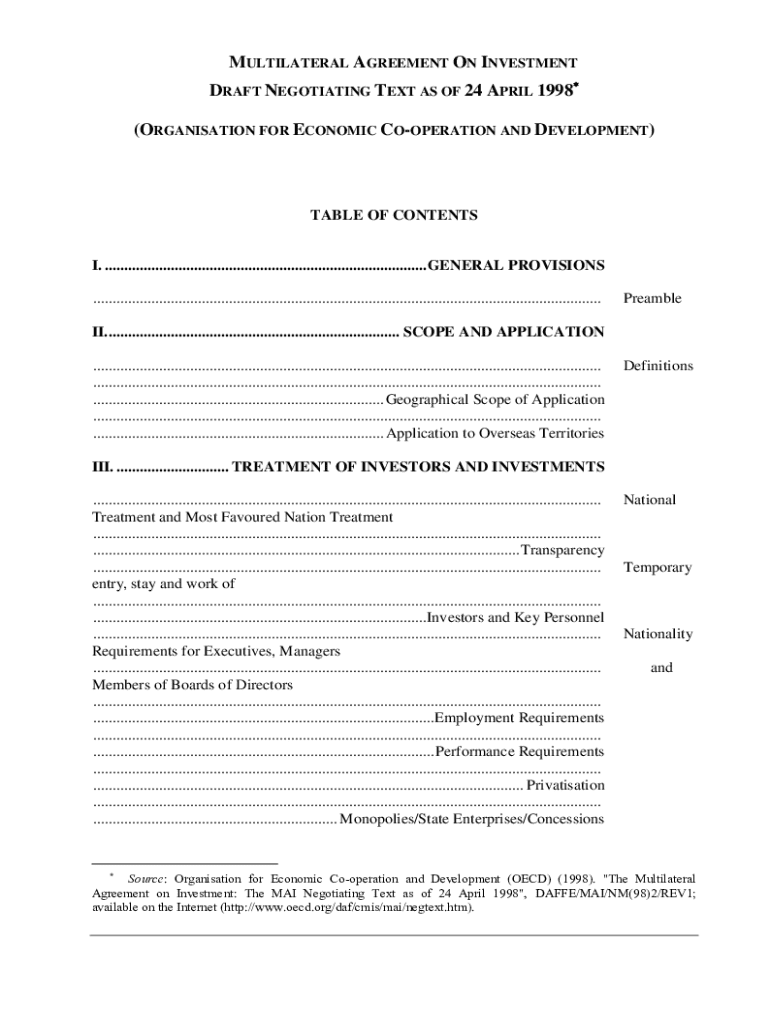

Understanding the multilateral agreement on investment (MAI)

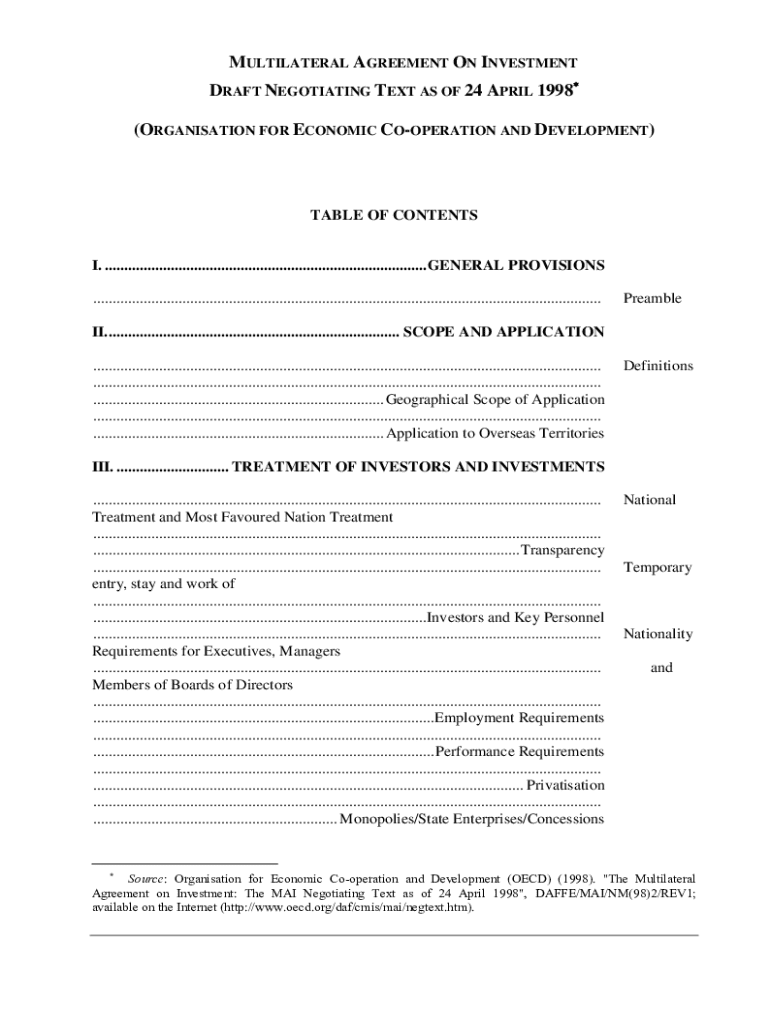

The Multilateral Agreement on Investment (MAI) is a proposed international treaty aimed at creating a uniform framework for investment across participating nations. While the concept of the MAI emerged in the late 20th century, its significance has only grown with globalization and the increasing interdependence of economies. The MAI seeks to protect and promote foreign investments by establishing the rights and obligations of investors and host countries.

Historically, discussions surrounding the MAI began in the 1990s under the Organisation for Economic Co-operation and Development (OECD). Although it faced significant opposition from various advocacy groups and was ultimately shelved, its principles have influenced various bilateral agreements and trade treaties globally. The importance of the MAI in international trade lies in its potential to enhance investor confidence, thereby increasing foreign direct investment (FDI), essential for economic growth and development.

Overview of the MAI form

The MAI form is a crucial document designed to capture essential details about investments made under the terms of the agreement. This form serves multiple purposes, including gathering data for regulatory compliance, facilitating investment approvals, and ensuring transparency in foreign investment activities. Companies or individuals looking to invest in a foreign nation’s economy typically need to fill out this form.

Filling out the MAI form is not just a bureaucratic requirement; it assures host countries of the legitimacy of the investment and helps to streamline the approval process. It's particularly relevant in circumstances involving significant financial commitments, such as establishing a new business, acquiring land, or expanding existing operations in a foreign market.

General provisions of the MAI

The MAI delineates several key principles that govern the investment landscape across participating countries. Among these principles are the promotion of fair and equitable treatment, the protection against expropriation without compensation, and the assurance of full protection and security for foreign investments. These foundational elements are designed to build investor trust and stimulate increased economic interaction.

Participating countries in the MAI have the responsibility to uphold these principles, particularly in terms of judicial remedies for investors if disputes arise. Additionally, investors must adhere to their commitments outlined in the MAI, which include complying with local laws and regulations. The MAI also includes specific provisions for amendments, which require consensus among member countries, reflecting the need for collaborative governance.

Scope and application of the MAI

The scope of the MAI is carefully defined to encompass various sectors and industries, promoting greater connectivity and trade relations between member countries. This includes sectors such as manufacturing, services, agriculture, and technology, allowing for a wide range of investment opportunities. However, the MAI does not apply universally; certain industry-specific limitations, especially those related to national security and public welfare, are explicitly outlined.

Understanding the applicability of the MAI helps investors assess whether their planned activities fall within the framework's protections. Additionally, clarifying the sectors that may be excluded from MAI provisions allows for informed decision-making based on localized dynamics and regulatory environments.

Treatment of investors and investments

The rights and protections afforded to investors under the MAI are central to its objectives. Investors benefit from assurances regarding the treatment of their investments, such as the right to receive prompt and adequate compensation in the event of expropriation, ensuring that their capital remains safeguarded. This is crucial for attracting foreign direct investments, as it lays down a clear legal framework.

In addition to investment protections, the MAI specifies guidelines to ensure equitable treatment of all investors, regardless of their country of origin. This non-discriminatory stance is vital in fostering an inclusive environment that encourages diverse participation in the global market.

Investment protection mechanisms

The investment protection mechanisms outlined in the MAI are designed to provide a robust framework for safeguarding investor interests. These protections encompass various dimensions, including prevention of unjust expropriation and stipulations for compensation when such events occur. For instance, if a government seizes private property for public use, investors are entitled to receive fair market value to mitigate financial loss.

Further, the MAI establishes a framework for lawful measures that impact foreign investments, allowing governments to enforce regulations while providing clarity on permissible actions. This balance is essential to ensure a conducive investment climate, reducing fears of arbitrary government actions among foreign investors.

Dispute settlement procedures

Disputes in the context of the MAI can arise due to various issues, including treaty violations or disagreements over investment treatments. The MAI outlines a structured dispute settlement process designed to resolve such grievances effectively. This process often involves several steps, beginning with negotiations between parties, followed by mediation, and potentially leading to arbitration if a resolution remains elusive.

International arbitration plays a crucial role in this process, offering a neutral avenue for resolving disputes outside domestic courts. By providing a transparent and impartial means of settling disagreements, investors feel more secure in their ventures, knowing there is a reliable recourse to enforce their rights.

Exceptions and safeguards within the MAI

While the MAI seeks to protect investors, it also recognizes the need for exceptions and safeguards to address specific circumstances. For instance, provisions are included for national security and public order concerns, allowing nations to implement necessary measures that might otherwise contravene the MAI's obligations. These exceptions are critical for balancing the interests of national regulators and foreign investors.

Additionally, temporary measures might be enacted in response to economic crises, ensuring countries can take the necessary steps to protect their economies while still being mindful of their commitments to investors. Consequently, the MAI aims to maintain a level of flexibility that acknowledges the dynamic nature of international investments.

Additional considerations in the MAI

The MAI interacts intricately with other international agreements, reinforcing mutual commitments while maintaining clarity on specific stipulations. This interplay emphasizes the need for investors to stay informed about other relevant treaties that may impact their business operations, thereby achieving a comprehensive understanding of their rights and obligations.

In the financial services sector, the MAI reinforces commitments to transparency and non-discrimination, crucial for attracting foreign investments. Furthermore, taxation considerations are crucial in the context of the MAI; investors must understand their tax obligations and rights to avoid unexpected liabilities.

Filling out the MAI form: step-by-step guide

Completing the MAI form requires careful preparation and thorough attention to detail. To begin, investors need to gather necessary documents such as proof of identity, details of the investment, and relevant financial information. A clear understanding of each section of the form is essential to avoid delays in the investment process.

Each part of the MAI form has a distinct purpose. For instance, the 'Applicant Information' section will necessitate personal and business identification details. The 'Type of Investment' section requires specifics about the investment vehicle, whether it be equity, debt, or other forms. Furthermore, disclosing risk factors and ensuring legal compliance are critical for maintaining transparency.

To ensure accuracy, it’s vital that applicants double-check each section before submission. Common mistakes include incorrect information entry or missing signatures, which can delay approvals and create unnecessary complications.

Managing your MAI documents with pdfFiller

pdfFiller offers a powerful platform for managing MAI documents efficiently. Users can edit and sign the MAI form digitally, allowing for smoother workflows and reducing the need for physical paperwork. Collaboration features enable teams to work together on investment agreements, ensuring that every stakeholder can contribute effectively.

Furthermore, pdfFiller incorporates robust security measures to protect sensitive investment data, including encryption and secure storage solutions. This focus on security ensures that users can confidently manage their MAI-related documents while maintaining compliance with all necessary legal and regulatory standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the multilateral agreement on investment in Chrome?

How can I edit multilateral agreement on investment on a smartphone?

How do I edit multilateral agreement on investment on an Android device?

What is multilateral agreement on investment?

Who is required to file multilateral agreement on investment?

How to fill out multilateral agreement on investment?

What is the purpose of multilateral agreement on investment?

What information must be reported on multilateral agreement on investment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.