Get the free Bank Verification Form Template

Get, Create, Make and Sign bank verification form template

How to edit bank verification form template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bank verification form template

How to fill out bank verification form template

Who needs bank verification form template?

A comprehensive guide to bank verification form template form

Understanding the bank verification form

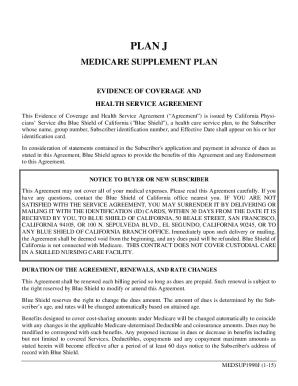

A bank verification form is a crucial document utilized to authenticate the existence and details of a bank account held by an individual or entity. Its primary purpose is to provide assurance to third parties about the legitimacy of the account, facilitating processes such as loan approvals, rental applications, or employment checks. The bank verification form not only serves to protect the financial interests of businesses and service providers but also assures consumers that their transactions are handled securely.

The importance of a bank verification form spans various transactions, making it a staple in different administrative processes. It provides banks, employers, and other institutions with essential information necessary for handling financial matters, ensuring that everything is above board.

When is a bank verification form required?

Bank verification forms are often required in several key scenarios. For instance, during the loan application process, lenders need to confirm the applicant's financial stability and their ability to repay the borrowed sum. Additionally, real estate agencies often use this form when assessing potential tenants for rental properties to ensure they can meet rental obligations. Employment scenarios may also require this form, particularly for jobs that involve handling money or sensitive financial information.

Common industries employing bank verification forms include real estate, finance, and insurance, among others. Understanding when this form is needed helps streamline various procedures involving monetary transactions, ensuring that all parties are accurately represented and that the accounts being dealt with are legitimate.

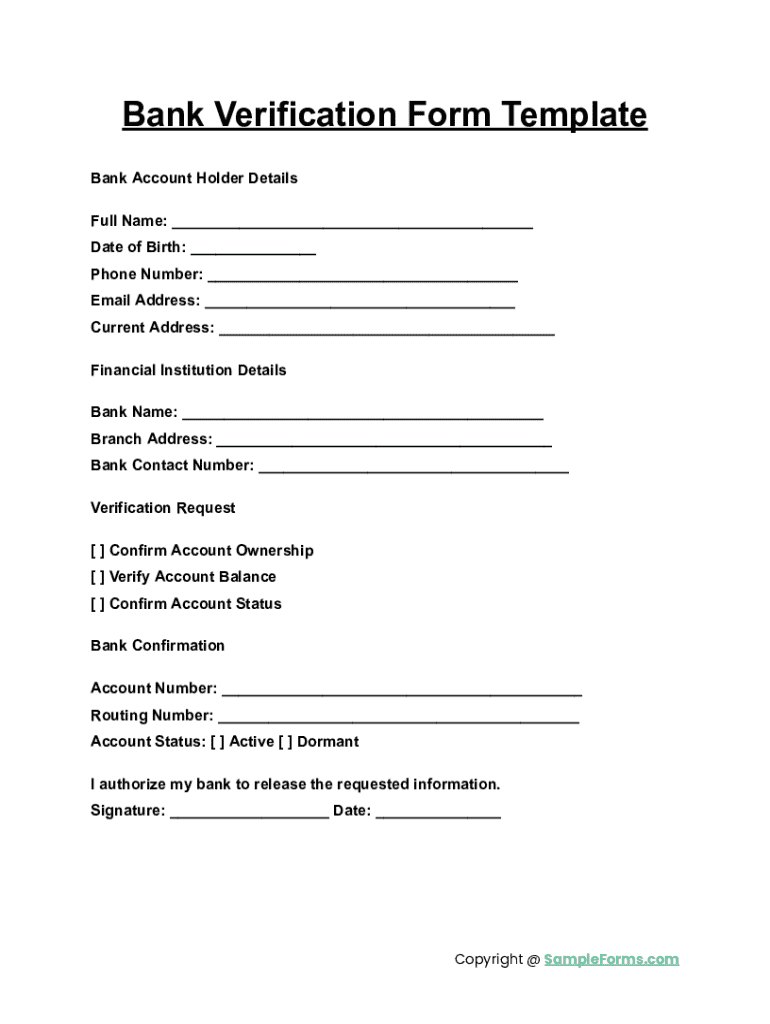

Key components of a bank verification form

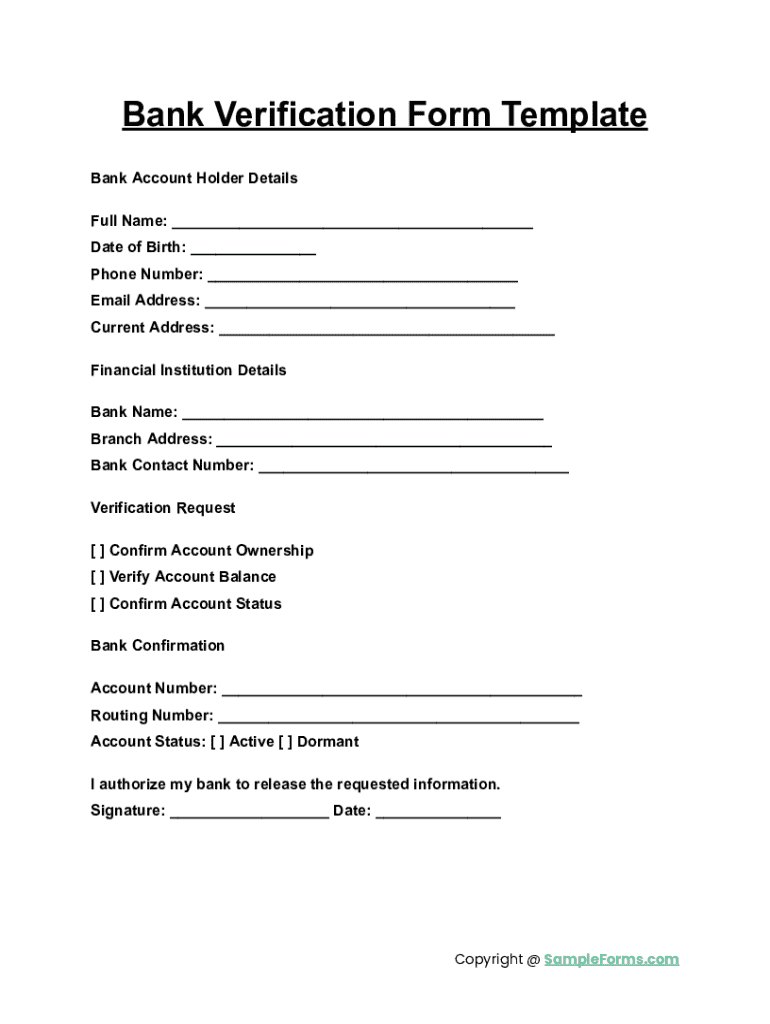

To effectively verify a bank account, certain essential information is required on the bank verification form. This includes personal details of the account holder, such as their name, address, phone number, and potentially their Social Security number. Financial details are equally important, necessitating the completion of sections detailing the account type, account number, current balance, and whether the account is a joint account.

In addition to the completed form, supporting documents play a vital role in the verification process. Commonly required documents include a government-issued ID, recent bank statements, or any official correspondence from the bank confirming account details. Ensuring that all information is accurate and complete not only expedites the verification process but also helps prevent delays.

How to fill out a bank verification form

Filling out a bank verification form may seem daunting, but it can be straightforward if completed step by step. Begin by entering personal information accurately, ensuring that the holder name and other details match those on your identification. Next, you will need to provide specific bank details, including your account number, account type, and balance.

In the subsequent sections of the form, you will typically be required to address questions about the account's purpose, and verify whether it is an individual, joint, or business account. It’s crucial that every section is accurately completed as incomplete or incorrect information can lead to delays in the verification process.

Common mistakes to avoid

While completing the bank verification form, it's easy to make mistakes that could compromise the entire process. Common errors include incorrectly entering the account number, omitting essential details like the holder name or account type, and failing to sign or date the document. Such mistakes can significantly delay the verification process, leading to unnecessary back-and-forth communications with the bank or the requesting entity.

To prevent these errors, consider reviewing the form with a second pair of eyes, or utilizing an interactive platform like pdfFiller, which simplifies the process by allowing you to edit and double-check your entries before submission. Preparing your documentation can also ease the burden; have all necessary documents accessible to provide any additional information required swiftly.

Options for editing and customizing your bank verification form

One of the strengths of utilizing pdfFiller is that it provides you with an intuitive platform to edit your bank verification form template. You can easily access a variety of pre-designed templates that cater to specific needs. Editing is straightforward; just upload your existing document or choose from a vast library of templates available through the site.

The customization options encompass text fields, checkboxes, and even the ability to add your branding if you're using the form for business purposes. With pdfFiller, you can ensure that the form meets your specifications while retaining both its functional integrity and compliance with local regulations.

Collaborating on your form

If you are working in a team or need third-party input, pdfFiller accommodates collaboration seamlessly. The platform allows you to invite colleagues or stakeholders to review or edit the bank verification form. Users can add comments, make edits, and provide feedback in real-time, significantly streamlining the completion of necessary documentation.

This collaborative feature is particularly true for organizations where multiple individuals contribute to the verification process. By centralizing all edits and comments within one platform, pdfFiller enhances teamwork, reduces errors, and expedites the preparation of the bank verification form.

Signing and submitting the bank verification form

After completing the bank verification form, the next step involves signing and submitting it. pdfFiller offers a user-friendly electronic signature (eSignature) option that simplifies this process. You can eSign directly on the platform, often eliminating the need for printing, scanning, or emailing physical copies. This feature is not only time-saving but also adds an extra layer of convenience, especially when dealing with remote transactions.

Once signed, you have several options for submission. Forms can be sent directly to the bank or the requesting party via electronic means, making the entire workflow efficient. Additionally, tracking the submission status is possible through pdfFiller, ensuring you remain informed about where your form stands in the verification process.

Managing your bank verification forms

Managing bank verification forms efficiently ensures that you have easy access to your records when needed. pdfFiller allows for the organization of your forms through cloud storage, giving you the ability to categorize documents based on date, type, or status. This method not only streamlines access but also enhances document management by ensuring that everything is neatly filed and retrievable when necessary.

Version control is another key benefit of managing your forms within pdfFiller. Saving updates allows you to keep track of changes over time, providing a reliable history of your submitted bank verification forms. This is particularly important in case you need to reference or refer back to previous submissions, promoting organized documentation practices.

Archiving and retrieving forms

Best practices for maintaining records of your bank verification forms involve proper archiving techniques. pdfFiller facilitates ease of archiving, ensuring that all filled documents are stored securely within the cloud, making retrieval straightforward whenever needed. Having a well-organized archive can save significant time and stress, especially during busy periods when documentation is required.

When searching for archived forms, pdfFiller's search functionality allows you to quickly identify and retrieve your files based on keywords or tags. This feature not only saves you time but also enhances your ability to manage financial records by ensuring you can quickly access essential information when necessary.

Frequently asked questions (FAQs)

Many users have common inquiries regarding the bank verification process. For instance, one prevalent question is what to do if your bank verification form is rejected. Often, reviewing the details submitted provides insight, allowing for corrections or additional information which may help address the issue promptly.

Following up on the verification status is another common concern. It's advisable to maintain an open line of communication with the requesting party to get updates on your application, ensuring that all parties are informed and aligned.

Policies and procedures

Each bank has specific policies regarding the verification forms they accept. Understanding these guidelines can help streamline the verification process and ensure that you submit correctly formatted and detailed forms. Most banks recommend double-checking all requirements before submission to avoid unnecessary complications.

Guidelines typically include best practices around document submission, including the preferred means of delivery, whether by postal mail or electronic submission, depending on the institution's preferences. Familiarizing yourself with these policies ensures that your application is handled as efficiently as possible.

Real-life applications of bank verification forms

Individuals often use bank verification forms in various personal scenarios such as securing a mortgage, applying for a rental apartment, or confirming a bank account for government subsidies. These forms provide a layer of transparency and security, giving landlords, lenders, and institutions the assurance they need while safeguarding personal financial data.

In business scenarios, these forms are equally significant. Companies might utilize the bank verification forms for employment verification to ensure candidates’ financial responsibilities are legitimate, or when applying for business credit lines. The forms substantiate a business's financial health, thus enabling informed decision-making by lenders and partners.

Advantages of using pdfFiller for your bank verification needs

Choosing pdfFiller for handling your bank verification forms comes with numerous benefits. The platform provides users with comprehensive document management features, ensuring forms are easily editable, sharable, and manageable in one place. Streamlining the editing process and collaboration capabilities enhances team productivity and efficiency.

Additionally, pdfFiller emphasizes security and compliance, allowing users to maintain privacy and data protection when filling out sensitive forms. With the platform’s commitment to adhering to various financial regulations, users can proceed with confidence, ensuring their documentation is reliable and secure.

Popular templates related to bank verification forms

Alongside the standard bank verification form template, pdfFiller offers a range of other relevant templates that enhance the document management experience. From employment verification letters to financial statements, having access to a variety of complementary forms allows users to create a cohesive documentation package for any financial undertaking.

These templates can simplify the process of creating necessary documentation, enabling users to maintain consistency in their submissions. With pdfFiller, you can effortlessly access and create additional templates tailored to specific needs, making it a versatile tool for managing financial forms and documentation seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bank verification form template to be eSigned by others?

How do I execute bank verification form template online?

Can I edit bank verification form template on an iOS device?

What is bank verification form template?

Who is required to file bank verification form template?

How to fill out bank verification form template?

What is the purpose of bank verification form template?

What information must be reported on bank verification form template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.