Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

Editing campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign finance receipts and form: A comprehensive guide

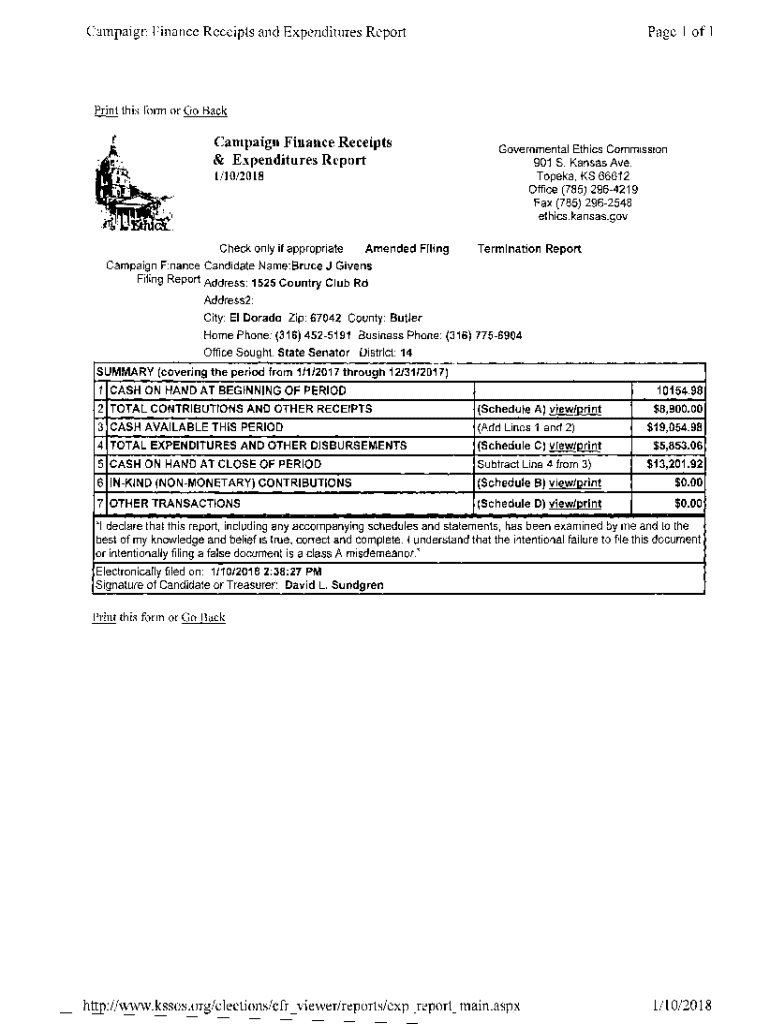

Understanding campaign finance receipts

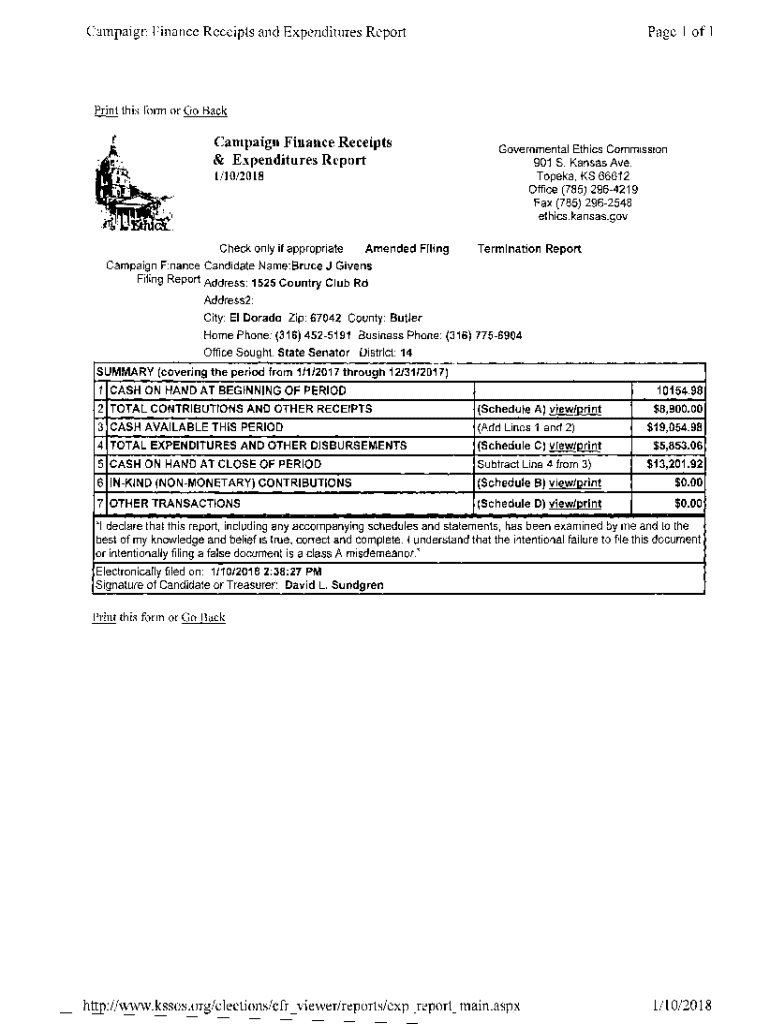

Campaign finance receipts are crucial components of political fundraising, representing the documented inflow of money into a campaign. These receipts serve as an official record that tracks contributions and expenditures, ensuring transparency and accountability in the political process. For candidates, committees, and their supporters, maintaining accurate and detailed financial documentation is not only a legal requirement but also fundamental in building trust with constituents.

The importance of tracking campaign finance receipts cannot be overstated. Properly documented receipts facilitate compliance with the laws governing campaign finance, thereby safeguarding candidates and their teams from potential legal ramifications. Moreover, transparency in financial dealings helps promote public trust, as voters are increasingly interested in where campaign funds originate and how they are utilized.

Key components of campaign finance receipts

Every campaign finance receipt should include several key components. Firstly, itemized contributions must record the name and address of contributors, the date of the contribution, and the amount given. Secondly, expenditures must also be meticulously documented, detailing the recipient, the purpose of the spending, and the amount paid out. Thirdly, legal requirements necessitate that campaign finance receipts be kept for a designated period, typically several years, allowing for audits and transparency checks.

Importance of compliance

Compliance with campaign finance laws is critical. Failure to properly report campaign finance receipts can lead to serious consequences such as hefty fines, disqualification of candidates from running for office, or even criminal charges in extreme cases. Campaign finance is governed by regulatory bodies like the Federal Election Commission (FEC), which establishes rules on how political contributions and expenditures must be reported. Understanding and adhering to these regulations is not just a legal obligation but also reinforces the integrity of the electoral process.

Types of receipts in campaign finance

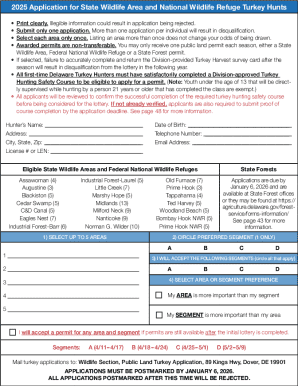

Campaign finance receipts can be categorized into several types, each subject to specific regulations and limits. Individual contributions, for instance, refer to donations made by private citizens, and these are typically capped at a certain amount per campaign cycle as defined by law. This ensures a level playing field where wealth does not unduly influence electoral outcomes.

Individual contributions

Individual contributions are essential to campaign financing, and understanding the associated limits is crucial for compliance. Contributors are restricted to giving a maximum amount, which varies by election cycle and by local or federal regulations. Documentation must include the contributor's details and the date and amount of the contribution, ensuring all information is precise and legible.

Corporate contributions

Corporate contributions are also regulated under campaign finance laws. In many jurisdictions, direct contributions from corporations to candidates are prohibited; however, corporations can donate to political action committees (PACs). These PACs must then distribute funds in accordance with strict regulations and disclose contributions fully. Transparency in corporate donations is essential to ensure that voters understand where funding originates.

In-kind contributions

In-kind contributions—donations of goods or services instead of cash—must also be recorded as part of campaign finance receipts. Examples include volunteer services, campaign materials, or advertising space provided by a media outlet. Accurately reporting in-kind donations can be more complex, as fair market value must be assigned to these contributions. Proper documentation should reflect the nature of the contribution and its assessed value to maintain compliance.

Required forms for filing campaign finance receipts

Filing campaign finance receipts necessitates the completion of specific forms designated by regulatory bodies. These forms vary depending on the type of campaign, but the Federal Election Commission (FEC) provides guidance on essential filing requirements. Key forms include the FEC Form 3, which is the report of receipts and expenditures for federal candidates, among others tailored to PACs and party committees.

Overview of necessary forms

Comprehensively understanding the necessary forms is essential to successful filing. Each form serves a distinct purpose and must be accurately filled out to reflect the financial status of the campaign. For instance, Form 3 summarizes all contributions and expenditures, while additional forms may be used to report independent expenditures or specific types of contributions. Knowledge of what each form entails will help candidates and their teams maintain compliance and avoid errors.

Detailed instructions for completing the forms

Completing campaign finance forms can seem daunting, but following detailed instructions can simplify the process. Begin by gathering all necessary documentation—contribution receipts, expenditure records, and supporting invoices. Next, ensure clarity and accuracy in entering each data point, double-checking names, amounts, and dates. Be mindful of deadlines, as late filings can incur penalties. Utilizing pdfFiller can streamline this process, allowing for easy customization of forms and ensuring prompt filing.

Tips for accuracy and compliance

Maintaining accuracy is critical in campaign finance reporting. Develop a systematic approach to documenting transactions, such as creating templates for recording contributions and expenditures that your team can easily follow. Consistently reviewing these documents before submission can help catch errors. Furthermore, adopting electronic forms allows quicker revisions and also provides easy access to historical records.

Using pdfFiller for campaign finance management

When it comes to managing campaign finance receipts, utilizing technology can simplify the process significantly. pdfFiller offers robust tools designed specifically for handling campaign finance forms, making it easier to create, edit, and sign necessary documents from anywhere, at any time. This cloud-based document management system facilitates collaboration between team members while enriching tracking capabilities.

Features of pdfFiller for handling campaign finance forms

pdfFiller provides a suite of features tailored for political campaigns. Document storage allows users to keep organized records that are easily accessible, while eSigning capabilities enable candidates to quickly sign forms without the hassle of printing. Collaboration tools facilitate shared access among team members, ensuring everyone can stay updated on financial management.

Step-by-step guide for using pdfFiller

To get started with pdfFiller, first create an account on the platform and log in. After that, you can upload your necessary forms directly onto the interface. Navigating the platform is straightforward; you can utilize interactive tools to fill out forms and electronically sign them if needed. The service also allows you to annotate documents, making it easy to highlight critical areas or add notes for your records.

Case studies or user experiences

Numerous campaigns have successfully streamlined their finance management processes by integrating pdfFiller. For example, a local candidate used pdfFiller to manage contributions effectively, enabling quick updates and timely submissions of compliance forms to local election officials. User testimonials frequently highlight how pdfFiller has saved time and reduced the financial management burdens often seen in political campaigns.

Managing and storing campaign finance receipts

Effective management and storage of campaign finance receipts are vital for compliance and easy retrieval. Keeping these documents organized also aids in preparing for any audits that may arise. Best practices involve creating a clear filing system for both digital and physical receipts, ensuring that all entries are easily traceable and backed up. With pdfFiller, you can create and store digital files that are fully searchable, enhancing the efficiency of your campaign management.

Best practices for record keeping

Good record-keeping habits bolster compliance and streamline the finance management process. Utilize labels and categorization systems for different types of contributions and expenditures, ensuring consistency across records. Retain receipts and agreements for in-kind contributions to have a comprehensive view of the campaign’s financial landscape. Backing up your data in a secure location, whether physical or cloud-based, can safeguard against loss.

Tips for easy retrieval and organization

To maximize efficiency, consider implementing a digital filing system utilizing pdfFiller. Create a logical structure that allows for easy categorization of various receipts and forms. Adding tags or notes within the documents supports better identification. Regularly reviewing archives and purging unnecessary documents can keep your records concise and relevant.

Auditing and reviewing your financial reports

Periodic audits of your campaign finance reports are essential. Conducting these reviews not only ensures compliance but also identifies discrepancies early on. Leverage tools within pdfFiller to generate reports and compare them against your financial records for accuracy. Establishing a routine for these audits—monthly or quarterly—can significantly enhance your oversight and reduce stress leading up to filing deadlines.

FAQs regarding campaign finance receipts and forms

Several questions frequently arise in the context of campaign finance receipts and forms. One common query is: 'What if contributions exceed the legal limit?' In such cases, the excess amount must be returned to the contributor immediately to remain compliant. Another question is: 'How should I handle in-kind contributions?' These should be reported similarly to cash contributions, assigning a fair market value and documenting the specifics.

Additional queries often revolve around managing unexpected audits. Candidates should maintain detailed records to support any claims and keep an organized digital filing system for easy access during these evaluations. Remember, transparency is key, and being proactive in addressing compliance issues fosters a culture of accountability.

Interactive tools and resources

Interactive checklist for preparing campaign finance receipts

Using an interactive checklist can ensure that all necessary steps are completed before finalizing your campaign finance receipts. This checklist might include critical items like confirming contribution limits, ensuring proper documentation, checking for timely filings, and reviewing compliance with regulations.

Templates available on pdfFiller for efficient document creation

pdfFiller offers various templates designed specifically for campaign finance documentation. These templates can be customized to fit the particular needs of your campaign, ensuring that all relevant data points are captured and formatted correctly. Utilizing templates can also save time and reduce errors during data entry.

Links to regulatory body resources

Staying informed about campaign finance regulations is crucial. Therefore, keeping links readily available to resources from regulatory bodies, such as the FEC, can help candidates and their staff assure they comply with the most current rules. Additionally, these resources often provide valuable educational materials and updates on any changes to campaign finance laws.

Staying informed about campaign finance regulations

Continuous education regarding campaign finance regulations fosters adherence to the evolving political landscape. Subscribing to newsletters or online platforms dedicated to campaign finance can provide timely updates about new laws or alterations to existing rules. Being part of forums or social media groups focused on political campaign management also offers insight into best practices and shared experiences.

Tracking changes in legislation

Pay close attention to announcements from legislative bodies regarding campaign finance regulations. Joining webinars or attending workshops focusing on political compliance can also deepen your understanding. Maintaining proactive measures ensures that your campaign remains compliant, avoiding any potential pitfalls related to new laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my campaign finance receipts and directly from Gmail?

How do I execute campaign finance receipts and online?

How do I complete campaign finance receipts and on an iOS device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.