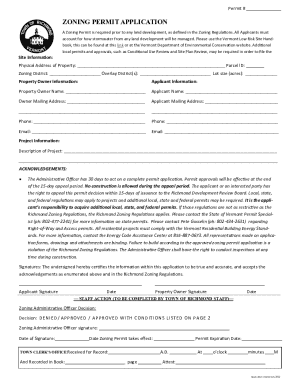

Get the free Occupational Tax Certificate Application

Get, Create, Make and Sign occupational tax certificate application

Editing occupational tax certificate application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out occupational tax certificate application

How to fill out occupational tax certificate application

Who needs occupational tax certificate application?

Occupational Tax Certificate Application Form: A Comprehensive Guide

Understanding the occupational tax certificate

An occupational tax certificate is an official document issued by a local tax authority, allowing individuals and businesses to operate legally within a specific jurisdiction. Its primary purpose is to ensure compliance with local tax laws and regulations while serving as a means for the government to collect revenue. For both individuals and businesses, obtaining this certificate is critical, as it showcases legitimacy and adherence to the pertinent legal framework within the community.

For businesses, an occupational tax certificate is often a prerequisite for acquiring licenses or permits required to conduct operations. For individuals, especially those engaging in freelance or contract work, the document helps establish credibility with clients and customers. However, many misconceptions exist regarding the occupational tax certificate, including beliefs that it is solely a tax liability or that it is only necessary for large businesses. In reality, anyone engaging in an occupation within a locality might require one.

Eligibility criteria for application

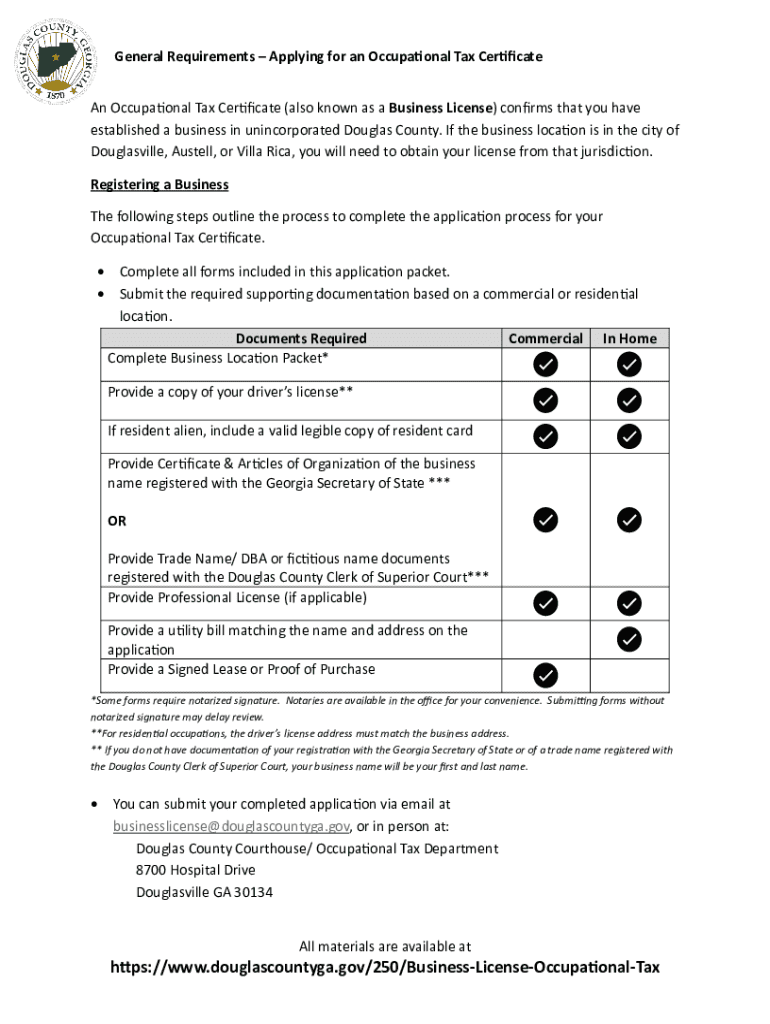

Understanding who needs an occupational tax certificate is crucial for a seamless application process. Generally, any person or business that operates within taxation jurisdiction is obligated to obtain this certification. Requirements may vary per state or locality; therefore, it is wise to consult the relevant tax department to clarify specific criteria.

Different applicants may face varied stipulations. For instance, sole proprietors may need only to provide basic identification and business details, while corporations could be required to submit additional documentation such as incorporation papers. Notably, some exemptions exist for charitable organizations or specific professions, such as certain governmental roles, which may not be liable for occupational taxes. Understanding these nuances can save applicants time and reduce potential delays in the application process.

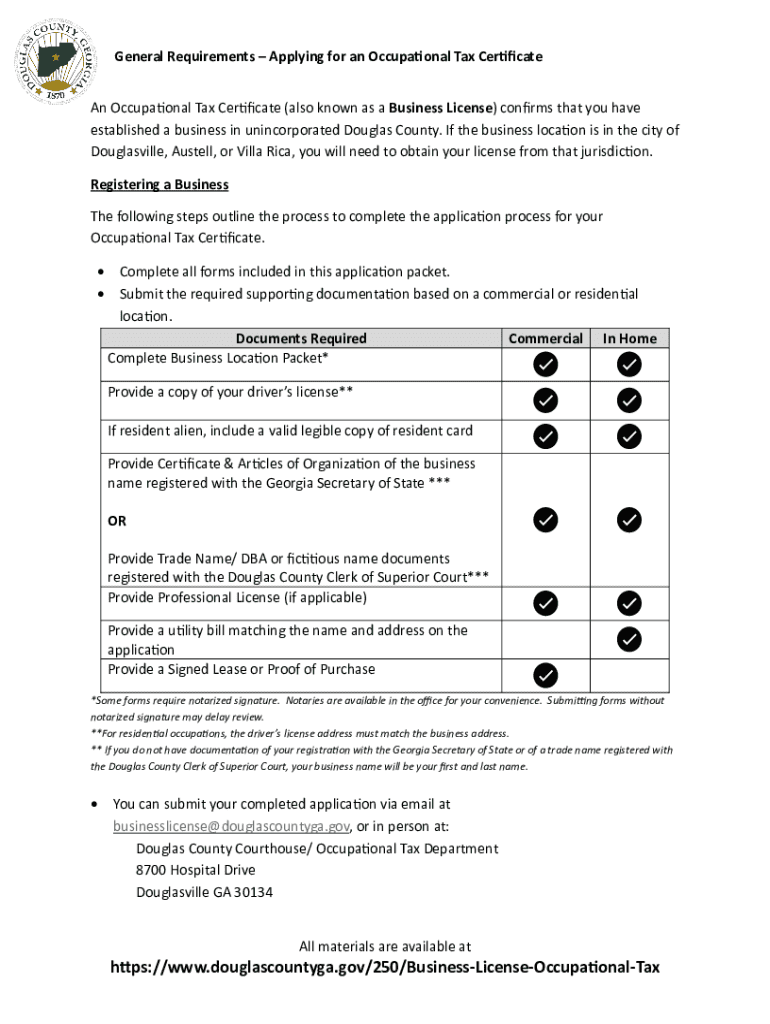

Step-by-step guide to filling out the application form

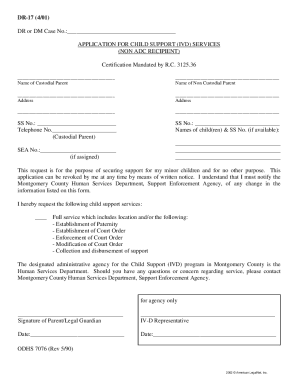

Filling out the occupational tax certificate application form efficiently can either make or break the application experience. This overview lays out critical elements of the form’s layout and structure. Generally, the form consists of several sections, including personal information, business details, and tax identification information, among others. Each section serves its purpose in outlining your professional activities and ensuring you meet local tax regulations.

Before diving into the application, gather the necessary information and documentation. Typically, you will need your Social Security Number or Employer Identification Number (EIN), proof of business registration (if applicable), and identification documentation. Organizing these beforehand prevents frustrating interruptions and promotes an efficient completion process. Here’s a detailed walkthrough of completing the application form effectively, avoiding common pitfalls.

Editing and customizing your occupational tax certificate application

Utilizing pdfFiller tools can vastly improve your experience in editing and customizing your occupational tax certificate application. If you discover any mistakes or the need for added details post-filling, pdfFiller offers versatile features that enable you to make necessary adjustments effortlessly. Modifying your application before submission ensures that your document is accurate and reflects all pertinent information.

You can add clarifications or additional information directly within the form. Always correct any mistakes, as omissions or inaccuracies can lead to delays or rejections in the application process. Utilizing the interactive capabilities of pdfFiller not only aids correction but also ensures your document stands out by presenting a polished and professional appearance.

Signing and submitting the application

Understanding the signing and submission process is essential once you have successfully completed the occupational tax certificate application form. You have the option of using either electronic signatures or traditional methods, with electronic signatures gaining significant traction due to their convenience and validity. Electronic signing not only speeds up the process but also ensures secure submission, as it adheres to recognized standards.

When it comes to submitting your application, you have multiple submission options. If your jurisdiction permits, you can submit it online directly through the respective tax department's website. Alternatively, you can submit a printed copy by mail or in person. It’s crucial to follow the guidelines specific to your area to ensure prompt processing of your application.

Post-submission process

Once submitted, understanding what to expect from the post-submission process mitigates apprehension. Typically, after submitting the occupational tax certificate application, you will receive a confirmation from the tax department acknowledging receipt and outlining the next steps. This is a critical point for tracking the status of your application.

To monitor progress, always keep a record of your confirmation number or receipt. If your application encounters any issues or rejections, you will likely be contacted by the tax department for clarification or necessary adjustments. Addressing these promptly and accurately significantly increases your chances of successful reapplication.

Frequently asked questions (FAQs)

Addressing common queries regarding the occupational tax certificate can assist applicants in navigating the complexities of the process more confidently. One prevalent question involves the expected processing time. This often varies by jurisdiction, but typically ranges from a few days to several weeks, depending on the volume of applications.

Another frequent concern relates to how to amend your application after submission. Most tax departments provide guidance for making changes post-filing, and failure to address inaccuracies promptly may lead to application rejection. For inquiries, always reach out to the appropriate agency; they usually have dedicated contact information available for applicants.

Interactive tools and resources

pdfFiller provides a suite of interactive tools and resources to enhance your experience with the occupational tax certificate application form. Resourceful features like PDF editing tools allow you to easily adjust your forms on the go. With these tools, you can seamlessly modify, annotate, or add supplementary materials when preparing your application.

Additionally, there are downloadable templates for offline use available on the pdfFiller platform. You can also find links to state-specific regulations and guidelines that offer valuable insights into the requirements applicable to your locality. Utilizing these resources can significantly streamline your application process, ensuring that you are well-informed and prepared.

Assistance and support

Having access to assistance and support can greatly enhance your experience when applying for an occupational tax certificate. pdfFiller embraces customer support as a pillar of its service, offering various options for reaching out. You can contact customer service via phone, email, or live chat for help navigating the application process or resolving specific technical issues.

Moreover, engaging with online forums or community groups can also offer a wealth of shared experiences from other users. These platforms create opportunities for exchanging tips and advice, which can be invaluable as you embark on your own application journey. Networking with others who have been through the process can lead to practical insights that ease your experience.

Additional information

Understanding the legal considerations surrounding occupational tax certificates remains paramount. Laws and regulations guiding these certificates may vary significantly by region; thus, staying informed is crucial. Local ordinances can introduce variations in requirements, necessitating a diligent review of your jurisdictional requirements to ensure compliance.

As tax regulations evolve, being aware of future changes is equally essential. This attention to detail ensures that your application remains valid and aligned with current requirements, ultimately diminishing the risk of complications. Monitoring tax bulletins and staying in contact with local tax authorities will keep you up-to-date with any relevant changes or announcements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit occupational tax certificate application online?

Can I create an eSignature for the occupational tax certificate application in Gmail?

How can I edit occupational tax certificate application on a smartphone?

What is occupational tax certificate application?

Who is required to file occupational tax certificate application?

How to fill out occupational tax certificate application?

What is the purpose of occupational tax certificate application?

What information must be reported on occupational tax certificate application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.